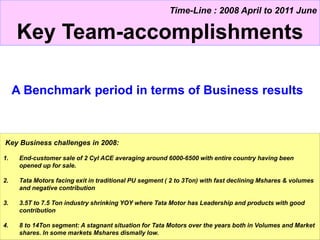

This document summarizes key business accomplishments and challenges for Tata Motors from 2008 to 2011. Some of the main points covered are:

1) Growth of ACE goods carrier sales from 6000-6500 to 14000 per month. Turnaround of the 2-3 ton segment after declining market share and negative contribution.

2) Development of the rural market and ramp up of ACE goods carrier sales. Increases in sales of other models like Magic, Venture, and Winger.

3) Turnaround of the 3.5-7.5 ton segment through increased volumes, market share, and contribution despite the economic crisis. Gains in the 9-14 ton segment through volume growth and