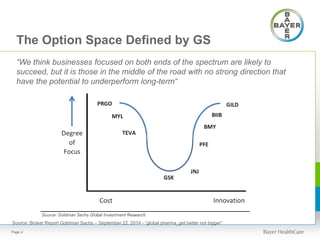

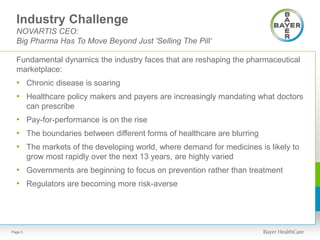

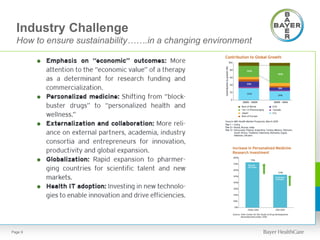

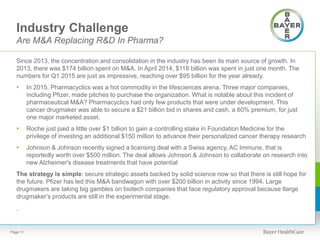

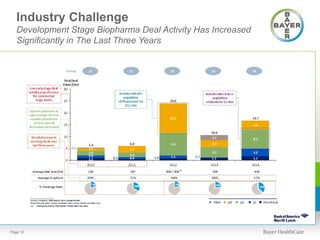

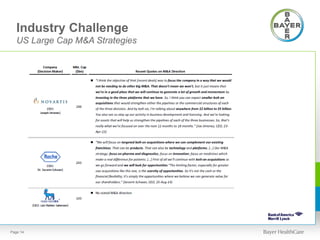

The pharmaceutical industry is facing significant changes due to rising chronic diseases, evolving regulatory environments, and the shift towards personalized medicine. Major companies are consolidating and engaging in mergers and acquisitions to maintain growth, while the focus is moving towards developing cost-effective and targeted treatments driven by advances in science and technology. The market demands adaptability in pricing and marketing strategies, emphasizing the importance of relationships within healthcare networks.