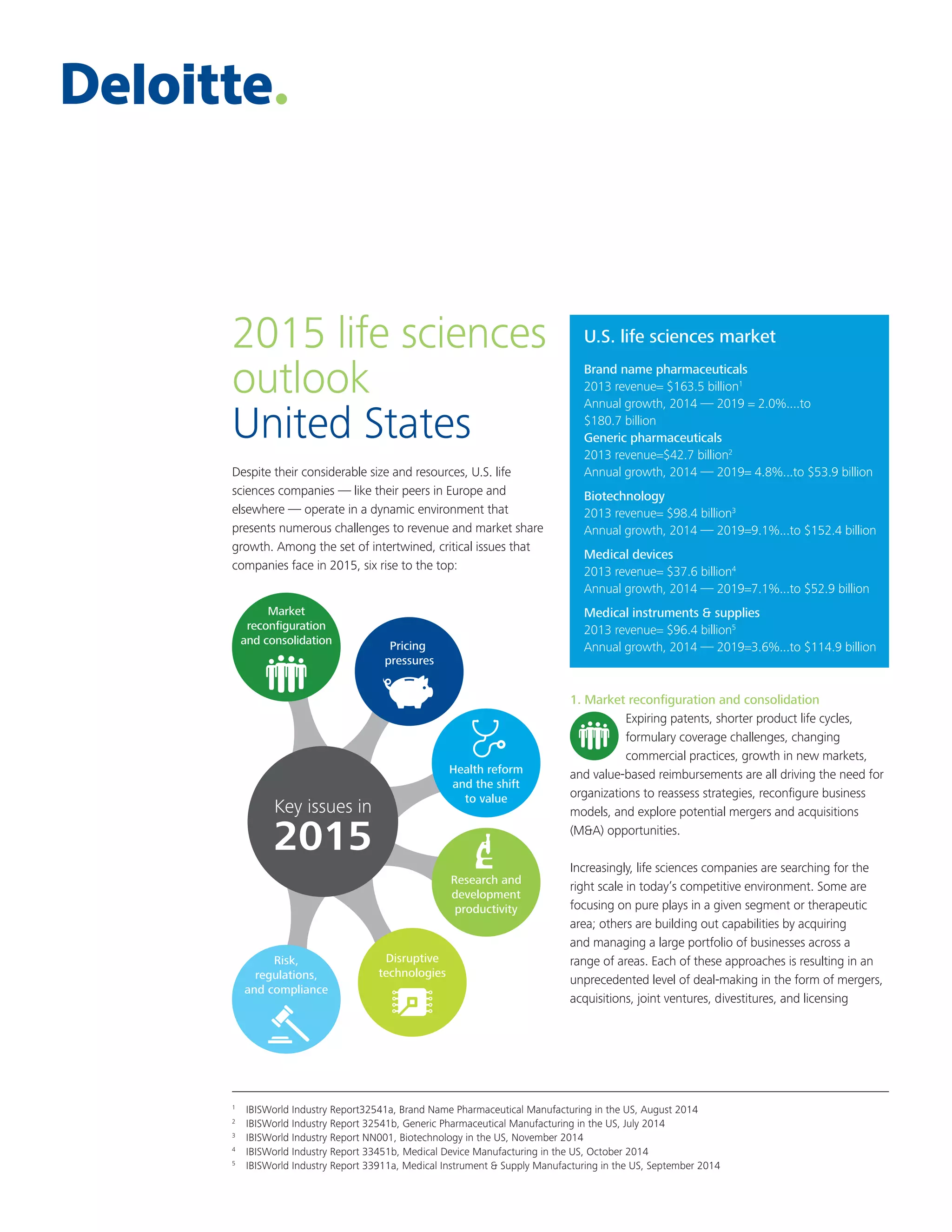

United States life sciences companies face numerous challenges in 2015 related to market changes, consolidation, pricing pressures, and health reform. Six key issues are highlighted: 1) Market reconfiguration and consolidation due to factors like expiring patents are driving the need for companies to reassess strategies and explore M&A opportunities. 2) Pricing pressures exist from government efforts to control costs and from health plans increasing efforts to reduce pharmaceutical costs. 3) Health reform is shifting the market to value-based care, requiring companies to demonstrate drugs' and devices' true value and economic impact compared to alternatives.