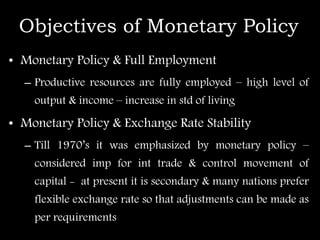

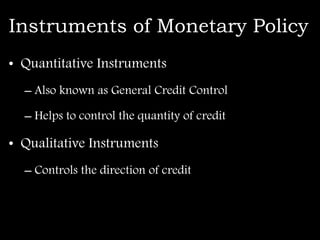

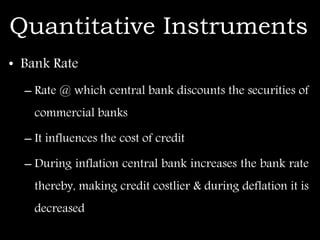

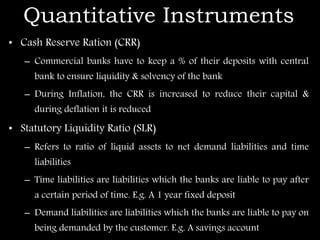

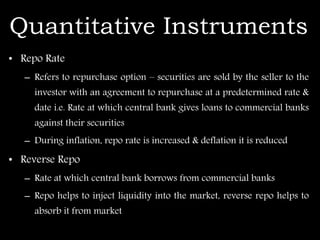

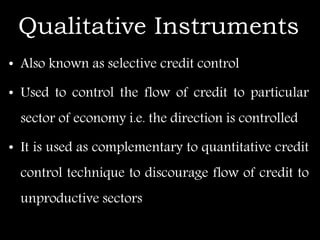

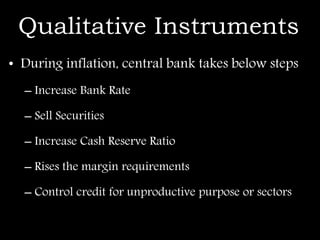

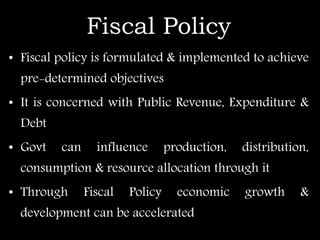

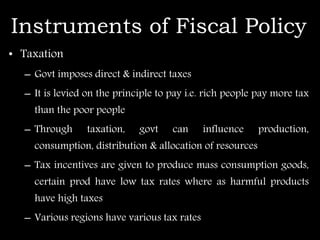

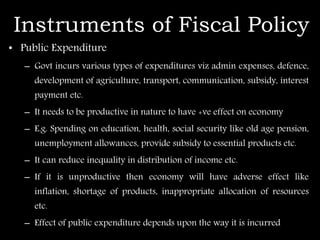

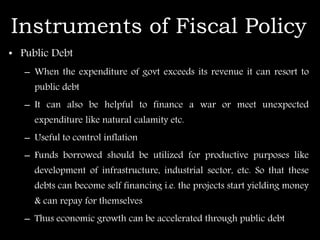

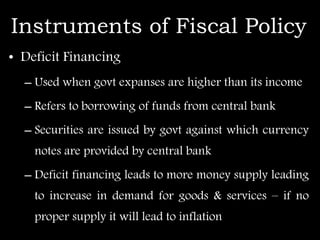

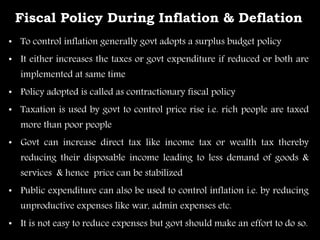

The document discusses monetary and fiscal policy as tools for economic stabilization. It explains that economic stabilization aims to maintain high levels of output, employment, and living standards. Monetary policy, implemented by central banks, uses tools like interest rates, reserve requirements, and open market operations to influence money supply and credit. Fiscal policy, set by governments, utilizes taxation, spending, debt, and deficit financing to impact production, income distribution, and resource allocation. Both policies seek to achieve full employment, price stability, and economic growth, adjusting their instruments as needed for inflationary or deflationary conditions.