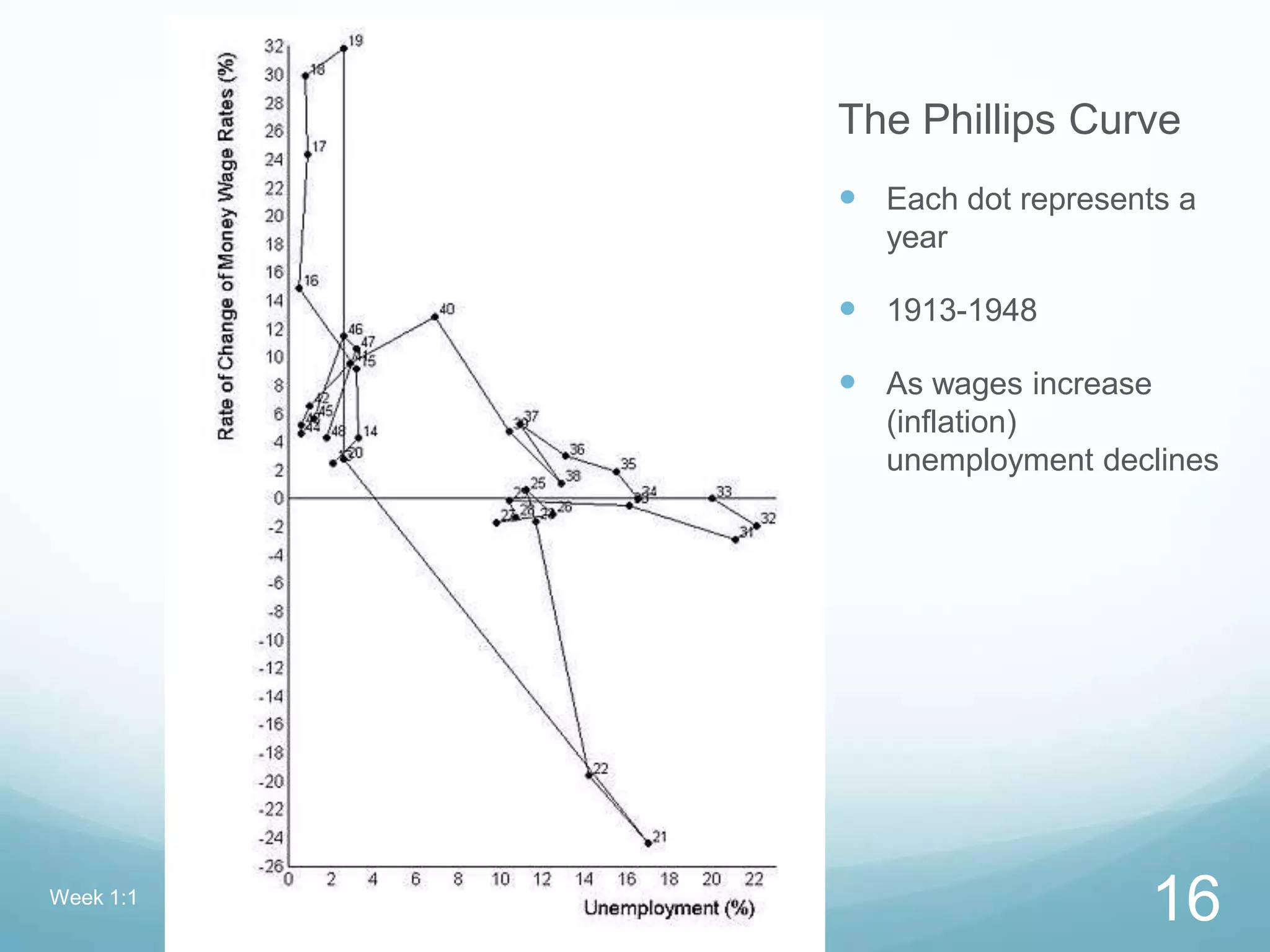

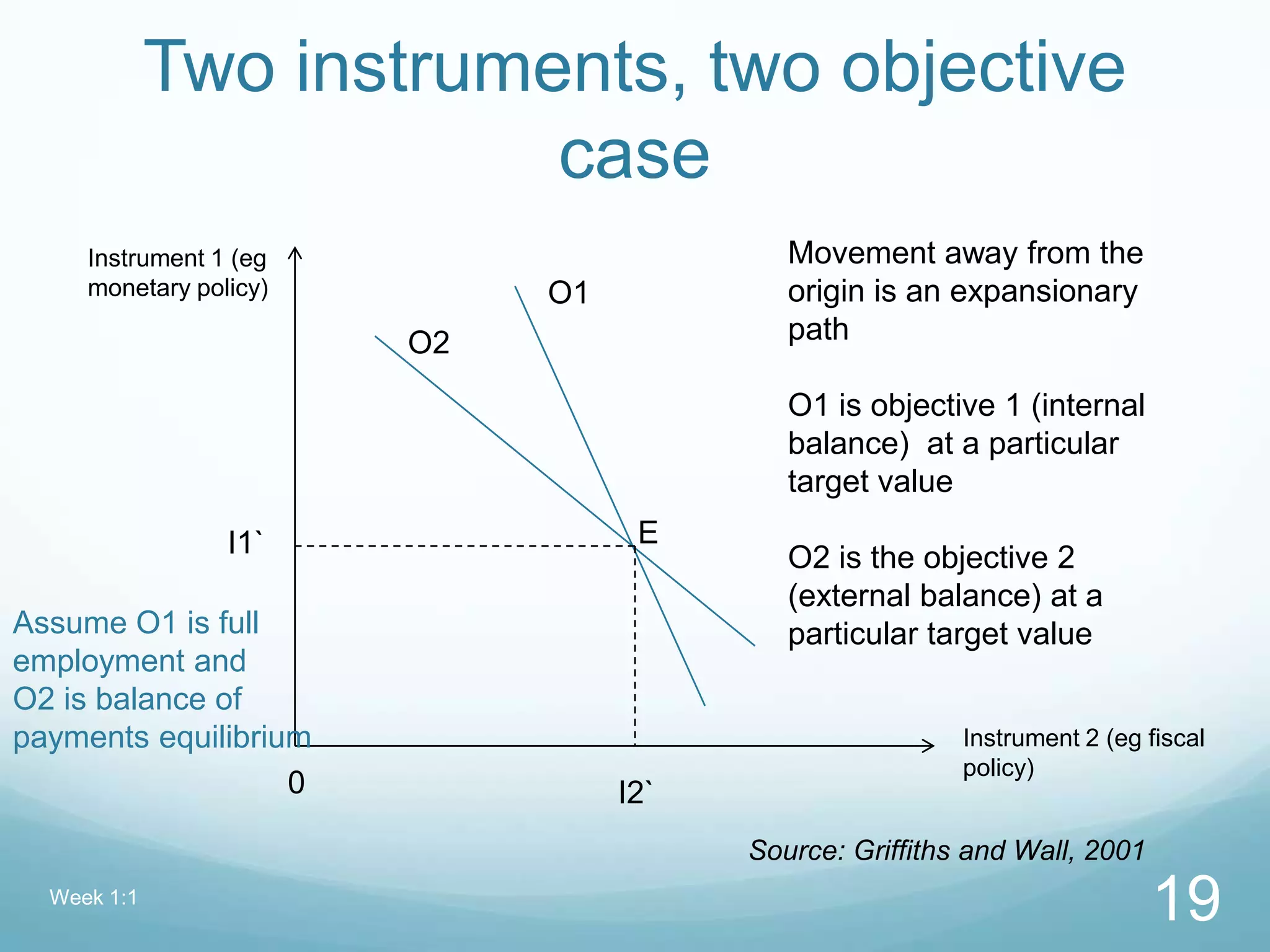

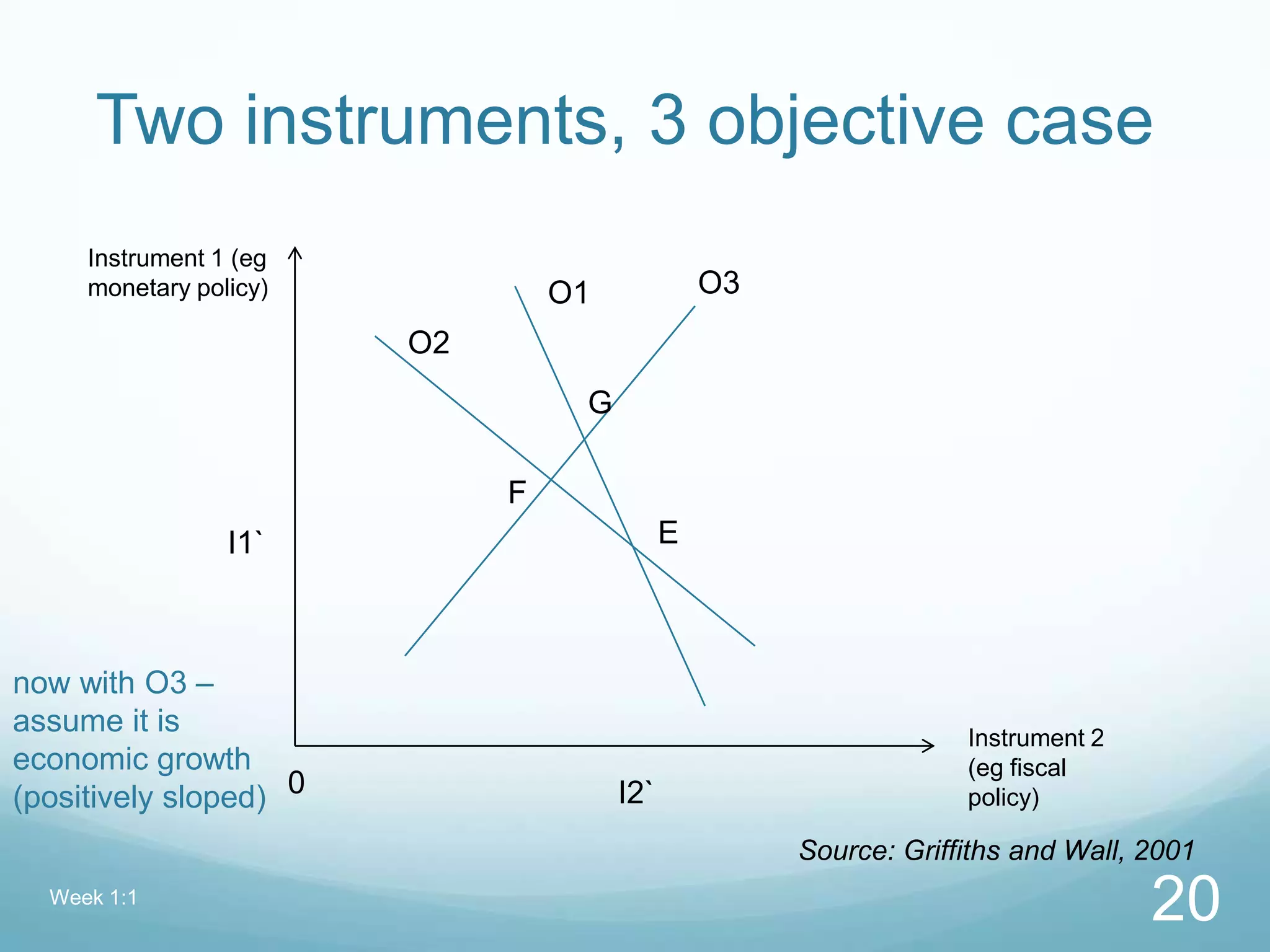

This document provides an overview of a course on the British economy. It introduces the aims of examining UK macroeconomic policy and trends since World War 2. Key topics to be covered over the next 5 weeks include post-war macroeconomic policies, the rise and fall of Keynesianism, policies under Thatcher, Blair and currently. The assessment will be a written exam weighing 45% of the grade. Various macroeconomic indicators and policy tools used by governments are also defined, such as fiscal and monetary policy, and their objectives like inflation and growth are outlined.