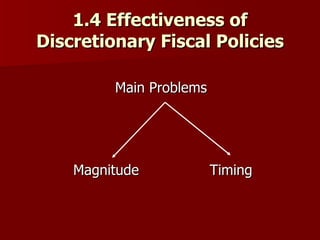

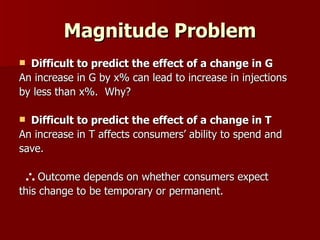

Fiscal and monetary policies can be used by governments to stabilize economies during recessions and booms. Fiscal policies include changing government spending and taxes, while monetary policies focus on interest rates, money supply, and credit availability. Both have benefits but also limitations. It can be difficult to accurately predict the effects of fiscal changes on consumption and investment. Meanwhile, monetary impacts depend on how responsive borrowing is to rates and how stable money demand is. Using both fiscal and monetary tools together can create a more effective policy mix than relying on either one alone.