12 March Daily market report

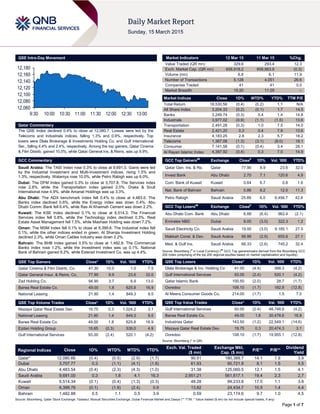

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.4% to close at 12,080.7. Losses were led by the Telecoms and Industrials indices, falling 1.3% and 0.9%, respectively. Top losers were Dlala Brokerage & Investments Holding Co. and Gulf International Ser., falling 4.4% and 2.4%, respectively. Among the top gainers, Qatar Cinema & Film Distrib. gained 10.0%, while Qatar General Ins. & Reins. was up 9.9%. GCC Commentary Saudi Arabia: The TASI Index rose 0.3% to close at 9,691.0. Gains were led by the Industrial Investment and Multi-Investment indices, rising 1.5% and 1.3%, respectively. Wataniya rose 10.0%, while Petro Rabigh was up 6.0%. Dubai: The DFM Index gained 0.3% to close at 3,707.8. The Services index rose 2.8%, while the Transportation index gained 2.0%. Drake & Scull International rose 4.9%, while Amanat Holdings was up 3.3%. Abu Dhabi: The ADX benchmark index fell 0.4% to close at 4,483.5. The Banks index declined 0.6%, while the Energy index was down 0.4%. Abu Dhabi Comm. Bank fell 6.4%, while Ras Al Khaimah Cement was down 2.2%. Kuwait: The KSE Index declined 0.1% to close at 6,514.3. The Financial Services index fell 0.8%, while the Technology index declined 0.3%. Real Estate Asset Management fell 7.5%, while Mashaer Holding was down 7.2%. Oman: The MSM Index fell 0.1% to close at 6,399.8. The Industrial index fell 0.1%, while the other indices ended in green. Al Sharqia Investment Holding declined 2.3%, while Oman Cables Industry was down 2.2%. Bahrain: The BHB Index gained 0.5% to close at 1,482.9. The Commercial Banks index rose 1.2%, while the Investment index was up 0.1%. National Bank of Bahrain gained 6.2%, while Esterad Investment Co. was up 4.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distrib. Co. 47.30 10.0 1.0 7.5 Qatar General Insur. & Reins. Co. 77.90 9.9 23.6 32.0 Zad Holding Co. 94.90 3.7 6.9 13.0 Barwa Real Estate Co. 49.00 1.8 625.8 16.9 National Leasing 21.90 1.4 849.3 9.5 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 19.75 0.3 1,024.2 3.1 National Leasing 21.90 1.4 849.3 9.5 Barwa Real Estate Co. 49.00 1.8 625.8 16.9 Ezdan Holding Group 15.65 (0.3) 539.0 4.9 Gulf International Services 93.00 (2.4) 520.1 (4.2) Market Indicators 12 Mar 15 11 Mar 15 %Chg. Value Traded (QR mn) 329.6 293.4 12.3 Exch. Market Cap. (QR mn) 656,918.2 658,963.9 (0.3) Volume (mn) 6.8 6.1 11.9 Number of Transactions 5,128 4,051 26.6 Companies Traded 41 41 0.0 Market Breadth 15:20 11:29 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,530.56 (0.4) (0.2) 1.1 N/A All Share Index 3,204.33 (0.2) (0.1) 1.7 14.5 Banks 3,249.74 (0.3) 0.4 1.4 14.8 Industrials 3,977.02 (0.9) (1.1) (1.5) 13.6 Transportation 2,491.28 (0.3) 1.0 7.5 14.0 Real Estate 2,421.20 0.3 0.4 7.9 13.6 Insurance 4,183.25 2.8 2.3 5.7 18.2 Telecoms 1,367.08 (1.3) (3.1) (8.0) 18.1 Consumer 7,141.58 (0.1) (0.4) 3.4 28.1 Al Rayan Islamic Index 4,387.92 (0.4) 0.3 7.0 14.9 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Qatar Gen. Ins. & Re. Qatar 77.90 9.9 23.6 32.0 Invest Bank Abu Dhabi 2.70 7.1 120.6 4.9 Com. Bank of Kuwait Kuwait 0.64 6.7 0.8 1.6 Nat. Bank of Bahrain Bahrain 0.86 6.2 12.0 11.3 Petro Rabigh Saudi Arabia 25.89 6.0 9,456.7 42.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Com. Bank Abu Dhabi 6.88 (6.4) 962.4 (2.1) Emirates NBD Dubai 9.00 (3.0) 322.3 1.2 Saudi Electricity Co. Saudi Arabia 19.00 (3.0) 9,185.1 27.5 Makkah Const. & Dev. Saudi Arabia 99.99 (2.9) 655.6 27.1 Med. & Gulf Ins. Saudi Arabia 66.33 (2.6) 745.2 32.4 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding Co 41.00 (4.4) 388.3 (4.2) Gulf International Services 93.00 (2.4) 520.1 (4.2) Qatar Islamic Bank 100.50 (2.0) 28.7 (1.7) Ooredoo 108.10 (1.7) 182.9 (12.8) Al Meera Consumer Goods Co. 214.00 (1.7) 1.5 7.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf International Services 93.00 (2.4) 48,748.8 (4.2) Barwa Real Estate Co. 49.00 1.8 30,478.6 16.9 Industries Qatar 143.50 (1.2) 22,549.1 (14.6) Mazaya Qatar Real Estate Dev. 19.75 0.3 20,474.3 3.1 Ooredoo 108.10 (1.7) 19,955.1 (12.8) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,080.66 (0.4) (0.5) (2.9) (1.7) 90.51 180,389.7 14.1 1.9 3.9 Dubai 3,707.77 0.3 (1.1) (4.1) (1.8) 61.93 90,721.9 8.1 1.5 5.5 Abu Dhabi 4,483.54 (0.4) (2.3) (4.3) (1.0) 31.38 125,060.5 12.1 1.5 4.1 Saudi Arabia 9,691.00 0.3 1.8 4.1 16.3 2,951.21 561,617.1 19.4 2.3 2.7 Kuwait 6,514.34 (0.1) (0.4) (1.3) (0.3) 48.28 99,233.8 17.5 1.1 3.8 Oman 6,399.76 (0.1) (1.9) (2.4) 0.9 13.82 24,434.7 10.5 1.4 4.4 Bahrain 1,482.88 0.5 1.1 0.5 3.9 0.59 23,174.6 9.7 1.0 4.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,060 12,080 12,100 12,120 12,140 12,160 12,180 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index declined 0.4% to close at 12,080.7. The Telecoms and Industrials indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari shareholders. Dlala Brokerage & Investments Holding and Gulf International Serv. were the top losers, falling 4.4% and 2.4%, respectively. Among the top gainers, Qatar Cinema & Film Distrib. Co. gained 10.0%, while Qatar General Ins. & Reins. Co. was up 9.9%. Volume of shares traded on Thursday rose by 11.9% to 6.8mn from 6.1mn on Wednesday. However, as compared to the 30- day moving average of 14.2mn, volume for the day was 52.0% lower. Mazaya Qatar Real Estate Development and National Leasing were the most active stocks, contributing 15.0% and 12.5% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change QNB Group (QNBK) Capital Intelligence Qatar FSR/LT FCR/ST FCR/SR AA-/AA-/A1+/1 AA-/AA-/A1+/1 – Stable – National Bank of Kuwait (NBK) Capital Intelligence Kuwait FSR/LT FCR/ST FCR/SR A+/AA-/A1+/1 A+/AA-/A1+/1 – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency) Earnings Releases Company Market Currency Revenue (mn) 4Q2014 % Change YoY Operating Profit (mn) 4Q2014 % Change YoY Net Profit (mn) 4Q2014 % Change YoY Abu Dhabi Ship Building Co. (ADSB)* Abu Dhabi AED 701.0 -37.3% 0.0 NA -132.6 NA Source: Company data, DFM, ADX, MSM (*FY2014 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/12 US BLS Import Price Index MoM February 0.40% 0.20% -3.10% 03/12 US BLS Import Price Index YoY February -9.40% -8.90% -8.70% 03/12 US Department of Labor Initial Jobless Claims 7-March 289K 305K 325K 03/12 US Department of Labor Continuing Claims 28-February 2,418K 2,400K 2,423K 03/12 US Bloomberg Bloomberg Consumer Comfort 8-March 43.3 – 43.5 03/12 US US Treasury Monthly Budget Statement February -$192.3B -$191.0B -$193.5B 03/12 EU Eurostat Industrial Production SA MoM January -0.10% 0.20% 0.30% 03/12 EU Eurostat Industrial Production WDA YoY January 1.20% 0.10% 0.60% 03/12 France INSEE CPI EU Harmonized MoM February 0.70% 0.60% -1.10% 03/12 France INSEE CPI EU Harmonized YoY February -0.30% -0.40% -0.40% 03/12 France INSEE CPI MoM February 0.70% 0.60% -1.00% 03/12 France INSEE CPI YoY February -0.30% -0.40% -0.40% 03/13 Germany Destatis Wholesale Price Index MoM February 0.50% – -0.40% 03/13 Germany Destatis Wholesale Price Index YoY February -2.10% – -2.60% 03/12 UK ONS Trade Balance January -£616.0 -£2,300.0 -£2,142.0 03/12 Spain INE CPI MoM February 0.20% 0.20% -1.60% 03/12 Spain INE CPI Core MoM February 0.00% 0.00% -1.50% 03/12 Spain INE CPI Core YoY February 0.20% 0.30% 0.20% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 67.78% 53.23% 47,960,448.24 Non-Qatari 32.22% 46.76% (47,960,448.24)

- 3. Page 3 of 7 News Qatar MRDS reports QR169.4mn net profit in FY2014 – Mazaya Qatar Real Estate Development Company (MRDS) reported a net profit of QR169.4mn in FY2014, reflecting an increase of 26.4% on a YoY basis. MRDS’ revenue (construction revenue + rental income) stood at QR416.1mn as compared to QR535.3mn in FY2013. However, lower construction costs (QR153.4mn in FY2014 versus QR338.0mn in FY2013) aided bottom-line growth. The company’s EPS amounted to QR1.69 in FY2014 versus QR1.34 in FY2013. Meanwhile, the company’s board has proposed to the general assembly to distribute cash dividends of 3%, (i.e. QR 0.3 per share), in addition bonus shares of 5% (i.e. 5 shares for each 100 shares). (QSE) ZHCD’s net profit increases 45.2% YoY in FY2014 – Zad Holding Company (ZHCD) reported 45.2% YoY increase in its FY2014 net profit to QR181.7mn, primarily driven by higher other income (up 152.8% YoY to QR199.1mn in FY2014). Total revenue for FY2014 stood at QR891.9mn, reflecting an increase of 15.7% YoY. The company’s EPS amounted to QR8.43 in FY2014 as compared to QR5.81 in FY2013. Meanwhile, the ZHCD’s board has recommended distributing a cash dividend of QR4.00 per share, which is equivalent to 40% of the nominal share value. (QSE) QSE suspends trading of QFLS, QIIK, QGRI shares on March 15 – The Qatar Stock Exchange (QSE) has announced trading suspension in Woqod’s (QFLS), Qatar International Islamic Bank’s (QIIK) and Qatar General Insurance & Reinsurance Company’s (QGRI) shares on March 15, 2015 due to their AGMs being held today. (QSE) CI affirms QNBK’s ratings – Capital Intelligence (CI) has affirmed QNB Group’s (QNBK) Financial Strength Rating (FSR) at 'AA-'. The FSR reflects the Bank's strong ownership and very good capital adequacy ratio (CAR), as well as its domestic and international franchise. The robust and supportive operating environment in Qatar and QNBK's geographically diversified business profile both support the rating. Fine loan asset quality and high profitability remain key supporting factors. High geopolitical risks in the broader MENA region also remain a rating constraint, although QNBK has successfully mitigated the latter by extensively diversifying its business internationally through organic growth and acquisitions. The Long and Short- Term Foreign Currency (FC) Ratings are also affirmed at 'AA-' and 'A1+', respectively, at the same level as the Sovereign Ratings for the State of Qatar. The Bank's Support Rating of '1' (affirmed) reflects ownership by the State of Qatar through Qatar Investment Authority (QIA) and the Bank's role as the financial arm of the Qatari Government. The Outlook on all ratings remains Stable. (Gulf-Base.com) Kahramaa awards QR17bn water reservoir deals – Qatar General Electricity & Water Corporation (Kahramaa) announced that it has started awarding contracts for the QR17bn strategic mega reservoirs project and the accompanying pipelines. This is considered to be the largest ever expansion of water storage in Qatar. The first phase of the project consists of building 24 reservoirs with a total capacity of 2,300mn gallons (MIG). Each reservoir will have a total capacity of about 100 MIG, which is considered to be the largest concrete reservoir in the world. The reservoirs will be constructed in five locations: Um Baraka, Um Salal, Rawdat Rashid, Abu Nakhla, and Al-Thumama. The first phase also covers the installation of 650 kilometers of large- diameter pipelines. Of the total QR17bn worth of contract works, 55% of works will be awarded to Qatari companies. Contracts include excavation and landscape, installing main pipelines and accompanying pipelines, and reservoir construction. (Peninsula Qatar) ORDS announces agenda for AGM, EGM on March 29 – Ooredoo (ORDS) announced that its ordinary and extraordinary general assembly meeting (AGM and EGM) will be held on March 29, 2015. Shareholders are invited to the AGM to discuss and approve the board of directors’ recommendations regarding dividend distribution and determine the remuneration for board members for the year ended December 31, 2014 as well as appoint new members. Shareholders at the EGM will approve the amendment of Article 25 of the company’s Articles of Association, to remove the clause that the board may not sell the company's assets or mortgage assets if their value exceeds 20% of the company's capital without the permission of the General Assembly. In case the required quorum is not met, a second meeting will be held on April 5, 2015. (QSE) ORDS: SIP-Trunking for businesses launched – Ooredoo (ORDS) has announced that its world class IP voice platform now has a new business grade voice service, SIP-Trunking (SIP-T). SIP-T is a direct connection from a business’ private voice infrastructure to the ORDS next generation network so that companies can carry multiple voice services through their existing data links. SIP-T has the ability to deliver a fully redundant voice network which means businesses can continue to receive calls without any service interruptions even if a cable is cut, a first for corporate voice services in Qatar. (Peninsula Qatar) Work under way on MERS new branches – Al Meera Consumer Goods Company (MERS) has announced that contractors have started work on its new branches located at Umm Salal Ali, Al Wakrah, North Sailiya (Al Meerad) and Bu Sidra. The new branches will include eateries and other retail outlets providing various services. In 2014, MERS built new shopping centers at Murraikh, Al Aziziya, Jeryan Nejaima, Al Zakhirah, Al Wakrah, Al Thumama, Al Wajbah and Rawdat Aqdim. Currently, MERS has 14 branches under construction. (Gulf-Times.com) QIMD selects K&A design for Lusail City project – Qatar Industrial Manufacturing Company (QIMD) has selected the design of Khatib & Alami (K&A) for one of its real-estate projects located on the waterfront district of Lusail City. The design selected by QIMD was evaluated to be highly effective, both in terms of space planning and energy conservation. With a total built-up area of 36,000 square meters, the 26-storey high project will have 148 apartments divided into one, two and three- bedrooms and two underground parking. (Peninsula Qatar) QCSD deposits AKHI’s bonus shares – The Qatar Central Securities Depository (QCSD) has announced the addition of bonus shares to the accounts of Al Khaleej Takaful Group’s (AKHI) shareholders. After this addition, AKHI’s new capital stands at QR255.28mn distributed across 25,527,902 shares. The company’s shareholders may trade these shares from March 15, 2015. (QSE) International Weak profit margins dampen US PPI; consumer sentiment falls in March – Producer prices in the US fell 0.6% YoY in February for a fourth straight month, pointing to tame inflation that could argue against an anticipated interest rate hike in June 2015 from the Federal Reserve. The Labor Department said its Producer Price Index (PPI) for final demand declined 0.5% as profit margins in the services sector, especially gasoline stations, were squeezed, and transportation & warehousing

- 4. Page 4 of 7 costs fell. The PPI had dropped 0.8% in January. Economists had forecast the PPI rising 0.3% YoY in February. Meanwhile, according to a survey, consumer sentiment in the US fell in March as optimism slipped among lower and middle-income households. The University of Michigan's preliminary reading on the overall index on consumer sentiment came in at 91.2 for March, down from 95.4 in February. It was below the Reuters median forecast of 95.5. The survey's barometer of current economic conditions fell to 103 from 106.9 in February and below a forecast of 105.7. Similarly, the survey's gauge of consumer expectations slipped to 83.7 from 88. However, the survey's one-year inflation expectation rose to 3.0% from 2.8%, marking the highest level since last September. The survey's five-year inflation outlook stood at 2.8% from 2.7%. (Reuters) UK to join China-backed Asian development bank; Australia to decide on membership soon – Britain said it will become a founding member of the Asian Infrastructure Investment Bank (AIIB), making it the first Western nation to embrace the China- backed institution, however, the US reacted frostily to the development. The AIIB was launched in Beijing in 2014 to spur investment in Asia in transportation, energy, telecommunications and other infrastructure. Analysts have said it could challenge the Western-dominated World Bank and Asian Development Bank. However, Britain's finance ministry said that the AIIB could complement work already done in the region by those organizations. Finance Minister George Osborne said joining the bank would boost the country's push to foster business and investment ties with countries in the region, especially China. Meanwhile, Australian Prime Minister Tony Abbott said the country expects to make a decision within weeks on whether it will seek to join the China-backed AIIB. Australia's decision on whether to become a founding member of the institution risks upsetting either key strategic allies the US and Japan, or its top trading partner China. (Reuters) Greece stems decline in tax revenues in February; S&P keeps rating on 'CreditWatch negative' – The Greek Finance Ministry said tax revenues in the country dipped slightly in February, but there was no repeat of the calamitous fall in January, bringing some relief to the government as it tries to negotiate a new bailout deal with Europe. Tax receipts came in just €121mn below target in February after a massive €1.05bn shortfall in January. Greeks put off paying taxes in the first weeks of 2015 ahead of a snap election in January. The ministry said overall the tax revenues came in at €7.23bn in the first two months of 2015, 13.8% below a target of €8.47bn. The ministry further added that the central government surplus came in at €1.24bn in the first two months of 2015, against a target of €1.41bn. Meanwhile, Standard & Poor's (S&P) said the long- term credit ratings for Greece remain on "CreditWatch with negative implications", citing the government's increasingly stretched liquidity position. S&P said it is maintaining its 'B-/B' long and short-term ratings on Greece. (Reuters) Bloomberg: US seeks billions from global banks in currency investigation – According to Bloomberg, the US Justice Department is seeking about $1bn each from leading global banks who are being investigated for manipulation of currency markets. Bloomberg said the figure is a starting point in settlement discussions. One bank that has cooperated from the beginning is expected to pay far less and penalties of about $4bn are on the table, adding that the number could change markedly. Bloomberg said with banks pushing back harder than in some previous negotiations, including those for mortgage- backed securities, the final penalties could be lower. Bloomberg said the discussions, which have begun in earnest in recent weeks, could lead to settlements that would resolve the US accusations of criminal activity in the currency markets against Barclays, Citigroup, JP Morgan Chase, Royal Bank of Scotland and UBS. (Reuters) Russia cuts interest rates as economy struggles – The Russian central bank cut its main lending rate on March 13, sending a strong signal that it now sees the rapidly declining economy as a more serious worry than high inflation. The bank reduced its one-week minimum auction repo rate by one percentage point to 14%, continuing an easing cycle that began in January 2015 when it unexpectedly cut the rate by two points. This time economists had broadly expected the move as the downturn gains pace due to the low international price of oil, Russia's main export, and Western sanctions imposed over Moscow's role in the Ukraine conflict. The ruble has stabilized since a panicky collapse in 2014, giving the bank some breathing room to continue easing. Data over the past few weeks showed that consumer spending, investment, real wages and GDP are all sinking even faster than many had expected, indicating that the economy is heading into a steep recession. (Reuters) Regional RSHC partners with Direcional Engenharia – Red Sea Housing Services Company (RSHC) has entered into a strategic alliance with Brazilian developer Direcional Engenharia, to provide affordable housing solutions in Saudi Arabia. The Kingdom needs nearly 1.25mn residential homes to be built by 2018 to keep pace with its growing population, which is expected to hit 37.2mn by 2020. To ensure adequate supply, the Saudi Ministry of Housing has adopted an ambitious target to build 500,000 affordable homes for Saudis. (GulfBase.com) STC signs MoU with SK Telecom – Saudi Telecom Company (STC) has signed a MoU with Korea-based SK Telecom to strengthen their ties and advance collaboration between the two companies. Under the MoU, the two companies agree to collaborate on the development of their innovation capabilities in Saudi Arabia with particular focus on digital products and services in key verticals such as healthcare and education. (GulfBase.com) Saudi Kayan extends maintenance at olefins unit in Jubail – Saudi Kayan Petrochemical Company has extended the maintenance work on the olefins plant at its petrochemicals complex in Jubail after a technical fault was discovered. The impact of the fault, along with another one that has been found, has been calculated to be around SR310mn at current prices, which will be reflected in the company’s 1Q2015 results. (GulfBase.com) Saudi CMA cancels SITC’s shares listing – The Saudi Capital Market Authority (Saudi CMA) has issued its decision to cancel the listing of Saudi Integrated Telecom Company’s (SITC) shares on the Saudi Stock Exchange (Tadawul). Saudi CMA’s decision was based on Article 6 of the Capital Market Law and Article 35 of the listing rules. (Tadawul) SABB EGM approves capital increase – Saudi British Bank (SABB) announced that its extraordinary general meeting (EGM) has approved the company’s capital increase via bonus shares and the additional shares will be deposited into the investor’s portfolios. (Tadawul) Saudi CMA approves capital rise for Alkhaleej Training – The Saudi Capital Market Authority has approved Alkhaleej Training & Education Company’s request to increase its capital from SR350mn to SR400mn by issuing one bonus share for every seven existing shares. This increase will be paid for by transferring an amount of SR50mn from the retained earnings

- 5. Page 5 of 7 account to the company's capital. The bonus shares’ eligibility is limited to those shareholders who are registered at the close of trading on the day of the extraordinary general assembly, which will be determined later. (Tadawul) Itqan pays 7% cash dividends in REIF-II – Itqan Capital, a member of Al Baraka Banking Group, paid 3.5% cash dividends to the investors in its Real Estate Income Fund- II (REIF-II), representing the second dividend pay-out, totaling 7% for the full year. Itqan’s MD & CEO, Adil Saud Dahlawi said that the fund continues to accomplish its strategic objectives by investing and managing income generating properties in prime locations across major cities in Saudi Arabia. (GulfBase.com) CDSI: Saudi inflation at lowest level in nine years – According to the Central Department of Statistics & Information (CDSI), inflation in the Kingdom during February 2015 dropped to its lowest level in nine years, driven by the strengthening riyal and a global dip in food prices. Annual inflation fell to 2.1%, the lowest level since 2006. Food inflation stood at 1.7% YoY in February 2015, representing a drop of 0.4% points on a MoM basis. Food prices comprise more than 20% of consumer expenditure. Meanwhile, Capital Economics said that Saudi Arabia’s inflation level will hover around 2% in 2015, as the US dollar is likely to appreciate further on the back of expected interest rate rises. (GulfBase.com) Saudi Aramco close to strike $10bn loan deal – According to sources, Saudi Aramco is about to secure a $10bn tightly-priced loan, part of which could be used to back the purchase of a stake in German synthetic rubber firm, Lanxess. The cash will replace an existing $4bn five-year loan due to mature later in 2015, which Saudi Aramco uses as a back-up facility. Reportedly, the deal is expected to be concluded by the end of March 2015. (GulfBase.com) SZHP signs financing services MoU with EDB – Sheikh Zayed Housing Programme (SZHP) and Emirates Development Bank (EDB) have signed a MoU to further promote cooperation between the two government entities and help find innovative solutions for providing quick access to housing services. As agreed in the MoU, EDB will provide banking and financing services to customers of SZHP, as well as construction businesses involved in the development of residential properties. (GulfBase.com) Abu Dhabi inflation falls in February 2015 – Inflation in Abu Dhabi slowed in February 2015, as the strengthening dirham reduced the cost of imported food in the Emirate. Abu Dhabi’s inflation rate dropped to 4.6% from 5.0% in January 2015. Alp Eke, Chief Economist at the National Bank of Abu Dhabi (NBAD) said that food and non-alcohol beverages constitute the main component of imported inflation, so a strong dollar is reducing food import prices. (GulfBase.com) Ras Al Khaimah picks banks for Sukuk sale – According to sources, the Emirate of Ras Al Khaimah (RAK) has picked four banks to arrange investor meetings for its potential dollar- denominated Sukuk issue of benchmark size. Ras Al Khaimah has mandated Al Hilal Bank, Citigroup, JP Morgan and NBAD to manage the sale. The deal is expected to happen before April 2015-end. (GulfBase.com) NCC BoD recommends 25% cash dividend – National Cement Company’s (NCC) board of directors has recommended the distribution of cash dividend equivalent to 25% of the shares nominal value. (DFM) Tabreed AGM approves 5 fils dividend – National Central Cooling Company (Tabreed) announced that its annual general assembly (AGM) has approved the distribution of dividend worth five fils per share, representing a payout ratio of 53% and a yield of 4.6%. (DFM) Amlak Finance plans to re-list on DFM – Amlak Finance is planning to relist its shares on the Dubai Financial Market (DFM) in April 2015, after obtaining regulatory approvals. (GulfBase.com) Emirates picks banks to arrange UK-guaranteed bond – Emirates, the Dubai-based airline, has hired eight banks to arrange for an Islamic bond that will be guaranteed by Britain's export credit agency. The airline has picked Citigroup, HSBC, JP Morgan and NBAD as the joint structuring agents, with Abu Dhabi Islamic Bank, Dubai Islamic Bank, Emirates NBD and Standard Chartered acting as joint lead managers. The deal assumes significance since this is the first time the UK export credit agency has guaranteed a Sukuk. (Reuters) Arqaam Capital picks Rothschild as float adviser – Dubai- based financial services firm, Arqaam Capital has chosen Rothschild to advise on its planned stock market flotation in the Emirate in 2015. The flotation is expected to happen in 2H2015 on either the Dubai Financial Market or Nasdaq Dubai. (Reuters) ADGAS signs $491m EPC contract for IGD-E1 – Abu Dhabi Gas Liquefaction Company (ADGAS), on behalf of Abu Dhabi National Oil Company (ADNOC), has signed an engineering, procurement & construction (EPC) contract worth $491mn for the Integrated Gas Development Expansion Phase-I (IGD-E1) project, with a consortium led by Tecnimont-Archirodon. The project’s total duration is 40 months, which is forecasted to be completed by June 2018. (GulfBase.com) Mubadala GE Capital plans bond issue – According to sources, Mubadala GE Capital is planning to issue a benchmark-size bond as early as April 2015. The company would use the proceeds to fund its lending business. Benchmark size is traditionally understood to mean upwards of $500mn. (GulfBase.com) TI acquires 2% stake in Gatehouse Bank – UK-based Threadneedle Investments (TI) has become a strategic shareholder for the Kuwaiti-owned Shari’ah-compliant investment management firm, Gatehouse Bank. TI acquired 2% of the bank's capital through direct investment via monetary contribution to purchase shares. (GulfBase.com) DIDIC seeks shareholders nod for cash, stock dividend – Dhofar International Development & Investment Holding Company (DIDIC) has invited its shareholders to approve the board of directors’ proposal to distribute 18% cash dividend of the paid-up capital i.e. 18 baizas per share. The shareholders will also consider and approve a proposal of 12% stock dividend at the rate of 12 shares for each 100 shares. Consequently, the number of the company’s shares will increase from 220mn shares to 246.4mn shares. (MSM) Sohar Power seeks nod for 9.4% cash dividend – Sohar Power has invited its shareholders to consider and approve the board of directors’ proposal to distribute final cash dividends of 9.4% (9.40 baizas per share) for the financial year ended December 31, 2014. (MSM) ORA: Oman’s real estate added 10% to economy in 2014 – The Oman Real Estate Association’s (ORA) Vice-Chairman, Hassan Mohammed Juma said that the country’s real estate sector accounted for 10% of GDP in 2014, contributing around OMR1.3bn to Oman's economy. He said the sector's contribution to the country’s GDP stood at OMR0.9bn in 2009. Real estate transactions in 2014 increased by 27% and stood at

- 6. Page 6 of 7 over OMR2.9bn as compared to OMR2.3bn in 2013. (GulfBase.com) Oman allocates $500mn aid for Egyptian economy – Oman has allocated a sum of $500mn aimed at supporting the Egyptian economy. A sum of $250mn from this amount will be allocated in support of monetary liquidity, while the remaining $250mn will go into carrying out projects that support the Egyptian economy. (GulfBase.com) GFG’s AGM approves 40% dividend payout – Gulf Hotels Group (GFG) announced that its annual general meeting (AGM) approved a dividend payout of 40% i.e. 40 fils per share, totaling BHD6.6mn and 5% bonus shares (one for every 20 shares). (Bahrain Bourse) NBB mulls mergers and acquisitions across GCC – The National Bank of Bahrain’s (NBB) Chairman, Farouk Almoayyed said that the bank is on the lookout for sound merger & acquisition opportunities in Bahrain and the wider GCC region. He said the bank has surplus capital and liquidity mainly because of a dearth of projects and investment opportunities in the local market. Regionally, the strategy of selective expansion in Abu Dhabi and Riyadh is progressing as planned, he added. (GulfBase.com)

- 7. Contacts Saugata Sarkar Abdullah Amin, CFA Ahmed Al-Khoudary Head of Research Senior Research Analyst Head of Sales Trading – Institutional Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6548 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Sahbi Kasraoui QNB Financial Services SPC Manager – HNWI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Feb-11 Feb-12 Feb-13 Feb-14 Feb-15 QSE Index S&P Pan Arab S&P GCC 0.3% (0.4%) (0.1%) 0.5% (0.1%) (0.4%) 0.3% (0.6%) (0.4%) (0.2%) 0.0% 0.2% 0.4% 0.6% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,158.55 0.4 (0.7) (2.2) MSCI World Index 1,719.82 (0.5) (1.3) 0.6 Silver/Ounce 15.66 0.4 (1.5) (0.3) DJ Industrial 17,749.31 (0.8) (0.6) (0.4) Crude Oil (Brent)/Barrel (FM Future) 54.67 (4.2) (8.5) (4.6) S&P 500 2,053.40 (0.6) (0.9) (0.3) Crude Oil (WTI)/Barrel (FM Future) 44.84 (4.7) (9.6) (15.8) NASDAQ 100 4,871.76 (0.4) (1.1) 2.9 Natural Gas (Henry Hub)/MMBtu 2.69 (4.5) (6.6) (10.1) STOXX 600 396.61 (0.8) (2.8) 0.4 LPG Propane (Arab Gulf)/Ton 52.75 (2.8) (9.3) 7.7 DAX 11,901.61 (0.2) (0.4) 4.8 LPG Butane (Arab Gulf)/Ton 64.13 (1.3) (8.1) (2.1) FTSE 100 6,740.58 (1.2) (4.6) (3.0) Euro 1.05 (1.3) (3.2) (13.2) CAC 40 5,010.46 (0.6) (2.5) 1.7 Yen 121.40 0.1 0.5 1.4 Nikkei 19,254.25 1.5 1.2 8.7 GBP 1.47 (0.9) (1.9) (5.3) MSCI EM 939.56 (0.9) (3.3) (1.8) CHF 1.00 (0.3) (1.9) (1.1) SHANGHAI SE Composite 3,372.91 0.8 4.0 3.4 AUD 0.76 (0.9) (1.0) (6.6) HANG SENG 23,823.21 0.1 (1.6) 0.7 USD Index 100.33 0.9 2.8 11.1 BSE SENSEX 28,503.30 (2.5) (4.4) 3.8 RUB 62.23 1.6 3.0 2.5 Bovespa 48,595.81 (3.4) (8.8) (20.9) BRL 0.31 (2.6) (5.8) (18.4) RTS 833.57 (3.0) (7.7) 5.4 173.6 142.1 129.6