QNBFS Daily Market Report May 11, 2016

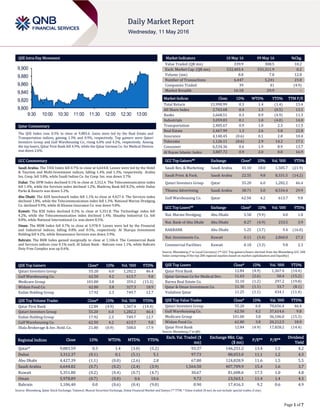

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.3% to close at 9,883.6. Gains were led by the Real Estate and Transportation indices, gaining 1.3% and 0.9%, respectively. Top gainers were Qatari Investors Group and Gulf Warehousing Co., rising 6.0% and 4.2%, respectively. Among the top losers, Qatar First Bank fell 4.9%, while the Qatar German Co. for Medical Devices was down 2.6%. GCC Commentary Saudi Arabia: The TASI Index fell 0.7% to close at 6,644.8. Losses were led by the Hotel & Tourism and Multi-Investment indices, falling 1.4% and 1.3%, respectively. Arabia Ins. Coop. fell 3.8%, while Saudi Indian Co. for Coop. Ins. was down 3.7% Dubai: The DFM Index declined 0.1% to close at 3,312.4. The Telecommunication index fell 1.4%, while the Services index declined 1.2%. Mashreq Bank fell 8.2%, while Dubai Parks & Resorts was down 5.2%. Abu Dhabi: The ADX benchmark index fell 1.1% to close at 4,427.4. The Services index declined 1.8%, while the Telecommunication index fell 1.3%. National Marine Dredging Co. declined 9.9%, while Al Khazna Insurance Co. was down 9.8%. Kuwait: The KSE Index declined 0.2% to close at 5,351.8. The Technology index fell 4.2%, while the Telecommunication index declined 1.4%. Shuaiba Industrial Co. fell 8.8%, while National International Co. was down 8.5%. Oman: The MSM Index fell 0.7% to close at 5,978.9. Losses were led by the Financial and Industrial indices, falling 0.8% and 0.5%, respectively. Al Sharqia Investment Holding fell 4.2%, while Renaissance Services was down 3.9%. Bahrain: The BHB Index gained marginally to close at 1,106.4. The Commercial Bank and Services indices rose 0.1% each. Al Salam Bank - Bahrain rose 1.1%, while Bahrain Duty Free Complex was up 0.6%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatari Investors Group 55.20 6.0 1,282.2 46.4 Gulf Warehousing Co. 62.50 4.2 613.7 9.8 Medicare Group 101.00 3.8 359.2 (15.3) Widam Food Co. 62.80 3.8 327.3 18.9 Ezdan Holding Group 17.92 2.3 749.7 12.7 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 12.84 (4.9) 1,367.4 (14.4) Qatari Investors Group 55.20 6.0 1,282.2 46.4 Ezdan Holding Group 17.92 2.3 749.7 12.7 Gulf Warehousing Co. 62.50 4.2 613.7 9.8 Dlala Brokerage & Inv. Hold. Co. 21.80 (0.9) 508.0 17.9 Market Indicators 10 May 16 09 May 16 %Chg. Value Traded (QR mn) 339.9 308.5 10.2 Exch. Market Cap. (QR mn) 532,403.4 531,311.9 0.2 Volume (mn) 8.8 7.8 12.8 Number of Transactions 6,447 5,241 23.0 Companies Traded 39 41 (4.9) Market Breadth 16:18 29:9 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,990.99 0.3 1.4 (1.4) 13.4 All Share Index 2,763.68 0.4 1.3 (0.5) 13.1 Banks 2,668.51 0.3 0.9 (4.9) 11.3 Industrials 3,059.83 0.1 1.0 (4.0) 14.0 Transportation 2,485.67 0.9 1.0 2.3 11.5 Real Estate 2,467.99 1.3 2.6 5.8 22.8 Insurance 4,148.45 (0.6) 0.1 2.8 10.4 Telecoms 1,126.11 (0.6) 2.9 14.2 17.1 Consumer 6,534.36 0.6 1.9 8.9 13.7 Al Rayan Islamic Index 3,887.72 0.9 2.0 0.8 16.9 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Res. & Marketing Saudi Arabia 45.10 10.0 1,585.7 (21.9) Saudi Print. & Pack. Saudi Arabia 22.55 9.8 8,331.5 (14.2) Qatari Investors Group Qatar 55.20 6.0 1,282.2 46.4 Tihama Advertising Saudi Arabia 38.71 5.0 8,534.4 29.9 Gulf Warehousing Co. Qatar 62.50 4.2 613.7 9.8 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Marine Dredging Abu Dhabi 5.58 (9.9) 4.0 1.8 Nat. Bank of Abu Dhabi Abu Dhabi 8.27 (4.9) 233.5 3.9 RAKBANK Abu Dhabi 5.25 (3.7) 9.4 (16.0) Nat. Investments Co. Kuwait 0.11 (3.4) 2,860.0 27.3 Commercial Facilities Kuwait 0.18 (3.3) 9.8 2.3 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar First Bank 12.84 (4.9) 1,367.4 (14.4) Qatar German Co for Medical Dev. 11.63 (2.6) 50.4 (15.2) Barwa Real Estate Co. 32.10 (1.2) 297.2 (19.8) Qatar & Oman Investment Co. 11.30 (1.1) 33.7 (8.1) Vodafone Qatar 11.25 (1.1) 434.1 (11.4) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatari Investors Group 55.20 6.0 70,656.4 46.4 Gulf Warehousing Co. 62.50 4.2 37,614.6 9.8 Medicare Group 101.00 3.8 36,106.0 (15.3) Widam Food Co. 62.80 3.8 20,212.5 18.9 Qatar First Bank 12.84 (4.9) 17,828.2 (14.4) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,883.59 0.3 1.4 (3.0) (5.2) 93.37 146,251.2 13.4 1.5 4.2 Dubai 3,312.37 (0.1) 0.1 (5.1) 5.1 97.73 88,053.0 11.1 1.2 4.3 Abu Dhabi 4,427.39 (1.1) (0.0) (2.6) 2.8 67.80 124,828.9 11.6 1.5 5.5 Saudi Arabia 6,644.82 (0.7) (0.2) (2.4) (3.9) 1,564.50 407,709.9 15.4 1.6 3.7 Kuwait 5,351.80 (0.2) (0.4) (0.7) (4.7) 30.67 81,608.6 17.5 1.0 4.8 Oman 5,978.89 (0.7) (0.0) 0.6 10.6 9.72 23,563.1 11.4 1.4 4.3 Bahrain 1,106.40 0.0 (0.6) (0.4) (9.0) 0.90 17,416.3 9.2 0.6 4.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,800 9,820 9,840 9,860 9,880 9,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 0.3% to close at 9,883.6. The Real Estate and Transportation indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Qatari Investors Group and Gulf Warehousing Co. were the top gainers, rising 6.0% and 4.2%, respectively. Among the top losers, Qatar First Bank fell 4.9%, while the Qatar German Co. for Medical Devices was down 2.6%. Volume of shares traded on Tuesday rose by 12.8% to 8.8mn from 7.8mn on Monday. However, as compared to the 30-day moving average of 9.2mn, volume for the day was 3.5% lower. Qatar First Bank and Qatari Investors Group were the most active stocks, contributing 15.5% and 14.5% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Al Madina Insurance Company Moody’s Oman IFSR Ba1 Ba1 – Stable Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, IFSR – Insurance Financial Strength Rating) Earnings Releases Company Market Currency Revenue (mn) 1Q2016 % Change YoY Operating Profit (mn) 1Q2016 % Change YoY Net Profit (mn) 1Q2016 % Change YoY Union Properties Dubai AED – – – – 42.1 49.5% National General Insurance Dubai AED 82.3 13.5% – – 6.4 -66.3% Emaar Malls Dubai AED 833.2 14.0% 576.3 16.5% 528.7 22.0% Aldar Properties Abu Dhabi AED 1232.0 4.5% – – 654.0 14.5% SICO Bahrain BHD – – 1.3 -55.2% -0.3 NA Al Baraka Banking Group Bahrain USD 327.8 10.7% 275.6 15.9% 37.8 -5.1% Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 05/10 US Nat'l Fed. of Ind. Business NFIB Small Business Optimism April 93.6 93.0 92.6 05/10 France INSEE Industrial Production MoM March -0.30% 0.70% -1.30% 05/10 France INSEE Industrial Production YoY March -0.80% 0.50% 0.40% 05/10 France INSEE Manufacturing Production MoM March -0.90% 0.60% -1.40% 05/10 France INSEE Manufacturing Production YoY March -1.10% 1.20% 1.40% 05/10 Germany Deutsche Bundesbank Industrial Production SA MoM March -1.30% -0.20% -0.70% 05/10 Germany Bundesministerium fur Wirtscha Industrial Production WDA YoY March 0.30% 1.10% 2.00% 05/10 Germany Deutsche Bundesbank Exports SA MoM March 1.90% 0.00% 1.30% 05/10 Germany Deutsche Bundesbank Imports SA MoM March -2.30% -0.30% 0.10% 05/10 China NBS CPI YoY April 2.30% 2.30% 2.30% 05/10 China NBS PPI YoY April -3.40% -3.70% -4.30% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting results No. of days remaining Status VFQS Vodafone Qatar 17-May-16 6 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 50.02% 49.39% 2,150,214.02 Qatari Institutions 10.62% 14.78% (14,142,466.44) Qatari 60.64% 64.17% (11,992,252.42) GCC Individuals 1.44% 0.89% 1,859,714.38 GCC Institutions 2.93% 5.20% (7,694,952.76) GCC 4.37% 6.09% (5,835,238.38) Non-Qatari Individuals 17.11% 17.62% (1,732,340.74) Non-Qatari Institutions 17.88% 12.12% 19,559,831.54 Non-Qatari 34.99% 29.74% 17,827,490.80

- 3. Page 3 of 7 News Qatar DHBK’s $5bn fund raising to strengthen balance sheet, liquidity – Doha Bank (DHBK) Chairman Sheikh Fahad bin Mohamad bin Jabor al-Thani said that the bank’s $5bn fund raising through Certificate of Deposits (CDs) and Euro Commercial Paper (ECPs), which is slated to begin within 3Q2016, will help it reduce asset liability mismatch and borrowing costs, strengthen balance sheet and enhance liquidity. He said at the general assembly meeting which approved the fund raising plan, “There is no doubt that the substantial decline in oil prices in addition to the political turmoil in the Middle East has adversely affected all economic sectors including the banking sector and market liquidity. Therefore, many banks resorted to issuing debt bonds and instruments to overcome this problem.” The bank, which is slated to see a 6-7% credit expansion this year in synchronization with the industry average - will issue up to $3bn CDs and another $2bn by ECPs either through a special purpose vehicle guaranteed by the bank or directly by it. Both the instruments are expected to be issued in Qatari riyals or in various major currencies. (Gulf-Times.com) ERES releases initial pricing thoughts for 5-year Sukuk – According to sources, Ezdan Holding Group (ERES) has released initial price thoughts for a five-year Sukuk issue. The pricing for the transaction is earmarked for the low-to-mid-300s basis points area over midswaps. Barwa Bank, Emirates NBD Capital, HSBC and Mashreq are arranging the US dollar issue. There was no indication of the size of the issue. (Reuters) BRES awards QR395mn warehouse project to Qbec – Barwa Real Estate Company (BRES) awarded a warehouse complex development project in Um Shahrein area to Qatar building and Engineering Company (Qbec) for a total value of QR395.85mn. The project is planned to finish within 12 months. The project consists of 259,446 square meters of storage warehouses with high ceilings including 131,671 square meters of dry storage areas, 71,755 square meters of air-conditioned storage areas, 36,992 square meters of chilled storage area, and 19,028 square meters of freezer storages. The project includes a residential compound for employees working in the complex with a total area of 7,655 square meters, and 532 square meters of offices. Also included are 38 commercial shops with a total area of 1,676 square meters and a 700 square meters mosque. The construction encompasses the infrastructure of the project, consisting of 13 electricity substations, inner roads, loading & unloading areas, networks for potable water, fire systems, irrigation, rain & sewage, and their respective tanks. It will also include CCTV surveillance, pump rooms, security rooms and a surrounding fence. The total construction area of the project will be 373,311 square meters. (Gulf-Times.com) QEWS signs MoU with Qeeri to support water security – Qatar Electricity and Water Company (QEWS) signed a Memorandum of Understanding (MoU) with Qatar Environment and Energy Research Institute (Qeeri), one of Hamad Bin Khalifa University’s research institutes, to develop science-based programs and install pilot tests for the development of desalination facilities to be in line with water security initiatives in Qatar. One of the overall objectives of Qeeri is to achieve water security in Qatar by increasing access to high-quality, adequate, affordable and sustainable water that meets & supports the country’s fast- expanding social and development programs. The research conducted at the institute is guided by an aim to increase energy efficiency, reduce costs and minimize health risks & environmental impacts. (Gulf-Times.com) Fitch affirms RasGas’s senior secured bonds at ‘A+’; outlook stable – Fitch Ratings affirmed RasGas’s senior secured bonds rating at ‘A+’ with Stable Outlook. The affirmations reflect the close operational and strategic ties that link RasGas’s debt ratings to the state of Qatar (AA/Stable), as assessed by Fitch’s Parent and Subsidiary Rating Linkage criteria. Qatar’s strong dependence on the revenue from its hydrocarbon sector, of which RasGas is a vital component, puts the project in an exceptionally strong position in terms of criticality of support. The Stable Outlook reflects the outlook on Qatar’s rating as well as sound operating and financial performance of RasGas. The standalone rating of RasGas’s bonds remains ‘A+’ due to the project’s high financial flexibility to withstand the fall in oil & gas prices as observed in the current operating environment. (Peninsula Qatar) QSE suspends trading of NLCS shares on May 11 – The Qatar Stock Exchange (QSE) suspended trading of National Leasing’s (NLCS) shares on May 11, 2016 due to its EGM being held on that day. (QSE) QP marks 10,000th LNG cargo from Ras Laffan Port – Qatar Petroleum (QP) marked a significant milestone on May 9 with the loading of the 10,000th liquefied natural gas (LNG) cargo from Ras Laffan Port. The cargo was loaded on board the Q-Max LNG carrier ‘Mozah,’ which is bound for the South Hook LNG Terminal in the UK. The vessel, chartered by Qatargas from Nakilat, is among the new generation Q-Max carriers, the largest type of LNG vessels in the world, which is able to load a full cargo of 260,000 cubic meter of LNG. QP president and CEO Saad Sherida al-Kaabi said, “The achievement of 10,000 LNG cargoes from Ras Laffan Port is a testament to all the hard work and dedication by Qatar Petroleum as well as Qatargas and RasGas, under the wise leadership of HH the Emir, Sheikh Tamim bin Hamad al-Thani.” (Gulf-Times.com) Energy Minister: Oil market on track to rebalance in 2H2016 – Qatar's Energy Minister and current OPEC President Mohammed al-Sada said that the oil market was on the right track toward rebalancing in 2H2016. Al Sada added that the global oil supply was contracting because of the closure of high-cost production facilities and declining numbers of drilling rigs in operation, which was leading to a fall in production. (Reuters) Qatar crude averages $33.04 in first four months of 2016 – According to official data Qatar’s crude price averaged $33.04 a barrel in the first four months of 2016, as the country has budgeted a significant outlay for major projects this year. Qatar’s budget this year has earmarked QR90.8bn for major projects, up QR3.3bn on 2015. Official data showed that Qatari crude benchmarks (Marine and Dukhan) fetched $27.08 in January, $29.3 in February, $35.83 in March, and $39.95 in April. The Qatari crude had averaged $53.16 in the first four months and $50.67 in the whole of 2015. Sources, citing figures published by the Ministry of Finance, reported that Qatar’s allocation in terms of “development expenditure” had not seen any “major curtailment” despite the lower oil price. The Quarterly Statistical Bulletin published by the Qatar Central Bank (QCB) recently showed that “development expenditure” provided in the State Budget stood at QR62.6bn in 2014-15. However, this is lower than QR69.65bn provided in 2013-14. Nevertheless, “development expenditure” has been showing an increase in Qatar since 2010-11, when it stood at QR43.8bn. In 2011-12 and 2012-13, it accounted for QR52.1bn and QR51.6bn, respectively. The source stated “In relative terms, Qatar’s economy has been doing well. Compared with our neighbors, Qatar’s budget has higher allocation for major projects and a significant outlay for key sectors such as infrastructure, health and education.” (Gulf-Times.com) MDPS: Al Rayyan Municipality issued most building permits in April – According to data released by the Ministry of Development Planning and Statistics (MDPS) in a monthly Statistics of Building

- 4. Page 4 of 7 Permits issued, Al Rayyan Municipality issued the most building permits last month, outnumbering the Doha Municipality. The number of building permits decreased 21% MoM in April. The decrease was seen in all municipalities except Al Wakrah and Al Khor, where there was an increase. Al Rayyan municipality (including Shihaniya) issued 172 permits, 30% of the total permits issued last month. Doha municipality came second with 142 permits, 25% of total, followed by Al Wakrah with 97 permits (17%), and Al Khor with 56 permits (10%). Al Da’ayen Municipality issued 49 permits (9%), Umm Slal 42 permits, (7%) and Al Shamal 10 permits (2%). New building permits (residential and non-residential) constitute 56% (319 permits) of the total building permits issued in April, while the “additions permits” constituted 40% (228 permits), and “fencing permits” 4% (21 permits). (Peninsula Qatar) QA delays launch of Doha-Auckland service – Qatar Airways (QA) delayed the launch of the world's longest direct flight from Doha to Auckland, New Zealand by two months because of the late delivery of Airbus A350s. (Reuters) Qatar-Belgium trade hits €1.3bn in 2015 – According to Belgian ambassador Christophe Payot, trade volume between Qatar and Belgium reached €1.3bn in 2015, as both countries are working closely to forge stronger economic ties. The ambassador said Belgium recorded a 56% growth in exports to Qatar in 2015, which is more than €320mn as compared to 2014. Payot said, “Qatar’s exports to Belgium stood at about QR2bn, which is mainly from exports of liquefied natural gas (LNG) and products related to oil and gas sector.” Payot added that Belgium is preparing for a visit by HE the Minister of Economy and Commerce Sheikh Ahmed bin Jassim bin Mohamed al-Thani by May-end. He noted that the Minister’s economic mission to Belgium would help enhance the level of its bilateral cooperation with Qatar, particularly in the fields of technology, research & development (R&D) and sustainable development, among others. (Gulf-Times.com) MEC discusses ways to facilitate flow of Qatari non-oil commodities to global markets – Minister of Economy and Commerce (MEC) HE Sheikh Ahmed bin Jassim bin Mohammed al Thani discussed ways to facilitate the flow of Qatari non-oil commodities to the global markets with private sector representatives and several government departments. The MEC said the meeting is part of its efforts to promote coordination between the economic & trade sectors and government departments concerned in the context of policies pursued by the state and economic trends. The minister stressed the importance of the meeting, which aims to promote ways of taking advantage of the international economic and trade agreements signed by Qatar aimed at facilitating the flow of Qatari goods and products to the global markets. (Qatar-Tribune) Sulaiti meets EU official – HE the Minister of Transport and Communications Jassim Seif Ahmed al-Sulaiti delivered a message to European Union Transport Commissioner Violeta Bulc on cooperation in the implementation of EU air safety systems during a meeting in Brussels. The meeting reviewed cooperation in transport & communications and the aviation sector between Qatar and the EU. Sheikh Ali bin Jassim al-Thani, Qatar’s ambassador to Belgium and head of the Qatari mission to the EU, attended the meeting along with Civil Aviation Authority Chairman Abdullah bin Nasser Turki al-Subaie. (Gulf-Times.com) MoI launches mobile security office in Al Gharia – Al Shamal Security Department has launched a mobile office to provide criminal investigation and patrolling services to residents and visitors to areas outside the city, especially those frequented by large number of tourists. The office started the first phase of its work in Al Gharia area, focusing on visitors during weekends and official holidays. (Peninsula Qatar) International US small business confidence rises from two-year low – The National Federation of Independent Business (NFIB) said US small business confidence rebounded from a two-year low in April amid growing labor market optimism, supporting views economic growth will regain momentum in the 2Q2016. The NFIB said its small business optimism index increased 1.0 point to a reading of 93.6 in April. It was the first increase in the index in 2016. The index hit a two-year low in March. Despite April's jump, it remained below the 100 reading in December 2014 and its 42- year average of 98. Last month's increase is in-line with expectations that the economy will pick up speed in the 2Q2016 after GDP growth slowed to a 0.5% annualized rate in the 1Q2016. Growth was hampered by the lingering effects of the dollar's rally between June 2014 and December 2015, weak global demand, an inventory overhang as well as low oil prices, which have hurt profits in the energy sector. (Reuters) US wholesale inventories barely rise, sales rebound – The Commerce Department said, US wholesale inventories barely rose in March as sales recorded their largest increase in nearly a year, suggesting little impact on the 1Q2016 economic growth estimate. It said wholesale inventories edged up 0.1%. February inventories were revised down to show a 0.6% decrease instead of the previously reported 0.5% decline. March's increase in wholesale inventories was in-line with expectations. Sales jumped 0.7% in March, the largest increase since April 2015, after slipping 0.2%in February. Despite March's fairly strong sales pace, it would still take wholesalers 1.36 months to clear shelves, unchanged from February. (Reuters) ONS: UK 1Q2016 trade deficit widens to biggest since 2008 – The Office for National Statistics (ONS) said Britain's trade deficit widened in 1Q2016 to its biggest since the early days of the financial crisis, adding to signs that global weakness is weighing on the economy. The shortfall in 1Q2016 widened to £13.273bn from £12.205bn in 4Q2015, it’s biggest for any calendar quarter since the 1Q2008. The deficit in goods alone widened to its highest since comparable records began in 1998 at £34.694bn. Figures for March alone showed some improvement with the deficit in the trade in goods narrowing a bit to £11.204bn, slightly under economists' forecasts for £11.3bn in a Reuters poll. British economic growth slowed to a quarterly rate of 0.4% in 1Q2016, down from 0.6% in 4Q2015, and the ONS said trade would be a drag over the period. Recent figures showed that goods export volumes in the 1Q2016 slipped by 0.1%, a smaller decline than at the end of 2015, while goods imports rose by 1.5%. (Reuters) Exports surge drives German trade surplus to record high in March – German industrial output rose strongly in the 1Q2016 and exports soared in March, propelling the trade surplus in Europe's largest economy to a record high. Production was strong in the first three months of the year despite a bigger-than-expected drop in March and the overall robust readout is likely to heat up debate about how Germany's strong exports are fuelling global economic imbalances. The US has for years called for Germany and other countries with current account surpluses to do more to boost lackluster domestic demand. The Organization for Economic Cooperation and Development (OECD) and the International Monetary Fund (IMF) has also urged Germany to step up public and private investment in infrastructure to reduce its current account surplus. Industrial output fell by 1.3% in March, the strongest monthly decline since August 2014. The figure came in below the consensus forecast in a Reuters poll for a 0.2% fall. In the 1Q2016, output rose by 1.8% QoQ, driven mainly by a strong hike in construction activity and higher demand for capital goods. (Reuters)

- 5. Page 5 of 7 Ministry: China's 2016 services trade expected to exceed $750bn – The commerce ministry said that the value of China's services trade is expected to grow rapidly and exceed $750bn in 2016 but the country's export sector remains under pressure. The ministry said global commodities markets have to cope with reductions in overcapacity in 2016 while the effect of trade frictions is becoming more obvious. China's economy continues to face big downward pressure. It said external demand remains weak and the situation for foreign trade remains "severe and complicated" in 2016. It added, China will stabilize the scale and speed of foreign investment inflows. Bilateral trade between China and "one belt, one road" countries totaled $995.5bn in 2015, or 25.1% of total foreign trade. President Xi Jinping's "one belt, one road" initiative is the new Silk Road and economic belt spreading from Western China to Central Asia and onwards to Europe. China's foreign services trade deficit was $137bn in 2015, as the country faces a large gulf in spending between Chinese who spend more abroad than foreigners in China in industries ranging from tourism to education. (Reuters) Regional S&P: Weak economy to weigh on Islamic banks – S&P Global Ratings has noted that weak economic environment will negatively weigh on the financial performance of Islamic banks in the Gulf Cooperation Council (GCC) countries in 2016 and 2017. The drop in the oil price that started since 2H2014 resulted in a significant slowdown of the GCC economies and reduced growth opportunities for their banking systems. The ratings agency now forecasts oil prices will reach $50 per barrel in 2018, with unweighted average economic growth of the six GCC countries of 2.1% in 2016 and 2.5% in 2017. As a result, a more pronounced slowdown is expected in the growth of both conventional and Islamic banks in the GCC. Nevertheless, S&P Global Ratings thinks that GCC Islamic banks have built sufficient buffers to navigate through this new environment. (Peninsula-Qatar) PwC: Low oil prices impacting infrastructure projects – Capital projects and infrastructure sector has been greatly impacted by slowdowns and deferrals of government spending as a result of ‘lower for longer’ oil prices. According to a recent survey “Delivering during change” released by PwC Middle East, more than 60% of respondents think spending will fall in 2016, while 75% have already been impacted by funding constraints. Lower for longer oil prices are creating a squeeze on government funding, and PwC’s report suggests that new methods of financing and delivery, such as PPPs, will be required in order to deal with these changes. However, respondents to the survey say that introducing new sources of finance could improve the efficiency of the delivery of projects, with 44% and 38% saying they think more projects would run on time and to budget respectively. (Peninsula-Qatar) UAE, Qatar interest rates climb as declining oil prices hurt liquidity – According to sources, the key interest rate in the UAE and Qatar climbed to their highest levels in several years as liquidity tightened across the region amid the decline in oil prices. The three-month Emirates Interbank Offered Rate, a benchmark used to price loans, jumped 3 basis points or 0.03 percentage points, to 1.07871% on May 9, the highest in more than three years. The equivalent rate in Qatar climbed 6 basis points to 1.5025%, the highest since January 2011. The bank liquidity in the GCC region, which includes the biggest Arab economy of Saudi Arabia, is tightening as more than a 50% slump in crude since mid-2014 slowed deposit growth and pushed the government to boost borrowing. According to estimates from Emirates NBD, GCC governments may notch up a combined budget deficit of about $140bn in 2016, if crude prices remain in the mid-$40s. (Bloomberg) SACC extends contract with Oman Air for 3 more years – Saudi Airlines Catering Company (SACC) has extended its contract with Oman Air for providing in-flight catering services. The contract was extended for another three years; starting from June 15, 2016 to June 19, 2019. The provisional value of this contract is SR35mn. The company is expecting a positive financial impact to appear in 3Q2016. Meanwhile, SACC’s BoD proposed a cash dividend of 17.5% of the share’s par value of SR1.75 for 1Q2016, totaling SR143.5mn. The eligibility of dividends shall be for the shareholders registered in the Securities Depository Center (Tadawul) on May 19. The dividends will be deposited into the shareholders' accounts on June 8 through Saudi British Bank (SABB). (Tadawul) JMC announces dividend for 1Q2016 – Jarir Marketing Company (JMC) has announced that Arab National Bank (ANB) will distribute dividend for 1Q2016 (SR1.75 per share) to all eligible shareholders registered in Jarir share registry at the end of trading of May 2, 2016 (record date). The dividend payment process will start on May 12, 2016 (payment date). The due dividends will be deposited directly into the current accounts of the investment portfolios of all eligible shareholders. (Tadawul) CEO: Saudi Aramco finalizes IPO options, plans global expansion – Saudi Aramco CEO Amin H. Nasser said that it is finalizing options for its partial privatization and will present them to its Supreme Council soon. He said the company has a huge team working on the proposals for the initial public offering (IPO) of less than 5% of the company's value, which include a single domestic listing and a dual listing with a foreign market. All these options will be presented soon to Aramco's Supreme Council, headed by Deputy Crown Prince Mohammed bin Salman, who is leading an economic reform drive to address falling oil revenue and sharp fiscal deficits by boosting the private sector, ending government waste and diversifying the economy. Nasser also said Aramco was seeking to expand globally via joint ventures in Asia and North America. (Reuters) Saudi Aramco will sign MoU with SABIC – Saudi Aramco CEO expects to sign a memorandum of understanding (MoU) with Saudi Basic Industries Corp (SABIC) soon for a joint oil-to- chemicals project. SABIC has previously said the proposed project could cost around $30bn, processing petrochemicals directly from crude oil instead of first refining the oil into products such as naphtha. (Reuters) SASCO signs mutual cooperation agreement with Shahia Food – Saudi Automotive Services Company (SASCO) has signed a mutual cooperation agreement with Shahia Food Limited Company. Shahia Food is the sole authorized franchisee of DUNKIN DONUTS brand in Saudi Arabia. This agreement states that Shahia, through its DUNKIN DONUTS brand, will open shops in the stations of SASCO and all palm stores inside cities and on the highways to operate the selling of coffee and donuts on a sharing revenue basis from the gross revenues of DUNKIN DONUTS. This shared revenue resulted from this agreement will be differentiated based on the level of total annual revenues of all locations. This agreement will be valid for 5 years, starting from June 1, 2016. (Tadawul) IMF expects UAE inflation to decline to 3.2% in 2016 – The International Monetary Fund (IMF) says UAE's average inflation is expected to decline to 3.2% in 2016 from 4.1% in 2015. The IMF estimates that the UAE's growth outlook is expected to moderate in 2016 amid low oil prices, with non-hydrocarbon growth projected at 2.4% due to fiscal consolidation, softer economic sentiment and tighter monetary and financial conditions. (GulfBase.com) UAE-Turkey bilateral trade reaches AED25.3bn in 2015 – According to Sharjah Investment and Development Authority (Shurooq) CEO

- 6. Page 6 of 7 Marwan Bin Jasem Al Sarkal, the bilateral trade between the UAE and Turkey reached AED25.3bn in 2015. The trade exchange between Sharjah and Turkey reached AED716mn in 2014 and nearly 100 Turkish companies are registered in the emirate. (GulfBase.com) UAE approves creation of central Islamic finance authority – The UAE’s cabinet has approved the creation of a centralized Shari’ah authority that will monitor and set standards for Islamic finance in the country, aiming to boost the growth of the industry. The authority, to be designed and established by the central bank, will supervise the Shari’ah boards of individual banks and financial institutions. (GulfBase.com) UAE banks need to reevaluate business strategies – According to KPMG’s new UAE Banking Perspectives report, banks will need to reevaluate the way they approach changes and challenges in their customer and business strategies and focus on digital and talent strategies in 2016 to stay ahead in the long run in the wake of market volatility and tightening global liquidity. The banking sector, both globally and in the UAE, is currently facing a number of headwinds. Globally, institutions are focusing on enhancing regulatory capital. Digital and broader technology advances are challenging the customary ways of doing business. New market participants – non-bank financial institutions – are encroaching on traditional hunting grounds. (GulfBase.com) Dubai private sector firms gain steam – Dubai witnessed the fastest rise in private sector business activity since September 2015 during April. In addition, Dubai private-sector companies are upbeat about their growth prospects for the year ahead. Dubai private-sector companies indicated a sustained recovery in growth momentum from the survey's record-low experienced in February. At 52.7 in April, up slightly from 52.5 in March, the seasonally- adjusted Emirates NBD Dubai Economy Tracker Index highlighted the fastest improvement in overall business conditions since November 2015. (GulfBase.com) Aldar plans AED5.2bn capex over next two years – Aldar Properties Chief Financial Officer (CFO) Greg Fewer said that Aldar has earmarked AED5.2bn for capital spending over the next two years. (Bloomberg) Investec raises $1bn for Emirates to lease Airbus A380 – Investec Bank has closed a $1bn operating lease transaction with Emirates Airline. The deal will pay for the delivery and sale and leaseback of four A380-800s. Investec Aviation Finance has around $5bn of aircraft assets under management through its own balance sheet and managed funds. (GulfBase.com) Treasury Heads at FGB, Al Hilal resign – According to sources, the Treasury Heads of two Abu Dhabi banks, First Gulf Bank (FGB) and Al Hilal Bank, have resigned, both lenders has confirmed on May 10. Christopher Wilmot, Head of Treasury and Global Markets group at FGB, will leave on June 9 after four-and-a-half years with the emirate's largest bank by market value. T.G. Ramani will take over as acting Head of Treasury & Global markets. Aladin al- Khatib, Head of Treasury and Investments at Shari’ah-compliant Al Hilal Bank, left in April. (Reuters) Boubyan Bank launches $250mn capital-boosting Sukuk – According to sources, Boubyan Bank has launched a $250mn capital-boosting Sukuk issue that was priced on May 10. The order books for the deal, which will enhance the bank's Tier 1, or core, capital, reached $1.3bn. The Sukuk, which is structured with a perpetual tenor and with an option for the bank to redeem the paper after the fifth year, will price at 6.75%, in line with the revised guidance provided by the bank on May 9, 2016. (Reuters) First venture capital firm in Oman starts operations – Oman's first equity-based venture capital firm, Innovation Development Oman Holding (IDO), was officially launched May 9. Four agencies – State General Reserve Fund, Oman Oil Company, the Research Council and Oman Telecommunications Company (Omantel) – joined together to establish the new venture capital firm. (GulfBase.com) Bahrain-Egypt trade increases to $340mn in 2015 – Bahrain Chamber of Commerce and Industry Chairman Khalid Almoayed said Bahrain-Egypt bilateral trade increased by more than 6% in 2015 to $340mn as compared to $320mn in 2014. Khalid Almoayed said the uptrend of bilateral trade confirms Bahraini businessmen’s willingness to increase their investments in Egypt that presently stand at more than $1.7bn. (GulfBase.com)

- 7. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. WLL One Person Company Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. WLL One Person Company (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Apr-12 Apr-13 Apr-14 Apr-15 Apr-16 QSE Index S&P Pan Arab S&P GCC (0.7%) 0.3% (0.2%) 0.0% (0.7%) (1.1%) (0.1%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,265.83 0.2 (1.7) 19.3 MSCI World Index 1,662.31 1.2 1.2 (0.0) Silver/Ounce 17.12 0.5 (2.0) 23.5 DJ Industrial 17,928.35 1.3 1.1 2.9 Crude Oil (Brent)/Barrel (FM Future) 45.52 4.3 0.3 22.1 S&P 500 2,084.39 1.2 1.3 2.0 Crude Oil (WTI)/Barrel (FM Future) 44.66 2.8 0.0 20.6 NASDAQ 100 4,809.88 1.3 1.6 (3.9) Natural Gas (Henry Hub)/MMBtu 2.04 3.7 10.9 (11.7) STOXX 600 336.24 0.8 1.0 (3.7) LPG Propane (Arab Gulf)/Ton 48.38 2.9 (1.8) 23.6 DAX 10,045.44 0.6 1.4 (2.5) LPG Butane (Arab Gulf)/Ton 57.00 2.2 (0.9) (0.9) FTSE 100 6,156.65 0.9 0.3 (3.4) Euro 1.14 (0.1) (0.3) 4.7 CAC 40 4,338.21 0.3 0.5 (2.0) Yen 109.27 0.9 2.0 (9.1) Nikkei 16,565.19 1.3 0.4 (3.9) GBP 1.44 0.2 0.1 (2.0) MSCI EM 806.91 0.7 0.2 1.6 CHF 1.02 (0.5) (0.4) 2.7 SHANGHAI SE Composite 2,832.59 0.1 (3.0) (20.4) AUD 0.74 0.6 (0.0) 1.1 HANG SENG 20,242.68 0.4 0.6 (7.8) USD Index 94.29 0.2 0.4 (4.4) BSE SENSEX 25,772.53 0.3 1.9 (2.0) RUB 66.27 (0.4) 0.1 (8.6) Bovespa 53,070.91 6.3 3.3 38.9 BRL 0.29 1.2 0.8 14.0 RTS 897.11 (1.6) (1.6) 18.5 111.8 88.4 88.2