QNBFS Daily Market Report August 11, 2016

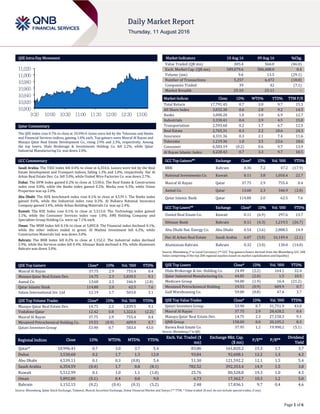

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 0.7% to close at 10,996.4. Gains were led by the Telecoms and Banks and Financial Services indices, gaining 1.0% each. Top gainers were Masraf Al Rayan and Mazaya Qatar Real Estate Development Co., rising 2.9% and 2.3%, respectively. Among the top losers, Dlala Brokerage & Investments Holding Co. fell 2.2%, while Qatar Industrial Manufacturing Co. was down 2.0%. GCC Commentary Saudi Arabia: The TASI Index fell 0.4% to close at 6,354.6. Losses were led by the Real Estate Development and Transport indices, falling 1.3% and 1.0%, respectively. Dar Al Arkan Real Estate Dev. Co. fell 3.0%, while United Wire Factories Co. was down 2.7%. Dubai: The DFM Index gained 0.2% to close at 3,530.6. The Real Estate & Construction index rose 0.8%, while the Banks index gained 0.2%. Marka rose 6.3%, while Union Properties was up 2.0%. Abu Dhabi: The ADX benchmark index rose 0.1% to close at 4,539.1. The Banks index gained 0.6%, while the Industrial index rose 0.2%. Al Buhaira National Insurance Company gained 3.4%, while Arkan Building Materials Co. was up 2.4%. Kuwait: The KSE Index rose 0.1% to close at 5,513.0. The Technology index gained 1.1%, while the Consumer Services index rose 1.0%. AWJ Holding Company and Specialties Group Holding Co. were up 7.1% each. Oman: The MSM Index fell 0.1% to close at 5,892.8. The Financial index declined 0.1%, while the other indices ended in green. Al Madina Investment fell 6.2%, while Construction Materials Ind. was down 3.0%. Bahrain: The BHB Index fell 0.2% to close at 1,152.2. The Industrial index declined 2.9%, while the Services index fell 0.4%. Ithmaar Bank declined 4.3%, while Aluminum Bahrain was down 3.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Masraf Al Rayan 37.75 2.9 755.4 0.4 Mazaya Qatar Real Estate Dev. 14.75 2.3 1,839.5 9.1 Aamal Co. 13.60 2.3 346.9 (2.8) Qatar Islamic Bank 114.80 2.0 62.5 7.6 Salam International Inv. Ltd 12.19 1.7 503.0 3.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 14.75 2.3 1,839.5 9.1 Vodafone Qatar 12.42 0.8 1,322.6 (2.2) Masraf Al Rayan 37.75 2.9 755.4 0.4 Mesaieed Petrochemical Holding Co. 19.53 (0.9) 609.9 0.7 Qatari Investors Group 53.90 0.7 583.4 43.0 Market Indicators 10 Aug 16 09 Aug 16 %Chg. Value Traded (QR mn) 305.4 566.0 (46.0) Exch. Market Cap. (QR mn) 589,079.6 586,488.0 0.4 Volume (mn) 9.6 13.5 (29.1) Number of Transactions 5,257 6,472 (18.8) Companies Traded 39 42 (7.1) Market Breadth 25:10 25:11 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,791.45 0.7 3.0 9.7 15.3 All Share Index 3,032.30 0.6 2.8 9.2 14.5 Banks 3,000.20 1.0 3.0 6.9 12.7 Industrials 3,330.41 0.4 3.9 4.5 15.8 Transportation 2,593.60 0.2 1.7 6.7 12.5 Real Estate 2,765.31 0.3 2.2 18.6 24.3 Insurance 4,331.36 0.3 2.1 7.4 11.6 Telecoms 1,219.36 1.0 3.5 23.6 18.6 Consumer 6,583.19 (0.2) 0.6 9.7 13.9 Al Rayan Islamic Index 4,228.43 0.7 3.3 9.7 18.5 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% BBK Bahrain 0.36 7.2 47.2 (17.9) National Investments Co. Kuwait 0.11 3.8 1,050.4 22.7 Masraf Al Rayan Qatar 37.75 2.9 755.4 0.4 Aamal Co. Qatar 13.60 2.3 346.9 (2.8) Qatar Islamic Bank Qatar 114.80 2.0 62.5 7.6 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% United Real Estate Co. Kuwait 0.11 (6.9) 297.6 13.7 Ithmaar Bank Bahrain 0.11 (4.3) 1,219.5 (26.7) Abu Dhabi Nat. Energy Co. Abu Dhabi 0.54 (3.6) 2,888.5 14.9 Dar Al Arkan Real Estate Saudi Arabia 6.07 (3.0) 16,149.4 (2.1) Aluminium Bahrain Bahrain 0.32 (3.0) 130.0 (14.0) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding Co. 24.49 (2.2) 164.1 32.4 Qatar Industrial Manufacturing Co. 44.05 (2.0) 1.5 10.5 Medicare Group 94.00 (1.9) 16.4 (21.2) Mesaieed Petrochemical Holding 19.53 (0.9) 609.9 0.7 Gulf Warehousing Co. 59.00 (0.8) 47.6 3.7 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatari Investors Group 53.90 0.7 31,751.9 43.0 Masraf Al Rayan 37.75 2.9 28,428.2 0.4 Mazaya Qatar Real Estate Dev. 14.75 2.3 27,158.3 9.1 QNB Group 158.00 0.0 20,105.2 8.3 Barwa Real Estate Co. 37.95 1.2 19,990.2 (5.1) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,996.41 0.7 3.0 3.7 5.4 83.86 161,820.2 15.3 1.7 3.7 Dubai 3,530.60 0.2 1.7 1.3 12.0 93.84 92,608.1 12.2 1.3 4.3 Abu Dhabi 4,539.11 0.1 0.3 (0.8) 5.4 51.30 121,592.2 12.1 1.5 5.4 Saudi Arabia 6,354.59 (0.4) 1.7 0.8 (8.1) 782.52 392,353.4 14.9 1.5 3.8 Kuwait 5,512.99 0.1 1.0 1.1 (1.8) 25.76 80,528.8 19.3 1.0 4.3 Oman 5,892.80 (0.1) 0.4 0.8 9.0 6.73 17,362.7 10.3 1.2 5.0 Bahrain 1,152.15 (0.2) (0.4) (0.3) (5.2) 2.48 17,836.1 9.7 0.4 4.6 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,900 10,920 10,940 10,960 10,980 11,000 11,020 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 0.7% to close at 10,996.4. The Telecoms and Banks & Financial Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Masraf Al Rayan and Mazaya Qatar Real Estate Development Co. were the top gainers, rising 2.9% and 2.3%, respectively. Among the top losers, Dlala Brokerage & Investments Holding Co. fell 2.2%, while Qatar Industrial Manufacturing Co. was down 2.0%. Volume of shares traded on Wednesday fell by 29.1% to 9.6mn from 13.5mn on Tuesday. However, as compared to the 30-day moving average of 5.8mn, volume for the day was 66.6% higher. Mazaya Qatar Real Estate Development and Vodafone Qatar were the most active stocks, contributing 19.2% and 13.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Gulf Insurance Group Moody's Kuwait IFSR – A3 – Stable – Industrial Bank of Kuwait Capital Intelligence Kuwait LT-FCR/ST-FCR/FSR A+/ A2/A A+/ A2/A – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, IFSR –Insurance Financial Strength Rating ) Earnings Releases Company Market Currency Revenue (mn) 2Q2016 % Change YoY Operating Profit (mn) 2Q2016 % Change YoY Net Profit (mn) 2Q2016 % Change YoY Dubai Insurance Co. Dubai AED 94.5 -4.5% 3.8 -32.7% 5.5 -18.9% Al Fujairah National Insurance Co. Abu Dhabi AED 34.5 3.3% 2.8 296.6% 4.1 -34.6% AXA Green Crescent Insurance Abu Dhabi AED 5.1 -35.4% – – -5.4 NA Abu Dhabi National Energy Co. Abu Dhabi AED 4,035.0 -14.3% – – -588.0 NA Bahrain Car Parks Co. Bahrain BHD – – 0.2 -35.5% 0.2 -31.8% Bahrain Duty Free Complex Bahrain BHD 13.8 1.9% – – 3.4 -35.4% Al Ahlia Insurance Co. Bahrain BHD – – 0.6 87.3% 0.2 NA Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/10 US Mortgage Bankers Association MBA Mortgage Applications 5-August 7.10% – -3.50% 08/10 France INSEE Industrial Production MoM June -0.80% 0.10% -0.50% 08/10 France INSEE Industrial Production YoY June -1.30% -0.40% 0.50% 08/10 France INSEE Manufacturing Production MoM June -1.20% 0.20% 0.10% 08/10 France INSEE Manufacturing Production YoY June -1.50% 0.10% 0.70% 08/10 Japan Bank of Japan PPI MoM July 0.00% -0.10% -0.10% 08/10 Japan Bank of Japan PPI YoY July -3.90% -4.00% -4.20% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 2Q2016 results No. of days remaining Status SIIS Salam International Investment 11-Aug-16 0 Due WDAM Widam Food Company 11-Aug-16 0 Due QGMD Qatar German Company for Medical Devices 14-Aug-16 3 Due ZHCD Zad Holding Company 14-Aug-16 3 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 32.23% 40.72% (25,921,211.35) Qatari Institutions 19.56% 24.77% (15,899,821.90) Qatari 51.79% 65.49% (41,821,033.25) GCC Individuals 0.66% 2.05% (4,254,693.73) GCC Institutions 5.31% 5.95% (1,970,886.98) GCC 5.97% 8.00% (6,225,580.71) Non-Qatari Individuals 12.92% 16.03% (9,504,811.09) Non-Qatari Institutions 29.33% 10.48% 57,551,425.05 Non-Qatari 42.25% 26.51% 48,046,613.96

- 3. Page 3 of 6 News Qatar DBIS’ profitability improves in 2Q2016 driven by reversal of AFS impairments – Dlala Brokerage & Investments Holding Company (DBIS) reported a 2Q2016 net profit of QR0.8mn, representing an 81.2% QoQ increase from QR0.4mn in 1Q2016. The company had reported a net loss of QR23.4mn in 2Q2015. The company’s net brokerage & commission income declined 16.8% QoQ and 40.3% YoY to QR5.0mn in 2Q2016. QR5.2mn in investment losses meant that net operating income for 2Q2016 also declined to QR3.4mn vs. QR12.9mn in 1Q2016 and QR14.3mn in the same quarter last year. The boost in earnings in 2Q2016 was primarily driven by reversal of AFS impairments to the tune of QR2.4mn; the company posted impairment losses of QR30.2mn and QR6.6mn in 2Q2015 and 1Q2016, respectively. Earnings per share amounted to QR0.028 in 2Q2016 as compared to QR0.020 in 1Q2016. (QSE, QNBFS Research) QISI’s bottom-line declines 38.8% QoQ in 2Q2016 – Qatar Islamic Insurance Company (QISI) reported a 2Q2016 net profit of QR13.6mn, indicating a decline of 38.8% QoQ and 19.8% YoY. The company’s total revenue declined 15.6% QoQ to QR25.8mn in 2Q2016, while it rose 2.7% on a YoY basis. Earnings per share came in at QR2.38 in 1H2016 as compared to QR3.35 in 1H2015. (QSE, QNBFS Research) MCGS’ net profit rises 17.2% QoQ in 2Q2016 – Medicare Group’s (MCGS) 2Q2016 net profit rose 17.2% QoQ to QR16.6mn. However, the net profit declined by 64.5% YoY. The company’s operating income increased by 2.8% QoQ to QR121.5mn in 2Q2016, but fell by 21.4% on YoY basis. Earnings per share stood at QR1.09 in 1H2016 as compared to QR3.41 in 1H2015. The decline in profitability thus far this year vs. last year is driven by lower revenue given the impact of the suspension of the Seha program while operating costs remain sticky and income from deposits has more than halved to QR298.0mn vs. QR600.6mn in 1H2015. (QSE, QNBFS Research) MCCS’ net profit declines 24.5% QoQ in 2Q2016 – Mannai Corporation’s (MCCS) net profit declined 24.5% QoQ and 15.0% YoY to QR94.5mn in 2Q2016. Earnings per share amounted to QR4.81 in 1H2016 as compared to QR6.06 in 1H2015. The company’s revenue declined 3.2% QoQ and 17.5% YoY in 2Q2016 to QR1,228.3mn. A company spokesperson said the net profit decline was due to depressed market conditions in the retail/luxury segment and general economic slowdown. However, with diversified earnings potential from across the various business segments and geographies the group is cautiously optimistic of the future. The company concluded the acquisition of majority stake in GFI Informatique, a public listed company in France during the current year. (QSE, QNBFS Research, Gulf- Times.com) Qatar on course to formulate next National Development Strategy (2017-22) – Qatar is well on course to formulate the next National Development Strategy (2017-22), which not only aims at creating conducive conditions for more private sector participation but also better manage financial resources and plan state spending within the "hard" budgetary constraints given the lower oil price levels. HE Minister of Development Planning and Statistics Dr Saleh Mohamed Salem al-Nabit said, "With oil prices now at lower levels than previously anticipated, there will need to be a focus on how to better manage our financial resources and plan state spending." He said the Ministry will consider several key issues in the process of creating the next National Development Strategy (2017-22), adding it will take stock of how well the country has been confronting challenges that were set out in the Qatar National Vision 2030. (Gulf-Times.com) DTZ: Qatar hospitality sector feels impact of additional supply – DTZ Associate Director Johnny Archer said around 5,000 hotel keys have been added to Qatar’s stock over the last 18 months and the additional supply has started to impact performance measures in 2Q2016. Occupancy levels fell 64% in April 2016 compared to 72% in April 2015, while average daily rates also experienced a YoY fall of 6.5% from QR551 in April 2015 to QR515 in April 2016. Speaking before stakeholders at the launching of DTZ’s “2Q2016 Qatar Market Report,” Archer said revenue per available room fell by 17.8% from QR399 in April 2015 to QR328 in April 2016. Meanwhile, DTZ Qatar General Manager Edd Brookes also said that retail space in Qatar will rise 220% by 2019 from the current supply level. DTZ estimates that in excess of 1.3mn square meters of retail space is currently at various stages of construction and is scheduled to open by 2019. The report further revealed that rents of prime residential properties as well as office space fell in the 2Q2016. A softening of rents is also anticipated among mid-range residential units in the third quarter, though such properties did not see much reduction during 2Q2016. The report said rents in the Grade A office market have dropped between 10% and 15% since the start of 2016, while vacancy of prime offices in West Bay has increased by approximately 5% over the last six months. DTZ said this result in “opportunities for tenants with lease events to negotiate advantageous terms.” Office supply in West Bay stood at almost 1.7mn square meters, with approximately 0.25mn square meters currently available to lease. The report said by 2017, it was estimated that a further 385,000 square meters would be added to the Grade A office market. DTZ said, “Demand for office accommodation in 2Q2016 was almost exclusively drawn from the private sector, with many companies looking to relocate within Doha to take advantage of falling rents.” (Gulf-Times.com, Qatar Tribune) Barwa awards ‘Dara A’ project to QDTC – Barwa Real Estate has awarded the construction of the ‘Dara A’ project to Qatar Development Company for Trading & Contracting (QDTC) for a total value of QR115.9mn and a duration of 18 months. The real estate company said that the Dara A project, which is located in the northern part of Fox Hills in Lusail City, “reflects modernity in design” and is scheduled to finish in the first quarter of 2018. The project will come up on a total land area of 16,425 square meters and includes the development of four residential buildings, each comprising five floors of residential units and underground parking with a total project built-up area of 51,037 square meters. (Gulf-Times.com) UPS Worldwide Express Freight expands into Qatar – Qatar is among the nine countries included in UPS Worldwide Express Freight’s global expansion. The other countries include Bahrain, Bangladesh, Kuwait, Malta, Morocco, Pakistan, Sri Lanka, and Tunisia. With the eight countries added last year, the service is now offered in 66 origin and 64 destination countries and territories. UPS said the service is designed for urgent, time- sensitive, and high-value international heavyweight shipments over 70kg, making it ideal for product launches, inventory shortages, and equipment failure replacement parts. (Gulf- Times.com) QA, QACC launch waste reduction program – Qatar Airways (QA) and Qatar Aircraft Catering Company (QACC) have launched a new waste reduction and recycling program in Doha, further contributing toward local and international environmental solutions. As a world-leading airline, QA is continually improving its process of managing its impact on the environment and has been working to introduce additional measures that will minimize packaging and increase recycling to reduce the amount of waste going to landfill. (Gulf-Times.com)

- 4. Page 4 of 6 Qatar envoy: Ties with US based on mutual trust – Qatari Ambassador to the US, Mohammed Jaham Al Kuwari, stressed that relations between both countries are based on strong foundations that stem from mutual trust. Al Kuwari said the Qatari-US ties have reached an advanced stage because they followed the right path based on mutual respect, taking peculiarities into account and understanding priorities, which created foundations for the relations in a way that ensure their continuity and growth. Al Kuwari said the bilateral relations took an upward curve with expanding interests between both countries, embodied in agreements, particularly the trade and investment deal. (Peninsula Qatar) Five Qatari firms find place in ‘most valuable’ non-banking list – Five companies in Qatar have featured in the list of ‘most valuable non-banking companies in the GCC’. The selection is based on financial performance and quantitative methods of the companies. The companies included in the list of Marmore Mena Intelligence’s ‘Most Valuable 30 GCC Companies’ are: Qatar Fuel, Widam Food, Medicare Group, Mazaya Qatar and Al Meera. (Peninsula Qatar) International Banks step up pressure on regulators finalizing global rules – A banking lobby said that new rules need to be better tested by regulators for any impact on lending and markets, ahead of a meeting next month to finalize the latest wave of reforms aimed at preventing another financial crisis. The Global Financial Markets Association (GFMA) said that it has written to the watchdogs, requesting an end to duplication and conflicts in rules already rolled out, and for them to study how the demands will mesh with reforms in the pipeline. During the 2007-09 crisis, leaders of the Group of 20 economies (G20) called for higher levels of bank capital, a step the Basel Committee of regulators implemented with "Basel III". (Reuters) US government posts $113bn deficit in July – The US Treasury Department said that the government posted $113bn budget deficit in July, a 24% YoY drop. According to Treasury's monthly budget, the government had a deficit of $149bn in July 2015. Analysts polled by Reuters had expected $113bn deficit for July. When accounting for calendar adjustments, July would have shown a $101bn deficit compared with an adjusted $107bn deficit in July 2015. The fiscal YTD deficit was $514bn through July, up 10% YoY from $466bn deficit. On an adjusted basis, the fiscal YTD gap was $505bn in July. That compared with $423bn at the same time last year. Receipts in July totaled $210bn, a 7% YoY decrease, while outlays stood at $323bn, a 14% YoY fall. (Reuters) US job openings increase in June, layoffs near two-year low – According to the US Labor Department, the country’s job openings increased in June and layoffs dropped to their lowest in nearly two years as labor market conditions tightened further. The Labor Department's monthly Job Openings and Labor Turnover Survey (JOLTS) report also suggested a growing skill shortage, which has been highlighted by independent surveys. The report revealed that the Job openings, a measure of labor demand, rose 110,000 to a seasonally adjusted 5.6mn. That raised the jobs openings rate one- tenth of a percentage point to 3.8%. The economy created 547,000 jobs in June and July. The pace of job growth is, however, expected to slow as the economy's recovery from the 2007-2009 recession shows signs of aging. Layoffs fell to 1.6mn in June, the lowest level since September 2014, from 1.7mn in May. The decline pushed the layoffs rate to 1.1%, the lowest since November 2013. (Reuters) INSEE: French June industrial output falls on refinery strikes – The official statistics agency INSEE said that French industrial production unexpectedly fell 0.8% MoM in June, due largely to a decline in refinery activity during nationwide strikes. The agency said that the decline was driven by a 12.4% drop in the refining sector, following a 21% MoM decrease, as strikes at Total's refineries disrupted production. The French oil major was only able to resume production around the middle of June after the 27- day strike. However, June output was also down 2.6% in the equipment goods sector and 1.7% in the transport material sector, with only the mining, energy and water sector expanding with a 1.9% rise. Over the 2Q2016 as a whole, industrial production was down 0.1% QoQ, and up 0.4% YoY. (Reuters) PBoC: China to expand yuan cross-border financing and investing channels – The People's Bank of China (PBoC) said that the country will further expand yuan cross-border financing and investment channels and will further expand cross-border usage of the yuan under the current account. The bank added that the country will also increase the amount of yuan used as a reserve currency. The yuan is set to be included in the IMF's special drawing rights basket for the first time in October. (Reuters) Regional Middle East region creating billionaires at a faster rate – The Middle East region is creating new billionaires at a faster rate than the rest of the global economy. The amount of wealth possessed by the region’s billionaires increased by 9% and reached $450bn. The Middle East region is now home to 6.7% of the world’s billionaires, which is more than the number of billionaires in south and central America. (GulfBase.com) Saudi Arabia reports record crude output on summer demand – Saudi Arabia communicated to the OPEC that it pumped out a record 10.67mn bpd in July to meet a summer surge in domestic demand. The increase will do nothing to endear the group’s leading exporter to other members seeking output limits to shore up prices. (Bloomberg) CMA: Saudi Arabia to open stock market wider to foreigners on September 4 – The Capital Market Authority (CMA) said that Saudi Arabia will ease restrictions on foreign investment in its securities market in September, 2016 sooner than previously indicated, in an effort to attract more institutional money into its bourse. With oil prices sagging and the economy slowing, KSA authorities are keen to attract more foreign capital into the kingdom. The stock market opened to direct investment by foreign institutions in June 2015, but all types of foreign investor still own only 1.03% of the $390bn market. (Peninsula Qatar) Saudi Aramco appoints Chief of sovereign wealth fund to board – State oil giant Saudi Aramco has appointed Yasir al-Rumayyan as a Managing Director of its top sovereign wealth fund, so that the two institutions plan to cooperate closely to restructure the economy in an era of low oil prices. (Peninsula Qatar) China set to choose yuan clearing bank for UAE by 2016-end – China’s central bank is expected to pick a Chinese lender to clear yuan transactions in the UAE by 2016-end. It would strengthen the growing economic ties between China and the Middle East region. (Gulf-Times.com) Consumer confidence in UAE economy picks up in 2Q2016 – Consumer confidence in the UAE improved in 2Q2016, reversing a decline in 1Q2016. The global information company, Nielsen said that 2Q2016 confidence score for the UAE rose by five points to 109, after declining four points in 1Q2016. (Bloomberg) Dubai private sector companies signal a positive start to 3Q2016 – Dubai private sector companies signaled a positive start to 3Q2016, with overall business conditions improving at the fastest pace since March 2015. This was highlighted by a rise in the headline seasonally adjusted Emirates NBD Dubai Economy Tracker Index from 54.6 in June to 55.9 in July. The best performing sub-sector monitored by the survey was wholesale & retail (index at 57.3 in July), followed by travel & tourism (55.1)

- 5. Page 5 of 6 and construction (53.5). In each case, the latest readings were above the crucial 50.0 no-change value. (GulfBase.com) Shaza to open 20 hotels by 2020 – Five-star hotel chain Shaza Hotels plans to expand its portfolio from one hotel to 20 by 2020. Dubai-based Shaza Hotels, a joint venture between Qatar’s Barwa Real Estate and Kempinski, currently operates one hotel located in Medina, Saudi Arabia, which opened in 2010. But in the next four years, it plans to open properties in Saudi Arabia, Qatar, Bahrain, Oman, Jordan and Spain. (Bloomberg) Ex-Arabtec CEO’s Marya Group invests $1bn – Abu Dhabi-based Marya Group, chaired by former Arabtec Holding Chief Executive Officer Hasan Ismaik, is considering an initial public offering after the company’s investment portfolio passed $1bn. (Bloomberg) Deyaar’s Facilities Management Division transitions to a stand- alone company – Deyaar Development, one of Dubai’s largest property development and real estate services companies, has announced that its Facilities Management Division has progressed to become a separate company. Deyaar Facilities Management LLC will build on the recent growth and success of the division with a new strategic vision and management. (DFM) Damac to sell off plots at Akoya Oxygen – Damac Properties is to start selling off plots of land at its Akoya Oxygen community in Dubai. The plots will have a starting price of AED600,000. Investors will get up to 10 years to develop them. (GulfBase.com) Masdar’s Dudgeon production will start in 1Q2017 – According to sources, Masdar’s Dudgeon offshore wind energy project is 60% complete and is set for production in 1Q2017. The project, with a capacity of 402 megawatts, is being developed by Masdar, in coordination with Norwegian companies Statoil and Statkraft. (GulfBase.com) TAQA may sell bonds after reporting loss – Abu Dhabi National Energy Company (TAQA), the government-controlled utility, reported a wider loss in 2Q2016 as the low oil and natural gas prices crimped revenue. The company may sell more bonds in 2016 after tapping debt markets for $1bn in June. (Bloomberg) Kuwait posts budget deficit after 16 years of surplus – The low oil prices have pushed Kuwait into a rare budget deficit, ending 16 straight years of surpluses for the energy-rich Gulf state. The OPEC member recorded a budget shortfall of KD4.6bn in the fiscal year, which ended on March 31, 2016. It was the first shortfall since the fiscal year March 1999. Revenues dropped by 45% to $45.2bn, while spending was cut by 14.8% to $60.5bn. Oil income was $40.1bn, a slump of 46.3% from 2015. (GulfBase.com) Fitch: Kuwait’s fiscal strength, politics mean slower adjustment – Fitch ratings said that Kuwait's new budget indicates smaller fiscal consolidation than in many highly rated regional peers. This reflects the government's exceptionally strong fiscal position, but also the difficulty of pursuing structural reforms, and the government's efforts to catch up with its domestic infrastructure investment plan. The budget for fiscal year ending March 2017 (FY2017), approved by parliament, implies a budget deficit excluding oil income and financial investment flows of 69% of non- oil GDP, compared with 87% of non-oil GDP in FY2015. (Bloomberg) Oman power sector subsidy projected at OMR495mn in 2016 – According to sources, subsidy provided by the Omani government towards the supply of electricity to consumers across the Sultanate is estimated to total OMR495.6mn during 2016, as compared to OMR454.4mn in 2015. (GulfBase.com) Oman deficit swells to OMR2.5bn in five months – On the back of low revenue from the weakened oil prices, the Sultanate’s budget deficit swelled to OMR2.540bn in the first five months of 2016. The difference is 58.7% higher than 2015, when the deficit stood at OMR1.601bn. (GulfBase.com) Inflation in Oman grows 1.3% in July – According to sources, Oman’s CPI-based inflation logged a 1.3% rise in July 2016 as compared to July 2015, primarily driven by a 7.87% rise in transport and 0.88% rise in housing, water, electricity, gas and fuel set prices. While inflation recorded a 0.3% increase in July 2016 as against June figures, average inflation over the January-July period increased by 0.82% as compared to 2015. (GulfBase.com) Galfar order book position stands at OMR690mn at June 2016-end – Galfar Engineering & Contracting Company, the Sultanate’s leading contracting firm, said the order book position of its parent company is around OMR690mn at June 2016-end. (GulfBase.com) Bank Dhofar, Bank Sohar merger would see short-term challenges – The proposed merger between Bank Dhofar and Bank Sohar is expected to bring long-term benefits with an overall positive impact on the former’s credit profile. However, it would generate short-term implementation challenges exacerbated by the weak operating environment. (GulfBase.com) Consortium awaits regulatory nod to acquire OAB unit – Oman International Development & Investment Company (Ominvest) said that the company and its strategic partners are in the process of finalizing regulatory approval for acquiring Oman Arab Bank’s (OAB) investment banking business (OABINVEST). Ominvest and its strategic partners – Oman Investment Fund (OIF) and Arab Bank (Switzerland) - have signed a memorandum of understanding with OAB in March 2016 to acquire the latter’s investment banking business. (GulfBase.com) Ithmaar Bank reports $3.19mn net profit in 2Q2016 – Ithmaar Bank reported a net profit of $3.19mn in 2Q2016 as compared to $3.02mn in 2Q2015. Total income decreased to $111.95mn in 2Q2016 as compared to $127.95mn in 2Q2015. Total assets stood at $8.47bn at the end of June 30, 2016 as compared to $8.14bn at the end of December 31, 2015. Murabaha & other financings stood at $3.44bn as compared to $3.40bn at the end of December 31, 2015. (BHB) BISB reports BHD3.08mn net profit in 1H2016 – Bahrain Islamic Bank (BISB) reported a net profit of BHD3.08mn in 1H2016 as compared to BHD8.20mn in 1H2015. EPS amounted to BHD0.00308 in 1H2016 as compared to BHD0.00987 in 1H2015. (BHB) UGB reports $1.21mn net profit in 2Q2016 – United Gulf Bank’s (UGB) net profit declined to $1.21mn in 2Q2016, as compared to $3.08mn in 2Q2015. Total income fell to $38.97mn in 2Q2016 as compared to $40.07mn in 2Q2015. Total assets stood at $2.98bn at the end of June 30, 2016 as compared to $2.72bn at the end of December 31, 2015. Loans & receivables stood at $1.14bn, while Customer deposits stood at $882.06mn at the end of June 30, 2016. (BHB)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. WLL One Person Company Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. WLL One Person Company (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg (#Market closed on August 10, 2016) Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 QSEIndex S&PPan Arab S&PGCC (0.4%) 0.7% 0.1% (0.2%) (0.1%) 0.1% 0.2% (0.6%) (0.3%) 0.0% 0.3% 0.6% 0.9% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,346.55 0.4 0.8 26.9 MSCI World Index 1,727.49 (0.1) 0.6 3.9 Silver/Ounce 20.15 1.6 2.3 45.4 DJ Industrial 18,495.66 (0.2) (0.3) 6.1 Crude Oil (Brent)/Barrel (FM Future) 44.05 (2.1) (0.5) 18.2 S&P 500 2,175.49 (0.3) (0.3) 6.4 Crude Oil (WTI)/Barrel (FM Future) 41.71 (2.5) (0.2) 12.6 NASDAQ 100 5,204.58 (0.4) (0.3) 3.9 Natural Gas (Henry Hub)/MMBtu 2.73 (0.6) (4.0) 18.2 STOXX 600 343.98 0.4 1.5 (3.4) LPG Propane (Arab Gulf)/Ton 42.00 (4.0) (3.4) 7.3 DAX 10,650.89 0.2 3.5 1.5 LPG Butane (Arab Gulf)/Ton# 53.00 0.0 1.2 (3.8) FTSE 100 6,866.42 0.2 0.5 (2.9) Euro 1.12 0.5 0.8 2.9 CAC 40 4,452.01 0.2 1.7 (1.3) Yen 101.29 (0.6) (0.5) (15.7) Nikkei 16,735.12 0.4 3.4 4.6 GBP 1.30 0.1 (0.5) (11.7) MSCI EM 902.99 0.4 2.0 13.7 CHF 1.03 0.6 0.6 2.8 SHANGHAI SE Composite 3,018.75 0.0 1.7 (16.6) AUD 0.77 0.4 1.1 5.7 HANG SENG 22,492.43 0.1 1.5 2.5 USD Index 95.65 (0.6) (0.6) (3.0) BSE SENSEX 27,774.88 (1.1) (0.9) 5.5 RUB 64.93 0.3 (0.8) (10.5) Bovespa 56,919.78 (1.2) 0.3 65.5 BRL 0.32 0.6 1.2 26.6 RTS 946.63 (0.8) 1.2 25.0 134.0 99.5 99.3