QNBFS Daily Market Report August 07, 2016

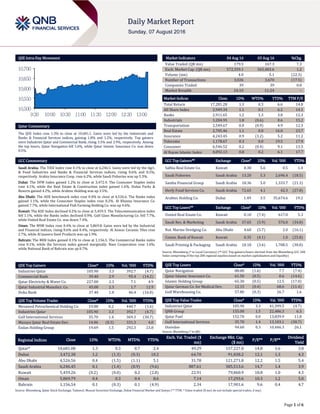

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 1.3% to close at 10,681.1. Gains were led by the Industrials and Banks & Financial Services indices, gaining 1.8% and 1.2%, respectively. Top gainers were Industries Qatar and Commercial Bank, rising 3.3% and 2.9%, respectively. Among the top losers, Qatar Navigation fell 1.6%, while Qatar Islamic Insurance Co. was down 0.5%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 6,246.5. Gains were led by the Agri. & Food Industries and Banks & Financial Services indices, rising 0.6% and 0.5%, respectively. Arabia Insurance Coop. rose 6.2%, while Saudi Fisheries was up 5.3%. Dubai: The DFM Index gained 1.2% to close at 3,472.4. The Consumer Staples index rose 4.1%, while the Real Estate & Construction index gained 1.6%. Dubai Parks & Resorts gained 4.2%, while Arabtec Holding was up 3.5%. Abu Dhabi: The ADX benchmark index rose 0.4% to close at 4,526.6. The Banks index gained 1.1%, while the Consumer Staples index rose 0.2%. Al Khazna Insurance Co. gained 7.7%, while International Fish Farming Holding Co. was up 4.6%. Kuwait: The KSE Index declined 0.2% to close at 5,459.3. The Telecommunication index fell 1.1%, while the Banks index declined 0.9%. Gulf Glass Manufacturing Co. fell 7.7%, while United Real Estate Co. was down 7.4%. Oman: The MSM Index rose 0.4% to close at 5,869.8. Gains were led by the Industrial and Financial indices, rising 0.6% and 0.4%, respectively. Al Anwar Ceramic Tiles rose 2.7%, while Al Jazeera Steel Products was up 1.9%. Bahrain: The BHB Index gained 0.1% to close at 1,156.5. The Commercial Banks index rose 0.1%, while the Services index gained marginally. Nass Corporation rose 1.6%, while National Bank of Bahrain was up 0.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Industries Qatar 105.90 3.3 392.7 (4.7) Commercial Bank 39.40 2.9 95.4 (14.2) Qatar Electricity & Water Co. 227.00 2.3 7.1 4.9 Qatar Industrial Manufact. Co. 45.00 2.3 1.7 12.9 Doha Bank 37.40 1.8 46.4 (16.0) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding Co. 19.08 0.2 440.7 (1.6) Industries Qatar 105.90 3.3 392.7 (4.7) Gulf International Services 35.70 1.4 369.3 (30.7) Mazaya Qatar Real Estate Dev. 14.06 (0.3) 331.3 4.0 Ezdan Holding Group 19.69 1.5 292.3 23.8 Market Indicators 04 Aug 16 03 Aug 16 %Chg. Value Traded (QR mn) 179.5 167.3 7.3 Exch. Market Cap. (QR mn) 572,359.1 565,483.6 1.2 Volume (mn) 4.0 5.1 (22.3) Number of Transactions 3,026 3,670 (17.5) Companies Traded 39 39 0.0 Market Breadth 24:10 11:24 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,281.28 1.3 0.3 6.6 14.8 All Share Index 2,949.34 1.1 0.1 6.2 14.1 Banks 2,911.65 1.2 1.3 3.8 12.3 Industrials 3,204.95 1.8 (0.6) 0.6 15.2 Transportation 2,549.67 0.0 (0.9) 4.9 12.3 Real Estate 2,705.46 1.1 0.0 16.0 23.7 Insurance 4,243.45 0.9 (3.2) 5.2 11.2 Telecoms 1,178.67 0.3 0.0 19.5 17.9 Consumer 6,546.52 0.2 (0.4) 9.1 13.5 Al Rayan Islamic Index 4,092.13 0.8 0.2 6.1 17.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Salhia Real Estate Co. Kuwait 0.38 5.6 0.5 1.4 Saudi Fisheries Saudi Arabia 13.20 5.3 2,696.4 (18.5) Samba Financial Group Saudi Arabia 18.36 5.0 1,333.7 (21.3) Herfy Food Services Co. Saudi Arabia 72.65 4.1 42.3 (27.8) Arabtec Holding Co. Dubai 1.49 3.5 35,674.6 19.2 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% United Real Estate Co. Kuwait 0.10 (7.4) 617.0 5.3 Saudi Res. & Marketing Saudi Arabia 37.65 (5.9) 576.0 (34.8) Nat. Marine Dredging Co. Abu Dhabi 4.60 (5.7) 2.0 (16.1) Comm. Bank of Kuwait Kuwait 0.35 (4.1) 1.0 (25.8) Saudi Printing & Packaging Saudi Arabia 18.18 (3.6) 1,708.5 (30.8) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Navigation 88.00 (1.6) 7.7 (7.4) Qatar Islamic Insurance Co. 61.50 (0.5) 0.6 (14.6) Islamic Holding Group 65.30 (0.5) 12.5 (17.0) Qatar German Co. for Medical Dev. 12.15 (0.4) 68.6 (11.4) Gulf Warehousing Co. 57.80 (0.3) 26.7 1.6 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 105.90 3.3 41,399.5 (4.7) QNB Group 155.00 1.5 22,486.3 6.3 Qatar Fuel 152.70 0.0 13,839.9 11.8 Gulf International Services 35.70 1.4 13,183.1 (30.7) Ooredoo 94.60 0.3 10,446.3 26.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,681.08 1.3 0.3 0.7 2.4 49.29 157,227.0 14.8 1.6 3.8 Dubai 3,472.38 1.2 (1.3) (0.3) 10.2 64.70 91,838.2 12.1 1.3 4.3 Abu Dhabi 4,526.56 0.4 (1.5) (1.1) 5.1 31.78 121,271.8 12.2 1.5 5.4 Saudi Arabia 6,246.45 0.1 (1.4) (0.9) (9.6) 887.61 385,513.6 14.7 1.4 3.9 Kuwait 5,459.26 (0.2) (0.0) 0.2 (2.8) 22.91 79,860.9 18.8 1.0 4.3 Oman 5,869.79 0.4 0.3 0.4 8.6 7.14 17,293.6 10.3 1.2 5.0 Bahrain 1,156.54 0.1 (0.3) 0.1 (4.9) 2.34 17,901.6 9.6 0.4 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,500 10,550 10,600 10,650 10,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index rose 1.3% to close at 10,681.1. The Industrials and Banks & Financial Services indices led the gains. The index rose on the back of buying support from non-Qatari and GCC shareholders despite selling pressure from Qatari shareholders. Industries Qatar and Commercial Bank were the top gainers, rising 3.3% and 2.9%, respectively. Among the top losers, Qatar Navigation fell 1.6%, while Qatar Islamic Insurance Co. was down 0.5%. Volume of shares traded on Thursday fell by 22.3% to 4.0mn from 5.1mn on Wednesday. Further, as compared to the 30-day moving average of 4.9mn, volume for the day was 17.9% lower. Mesaieed Petrochemical Holding Co. and Industries Qatar were the most active stocks, contributing 11.0% and 9.8% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change DP World Limited Fitch Dubai LT-IDR/ST-IDR BBB-/F3 BBB/ F2 Stable – Islamic Arab Ins. Co. S&P Dubai LT-LICR/FSR BBB+/ BBB+ BBB-/ BBB- Negative – Warba Insurance Co. Moody's Kuwait IFSR/LTR – Baa1/Baa1 – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, IFSR – Insurance Financial Strength Rating LICR – Local Issuer Credit Rating) Earnings Releases Company Market Currency Revenue (mn) 2Q2016 % Change YoY Operating Profit (mn) 2Q2016 % Change YoY Net Profit (mn) 2Q2016 % Change YoY Alliance Insurance Dubai AED 32.0 -4.6% 11.0 86.5% 11.9 30.1% United Foods Co. Dubai AED 114.9 -5.1% – – 9.1 -20.4% International Fish Farming Holding Co. Abu Dhabi AED 87.6 -3.7% 1.0 -88.4% 4.0 -95.0% RAK Properties* Abu Dhabi AED 147.1 59.8% 34.2 65.8% 38.7 70.5% Global Financial Investment* Oman OMR 2.6 20.3% – – 1.1 41.9% Bahrain Telecommunications Co. Bahrain BHD – – – – 13.1 -1.7% Source: Company data, DFM, ADX, MSM (*6M2016-results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/04 US Department of Labor Initial Jobless Claims 30-July 269k 265k 266k 08/04 US Department of Labor Continuing Claims 23-July 2,138k 2,130k 2,144k 08/04 EU Markit Markit Eurozone Retail PMI July 48.9 – 48.5 08/05 UK Lloyds TSB Halifax House Prices MoM July -1.00% -0.20% 1.20% 08/04 Germany Markit Markit Germany Construction PMI July 51.6 – 50.4 08/04 Germany Markit Markit Germany Retail PMI July 52.0 – 51.6 08/04 France Markit Markit France Retail PMI July 51.6 – 51.0 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 2Q2016 results No. of days remaining Status DOHI Doha Insurance 8-Aug-16 1 Due MPHC Mesaieed Petrochemical Holding Company 9-Aug-16 2 Due MERS Al Meera Consumer Goods Company 9-Aug-16 2 Due QISI Qatar Islamic Insurance 10-Aug-16 3 Due MCCS Mannai Corp. 10-Aug-16 3 Due DBIS Dlala Brokerage & Investment Holding Company 10-Aug-16 3 Due MCGS Medicare Group 10-Aug-16 3 Due SIIS Salam International Investment 11-Aug-16 4 Due WDAM Widam Food Company 11-Aug-16 4 Due QGMD Qatar German Company for Medical Devices 14-Aug-16 7 Due ZHCD Zad Holding Company 14-Aug-16 7 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 24.99% 35.75% (19,315,285.69) Qatari Institutions 14.75% 23.59% (15,871,634.12) Qatari 39.74% 59.34% (35,186,919.81) GCC Individuals 1.10% 0.80% 551,117.03 GCC Institutions 8.73% 7.10% 2,924,493.19 GCC 9.83% 7.90% 3,475,610.22 Non-Qatari Individuals 8.95% 9.34% (689,974.18) Non-Qatari Institutions 41.48% 23.43% 32,401,283.77 Non-Qatari 50.43% 32.77% 31,711,309.59

- 3. Page 3 of 6 News Qatar QNB Group: Oil at $60 probable in medium term – QNB Group said in a report that the oil markets may rebalance in 2017 with a price of $60/barrel “probably within range” in the medium term. Oil prices have had an eventful 2016. QNB Group said they started the year on a downward trend, falling to a low of $28/b in late January on concerns about slowing global growth and currency devaluation risk in China, in its weekly economic commentary. Prices then recovered to around $50/b by mid-year only to moderate to their year-to-date average of $42/b. Given the stronger-than-expected rebalancing currently underway in the oil market, QNB Group has revised up its forecast and currently expects prices to average $44.7/b in 2016, up from its previous forecast of $40.8/b. Beyond that, QNB Group expects the continued rebalancing in the oil market to lift prices to an average of $55/b in 2017 (up from a previous forecast of $51.3/b) and $57.9/b in 2018 (up from USD56/b). (Gulf-Times.com) Hotel occupancy rate fell to 47% in June in Qatar – According to a monthly report issued by the Ministry of Development Planning and Statistics (MDPS), the hotel occupancy rate in Qatar in June was at 47%, much lower than the occupancy rate of 63% during the same month in 2015. The average hotel room rent decreased to QR429 in June 2016 from QR481 in the same month in 2015. The average revenue per available room also dropped from QR301 in June 2015 to QR203 in June 2016. Meanwhile, according to a hotel executive from Shangri-La Hotel Doha, Qatar will not see an oversupply of hotels in the country and will still be able to maintain good occupancy levels even after the 2022 FIFA World Cup. Citing Qatar Tourism Authority (QTA) figures, DTZ, in its “Q1 2016 Qatar Market Report: Hospitality Market Overview,” said 56 hotels and 13 hotel apartment buildings are currently under construction and due to be released within the next five years, bringing the total number of rooms to 26,653. The report further said, “Of these, the QTA expects 20 hotels and hotel apartments to open in 2016. In addition, there are proposals for another 130 establishments.” (Qatar-Tribune, Gulf-Times.com) Qatar’s Emir meets Saudi King in Morocco – Qatar’s Emir HH Sheikh Tamim bin Hamad Al Thani met with Custodian of the Two Holy Mosques King Salman bin Abdulaziz Al Saud of Saudi Arabia at the residence of the latter in the Moroccan city of Tangier. The Emir and the Saudi King reviewed the close ties between the two brotherly countries and ways to further develop and strengthen them for the benefit of the two countries. (Peninsula Qatar) QOC opens Bayt Qatar in Rio – The Qatar Olympic Committee (QOC) has officially opened Bayt Qatar in Rio de Janeiro, following a reception attended by QOC President HE Sheikh Joaan bin Hamad al-Thani and officials from the world of sport. The Olympic hospitality house will showcase Qatar’s culture, heritage and passion for sport throughout the Rio 2016 Olympic Games. (Gulf- Times.com) Ooredoo showcases smart ICT solutions for Smart Cities – Ooredoo will demonstrate the power and potential of a wide range of next- generation smart ICT solutions at the 2016 Olympic Games. The company, which is a National Sponsor of the Qatar Olympic Committee, is hosting a solutions booth inside Bayt Qatar, the QOC’s Olympic hospitality house that will share Qatar’s culture, heritage and sporting passion with visitors to the mega sporting event. (Gulf-Times.com) International Strong US employment report brightens economic outlook – The US Labor Department said that the country’s employment rose more than expected for the second month in a row in July and wages picked up, bolstering expectations of faster economic growth, and raising the probability of a Federal Reserve interest rate increase in 2016. Nonfarm payrolls rose by 255,000 jobs after an upwardly revised 292,000 surge in June, with hiring broadly based across the sectors of the economy. In addition, 18,000 more jobs were created in May and June than previously reported. The unemployment rate was unchanged at 4.9% as more people entered the labor market. Highlighting job market strength, average hourly earnings increased a healthy eight cents and are up 2.6% YoY, while workers put in more hours. (Reuters) US trade deficit rises to ten-month high in June – The US Commerce Department said that the country’s trade deficit rose to a 10- month high in June as rising domestic demand and higher oil prices boosted the import bill while the lagging effects of a strong dollar continued to hamper export growth. The Department added that the trade gap increased 8.7% to $44.5bn in June, the biggest deficit since August 2015. May's trade deficit was revised slightly down to $41.0bn. June marked the third straight month of increases in the deficit. Exports of goods & services edged up by 0.3% in June. Exports to the European Union jumped 7.8%, with goods shipped to the UK soaring 18.2%. China bought more US- made goods in June, with exports to that country rising 3.6%. Imports of goods & services increased 1.9% to $227.7bn in June, with oil prices accounting for part of the rise. Oil prices averaged $39.38 per barrel in June, the highest level since October 2015, from $34.19 in May. (Reuters) BoE’s Broadbent would back further cut in rates – Bank of England (BoE) Deputy Governor Ben Broadbent said he would support cutting interest rates again in 2016, but ruled out using a new bank funding scheme to bring in negative rates by the back door. Broadbent said he was closely watching the labor market to gauge the hit to Britain's economy from June's vote to leave the European Union, and pointed to a survey overnight that showed the biggest fall in permanent hiring since 2009. The BoE unleashed its biggest package of stimulus since the financial crisis, reducing its main interest rate to a record-low 0.25%, restarting quantitative easing and launching new plans to buy corporate debt and offer cheap credit to lenders. The central bank also said most of its nine- member Monetary Policy Committee expected to cut rates even closer to zero later in 2016, and Broadbent said that included him. Meanwhile, HSBC said that it would pass on a 25 basis point cut in the BOE base rate to its tracker mortgage borrowers, and extend savings to standard variable rate mortgage borrowers from September 1, 2016. (Reuters) ECB: World's economic outlook more uncertain after Brexit vote – The European Central Bank (ECB) said global economic outlook has become more uncertain after Britain's vote to leave the European Union, reaffirming its readiness to act if needed to support Eurozone inflation. After a spike in volatility in the wake of the June 23 referendum, financial markets have returned to a relative calm, but economists have warned the full economic effect of the Brexit vote may have yet to materialize. With the Eurozone economy having largely shrugged off the Brexit vote so far, the ECB reaffirmed its expectation of a "moderate" recovery. This view was shared by the head of Germany's central bank, Jens Weidmann, one of the most hawkish ECB rate setters. (Reuters) Japan June real wages rise the most in 6 years – According to Japan’s Labor Ministry, real wages in the country rose the most in almost six years in June, but the gain was exaggerated by the effect of falling prices, highlighting the government's struggle to pull the economy out of deflation. Prime Minister Shinzo Abe has sought to lift the economy out of two decades of stagnation through a three- pronged mix of big government spending, ultra-loose monetary policy and structural reforms. While pay increases and higher spending are key for the success of Abenomics, wage gains inflated

- 4. Page 4 of 6 by low prices may not spur private consumption, which remains sluggish. Real wages, which are adjusted for inflation, jumped 1.8% YoY in June, the highest level since September 2010. In May, they rose 0.4% YoY. (Reuters) India implements CPI target – India formally implemented its central inflation target of 4%, an important confirmation of the inflation-fighting policies championed by Reserve Bank of India (RBI) Governor Raghuram Rajan, who steps down next month. Junior finance minister Arjun Ram Meghwal tabled a notification in parliament's upper house that confirmed the target at 4%, plus or minus 2%, in line with the goal the government originally agreed with Rajan. A senior government official earlier said that candidates are also being shortlisted for the six-member monetary policy committee (MPC), but the panel was unlikely to be formed in time for next RBI policy meeting. (Reuters) Regional Apicorp: MENA region leading global LNG demand growth in 2016 – Arab Petroleum Investments Corporation (Apicorp), in its “Energy Research” report for August 2016, said the MENA region is leading global LNG demand growth in 2016 – a trend that would continue as domestic gas output falls short of surging regional demand for power and industry. Despite its dominant role in terms of hydrocarbons reserves, MENA would become the world’s second- largest gas-importing region, believes the International Energy Agency. Consumption of natural gas in the Middle East, the agency forecasts, would rise from 480bn cubic meters in 2015 to 738bcm in 2040. (GulfBase.com) Resurging oil prices signal to invest in tech innovation – Rebounding oil prices signal the moment for Saudi Arabia’s oil & gas firms to invest in technology innovation, supporting Saudi Vision 2030 and driving around $300bn in oil exports. The Kingdom is the world’s largest petroleum exporter, producing 10mn barrels per day. KSA’s global importance has increased with the drop in oil production by several major members of the Organization of Petroleum Exporting Countries (OPEC). Saudi Arabia’s oil exports are worth around $285bn per year. (GulfBase.com) IMF: KSA budget deficit would fall to 9.6% in 2017 – The International Monetary Fund (IMF) said it is finding more reasons to be optimistic about the Saudi Arabian economy. According to IMF’s Saudi mission Chief Tim Callen, spending cuts and measures, including the gradual reduction of energy subsidies mean that the budget deficit would probably fall to 9.6% of economic output in 2017 from 13% in 2016. In October 2015, the agency had warned that Saudi Arabia could deplete its financial assets within five years. (Bloomberg) Al-Fadli: KSA supporting grain sector with SR3bn – Jeddah’s Minister of Water, Environment & Agriculture and Saudi Grains Organization (SAGO) Chairman Abdul Rahman Al-Fadli said that the country was supporting the grain sector with SR3bn. The Minister said that new expansions would be launched and new branches would be opened in the Eastern Province and Al-Ahsa. The expansion and the increase in the number of branches would be decided according to supply and demand. It would not be decided by the management but would be done on economic grounds. (Bloomberg) KSA to seek private investment for $800mn housing scheme – Saudi Arabia plans to launch an $800mn social housing project, in partnership with the private sector. The government will appeal to investors to partake in the project via either build-operate- transfer (BOT) or public-private partnerships (PPP) basis. (Bloomberg) Kingdom’s oil sector expands by 5.1% YoY in real terms – According to sources, figures released by the General Authority for Statistics reveal the oil sector expanded by 5.1% YoY in real terms, up from 4.5% YoY in the previous quarter, driven mainly by record oil production that remained above the 10mn barrels per day level throughout 2016. The government has opted not to invest in the production capacity beyond the 12.5mn bpd. Given the moderation in oil prices, the oil sector contribution to the economy would remain limited going forward. (Bloomberg) KSA’s consumer confidence index remains flat in 2Q2016 – Saudi Arabia’s consumer confidence score remained flat in 2Q2016 at 104. At the current level, Saudi Arabia is among the 12 countries globally to reach or exceed a score of 100, which is the optimism benchmark. Job prospect sentiment improved two percentage points (50%), personal finance sentiment remained bright (64% favorable), while immediate-spending intentions reduced by four percentage points (45%). (Bloomberg) Ras Al Khaimah GDP may have crossed $8bn in 2015 – According to sources, gross domestic product (GDP) of Ras Al Khaimah is expected to have crossed $8.165bn during 2015. (GulfBase.com) Russian interest in Dubai properties picking up amid weak ruble – Interest in Dubai properties is picking up once again among Russian buyers despite the fact that the ruble’s worth remained almost half of what it was two years ago. According to sources, there has been a definite increase in visits from Russians to its sites since the start of 2016, when oil prices were in the doldrums and the ruble came under severe pressure. (GulfBase.com) Arqaam Capital targeting AUMs around $3bn in two years – According to sources, Dubai-based financial services firm Arqaam Capital is planning to increase its total assets under management (AUMs) to $3bn in the coming two years. (Bloomberg) Dubai-based firm inks deal to acquire Guinea, Liberia diamond mines – A Dubai-based commodities trading company has signed an agreement to acquire diamond mines in Guinea and Liberia. The agreements include a Baoulé kimberlite mining project in Guinea that has a resource estimation of approximately 3mn carats and two exploration licenses in western Liberia, which have recently been awarded to Stellar Diamonds. (Bloomberg) Dubai likely to double energy efficiency by 2030 – Dubai’s energy efficiency would double by 2030. Dubai Supreme Council of Energy (DSCE) has joined the United Nation’s Building Efficiency Accelerator (BEA) partnership to achieve this target. Dubai’s building efficiency policies could result in energy demand reductions up to 25-50%, for both new and existing buildings, saving money and reducing pollution. (Bloomberg) S&P affirms Abu Dhabi’s AA/A-1+ rating; outlook stable – S&P Global Ratings said that the Abu Dhabi government's large net asset position continues to provide a considerable buffer to mitigate the impact of commodity market volatility on the economy. The credit rating agency has affirmed its 'AA' long-term and 'A-1+' short-term foreign and local currency sovereign credit ratings on the Emirate with a stable outlook. S&P said that the ratings are supported by Abu Dhabi's strong fiscal and external positions. The exceptional strength of the government's net asset position provides a buffer to counter the negative impact of oil price declines on economic growth and government revenues, as well as on the external account. (Bloomberg) Kuwait’s budget deficit estimated to be 26% of GDP for 2016-17 – Kuwait’s National Assembly recently approved the budget for the fiscal year 2016-2017 with an official deficit projection of KD8.7bn, or 26% of GDP. The deficit, before the mandatory transfer to the Future Generations Fund (FGF), is likely to be significantly lower, as oil prices for the fiscal year are expected to average above the $35 per barrel assumed in the budget. Kuwait estimates a deficit of 13% of GDP, as compared to the fiscal year 2015-2016. (GulfBase.com)

- 5. Page 5 of 6 New contract for Oman’s wind power project likely by September 2016 – A contract to build the Sultanate’s first large-scale wind- based renewable power project is expected to be signed by September 2016. A European company is most likely to bag the project, which will generate 50 megawatt electricity at Harweel in Dhofar governorate. The renewable energy project is being jointly developed by the state-owned Rural Areas Electricity Company (Raeco) and the UAE-based Masdar. The construction is likely to take 18 to 24 months to start power generation, after awarding the project. (GulfBase.com)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. WLL One Person Company Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. WLL One Person Company (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 QSEIndex S&PPan Arab S&PGCC 0.1% 1.3% (0.2%) 0.1% 0.4% 0.4% 1.2% (0.3%) 0.0% 0.3% 0.6% 0.9% 1.2% 1.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,335.55 (1.9) (1.1) 25.8 MSCI World Index 1,716.65 0.5 (0.3) 3.2 Silver/Ounce 19.71 (3.2) (3.1) 42.2 DJ Industrial 18,543.53 1.0 0.6 6.4 Crude Oil (Brent)/Barrel (FM Future) 44.27 (0.0) 4.3 18.8 S&P 500 2,182.87 0.9 0.4 6.8 Crude Oil (WTI)/Barrel (FM Future) 41.80 (0.3) 0.5 12.9 NASDAQ 100 5,221.12 1.1 1.1 4.3 Natural Gas (Henry Hub)/MMBtu 2.85 (1.4) (3.3) 23.1 STOXX 600 341.38 0.6 (0.8) (4.8) LPG Propane (Arab Gulf)/Ton 43.38 1.8 0.9 13.0 DAX 10,367.21 0.9 (0.3) (1.9) LPG Butane (Arab Gulf)/Ton 52.38 1.9 6.1 (5.0) FTSE 100 6,793.47 0.5 (0.1) (3.4) Euro 1.11 (0.4) (0.8) 2.1 CAC 40 4,410.55 1.0 (1.3) (2.9) Yen 101.82 0.6 (0.2) (15.3) Nikkei 16,254.45 (0.6) (1.3) 1.2 GBP 1.31 (0.3) (1.2) (11.3) MSCI EM 885.52 1.1 1.4 11.5 CHF 1.02 (0.7) (1.2) 2.2 SHANGHAI SE Composite 2,976.70 (0.4) (0.3) (18.0) AUD 0.76 (0.1) 0.3 4.6 HANG SENG 22,146.09 1.5 1.2 1.0 USD Index 96.19 0.5 0.7 (2.5) BSE SENSEX 28,078.35 1.2 0.0 6.5 RUB 65.47 (0.3) (0.7) (9.7) Bovespa 57,661.14 0.9 2.4 65.1 BRL 0.32 0.9 2.7 25.1 RTS 935.46 0.9 0.9 23.6 130.1 97.8 97.8