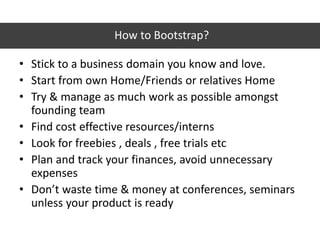

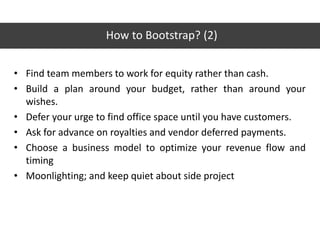

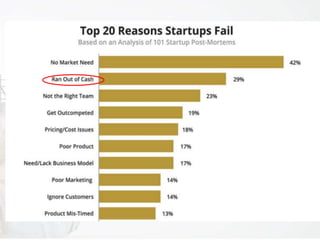

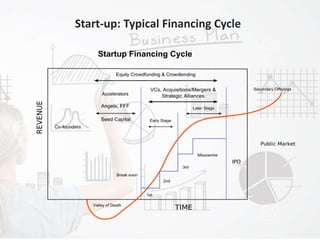

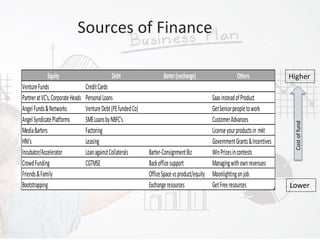

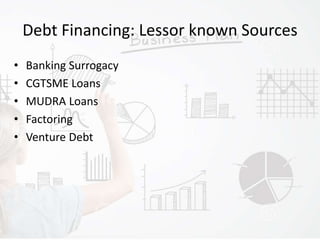

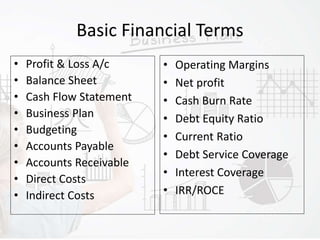

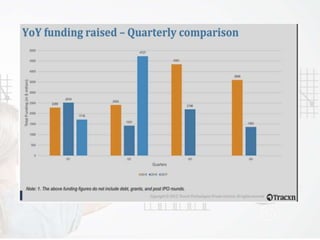

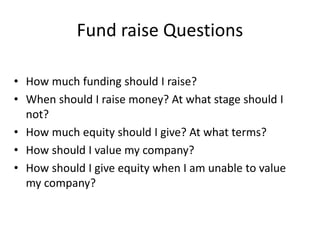

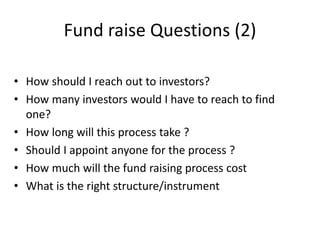

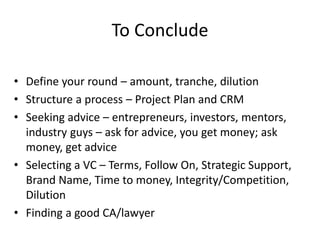

The document presents an agenda focused on bootstrapping startups, discussing sources of finance, financial management, surviving tough times, and fundraising trends. It provides practical tips for founders, including leveraging personal connections for resources and managing finances efficiently. Additionally, it addresses common fundraising questions and outlines important financial management principles.