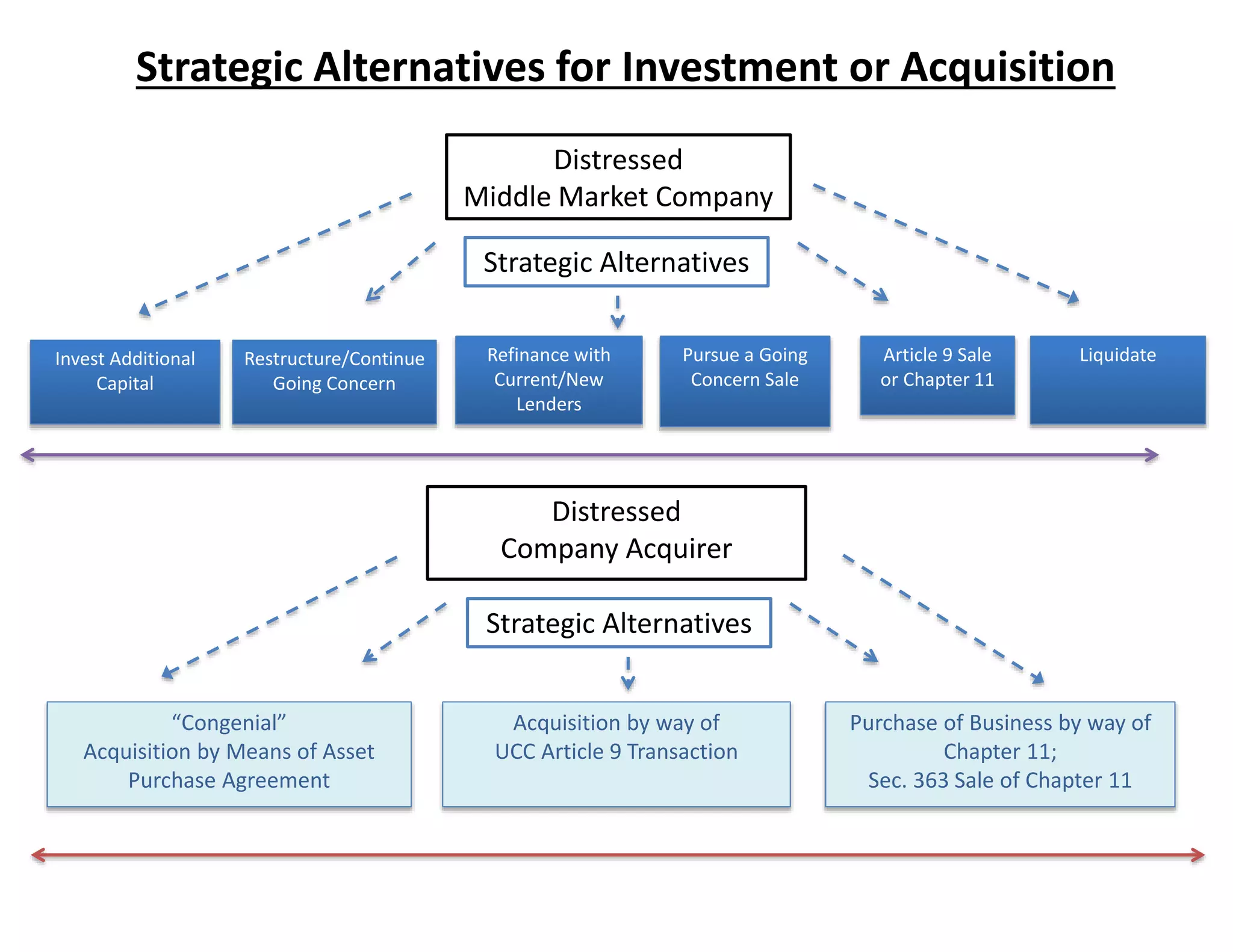

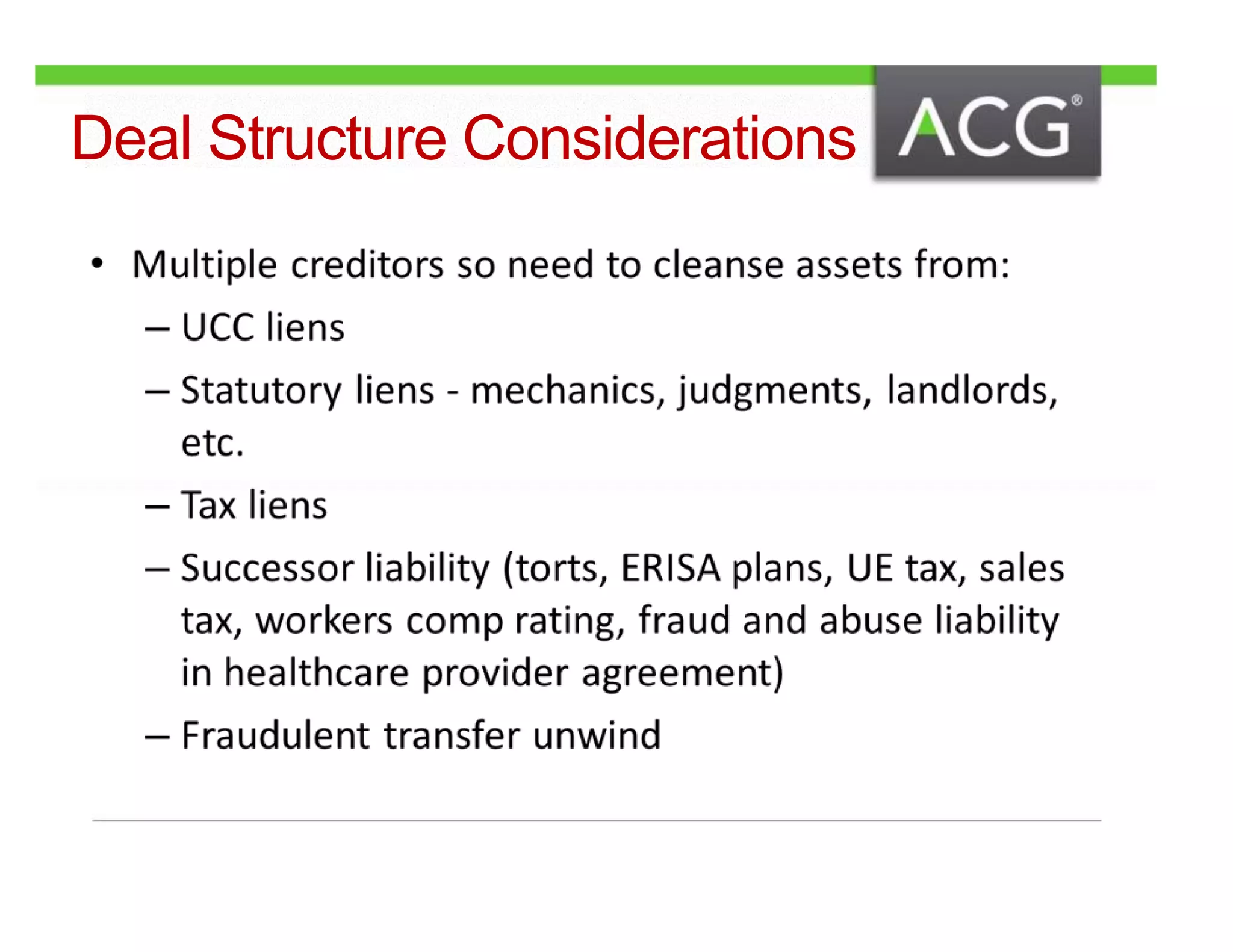

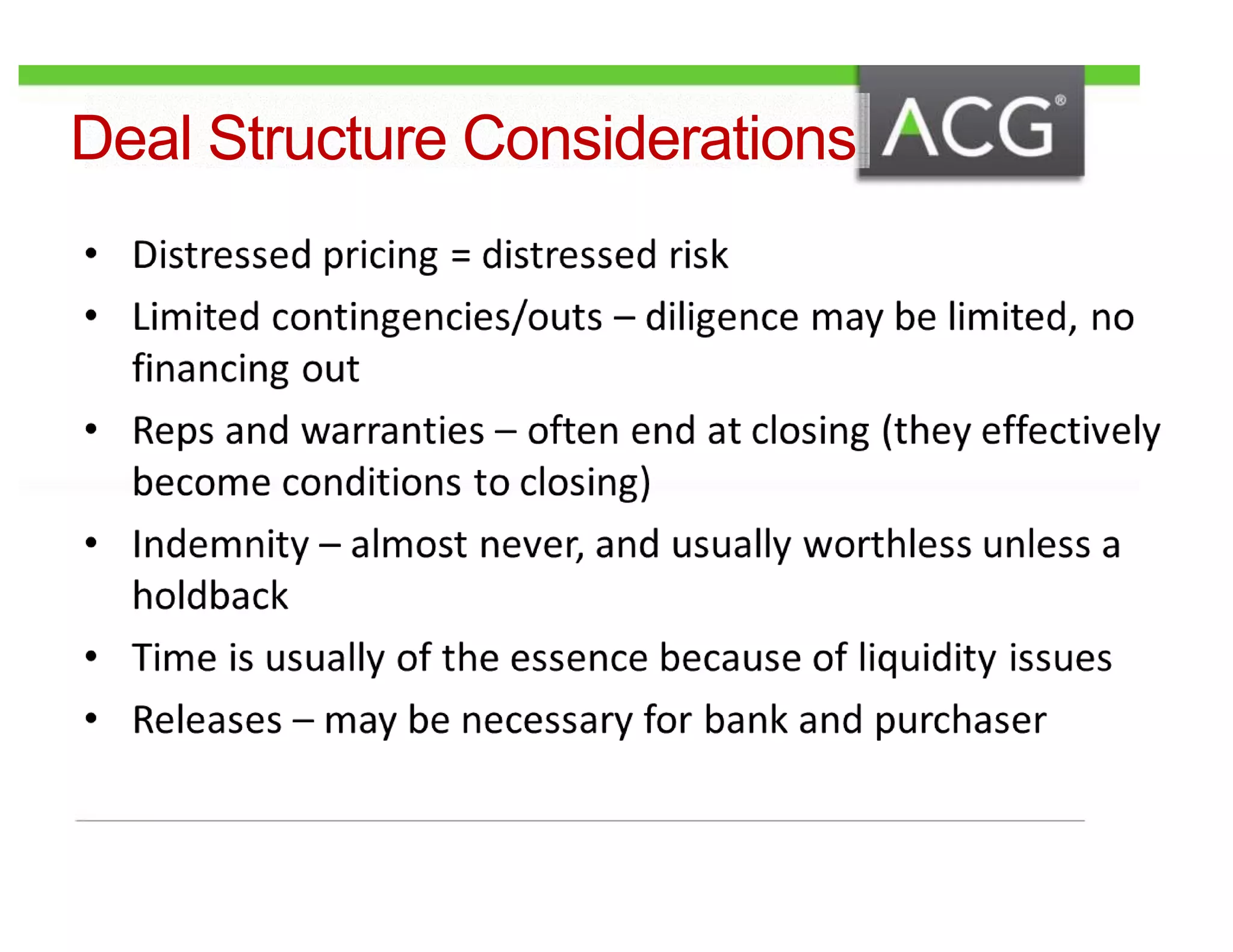

The document discusses strategies for acquiring and divesting distressed assets, highlighting characteristics of distressed businesses and investor considerations. It outlines various strategic alternatives for investment or acquisition, including asset purchase agreements and Chapter 11 sales. The panel moderated by Mark Greenberg features insights from financial experts on navigating the complexities of distressed asset transactions.