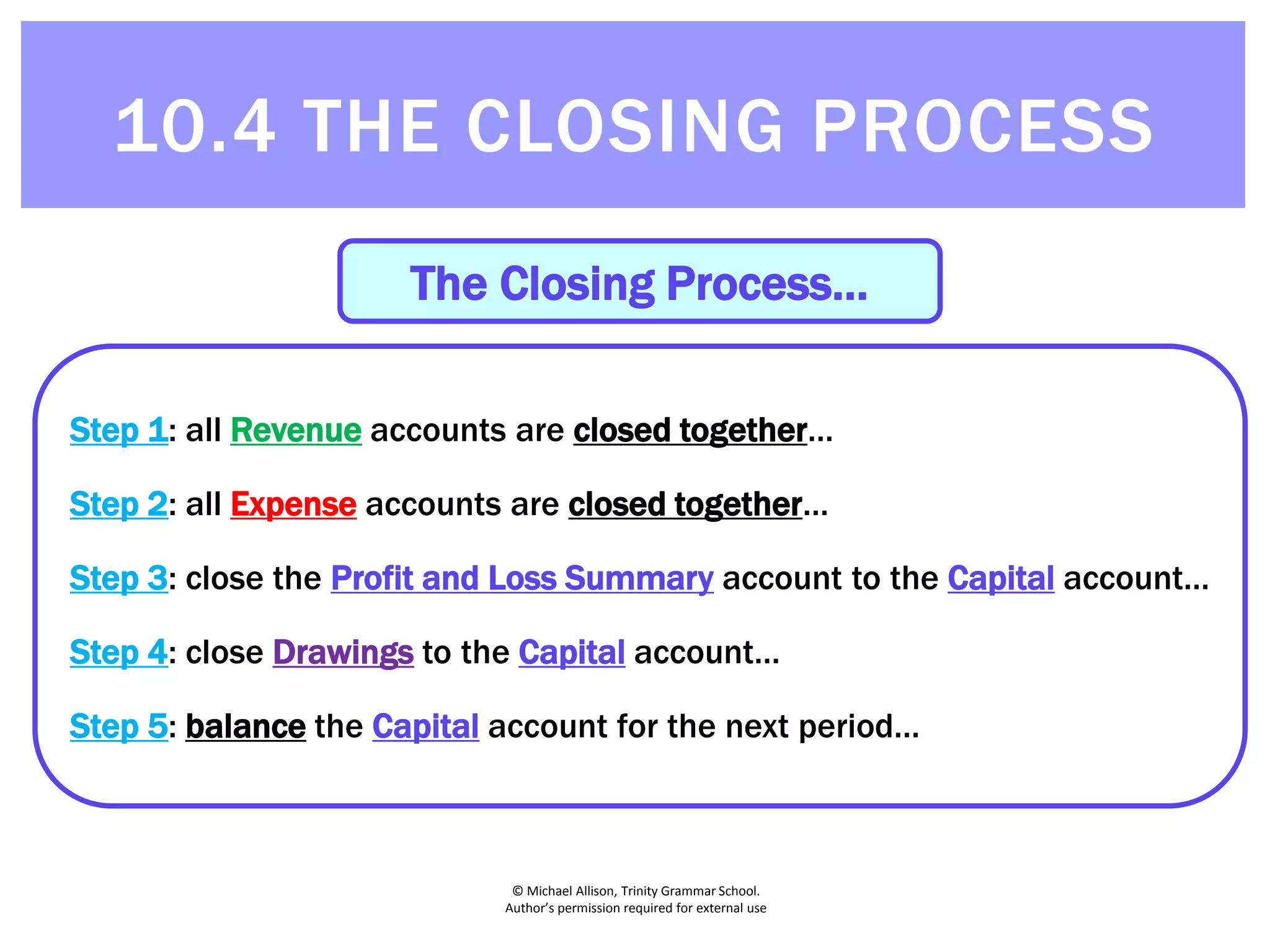

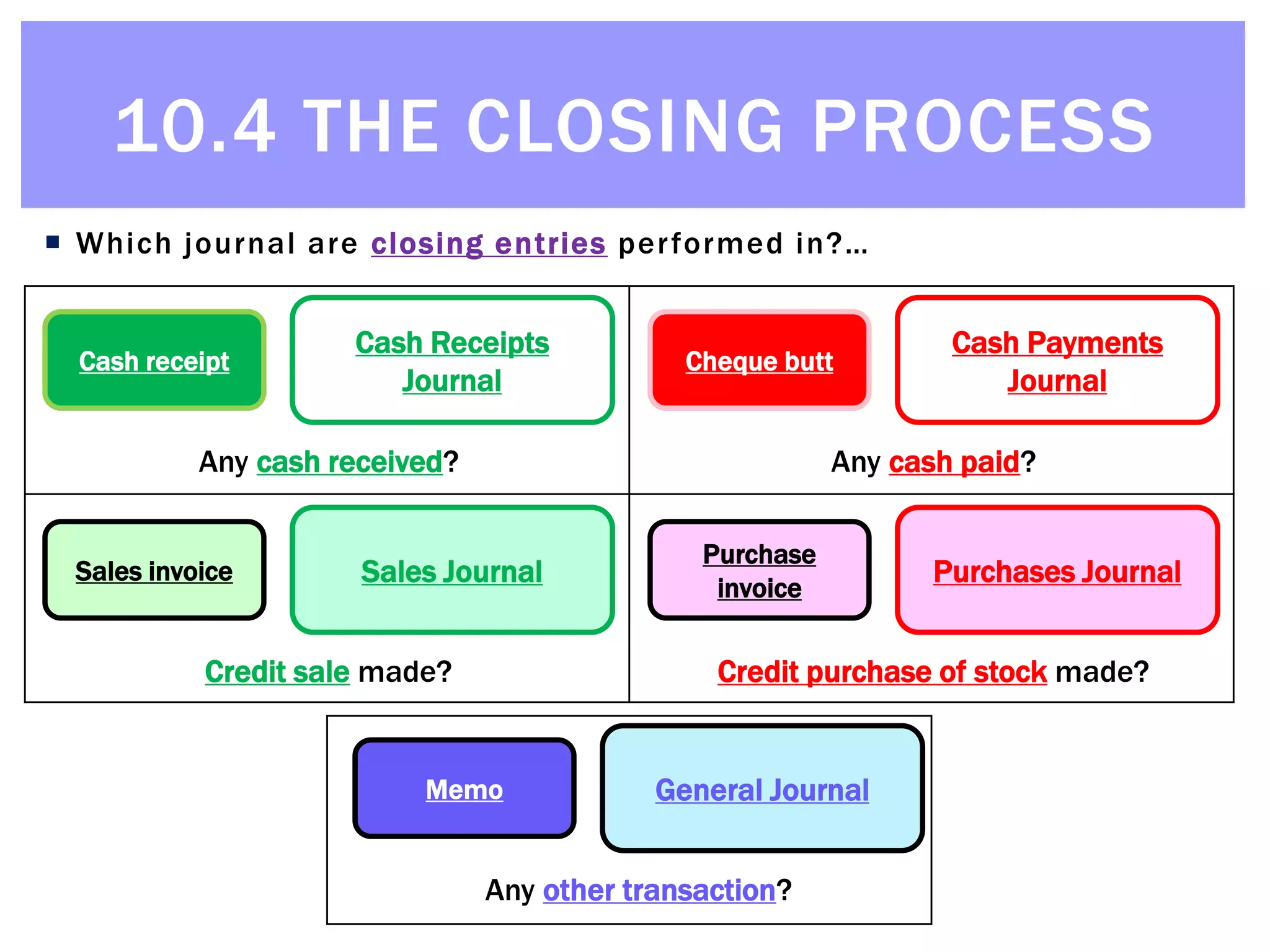

The document summarizes the closing process which involves 5 steps:

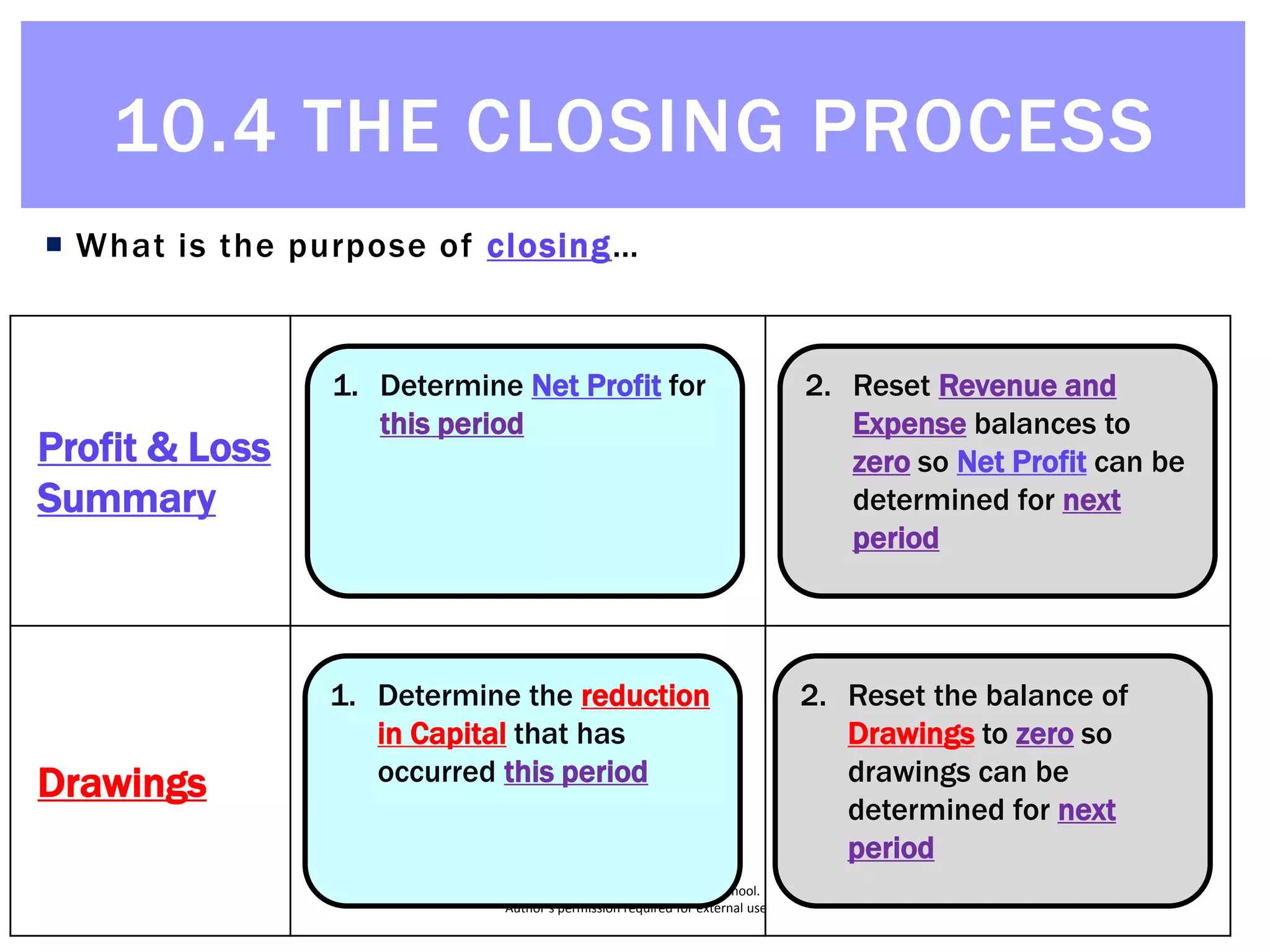

1) All revenue accounts are closed together to the profit and loss summary account

2) All expense accounts are closed together to the profit and loss summary account

3) The profit and loss summary account is closed to the capital account, transferring the net profit or loss for the period

4) The drawings account is closed to the capital account to record withdrawals of capital

5) The capital account is balanced to carry forward the updated balance to the next period.

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Step 1: all Revenue accounts are closed together…

Cash Sales [R]

30 Jun Cash 9000

Profit and Loss Summary [OE]

Credit Sales [R]

30 Jun Debtors control 12000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

Cash Sales [R]

30 Jun Profit and Loss Summary 9000 30 Jun Cash 9000

9000 9000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Cash sales 9000

Credit Sales [R]

30 Jun Profit and Loss Summary 12000 30 Jun Debtors control 12000

12000 12000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Cash sales 9000

Credit sales 12000

Profit and Loss Summary [OE]

30 Jun Revenue accounts 21000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Cash sales 9000

Credit sales 12000

P&L Summary 21000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Cash sales 9000

Credit sales 12000

P&L Summary 21000

Closing of Revenue a/c’s

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-3-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Step 2: all Expense accounts are closed together…

Wages [E]

30 Jun Cash 6000

Profit and Loss Summary [OE]

30 Jun Revenue accounts 21000

Rent [E]

30 Jun Cash 9000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

Profit and Loss Summary [OE]

30 Jun Expense accounts 15000 30 Jun Revenue accounts 21000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Profit & Loss Summary 15000

Wages [E]

30 Jun Cash 6000 30 Jun Profit and Loss Summary 6000

6000 6000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Profit & Loss Summary 15000

Wages 6000

Rent [E]

30 Jun Cash 9000 30 Jun Profit and Loss Summary 9000

9000 9000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Profit & Loss Summary 15000

Wages 6000

Rent 9000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Profit & Loss Summary 15000

Wages 6000

Rent 9000

Closing of Expense a/c’s

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-4-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

The Profit and Loss Summary account enables the firm to determine whether it

has made either a…

Profit and Loss Summary [OE]

30/6 Expense a/c’s 5100 30/6 Revenue a/c’s 9400

9400 9400

Net Profit Net Loss

Revenue

- Expenses

= Net Profit (Loss)

Profit and Loss Summary [OE]

30/6 Expense a/c’s 5100 30/6 Revenue a/c’s 9400

9400 9400

9400

Profit and Loss Summary [OE]

30/6 Expense a/c’s 5100 30/6 Revenue a/c’s 9400

9400 9400

5100

Profit and Loss Summary [OE]

30/6 Expense a/c’s 5100 30/6 Revenue a/c’s 9400

30/6 Capital 4300

9400 9400

4300

Profit and Loss Summary [OE]

30/6 Expense a/c’s 7800 30/6 Revenue a/c’s 5900

7800 7800

Revenue

- Expenses

= Net Profit (Loss)

Profit and Loss Summary [OE]

30/6 Expense a/c’s 7800 30/6 Revenue a/c’s 5900

7800 7800

5900

Profit and Loss Summary [OE]

30/6 Expense a/c’s 7800 30/6 Revenue a/c’s 5900

7800 7800

7800

Profit and Loss Summary [OE]

30/6 Expense a/c’s 7800 30/6 Revenue a/c’s 5900

30/6 Capital 1900

7800 7800

(1900)

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-5-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Step 3: close the Profit and Loss Summary account to the Capital account…

Revenue = $21,000

Expenses = $15,000--

Net Profit = $6,000=

Profit and Loss Summary [OE]

30 Jun Expense accounts 15000 30 Jun Revenue accounts 21000

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-6-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Step 3: close the Profit and Loss Summary account to the Capital account…

The balance in the Profit and Loss Summary account is then transferred to the

Capital account because:

A Net Profit will Owner’s Equity

A Net Loss will Owner’s Equity

Capital [OE]

NetProfit

NetLoss

10.4 THE CLOSING PROCESS

Debit Credit

Owner’s Equity

Debit Credit

Owner’s Equity

Debit Credit

Owner’s Equity ](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-7-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Step 3: close the Profit and Loss Summary account to the Capital account…

Profit and Loss Summary [OE]

30 Jun Expense accounts 15000 30 Jun Revenue accounts 21000

Capital [OE]

Profit and Loss Summary [OE]

30 Jun Expense accounts 15000 30 Jun Revenue accounts 21000

21000

Profit and Loss Summary [OE]

30 Jun Expense accounts 15000 30 Jun Revenue accounts 21000

21000 21000

Profit and Loss Summary [OE]

30 Jun Expense accounts 15000 30 Jun Revenue accounts 21000

30 Jun Capital 6000

21000 21000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Profit and Loss Summary 6000

Capital [OE]

30 Jun Profit and Loss Summary 6000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Profit and Loss Summary 6000

Capital 6000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Profit and Loss Summary 6000

Capital 6000

Transfer of Net Profit

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-8-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Step 4: close Drawings to the Capital account…

The Drawings account must be closed to capital because drawings represent a

withdrawal of capital by the owner. Hence:

Drawings will Capital

Capital [OE]

Drawings

10.4 THE CLOSING PROCESS

Debit Credit

Owner’s Equity

Debit Credit

Owner’s Equity ](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-9-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Step 4: close Drawings to the Capital account…

Drawings [-OE]

30 Jun Cash 13000

Capital [OE]

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

Capital [OE]

30 Jun Drawings 13000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Capital 13000

Drawings [-OE]

30 Jun Cash 13000 30 Jun Capital 13000

13000 13000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Capital 13000

Drawings 13000

General Journal

Date Details

General Ledger Subsidiary Ledger

Debit $ Credit $ Debit $ Credit $

30 Jun Capital 13000

Drawings 13000

Transfer of Drawings

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-10-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Step 5: balance the Capital account for the next period…

As with all Balance Sheet accounts, the Capital account must be balanced in

preparation for the next period

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Profit and Loss Summary 6000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Profit and Loss Summary 6000

126000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Profit and Loss Summary 6000

126000 126000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-12-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

While this business made a Net Profit, its overall Capital balance went down?

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

Why?

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-13-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Because Capital will increase/decrease due to:

Net Profit and Net Loss

Capital contributions and Drawings

Capital [OE]

NetProfit

NetLoss

Capital

contribution

Drawings

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-14-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

While this business made a Net Profit of $6,000, the owner made Drawings of

$13,000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-15-2048.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

The Owner’s Equity section of the Balance Sheet must change to reflect this…

Balance Sheet as at 31 December 2015

$ $

Owner’s Equity

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

Balance Sheet as at 31 December 2015

$ $

Owner’s Equity

Capital 120000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

Balance Sheet as at 31 December 2015

$ $

Owner’s Equity

Capital 120000

plus Net Profit (Loss) 6000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

Balance Sheet as at 31 December 2015

$ $

Owner’s Equity

Capital 120000

plus Net Profit (Loss) 6000

126000

Balance Sheet as at 31 December 2015

$ $

Owner’s Equity

Capital 120000

plus Net Profit (Loss) 6000

126000

less Drawings 13000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

Balance Sheet as at 31 December 2015

$ $

Owner’s Equity

Capital 120000

plus Net Profit (Loss) 6000

126000

less Drawings 13000 113000

Capital [OE]

30 Jun Drawings 13000 1 Jun Balance 120000

30 Jun Balance 113000 30 Jun Profit and Loss Summary 6000

126000 126000

1 Jul Balance 113000

10.4 THE CLOSING PROCESS](https://image.slidesharecdn.com/10-150514052419-lva1-app6892/75/10-4-The-closing-process-16-2048.jpg)