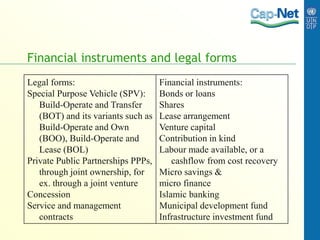

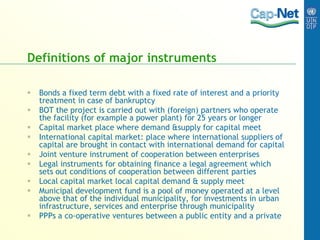

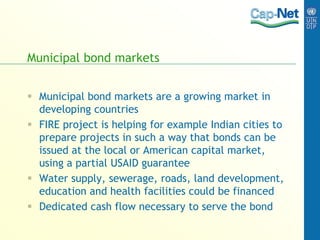

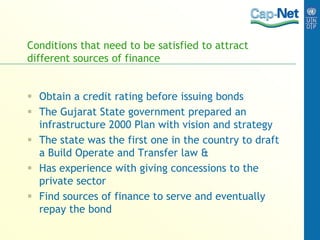

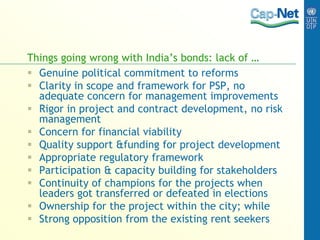

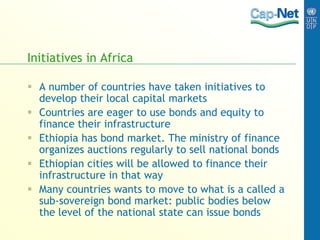

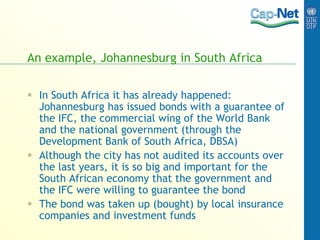

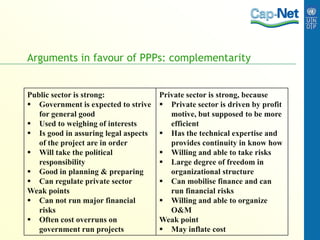

This document discusses financing water and sanitation projects through capital markets and different financial instruments. It begins by outlining the goals of exploring how to use a national capital market for integrated water resource management. It then defines various legal forms and financial instruments that can be used to fund water projects, such as special purpose vehicles, public-private partnerships, bonds, and loans. The document also discusses how to develop local capital markets, drawing on experiences from India and Africa. It argues that public-private partnerships can work well if the public and private sectors play to their respective strengths, and concludes by encouraging participants to discuss financing water projects in their own contexts.