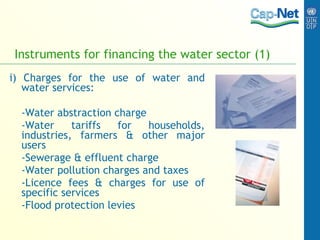

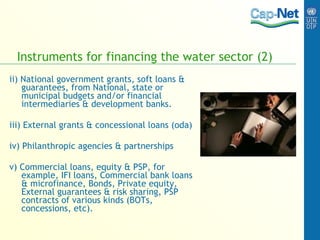

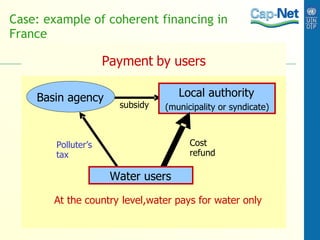

This document discusses financing strategies for integrated water resource management. It outlines the main components of the water sector that require financing, including infrastructure, resource development, and operations. It also categorizes costs as recurrent (operations) or capital (infrastructure investments) and lists typical sources of funding. The document advocates developing financing strategies that recover costs from users, leverage public and external grants, and explore partnerships with private sector to attract new sources of financing to adequately fund the water sector over the long term.