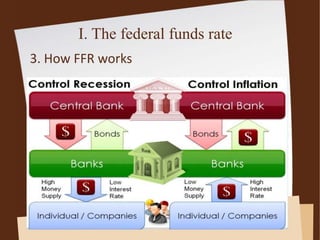

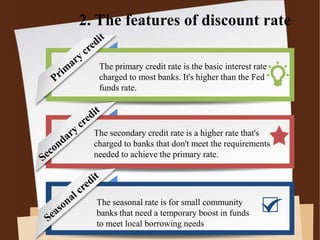

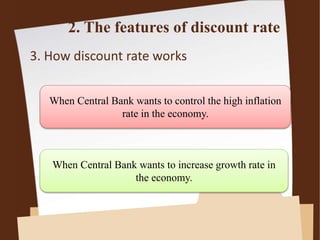

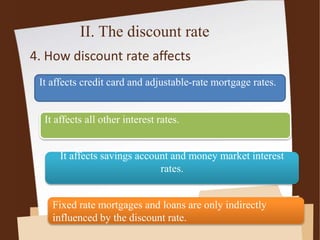

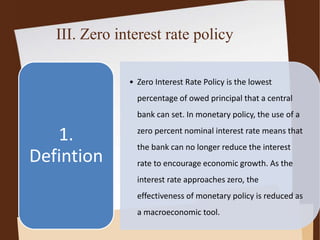

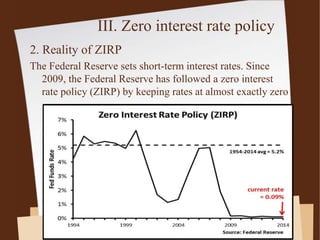

This presentation discusses interest rate policy in the US. It covers three main topics: the federal funds rate, the discount rate, and the zero interest rate policy. The federal funds rate is the interest rate at which banks lend balances held at Federal Reserve to other banks overnight. The discount rate is the interest charged to banks borrowing from the Federal Reserve's discount window. The zero interest rate policy means setting rates near zero to encourage growth when inflation is low and unemployment is high. Regular adjustments are made to short-term rates to manage economic growth and inflation.