The FOMC document discusses:

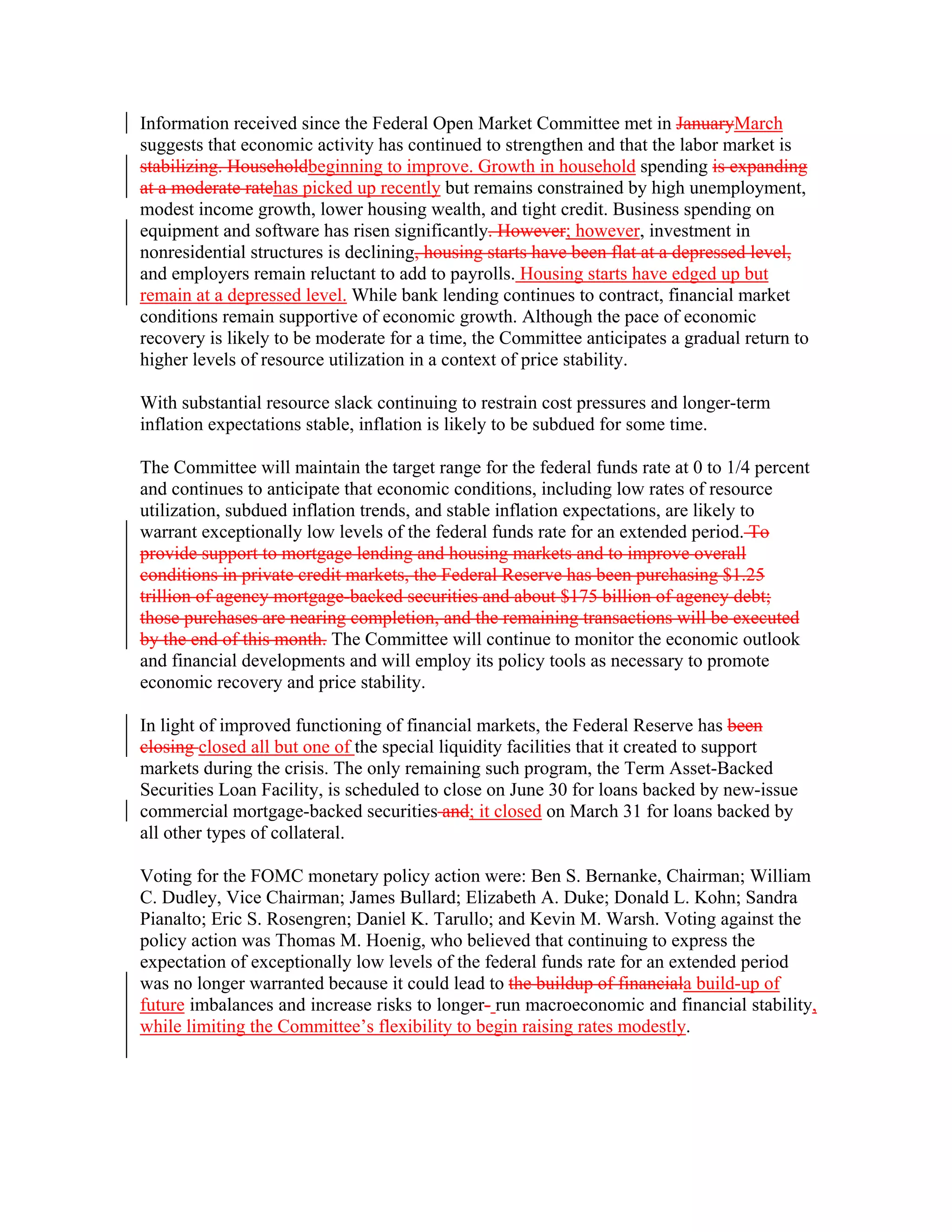

1) Economic activity has continued to strengthen and the labor market is stabilizing, though unemployment remains high and income and housing wealth are constrained.

2) Business spending on equipment has increased while housing construction remains depressed.

3) Inflation is expected to remain subdued due to economic slack and stable long-term expectations.

4) The FOMC will maintain the federal funds rate target at 0-0.25% and expects rates to stay low for an extended period due to economic conditions.