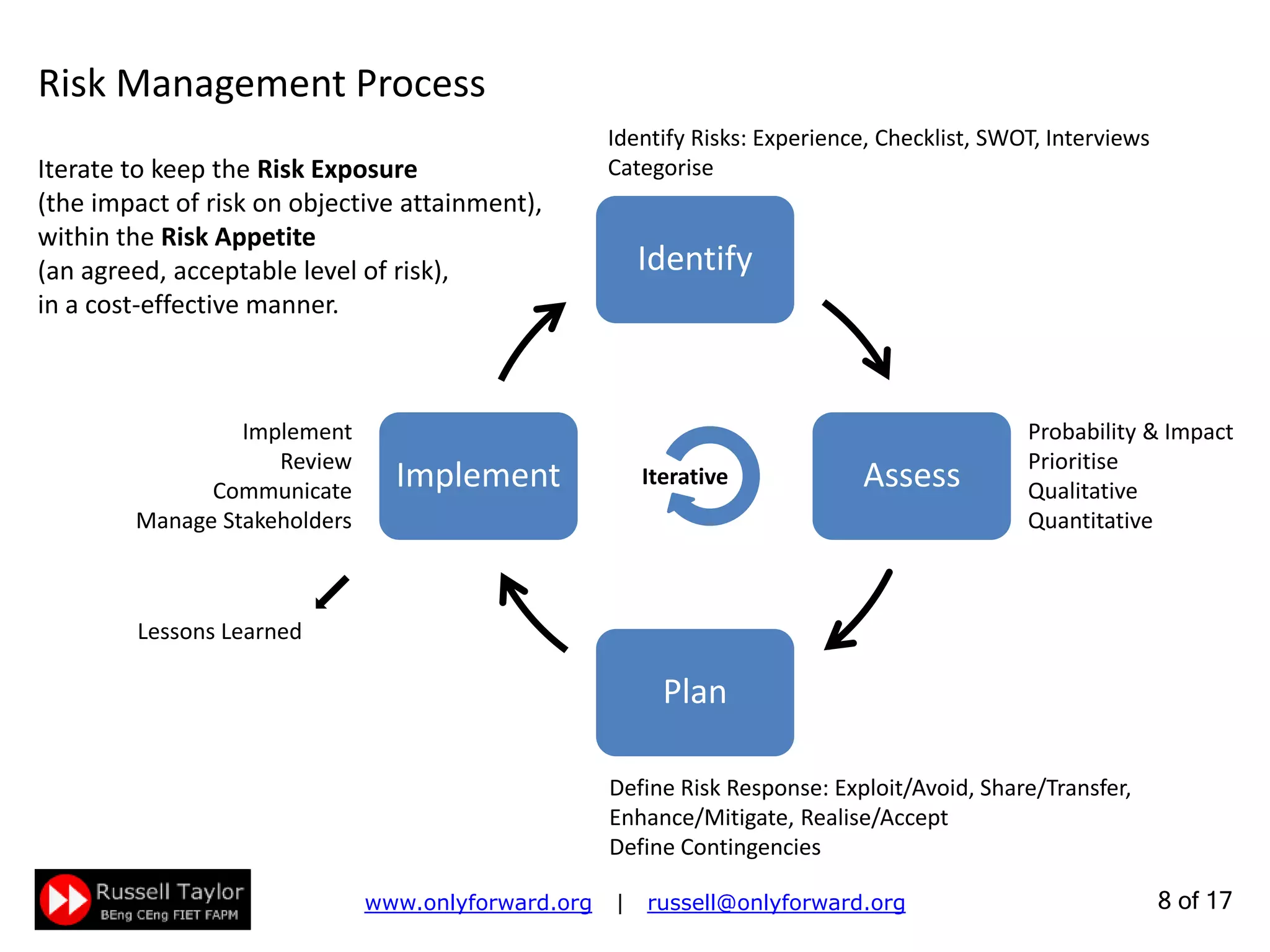

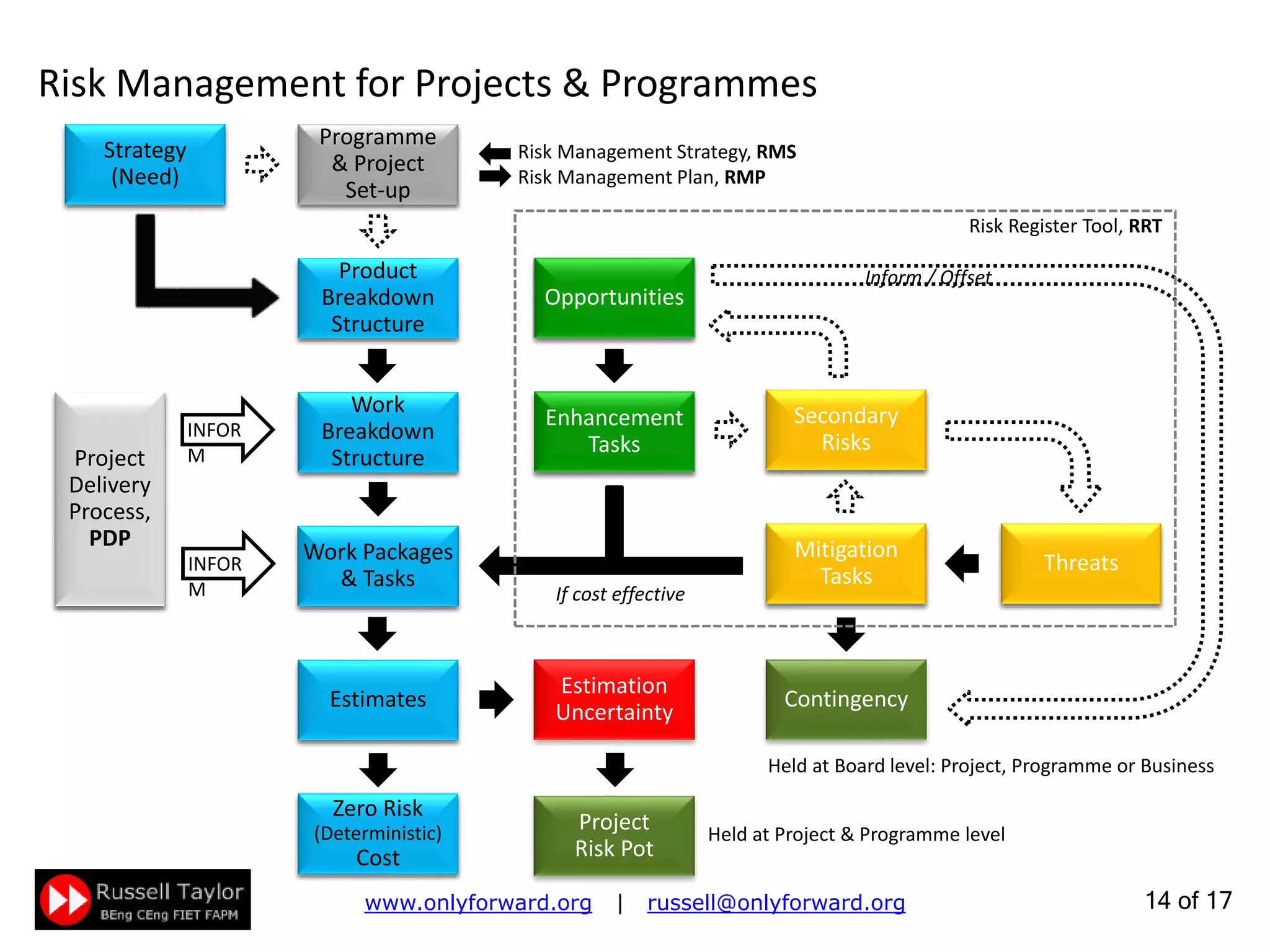

This document discusses risk management for projects and programmes. It defines key risk management terms like known knowns, known unknowns, and unknown unknowns. It explains that risk management involves identifying, assessing, planning for, and implementing responses to significant uncertainties that could impact a project's objectives. The goal is to keep the level of risk exposure within the agreed risk appetite in a cost-effective manner through an iterative process.

![5 of 22

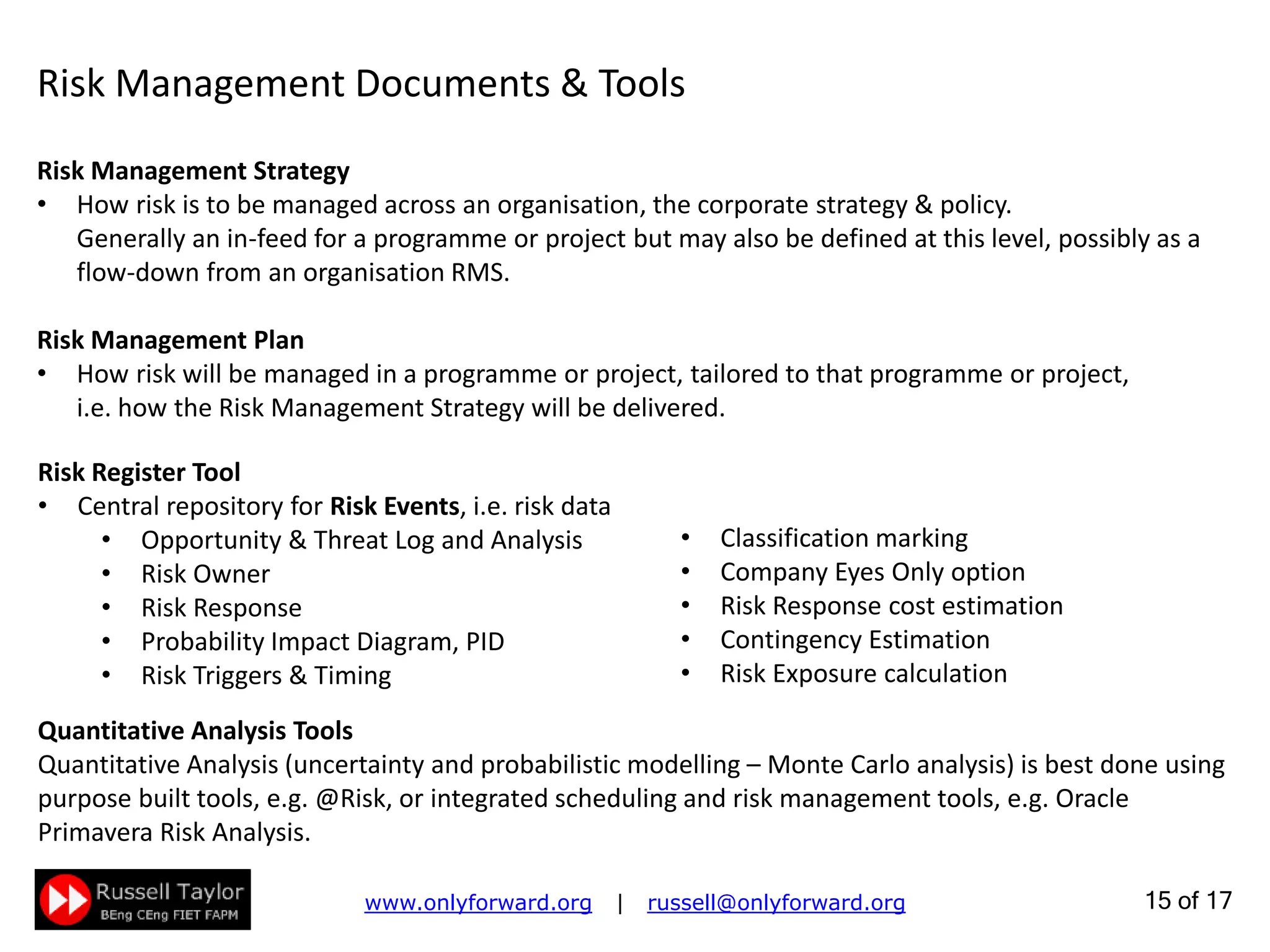

International Standards Organisation

ISO 31000 [2009] Risk Management Principles & Guidelines

ISO IEC 31010 [2009] Risk Management Risk Assessment Techniques

ISO Guide 73 [2009] Risk Management Vocabulary

British Standards

BS 6079-3 [2000] Guide to the Management of Business Related Project Risk

Association for Project Management

PRAM: Project Risk Analysis and Management Guide, 2nd Edition [2010]

Interfacing Risk and Earned Value Management [2008]

Prioritising Project Risks [2008]

Project Management Institute

Practice Standard for Project Risk Management [2009]

The Institute of Risk Management

Publications that primarily deal with enterprise risk management

UK Government

The Orange Book: Management of Risk, Principles and Concepts [2004]

Management of Risk, Guidance for Practitioners, 3rd edition [2010, Axelos]

Ministry of Defence Acquisition System Guidance: Risk Management [v4.2.2]

Risk Management Best Practice Guidance](https://image.slidesharecdn.com/riskmanagement-140714073222-phpapp01/75/Project-Risk-Management-5-2048.jpg)