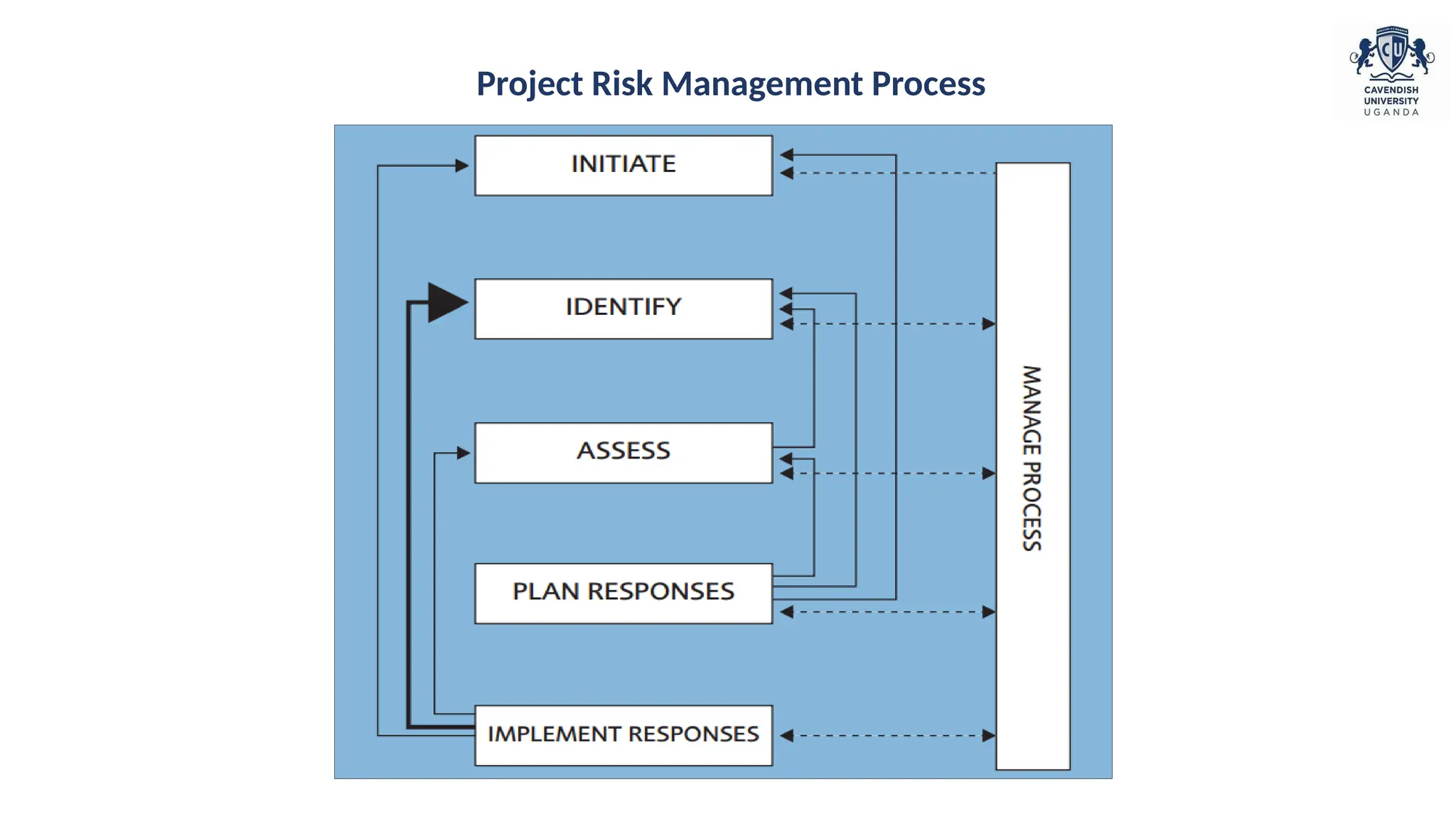

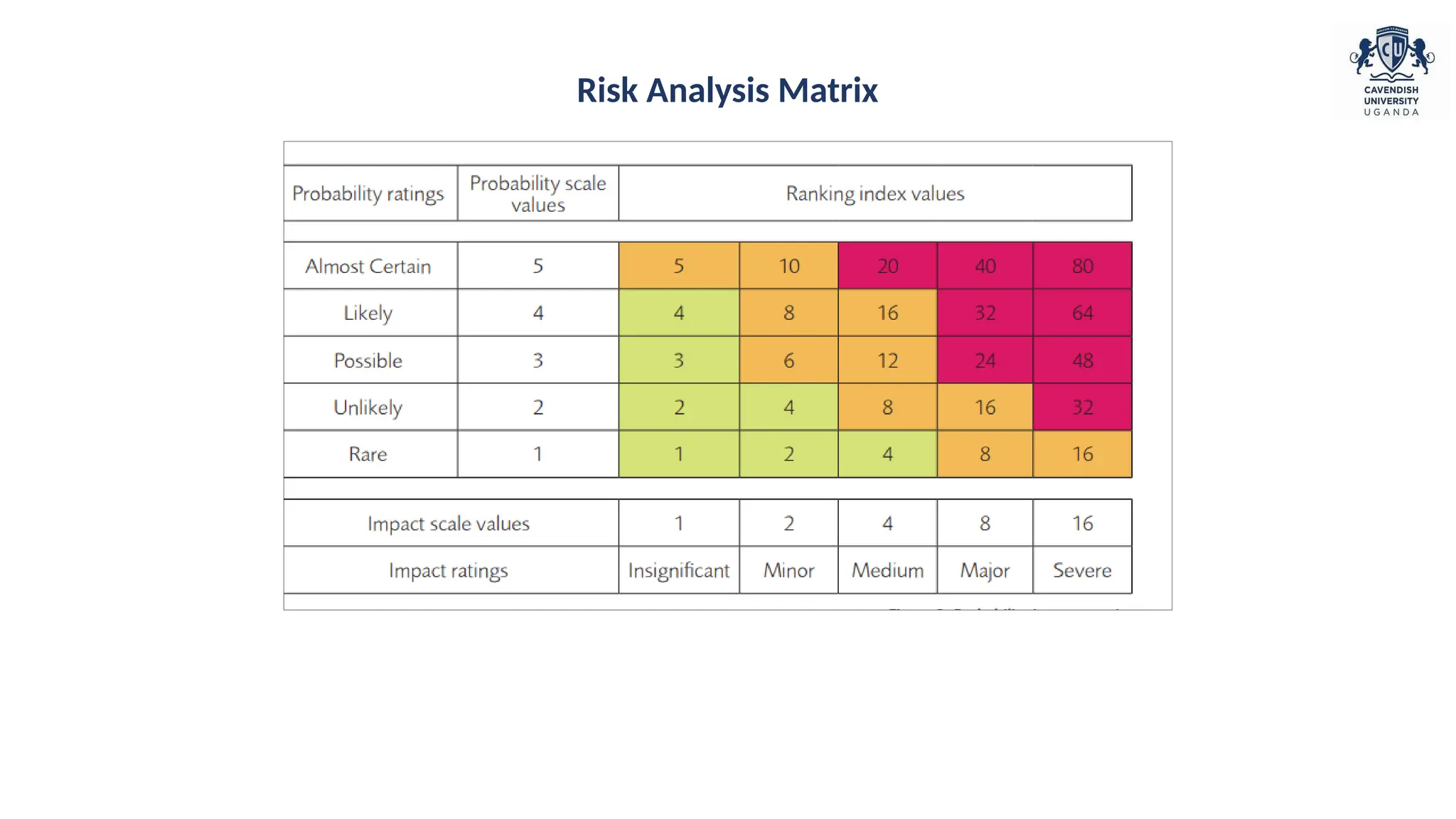

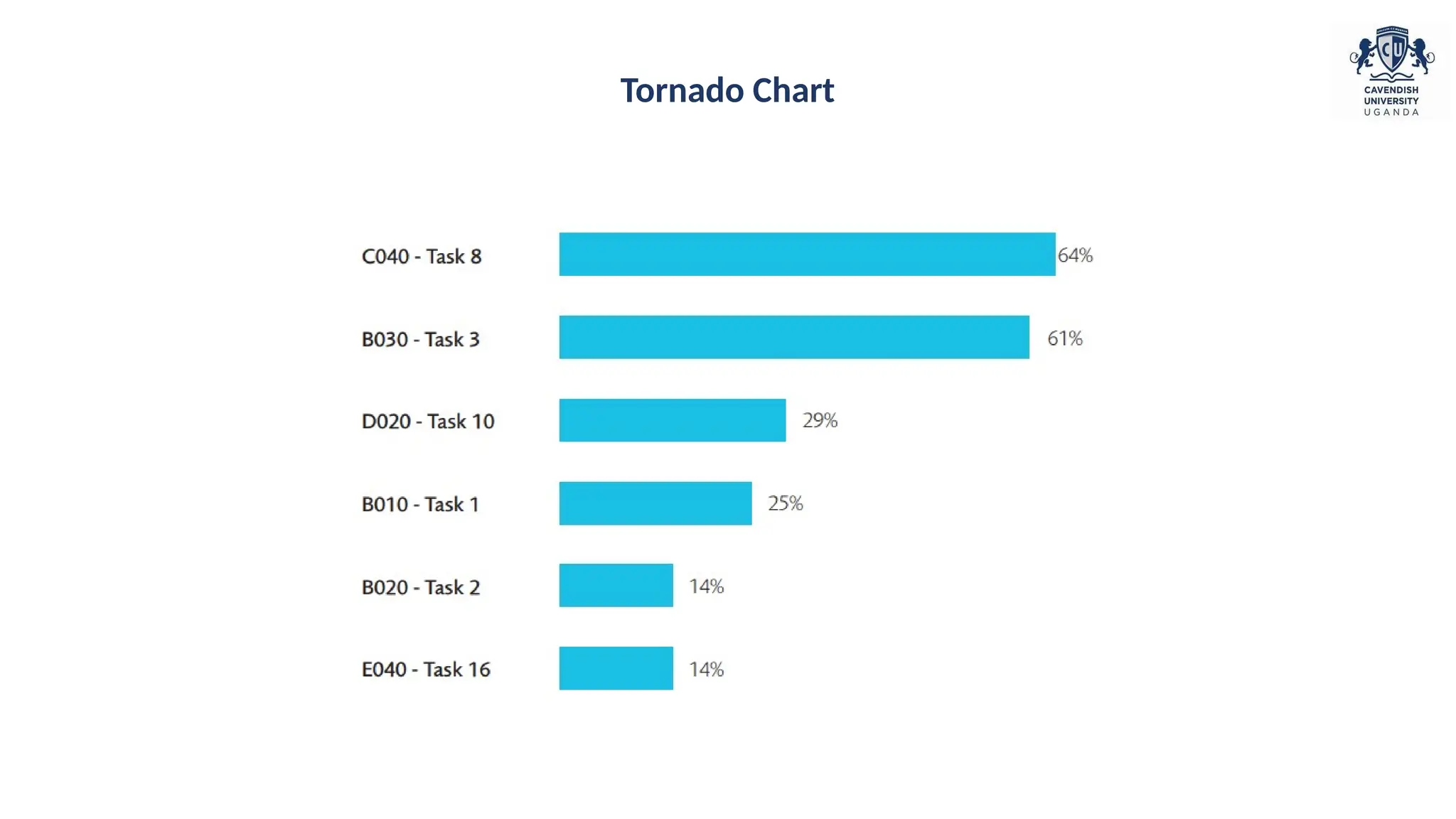

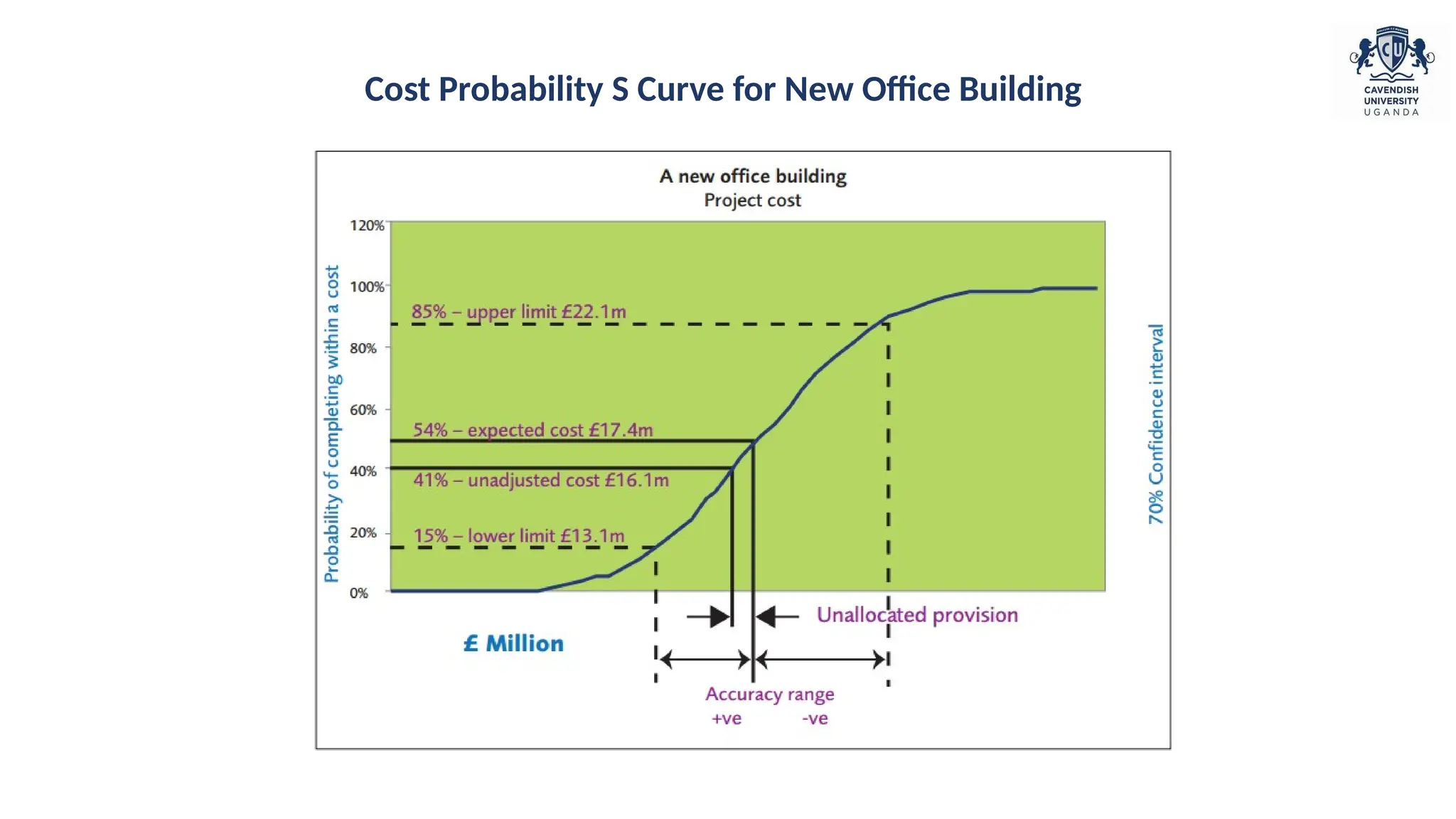

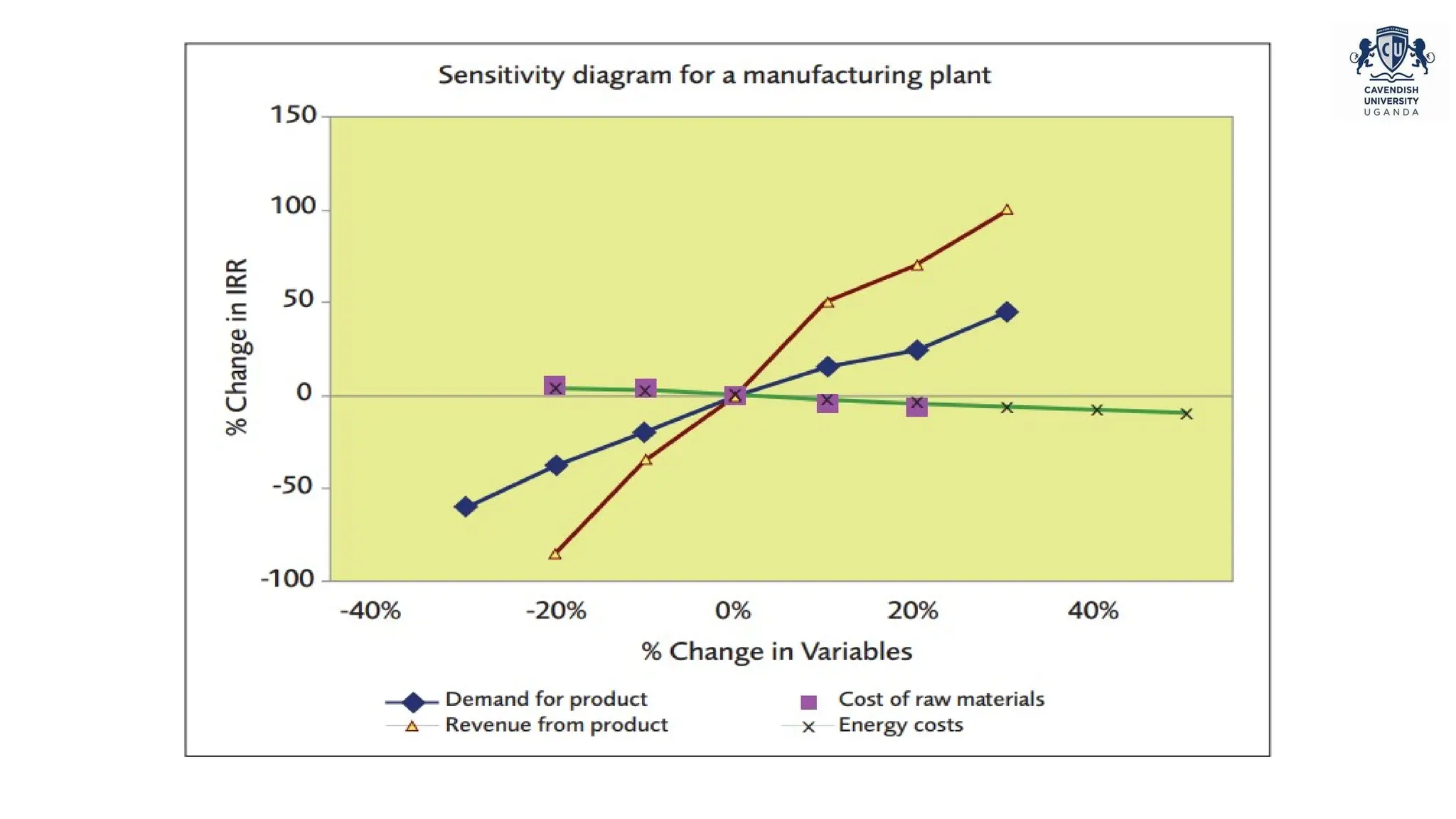

The document outlines the importance of project risk management and its methodologies, describing risk as an uncertain event that can impact project objectives either positively or negatively. It details the processes involved in risk management, including risk identification, analysis, and response planning, highlighting the benefits for organizations, stakeholders, and project managers. Additionally, it discusses when and how to implement risk management techniques, including qualitative and quantitative analysis, to enhance project performance and decision-making.