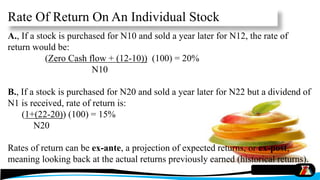

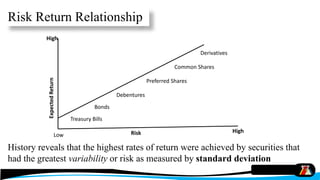

The document discusses various types of assets, including tangible, equity, income assets, and cash reserves, emphasizing the relationship between risk and return in investment. It explains how investors must balance potential returns against different kinds of risks, including inflation, business, political, liquidity, and interest rate risks, while diversifying their portfolios to mitigate these risks. Additionally, it covers the measurement of risk using variance, standard deviation, and beta, with an emphasis on understanding real rates of return adjusted for inflation.