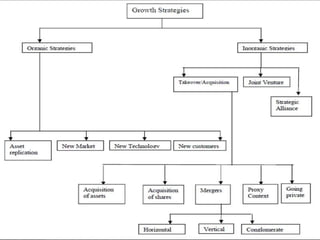

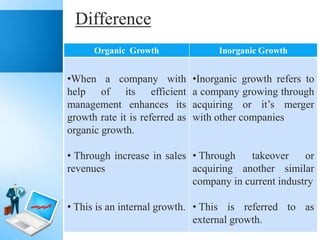

This document discusses inorganic growth strategies like mergers and acquisitions as options for growth among Indian businesses. It provides examples of major Indian companies that have utilized inorganic growth strategies in recent years, including Wipro, Tata Group, ICICI Bank, Reliance, Fortis Healthcare, Essar-Vodafone, iGate-Patni, Aditya Birla Group, and Mahindra & Mahindra. The document argues that inorganic growth can help companies enter new markets, expand customer bases, cut competition, consolidate quickly, and employ new technologies, making it a viable strategic option for growth among Indian companies.