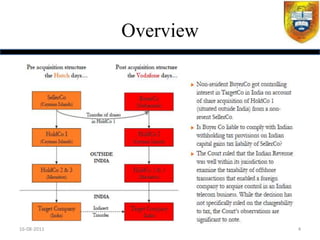

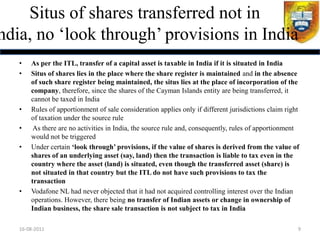

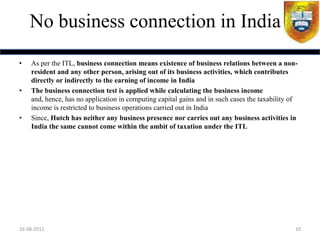

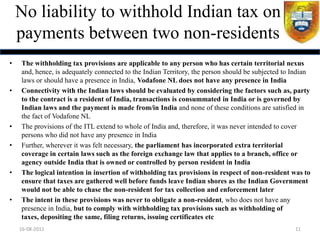

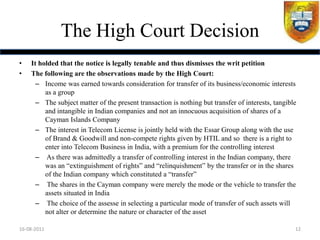

The document summarizes a tax case involving Vodafone being issued an order by Indian Tax Authorities for capital gains tax on its acquisition of an Indian telecom company. Vodafone appealed to the Bombay High Court arguing the transaction was not designed to evade tax and occurred between two non-resident entities. The High Court ruled in favor of the Tax Authorities, saying the transaction transferred underlying Indian assets. Vodafone is now appealing to the Supreme Court.