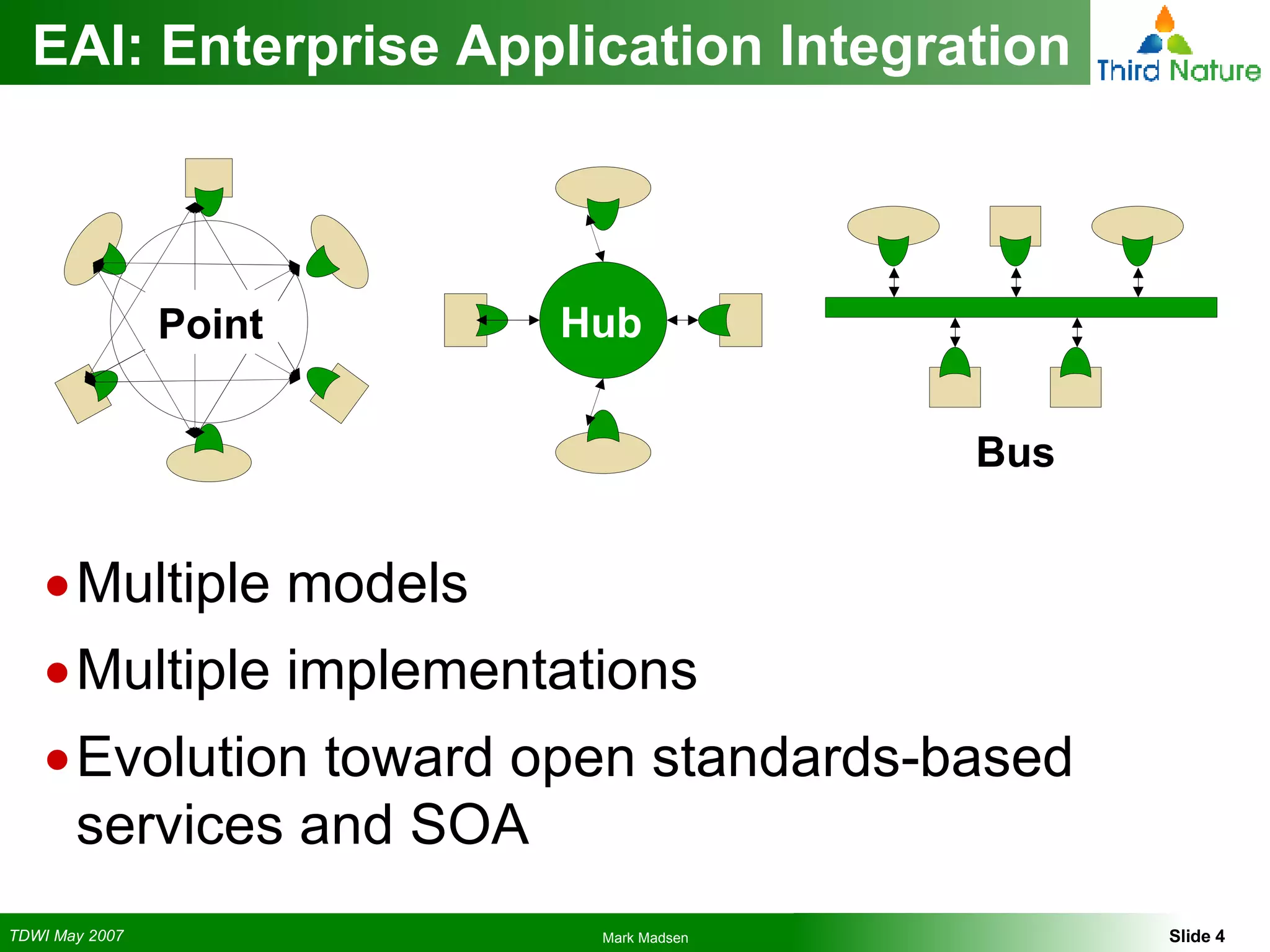

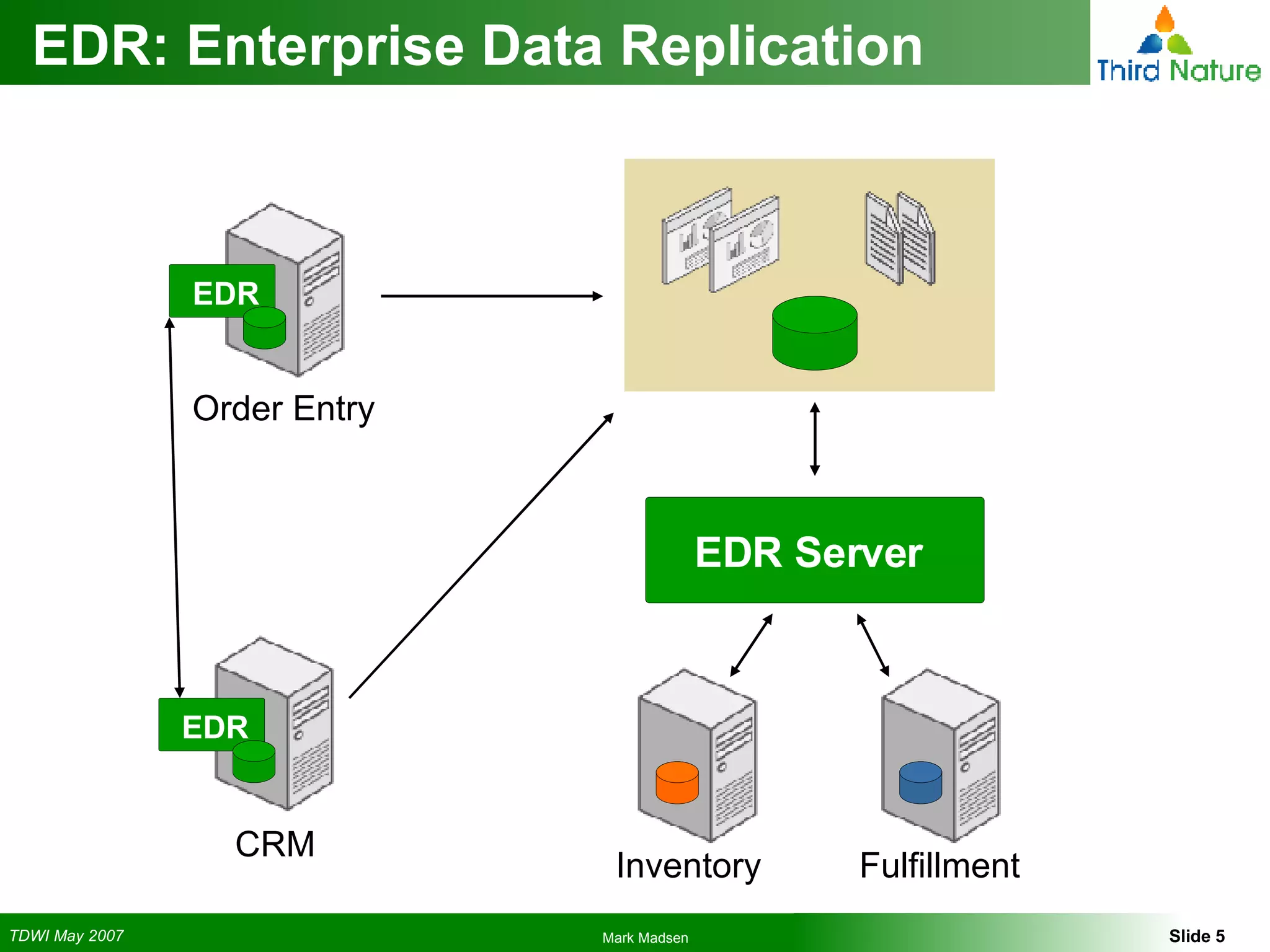

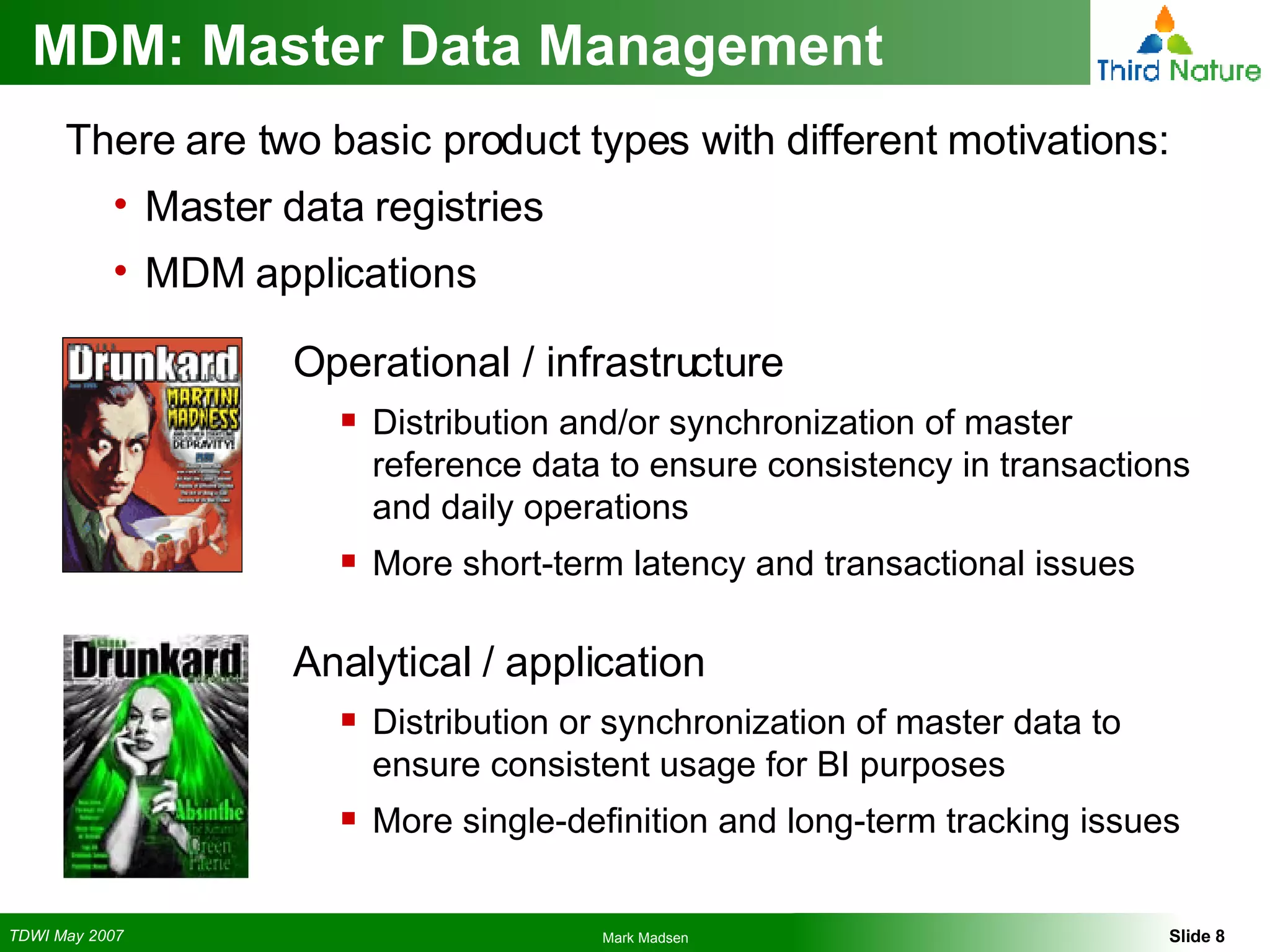

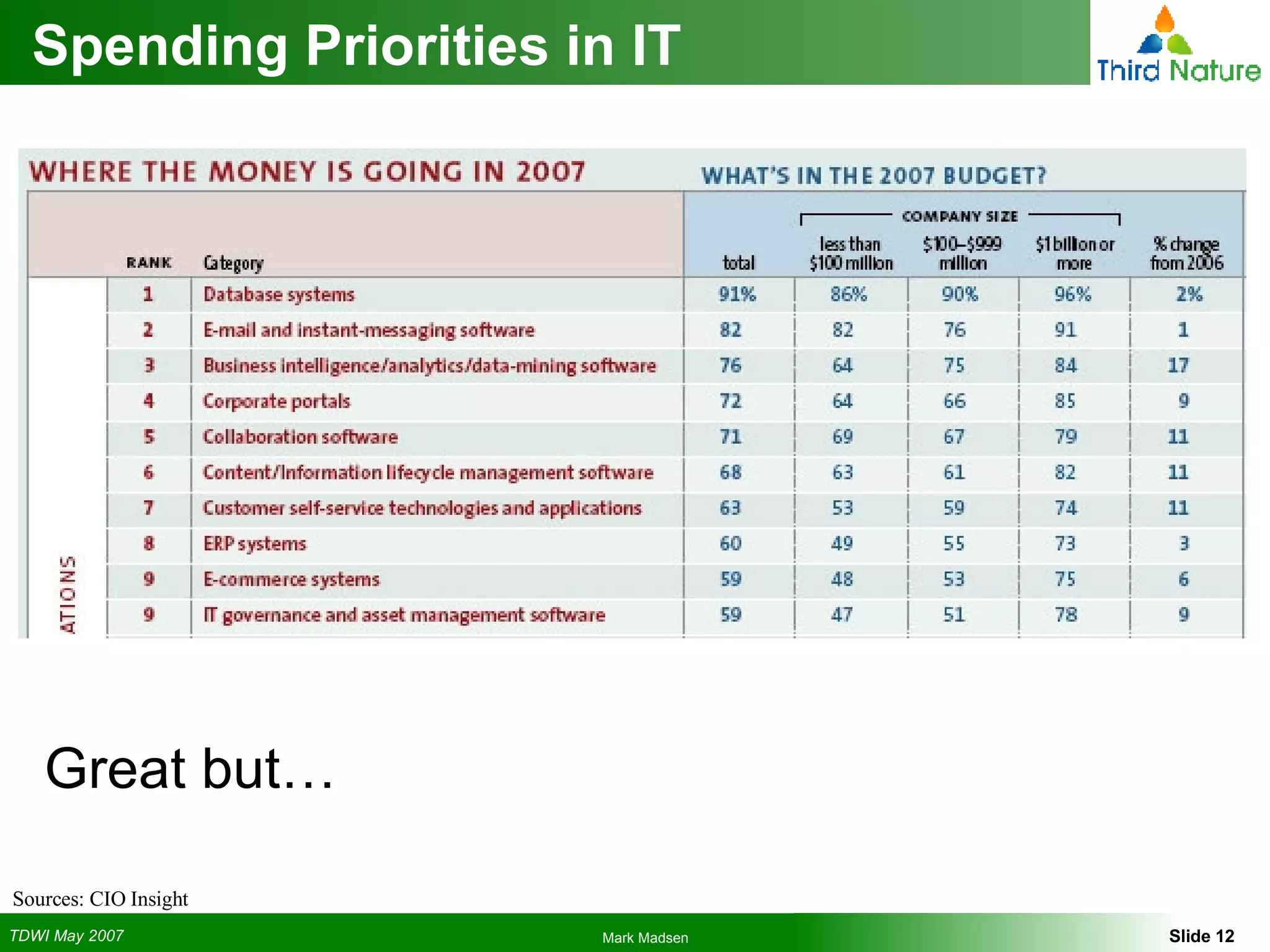

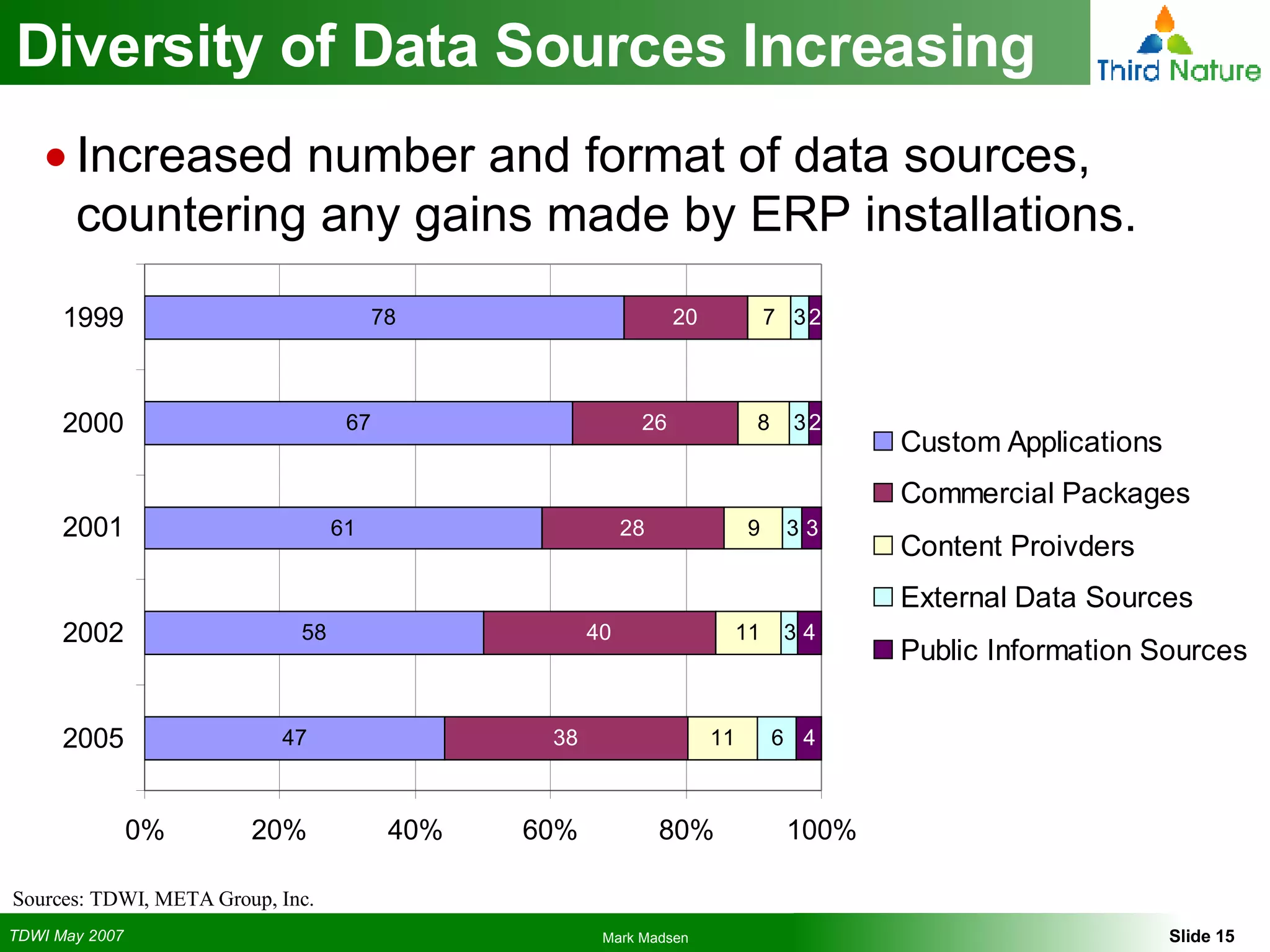

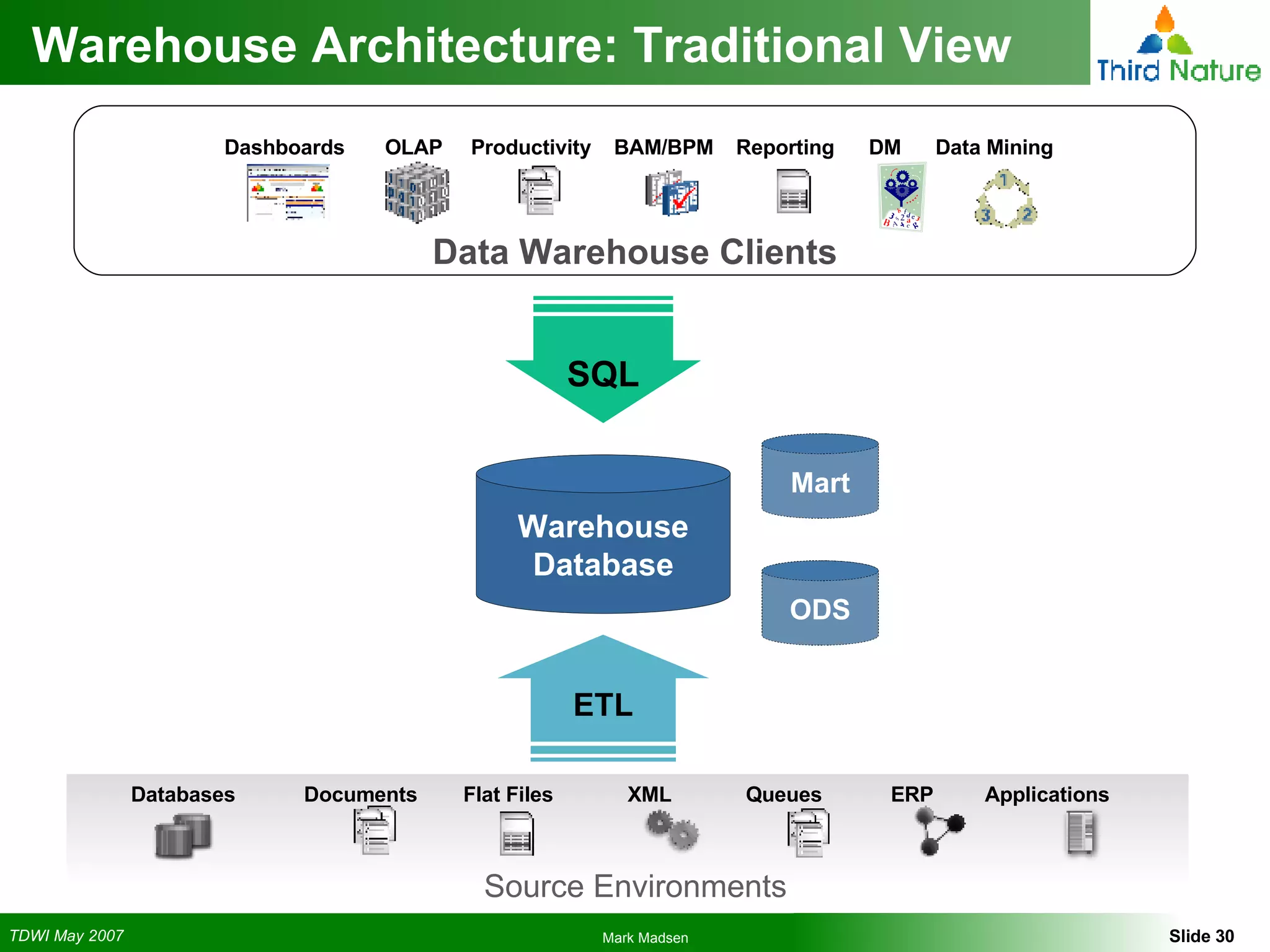

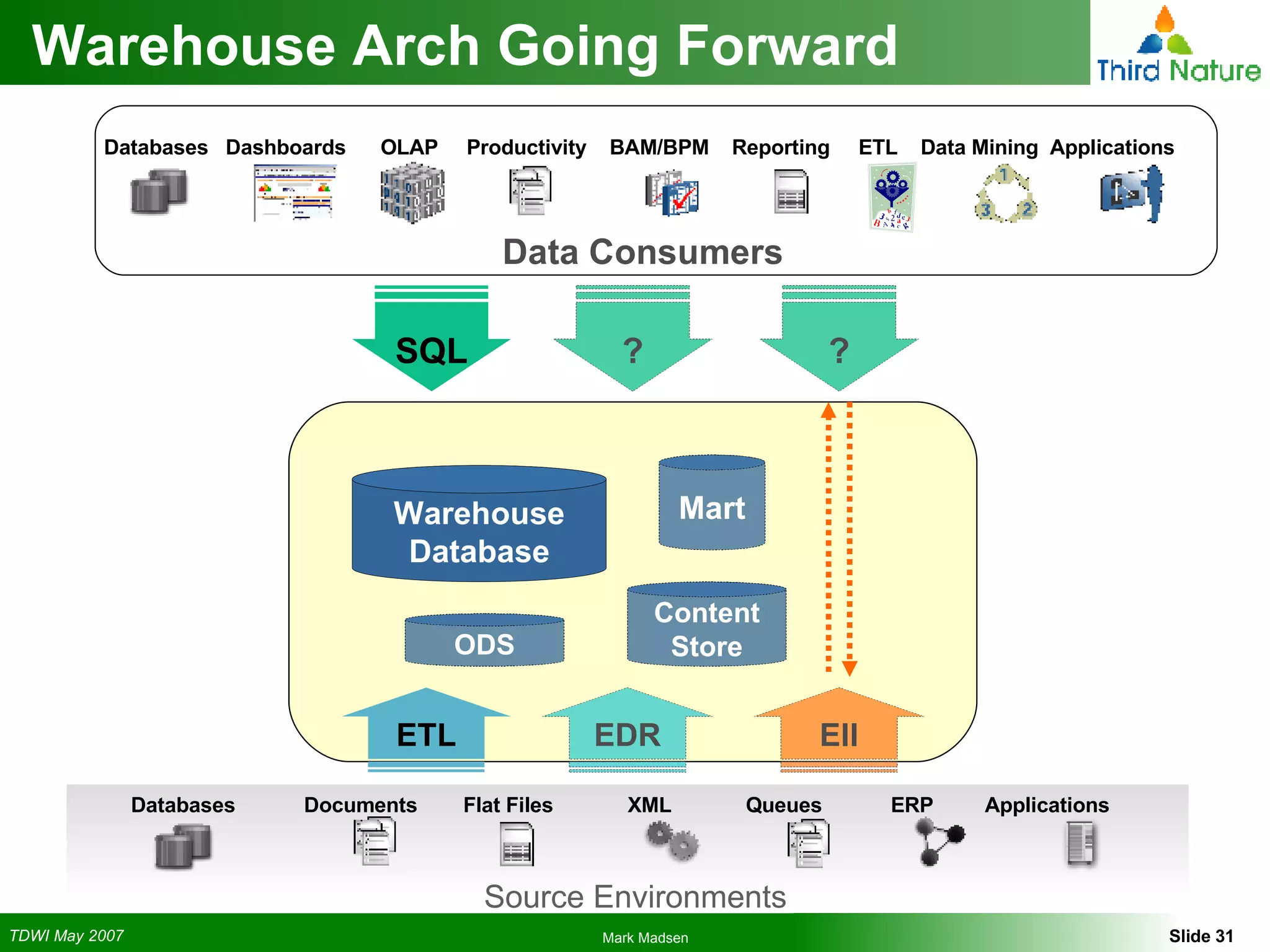

The document provides an overview of the Extract-Transform-Load (ETL) market and its trends in data integration, highlighting the evolution towards open standards and the increasing complexity of integration amidst growing data sources. It discusses the importance of master data management and the ongoing consolidation in the market, while emphasizing the need for improved data quality and governance. The future expectations include further commoditization, new entrants in specialized areas, and an evolving landscape of integration technologies.