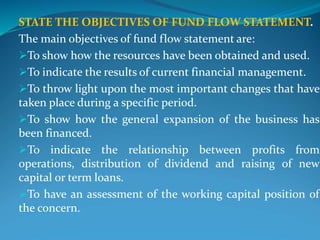

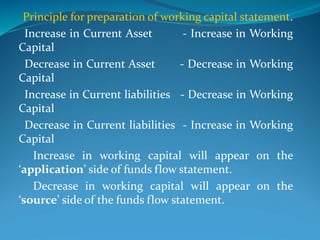

The document defines key terms related to funds and cash flow statements. It explains that a funds flow statement shows how working capital is raised and used during an accounting period, while a cash flow statement reports cash inflows and outflows classified by operating, investing and financing activities. The objectives of both statements are to show how financial resources are obtained and used, assess the working capital position, and evaluate an organization's ability to generate cash flows.