Saudi Arabia's Cheapest Solar Bids, Plans for Russia Deals

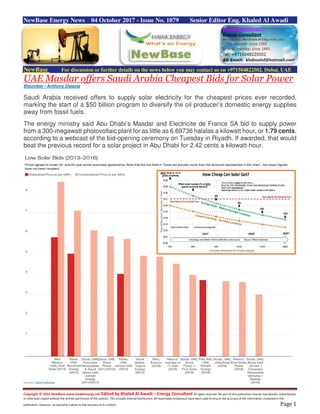

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase Energy News 04 October 2017 - Issue No. 1079 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE Masdar offers Saudi Arabia Cheapest Bids for Solar Power Bloomber - Anthony Dipaola Saudi Arabia received offers to supply solar electricity for the cheapest prices ever recorded, marking the start of a $50 billion program to diversify the oil producer’s domestic energy supplies away from fossil fuels. The energy ministry said Abu Dhabi’s Masdar and Electricite de France SA bid to supply power from a 300-megawatt photovoltaic plant for as little as 6.69736 halalas a kilowatt hour, or 1.79 cents, according to a webcast of the bid-opening ceremony on Tuesday in Riyadh. If awarded, that would beat the previous record for a solar project in Abu Dhabi for 2.42 cents a kilowatt-hour.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Saudi Arabia and its neighbors are among Middle Eastern oil producers looking to renewables to feed growing domestic consumption that’s soaking up crude they’d rather export to generate income. While the offers submitted are remarkably low, the actual cost of power coming from the projects may be inflated by terms within the contracts that aren’t yet published, according to Bloomberg New Energy Finance in Zurich. “There is great pressure in the Middle East to come up with an impressive headline number, and these are becoming increasingly divorced from the reality of payments,” said Jenny Chase, chief solar analyst for BNEF in Zurich. Solar Laggards The Middle East, rich in oil and natural gas, is trailing most other regions in developing renewables such as solar and wind. Governments from the United Arab Emirates to Iran and Saudi Arabia have spent the past two years sketching out incentive programs and regulatory changes needed to jump- start their clean-energy industries, which remain a fraction of the scale built up in places like Japan and Germany where energy is scarce. Saudi Arabia’s price may reflect a “base rate” paid at periods of peak demand or a price that applies only for part of the project’s life, Chase said. It also could include a payment to the winning developer, land grants or other incentives to get the solar industry started in Saudi Arabia, she said. “I don’t think this is possible as an all-in price of electricity from a 2019 PV project, particularly given the rising cost of debt in Saudi Arabia,” Chase said. Even so, the announcement is a milestone in Saudi Arabia’s nascent solar program. The country that gets less than 1 percent of its power from renewables currently plans to develop 30 solar and wind projects over the next 10 years. Officials at the ministry’s Renewable Energy Project Development Office will review all the bids presented before awarding a power-purchase contract, according to the webcast. It plans to make a final decision on who will build the solar plant at Sakaka in the country’s north in January, according to an emailed statement from the office. First Award The plant will be the first awarded under the renewables program, which targets 9,500 megawatts of electricity generation capacity using solar and wind by 2030. The project is set to start producing power by June 2019, according to the bid. Saudi power-plant developer ACWA Power made the second-lowest bid at 8.7815 halalas per kilowatt-hour, and a group led by Marubeni Corp. made the third-lowest bid. Masdar, officially named Abu Dhabi Future Energy Co., and EDF are already partnersin an 800-megawatt project in Dubai. Prices for solar projects in the Middle East have set successive records with first Dubai and then Abu Dhabi coming in with all-time low power pricing. A combination of improving and less costly technology, free land earmarked for the plants, connections to the national power grid and favorable financing have helped cut the costs. The large size of the projects being offered has also played a key role, as developers have been able to bid lower prices for electricity because of anticipated economies of scale. Saudi Arabia’s renewable energy program is part of a broader project to wean the economy from its reliance on oil exports. The government is seeking to build new industries such as petrochemicals, manufacturing and tourism. State crude giant Saudi Arabian Oil Co., known as Saudi Aramco, is preparing to sell a stake of about 5 percent in an initial public offering that Crown Prince Mohammed bin Salman has said could value the company at about $2 trillion and provide cash to help diversify the economy.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Saudi Arabia to Plan Russia Deals, Deepening Energy Ties Bloomberg - Wael Mahdi Saudi Arabia is looking at unprecedented deals to acquire oil and gas assets in Russia, deepening ties between the world’s largest energy exporters as the Saudi king prepares to visit Moscow later this week. OPEC’s biggest crude producer is considering investing in Russia’s largest oil drilling contractor, Eurasia Drilling Co., and Novatek PJSC’s proposed Arctic LNG 2, according to officials with knowledge of talks, who asked not to be identified because the talks are private. While discussions are at an early stage, some framework accords could be signed during King Salman bin Abdulaziz’s trip, one of the officials said. Saudi Arabia and Russia produce almost a quarter of the world’s oil between them and led an historic agreement between the Organization of Petroleum Exporting Countries and other major suppliers last year to cut output and help end a global glut of crude. Direct Saudi investment in Russian assets would show continued commitment to cooperation between the two energy superpowers as Salman and Russian President Vladimir Putin prepare for talks that are likely to include whether to extend the pact on oil production limits. Salman is scheduled to meet Vladimir Putin in Moscow on Thursday, while a delegation traveling with him, including Saudi Arabian Energy Minister Khalid Al-Falih, will participate in an investment forum the same day. Final agreements are subject to due diligence and are establishing that the deals don’t violate any international sanctions against Russia, one official said. Investments with Eurasia and Novatek aren’t the only deals on the table. Saudi Arabian Oil Co., or Aramco, is in talks with Sibur Holding PJSC, Russia’s largest petrochemical producer, about forming a joint venture to make synthetic rubber in the desert kingdom, two people with knowledge of the discussions said last month. Saudi Energy Minister Al-Falih told reporters during his first OPEC meeting last summer that Saudi Aramco will consider investing in upstream projects abroad after the company goes public, focusing mainly on developing natural gas. He didn’t rule out importing gas into the kingdom. The state-run giant plans to sell shares to investors by the end of 2018. Saudi investment in Russian gas production would mirror an earlier, unsuccessful joint venture when Lukoil PJSC spent more than a decade fruitlessly trying to develop gas deposits in Saudi Arabia’s barren Empty Quarter. Novatek, which aims to launch its first liquefied natural gas plant in the Arctic in November, is planning the second project to follow in 2022 or 2023, making it Russia’s biggest LNG producer.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 The company will select potential partners for the development closer to the final investment decision, expected by 2019, its billionaire chief executive Leonid Mikhelson said in July. Eurasia, which has around 20 percent of the Russian oil-drilling market, in June agreed “on investments” from China and the Middle East, led by the state-run Russian Direct Investment Fund. The partners didn’t disclose any details. Eurasia’s principal shareholders have also agreed to sell 51 percent to Schlumberger Ltd.This acquisition is due to be approved by Russia’s regulators, who are demanding guarantees from the world’s largest oilfield-services provider that all Eurasia’s contracts will be met even if U.S. and its allies expand sanctions against Russia.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Indonesia: Sonoro Energy spuds Budong Budong appraisal well Source: Sonoro Energy Sonoro Energy has announced that drilling has begun at its LG-1 Up-dip appraisal well in Indonesia. Sonoro’s drilling contractor, PTI Advanced Services Indonesia ('ASI'), has rigged up with all personnel and services on site at the LG-1 Up-dip wellsite on the Budong Budong Production Sharing Contract (PSC) lease in West Sulawesi, and has begun drilling operations with its Rig 3. Sonoro is also pleased to announce that it has received further confirmation from Indonesia’s Directorate General of Oil and Gas ('MIGAS') that the exploration period for the Budong Budong PSC remains valid through Jan. 15, 2018, and that Sonoro has until that date to drill, complete and test the LG-1 Up-dip well with no further conditions attached. A MIGAS representative visited the LG-1 Up-dip site in West Sulawesi this past weekend and performed an inspection to its satisfaction, enabling Sonoro to begin drilling operations. 'We are pleased to have the continued support of the Indonesian government regulator SKKMIGAS and MIGAS to commence drilling operations with confidence,' said Sonoro CEO and Director Richard Wadsworth. 'With this confirmation and inspection,' added Mr. Wadsworth, 'we expect the initial drilling to now proceed cautiously in the top hole section, given the documented hydrocarbon overpressure encounters in the region, such that extra precautions are taken to be prepared for potential shallow gas kicks in the upper hole.' Sonoro has posted additional photos of final LG-1 Up-dip rig preparation and establishment to its website, sonoroenergy.com. or technical info regarding the LG-1 Updip appraisal well program in the Budong Budong PSC, see Corporate Presentation (August 2017)

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 US : State taxes on gasoline in 2017 up 4.5% from 2016 Source: U.S. Energy Information Administration, Petroleum Marketing Monthly In EIA’s latest update of state gasoline and diesel fuel taxes data, the simple average of taxes and fees on gasoline levied by the states and the District of Columbia in effect as of July 1, 2017, was 27.9 cents per gallon (¢/gal), up 4.5% from the same time last year. These taxes and fees range from a low of 8.95 ¢/gal in Alaska to a high of 59.3 ¢/gal in Pennsylvania. Gasoline buyers in the United States pay these taxes at the pump in addition to the federal tax of 18.4 ¢/gal, which has remained unchanged since 1993. State taxes on diesel tend to be somewhat higher—averaging 28.6 ¢/gal and ranging from 8.95 ¢/gal in Alaska to 75.8 ¢/gal in Pennsylvania. The federal tax on diese l of 24.4 ¢/gal is slightly higher than the federal tax on gasoline. Since July 1, 2016, New Jersey had the highest increases in their state excise taxes for gasoline and diesel fuel, which were up by 23 ¢/gal and 27 ¢/gal, respectively. Over the same period, Iowa reduced its gasoline and diesel taxes and fees by 1.2 ¢/gal and 1.0 ¢/gal, respectively, and California reduced its diesel taxes by 4.5 ¢/gal.

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 A variety of taxes and fees are levied on motor fuels by all levels of government in the United States. Although these charges often include relatively small fees that provide revenue for environmental protection and other dedicated funds, governments use the largest portion of fuel tax revenues to build and maintain transportation infrastructure, effectively making the taxes equivalent to road user fees. Some states base tax rate changes on average historical prices for fuel sold within the state. For instance, Pennsylvania computes the portion of its tax called the Oil Company Franchise Tax on the average wholesale price per gallon of each type of fuel. Other states also apply sales taxes to motor fuels used on-highway. These taxes can represent a significant portion of the final selling price of fuel to consumers. Indiana's Gasoline Use Tax, computed on a monthly basis, was 12.8 ¢/gal as of July 1, 2017. A 7% sales tax applies at the pump to retail, on-highway diesel prices before federal and state excise taxes are applied. In EIA’s Short-Term Energy Outlook (STEO), these changes in state tax rates are reflected in the differences between the U.S. wholesale average gasoline price and the retail gasoline prices, which include all federal and state taxes, across different Petroleum Administration for Defense Districts (PADDs). Most of the tax increases over the past year occurred in states in the Northeast (PADD 1) and Midwest (PADD 2). Through the first half of 2017, the spread between retail prices for regular gasoline in the Northeast and the U.S. average wholesale gasoline price averaged 68 ¢/gal, 3 ¢/gal higher than in the same period in 2016, following tax increases in New Jersey and Pennsylvania. Price spreads between regular retail gasoline and regular wholesale gasoline in the Midwest increased by about 2 ¢/gal over the same period to reach an average of 61¢/gal, following tax increases in Michigan. In addition to already existing tax changes at the time of publication, the STEO also accounts for future approved tax increases, such as California’s planned 12 ¢/gal increase set to begin on November 1, 2017. California represents a major portion of West Coast (PADD 5) gasoline consumption, so changes in California’s fuel taxes are expected to contribute to larger differences between West Coast retail and U.S. average wholesale gasoline prices in the STEO forecast.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 NewBase October 04 - 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Oil Prices dips over doubts recent rally will last Reuters + NewBase + Bloomberg Oil prices eased on Wednesday, with U.S. crude dipping below $50 per barrel, pulled down by caution that a rally that lasted for most of the third quarter would not extend through the last three months of the year. U.S. West Texas Intermediate (WTI) crude oil futures CLc1 were trading at $50 per barrel at 0417 GMT, down 42 cents, or 0.8 percent, from their last close. They fell below $50 per barrel earlier in the session. Brent crude futures LCOc1, the international benchmark for oil prices, were down 38 cents, or 0.7 percent, at $55.62 a barrel. Traders said the drops came over concerns that a third-quarter market rally that had lifted Brent to mid-2015 highs by late September had been overdone. “Fundamentals may not yet be strong enough to support a continued rally, especially in growth- dependent commodities such as oil,” said Ole Hansen, head of commodity strategy at Denmark’s Saxo Bank in a quarterly outlook to investors. Analysts say that a so-called market rebalancing is now well underway, meaning that demand is no longer undershooting available supply. The re-balancing is a result of strong consumption and also due to efforts led by the Organization of the Petroleum Exporting Countries (OPEC) to cut output by around 1.8 million barrels per day (bpd) in 2017 and the first quarter of next year. Oil price special coverage

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 “Compliance with the OPEC production cuts was over 100 percent in August (meaning members produced less than their quotas, on average) and U.S. oil inventories have been declining for several months now,” said William O‘Loughlin, investment analyst at Australia’s Rivkin Securities. But rising production in the United States, which is not participating in the deal to cut output, has prevented prices from climbing further. U.S. production C-OUT-T-EIA hit 9.55 million bpd in late September, its highest level since July 2017 and not far off its 9.61 million bpd record from June 2015. “The number of active drilling rigs in the U.S. increased last week, highlighting the fact that higher oil prices will inevitably lead to more production from U.S. shale. These factors have kept WTI oil in a relatively tight trading range for several months now,” O‘Loughlin wrote in a note to clients. Drillers added six oil rigs looking for new production in the week to Sept. 29, bringing the total count up to 750, according to energy services firm Baker Hughes. Due largely to rising U.S. output, Saxo Bank’s Hansen said that “an extension of output curbs beyond March (2018) will be needed to ensure continued support for the oil market”. Oil Extends Loss as Industry Data Shows Gasoline Build Prices extended declines in after-market trading following the release of data from the American Petroleum Institute Tuesday, which was said to show U.S. gasoline inventories rose by 4.91 million barrels last week. That would be the largest build since January if Energy Information Administration data released on Wednesday confirms it. U.S. crude inventories fell by 4.08 million barrels last week, the data showed. A build in gasoline wouldn’t be surprising as we aren’t using as much product this time of year, James Williams, president of London, Arkansas-based energy researcher WTRG Economics, said by telephone. If EIA data confirms the build in gasoline though, it’s likely we will see a drop in product prices, he said.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 End-of-year demand for oil typically weakens as refiners shut units for repairs and maintenance, shunting more supplies into storage tanks. However, in the advent of Hurricane Harvey, some refiners have decided to delay maintenance projects to take advantage of strong demand for fuel and fatter profits. West Texas Intermediate for November delivery traded at $50.20 a barrel at 4:43 p.m. after settling at $50.42 a barrel on the New York Mercantile Exchange, the lowest close in more than a week. Total volume traded was about 43 percent below the 100-day average. Brent for December settlement dropped 12 cents to end the session at $56 a barrel on the London- based ICE Futures Europe exchange. The global benchmark crude traded at a premium of $5.26 to December WTI. The API report also showed distillate supplies dropped by 584,000 barrels, according to people familiar with the data, who asked not to be named because the information isn’t public. Inventories at the Cushing, Oklahoma, storage hub climbed by 2.08 million, the API data showed, which would be the biggest build since March if EIA data confirms it. The Bloomberg survey showed a 500,000-barrel drop in crude stockpiles, while gasoline supplies probably rose by 1 million barrels and distillate inventories slid by 1.5 million barrels. Oil stored at the key Cushing, Oklahoma, storage hub probably swelled by 1.8 million barrels, according to a forecast compiled by Bloomberg. Extension of cuts OPEC and its partners, including Russia, need to extend their oil-production cuts for at least three more months to keep crude prices at current levels, according to UBS Group AG. “Just out of necessity they will stick together,” Dominic Schnider, head of commodities and Asia- Pacific currencies at UBS’s wealth-management unit in Hong Kong, said in an interview in Moscow. “Falling back to the old scheme with decent U.S. shale-supply growth expected for next year is not an option.” While oil returned to a bull market last week, it’s still trading at half mid-2014 levels on concern that output curbs by the Organization of Petroleum Exporting Countries and its allies won’t be sufficient to clear a global surplus. The group’s current agreement expires at the end of next March, and as yet there’s no decision on extending or deepening the cuts.

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 Saudi Arabia wants oil-market stability given the planned share sale of its state-owned energy company Saudi Aramco, while Russia will also favor prices over production, according to Schnider. For Russia, “price gains are more valuable than volume gains -- how much can you really pump more from last year’s peak production level?” he said. “We think they’re going to stick to the pact and over the coming months they are likely to extend it -- hopefully for six months and not three months.” Following a meeting in Vienna in September, OPEC and Russia said they were about halfway toward clearing the global glut and urged fellow producers to stay focused and finish the job, while stopping short of announcing additional action. They’ll meet again this week in Moscow to discuss the market and the mechanism for monitoring exports, Russian Energy Minister Alexander Novak said Tuesday, adding that no decision on extending the deal will be made. Brent crude, the benchmark for more than half the world’s oil, traded around $56 a barrel on Tuesday. Prices jumped almost 10 percent in September on forecasts for strong demand, on signs the surplus was finally easing, and on threats from Turkey of a possible halt in oil exports from Iraqi Kurdistan. Price Outlook Brent may climb as high as $60 this quarter as a result of rising demand and political risks, including tensions in Iraq, U.S. President Donald Trump’s dissatisfaction with the Iran nuclear deal and social upheaval in Venezuela, Schnider said. “The problem is next year,” when prices may average $55, UBS forecasts show. At current prices, oil production in the U.S. may increase by as much as 800,000 barrels a day next year, or 1 million a day when including natural-gas liquids, according to Schnider. Total non-OPEC growth could reach as much as 1.4 million barrels a day, he said. “Where are we left, if OPEC together with Russia is not sticking together?” he said. “If the agreement falls apart, then prices just sink immediately. Libya Works to Revive Production Oil steadied near $50 a barrel in New York after slumping on Monday, as OPEC member Libya worked to revive output at its biggest oil field. West Texas Intermediate futures were little changed after dropping 2.1 percent to a one-week low on Monday. The Organization of Petroleum Exporting Countries pumped 32.83 million barrels a day in September, up 120,000 barrels a day from August, according to data compiled by Bloomberg. Libyan production is set to recover from a five-month low as the nation’s biggest field restarts following a brief halt. Oil capped the biggest monthly advance in September since April 2016 after entering a bull market on forecasts for rising demand and as Turkey said it may halt Kurdish exports through its territory. U.S. crude inventories probably extended declines last week, falling by a projected 500,000 barrels, according to a Bloomberg survey before a government report on Wednesday.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 “With news of Libyan output looking to recover back to the 1 million-barrel-a-day level, oil bulls need to hold out for another bout of news on geopolitics,” said Jens Naervig Pedersen, senior analyst at Danske Bank A/S in Copenhagen. West Texas Intermediate for November delivery was at $50.51 a barrel on the New York Mercantile Exchange, 7 cents lower, at 10 a.m. in London. Total volume traded was about 49 percent below the 100-day average. Prices slid $1.09 to $50.58 on Monday after advancing 9.4 percent last month. See also: In Oil-Thirsty India, Refiners Lend Unlikely Aid to Natural Gas Brent for December settlement fell 7 cents to $56.05 a barrel on the London-based ICE Futures Europe exchange. Prices lost $1.42, or 2.5 percent, to $56.12 on Monday. The global benchmark crude traded at a premium of $5.22 to December WTI. Saudi Arabia, OPEC’s biggest producer, boosted production by 60,000 barrels a day to 10.06 million barrels, while Gulf neighbor Kuwait lifted output by 50,000 barrels to 2.76 million barrels a day, according to a Bloomberg survey of analysts, oil companies and ship-tracking data

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 NewBase Special Coverage News Agencies News Release October 04-2017 Statoil, Shell and Total enter CO2 storage partnership Source: Statoil Statoil, Shell and Total have signed a partnership agreement to mature the development of carbon storage on the Norwegian continental shelf (NCS). The project is part of the Norwegian authorities’ efforts to develop full-scale carbon capture and storage in Norway. In June, Gassnova awarded Statoil the contract for the first phase of the project. Norske Shell and Total E&P Norge are now entering as equal partners while Statoil will lead the project. All the partners will contribute people, experience, and financial support. The first phase of this CO2 project could reach a capacity of approx. 1.5 million ton per year. The project will be designed to accommodate additional CO2 volumes aiming to stimulate new commercial carbon capture projects in Norway, Europe and more globally across the world. In this way, the project has the potential to be the first storage project site in the world receiving CO2 from industrial sources in several countries. The agreement was signed in Oslo on 2 October. (Photo: Ole Jørgen Bratland)

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 'Statoil believes that without carbon capture and storage, it is not realistic to meet the global climate target as defined in the Paris Agreement. A massive scale up of number of CCS projects are needed and collaboration and sharing of knowledge are essential to accelerating the development. We are very pleased to have Shell and Total as partners and believe their experience and capabilities will further strengthen this project' says Irene Rummelhoff, Statoil’s executive vice president for New Energy Solutions. 'We trust that this robust partnership is well positioned to develop this first-of-a- kind project'. The three companies share a common vision of a carbon storage infrastructure. 'Shell sees CCS as a transformative technology that can significantly reduce emissions from those industrial sectors that will continue to rely on hydrocarbons for decades to come. Shell has significant experience of working with governments and other experts to support the development and wide-scale deployment of CCS and are pleased to be joining forces with our joint venture partners', says Monika Hausenblas, Shell’s executive vice president for Environment and Safety. 'Total is integrating the climate challenge into its strategy. Total’s involvement in this first commercial-scale storage project, is thus fully aligned with our low carbon roadmap and our strategy to ultimately become a global CCUS leader' said Philippe Sauquet, President, Gas, Renewables & Power and President, Strategy-Innovation at Total. 'The aim of this first integrated industrial-scale project, supported by the Norwegian Government, is to develop viable, reproducible commercial CCUS model in view of carrying out other major projects around the world.' The storage project will store CO2 captured from onshore industrial facilities in Eastern Norway. This CO2 will be transported by ship from the capture facilities to a receiving terminal located onshore on the west-coast of Norway. At the receiving terminal CO2 will be transferred from the ship to intermediate storage tanks, prior to being sent through a pipeline on the seabed to injection wells east of the Troll field on the NCS. There are three possible locations for the receiving terminal; a final selection will be made later this year.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 The objective for the project, which is supported by Gassnova and other relevant governmental stakeholders, is to stimulate necessary development of CCS so the long-term climate targets in Norway and the EU can be reached. The collaboration will form basis for establishing a further partnership for the construction and operational phases. Shell’s Quest Carbon Capture and Storage Project Shell’s flagship CCS project Quest in Alberta, Canada is ‘a first’ in many ways. Designed to capture and safely store an average of one million tonnes of CO2 per year – equal to the annual emissions from about 250,000 cars – it’s one of only 15 operational large-scale CCS projects in the world. And it’s the first CCS project associated with oil sands production. Shell believes the world will need CCS to achieve the ambition of net-zero emissions. Royal Dutch Shell CEO Ben van Beurden and Quest Business Opportunity Manager Tim Wiwchar turn a ceremonial valve* at the Quest Carbon Capture and Storage Project launch (Shell Scotford, November 6, 2015) Source: Shell Quest has been working better than planned, both in preventing CO2 from entering the atmosphere and in safely storing that CO2 deep underground, since its start- up celebration last November. Both its capture technology and storage capability have helped Quest exceed its target of capturing one million tonnes of CO2 per year, and through careful study and monitoring, the subsurface geology is proving ideal for long-term, safe storage of CO2. “The success we are seeing in Quest demonstrates that Canadians are at the forefront of carbon capture and storage technology, showing the world that we can develop real solutions to address climate change,” said Zoe Yujnovich, Executive Vice President, Oil Sands for Shell. “Not only is Quest capturing and storing CO2 emissions from our oil sands operations, but its technology can be applied to other industries around the world to significantly reduce their CO2 emissions.” From the outset, any intellectual property or data generated by Quest has been publicly available, in collaboration with the governments of Alberta and Canada to help bring down future costs of CCS and encourage wider use of the technology around the world. This means that others can take the detailed engineering plans, valued at C$100 million, to help build future CCS facilities. “Supportive government policy was essential in getting Quest up and running and will continue to play a vital role in developing large-scale CCS projects

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 globally,” added Yujnovich. “Together with government, we are sharing lessons learned through Quest to help bring down future costs of CCS globally. If Quest was built again today, we estimate that it would cost 20-30 per cent less to construct and operate thanks to a variety of factors including capital efficiency improvements and a lower cost environment.” Since 2014, more than 50 delegations have come to visit Quest to learn about the project, drawing government and educational interest from places including US, Korea, The Netherlands, Norway, Mexico and Taiwan. A Quest study tour coordinated by the Global CCS Institute took place September 21 and 22 involving participants from several countries including the US, Poland, UK and Japan. The ceremonial valve and associated photo backdrop used to mark the official launch of the Quest Carbon Capture and Storage (CCS) Project with the Quest unit in the background (Shell Scotford, November 6, 2015). Source: Shell Shell is also involved in other demonstration CCS projects around the world. In Australia, Chevron is leading the Gorgon project, with Shell and ExxonMobil as partners. Gorgon will be the world’s largest CCS project with a storage capacity of 3-4 million tonnes a year. CO2 capture technology developed by Shell Cansolv is now in use at SaskPower’s Boundary Dam power station in Saskatchewan, Canada, designed to capture around 800,000 tonnes of CO2 a year. Statoil evaluating new CO2 storage project on the Norwegian continental shelf Gassnova has assigned Statoil to evaluate the development of carbon storage on the Norwegian continental shelf (NCS). This will be the first storage site in the world receiving CO2 from several industrial sources. The storage project is part of Norwegian authorities’ efforts to develop full-scale carbon capture and storage in Norway. It will capture CO2 from three onshore industrial facilities in Eastern Norway and transport CO2 by ship from the capture area to a receiving plant onshore located on the west-coast of Norway. At the receiving plant CO2 will be pumped over from the ship to tanks onshore, prior to being sent through pipelines on the seabed to several injection wells east of the Troll field on the NCS. There are several possible locations for the receiving plant, and the final choice will be based on criteria such as safety, costs and expansion flexibility. Gassnova has previously been awarded the assignments for carbon capture and transportation in the project. The storage solution to be evaluated by Statoil will have the potential to receive CO2from both Norwegian and European emission sources. “Carbon capture and storage (CCS) is an important tool to reduce carbon emissions and to achieve the global climate targets as defined in the Paris Agreement. The CCS project that has been assigned to us will require an entirely new collaboration model with carbon capture from several industrial sources, carbon transportation by ships, and carbon storage 1000-2000 metres below the seabed. In addition, this may be the start of the world’s first CCS network across national borders. Much work remains, but if we are successful, this may open new business opportunities both for Statoil, our collaboration partners and Norwegian industry,” says Irene Rummelhoff, Statoil’s executive vice president for New Energy Solutions.

- 17. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 17 The results of studies performed in 2016 show that it is technically feasible to realise a carbon capture and storage chain in Norway. The next phase of the project, which Statoil has been assigned to perform, will involve concept and pre-engineering studies in order to evaluate the possibilities in more detail, and to get accurate cost estimates towards a possible investment decision. An investment decision for project implementation is expected to be made by the Norwegian Parliament in 2019. The technologies for carbon capture and storage in geological formations are known and established. There are 21 full-scale carbon capture and storage projects worldwide in the development or operations phase. Statoil’s CCS projects at Sleipner and Snøhvit are among these, and have given Statoil more than 20 years of operational carbon storage experience. “The next big tasks are developing technology, regulations and general commercial conditions that may stimulate an extensive roll-out of CCS,” says Rummelhoff. The Norwegian CCS project will be a collaboration project between onshore industry, government authorities and companies with offshore expertise, such as Statoil. “Collaboration and sharing of knowledge are essential to accelerating the development of a market for carbon capture and storage. It is therefore important that we collaborate with other industrial players that can and will help implement projects and qualify CCS as an important climate tool,” says Rummelhoff. Future carbon storage may also help realise a hydrogen market. Hydrogen produced from natural gas generates CO2 as a by-product, and with a value chain for CO capture, transportation and storage it will be possible to further examine a full-scale value chain for hydrogen, which is a low- carbon energy solution with potentials within both power, heating and transportation.

- 18. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 18 Total - Lacq CCS Pilot report The Lacq Pilot project is a fully integrated carbon capture and storage (CCS) project operated by Total in the Lacq region of south-eastern France. From 2009 to 2013 the project captured more than 51 thousand tonnes (kt) of carbon dioxide (CO2) through oxyfuel combustion at a gas-fired power station, transported it by pipeline and injected it safely into the nearby Rousse geological reservoir. Total has published a new report detailing the Lacq pilot through the Global CCS Institute. In this Insight, Jacques Monne, R&D manager in Exploration and Production at Total, introduces the report and gives an overview of the objectives of the Lacq project. Total is pleased to present “Carbon Capture and Storage: The Lacq Pilot”, which sets out our experiences in developing and operating a pilot study in capture and geological storage of CO2 which began in 2007 on the Lacq and Rousse industrial sites. This large-scale project was an opportunity for the Total group to test a complete CO2 capture, transport and storage chain, starting with the conversion of an air boiler with a 30 thermal megawatt (MWth) output, into an oxy-combustion boiler. The pilot, an unmatched first in Europe, fulfilled all its technical and theoretical objectives. Total set itself ambitious goals as part of our commitment to curbing greenhouse gas emissions: • To demonstrate the technical feasibility and reliability of an integrated chain comprising CO2 capture, transportation and injection into a depleted gas reservoir and steam production • To acquire operating experience and data to upscale the oxy-combustion technology from pilot (30 MWth) to industrial scale (200 MWth) while down-scaling the capture cost of oxy- combustion compared to classical post capture technologies • To develop and apply geological storage qualification methodologies, monitoring methodologies and technologies on site to serve in future onshore storage monitoring programs that will be larger in scale, longer in term and economically and technically viable (microseismic monitoring, environmental monitoring) • To promote CCS knowledge sharing among the public, companies, associations and the academic community through the communication of scientific results, project achievements and lessons learnt.

- 19. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 19 This pioneering experiment promoted CO2 capture and storage as an innovative solution, complementary to the reduction of emissions at source (managing energy consumption, development of non-carbon energies). The report presents the results of seven years’ field experimentation by Total and its many partners working on greenhouse-gas abatement solutions. It is a collegiate work, the corollary and symbol of the culture of innovation the Group nurtures and advocates. It is published at Total’s initiative in a true spirit of open data, to make all the data collected in the course of the pilot available to the scientific community. Schematic drawing of Lacq CO2 Pilot monitoring system. Picture courtesy of Total The above-mentioned objectives are discussed through the different chapters of this report, which has been written to give the reader an overview of this industrial adventure in accordance with the scientific information sharing, and open and transparent dialogue policies promoted by Total during the whole life of this pilot project. It describes the period from the decision being taken to proceed with the project to the end of CO2 injection. The wider deployment of CCS technology by 2020-2030 can benefit from the input that this type of project offers.

- 20. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 20 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 27 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase October 2017 K. Al Awadi

- 21. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 21

- 22. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 22