109829014 case-study

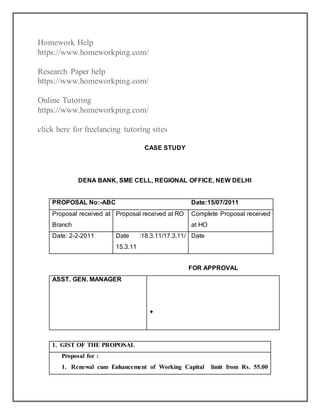

- 1. Homework Help https://www.homeworkping.com/ Research Paper help https://www.homeworkping.com/ Online Tutoring https://www.homeworkping.com/ click here for freelancing tutoring sites CASE STUDY DENA BANK, SME CELL, REGIONAL OFFICE, NEW DELHI PROPOSAL No:-ABC Date:15/07/2011 Proposal received at Branch Proposal received at RO Complete Proposal received at HO Date: 2-2-2011 Date :18.3.11/17.3.11/ 15.3.11 Date FOR APPROVAL ASST. GEN. MANAGER + 1. GIST OF THE PROPOSAL Proposal for : 1. Renewal cum Enhancement of Working Capital limit from Rs. 55.00

- 2. Lacs to Rs. 65.00 lacs. 2. Renewal of existing Negotiation of Bills under L/C Limit of Rs. 50.00 Lacs. (outside MPBF) 3. Renewal of Forward Cover Limit of Rs. 200.00 Lacs.* 2. PROFILE Name of borrower XYZ Address (Regd. Office) 15B Friends Colony (West), New Delhi-65. Tel.: 011-41629685, 26933279 Fax.: 011-41598604 Email: xyzapp@vsnl.net Unit Unit Address RZ-3A/11, Tuglakabad Extension, New Delhi-19. Branch: Okhla Region: New Delhi Established on 01.04.2008 Whether appearing in Dealing with us since 08.04.2008 Standard B List No Group: Yes (XYZGroup) Willful Defaulter List No Line of Activity Manufacturing and export of readymade garments. Defaulter / CIBIL List No Key Person/Promot er Key Person Sh. Mohit Gupta Promoter Multiple / Consortium Sole EXISTING PROPOSED Leader Bank N.A. Asset Classification Standard Standard

- 3. Our share: 100.00% Asset Category as per CMC Guidelines N.A. P1 FB - 115.00 D2K Codes & Description NFB- % 0.00 Activity 6519 READY MADE GARMENTS (NON- BRANDED) STL- 0.00 Sector 15SME TL- 0.00 Special Category Priority No BSR Code: Basel II Code: Risk Weightage 100% Provisioning: 0.25% Credit Risk Rating BB Risk Grade as per ABS Dt 31.03.09 “Best” BPLR+1.00% 3. NAMES OF DIRECTORS/ PARTNERS / PROPRIETOR & NET WORTH (Rs. in Lacs) Sr. Name Net Worth As on Basis 1 Mohit Gupta 35.23 10.03.2011 As mentioned in Branch Process Note Whether Proprietor / Partner/ Director / Guarantor has any relationship with any Director or Senior Official (Scale IV & above) of the Bank. If so give details (Refer to Guidelines) No * CA certificate confirming Net Worth of the Proprietor to be obtained by the Branch before release of enhanced limit and Branch to ensure that the same is in accordance with Net Worth as mentioned in the Process Note. 4. Major Shareholders: S.N Name Status No. of Share Percentage

- 4. N.A.( Proprietorship Firm) 5. EXPOSURE: [Rs in lacs] Borrower EXPOSURE Existing Proposed Variation(+/-) Fund Based 105.00 115.00 +10.00 Non Fund Based NIL NIL NIL Forward Cover* 4.00 4.00 0.00 Total Credit Exposure 109.00 119.00 +10.00 Investments NIL NIL NIL Other Commitments NIL NIL NIL Total Exposure 109.00 119.00 +10.00 GROUP EXPOSURE Fund Based 122.29 128.84 +6.55 Non Fund Based NIL NIL NIL Forward Cover* 4.00 4.00 0.00 Total Credit Exposure 122.29 128.84 +6.55 Investments NIL NIL NIL Other Commitments NIL NIL NIL Total Exposure 122.29 128.84 +6.55 * (Specified 2% of forward cover limit, which is to be reckoned as part of exposure as per extant guidelines.) # The Firm has availed Car Loan of Rs. 4.50 lacs and the present outstanding is Rs.3.63 Lacs. The account is classified as Standard. However, being retail exposure, the present outstanding is not reckoned in the overall exposure. ** Further the borrower is presently enjoying OD limit against FDR and the outstanding as on date is Rs.6.52 Lacs. The account is classified as Standard. Since the loan is against FDR the outstanding is not considered as part of overall exposure in the account.

- 5. With a view to ease the liquidity position, we propose a stipulation that the borrower should liquidate the OD facility before release of the enhanced limits. 6 COMPLIANCE TO PRUDENTIAL / INTERNAL EXPOSURE LIMITS: (Rs in crores) As per RBI guidelines As per Internal Guidelines For Corporate For Non Corporate Individual 476.96 400.00 15.00 Group 1271.80 800.00 60.00 Whether the limits proposed exceed the prudential exposure norms (Individual / Group) No No No In case of exceeding, details of permission from the competent authority N.A. 7. BRIEF HISTORY OF SANCTIONS INCLUDING REVIEWS AND ADHOCS DURING THE PAST TWELVE MONTHS. Sanctions Dt. 11-07-09 Sanctioned by Dy. Regional Manager(NDR) 02-02-10 Approval for one time use of Negotiation of Bills under L/C by DGM.

- 6. 2. PRESENT PROPOSAL: 3. To permit the following:: I. Status of existing and proposed limits (Rs in lacs) Facility Existing Outstand ing as on DRAW ING POWE R Irregul ar/ Overdu e amount Proposed Variatio n Limi t Margin (%) 10.01.10 Limit Margin (%) a) Fund Based 1 PCH cum FBP 55.00 PC- 10.00% 54.59 55.00 0.00 65.00 PC-10.00% +10.00 2 Neg. of Bills/LC 50.00 23.56 50.00 0.00 50.00 0.00 Sub-Total (a) 105.0 0 78.15 105.00 0.00 115.00 +10.00 b) Non - Fund Based 0.00 0.00 0.00 0.00 0.00 Sub-Total (b) 0.00 0.00 0.00 0.00 c) Forward Cover * 4.00* 1.38 0.00 4.00 0.00 d) Grand Total (a+b+c) 109.0 0 79.53 0.00 119.00 +10.00 e) Investment Exposure 0.00 0.00 0.00 0.00 0.00 TOTAL EXPOSURE 109.0 0 79.53 0.00 119.00 +10.00

- 7. *Borrower is enjoying Forward Cover Limit of Rs. 20.0 lacs ( 2% of the limits is reckoned as part of exposure, as per extant guidelines). II. SECURITY / DOCUMENATION a) Prime Security (Rs. in lacs) Nature Value Basis Hypothecation of Stocks and Book Debts 81.57 Paid Stocks as per Stock Statement of Nov.2010 b) Collateral Security (Rs. in lacs) Nature of Security Type of Charge Value Basis / Source Whether eligible under CRM (Basel II Norms) Residential property belonging to Mr. M.C. Gupta situated at 15B Friends Colony (West), New Delhi-65, comprising of 418 sq. yards having construction on Ground, First and Second Floor. Equitable Mortgage 680.26** Valuation Report by Banks’ Panel Advocate Shri K.C. Talwar, as on 20.02.09. As per Legal Opinion-cum- Non-Encumbrance Certificate by our Panel Advocate, Shri Kalim Ur Rehman dated 08-07-09, the subject property bears clear title and is marketable. No Total Collateral Security (considering Realisable Value of property) is Rs 680.26 lacs

- 8. The said property is also mortgaged to the Bank for Mortgage Loan of Rs. 10.85 Lacs sanctioned to Sh.. Mahesh C. Gupta, Smt. Shashi Khandelwal, Sh. Vikas Gupta, Sh. Mohit Gupta –O/S as on 10.01.2010 being Rs. 7.95 Lacs and Machinery Term Loan sanctioned to M/s xyz Apparels Inc-O/S as on 10.01.2010 being Rs. 5.89 Lacs. The conduct of the aforesaid accounts are satisfactory as reported by the Branch and both the accounts are classified as Standard. ** Value of Collateral Security (Rs. In Lacs.) S. No. Particulars Value 1. Market Value of the Property 867.63 2. Realisable Value of the Property 694.10 3. Less: O/s in Mortgage Loan 7.95 4. Less: O/s in Machinery Loan to xyz Apparels 5.89 Total 680.26 i) Percentage coverage of Collateral Security: 1 Total value of Collateral Security(considering Realisable value) Rs. 680.26 lacs 2 Of which our share Rs. 680.26 lacs 3 Total limits proposed from our Bank Rs. 128.84 lacs 4 Collateral Coverage 527.99% ii) Reasons in case of dilution of security coverage: N.A. c) Date of creation of Charge: 22.07.2009 d) Date of subsequent modification of charge: N.A. e) Date of vetting of documents by legal officer /Panel Advocate: 29.07.2009

- 9. f) Name of Guarantors & their Net Worth (Rs. in lacs) Name Relationship Net Worth As of Basis Mahesh Chand Gupta Father of Prop. 867.00 lacs 30.09.09 Annexure CC Smt. Shashi Khandelwal Mother of Prop. 4.50 lacs 30.09.09 Annexure CC Vikas Gupta Brother of Prop. 8.04 lacs 30.09.09 Annexure CC * Net Worth of the guarantors includes their investment in the subject Company and Group Companies. *CA Certificate confirming Net Worth of the Guarantors to be obtained by the Branch before release of enhanced limit and Branch to ensure the same is in accordance with Net Worth as mentioned in the Process Note. III. CREDIT RATING & Pricing: Pricing Existing Proposed Credit Rating Score Based on ABS [ March ’08 / Mar ‘08] BBB BB Applicable interest rate as per Credit Rating BPLR+0.75% BPLR+1.00% at present Interest rate presently Charged and Proposed As per HO/RBI guideline issued from time to time. Concession if any Nil Interest Rate charged by Lead Bank N.A. Commission on NFB Limits N.A. Processing Charges 0.25% of the Sanctioned Limit - Credit Rating Work Sheet furnished as Annexure 1

- 10. a) Factors contributing to the up gradation / slippage in credit rating: Change in the parameters of Risk Rating and lower profitability of the Firm. b) Justification for proposing lower rate of interest/concession in charges/process fees: N.A. IV. Permissions for Deviations, Issue of NOCs etc & Concessions in service charges : N.A. 9. Ratifications required for actions, exceeding permitted etc. beyond discretionary powers: N.A. 10. COMPANY PROFILE (in brief) M/s XYZ Exim is Proprietary concern of Sh. Mohit Gupta started in April 2008 and is engaged in manufacturing and export of readymade garments. Sh. Mohit Gupta was earlier working as a Partner in the Partnership Firm M/s xyz Apparels Inc. along with Sh. Vikas Gupta and were availing credit facilities since 1999. The Partnership Firm was availing various credit facilities from which a Machinery Term Loan is still operational having a current outstanding balance of Rs. 5.89 lacs as on 10.01.2010. Sh. Mohit Gupta, Proprietor, has a decade long experience in the manufacturing and exports of readymade garments. They had been earlier sanctioned credit limits on 02.02.09 by DRM, New Delhi of Negotiation of Bills under L/C for one time use of Rs. 100.00 lacs. The conduct of the account has been satisfactory. The Firm manufactures Hi Fashion garments like ladies tops, blouses, dresses, skirts and trousers etc. and exports to various customers in France, Germany and USA. The goods are currently exported to M/s Palais Oriental on D.A. as well as L/C at 90 days sight basis, rest all the customers are on L/C-DP on sight basis. 1. Palais Oriental- France 2. Ternay Diffusion Carling- France 3. Nolita NYC Inc.- USA

- 11. 11. INDUSTRY SCENARIO a. Industry Categorisation Manufacturing and exports of readymade garments. b. Demand and supply situation of the product – present and projected (source of information) Due to slowdown in the Global Economy, mainly in the EU and USA there has been slackness in the demand and business. The Govt has by various measures like increase in Duty Drawback Rates and decrease in rates of interest in pre and post shipment credits has helped the Garments Exports sector to maintain its competitive edge. With now the Global Economy is looking up, it is expected to further increase & creates fresh demand as India is one of the main producers of high quality cotton garments. The raw material consisting of mill made and a power loom fabric is readily available in Delhi through various traders. The firm is located in the one of the hubs of garments manufacturing in India and hence essential requirements of skilled labour and other value added services like embroidery, dyeing and printing etc. are easily available. The entire requisite infrastructure is also in place. c. Major players & their market share Mr. Mohit Gupta, proprietor has over the years developed products for his own overseas customers, who send their own designs which are to be developed by the Firm under various brand names like ELLYPS, ANJINI, CARLING etc and therefore the firm would enjoy good clientage. As the market for this product is good the scope for increase in sales is immense.

- 12. d. Bank’s exposure in this industry as of Sep. 2009 Rs. 1757.13 lacs e. NPA position as of Sep. 2009 Rs. 239.07 lacs i.e. 15.74% of the aggregate Bank’s exposure. f. Cyclical trends Since the firm will be meeting requirements of manufacturing mainly producing garments made of cotton based fabrics they have more orders for the summer month production and sales of it is mainly from Oct-May. For the winter season the orders are less than summers and hence there is a slight cyclic trend in this business. g. Govt. policies There are specific Govt Policies for boost in this sector like Duty Drawback, etc to boost this industry. Presently with the abolishment of quota system the Govt policies are favourable for exports as this sector is one of the major sources of Foreign Exchange earning for the country. The govt has also reduced the rate of interest on pre and post shipment credit availed through Banks’ by way of Interest Subvention. h. Whether the product is an import substitute, if so, what is the landed cost of import and what is the production cost of the indigenous manufacture No i. Availability of raw materials, labour, infrastructural advantages Easily available.

- 13. j. What are internal & external advantages of the borrower/technology used The proprietor is well experienced in this line of business. The Firm has installed the latest machinery/ infrastructure etc. for execution of orders as per the specification of buyers. The Firm adheres to strict quality control and timely delivery of shipment/ execution of orders. Since the proprietor plans to work with the same customers along with new customers, the firm is assured of repeated orders from them. k. What are the weaknesses The trade is very responsive to price factor as the trade is very competitive from Indian and other Asian Countries viz. China. l. What are the relative opportunities Now with the revival of the Economy there would be fresh & new opportunities for export of readymade garments. m. What are the threats Stiff competition n. Any other information Nil 12. PRODUCTION CAPACITY : Production Capacity Existing Proposed Installed Firm vide Letter dated 14-12-2009 has informed us that a lot of production is done in house as well as from outside on job work basis depending on the needs of the orders. Hence it is difficult to assess production and capacity utilisation Utilised % Utilisation 13. MARKET CAP : N.A. (not a listed Company)

- 14. 14. FINANCIAL INDICATORS : (Rs in lacs) Audited Audited Estimate Projection As on 31.03.2008 31.03.2009 31.03.2010 31.03.2011 XYZ Apparels XYZ Exim XYZ Exim XYZ Exim i. Capital 22.10 15.62 21.17 26.60 ii. Reserves & Surplus 3.55 5.95 7.40 iii. Intangible Assets 0.00 0.00 0.00 0.00 Tangible Net worth 22.10 19.17 27.12 34.00 Net Working Capital 19.79 17.11 19.80 23.90 Current Ratio 1.29 1.41 1.24 1.29 Net Block 18.16 5.85 19.50 18.36 Net Sales 288.28 312.24 360.00 381.50 - of which exports 262.11 287.61 330.00 350.00 PBDIT 20.35 11.76 17.31 20.14 Gross Profit - PBDT 6.49 4.65 8.31 10.64 Net Profit / Loss – PAT 3.12 3.55 5.95 7.40 Depreciation 3.37 1.10 2.36 3.24 Cash Accruals 6.49 4.65 8.31 10.64 PBDIT/ Gross Sales 0.07 0.04 0.05 0.05 Gross Profit Margin 2.25% 1.49% 2.31% 2.79% Net Profit Margin 1.08% 1.14% 1.65% 1.94% TDER (TOL/TNW) 3.14 2.17 3.03 2.40 Interest Coverage Ratio 1.47 1.65 1.92 2.12 Current Assets to Turnover Ratio 5.40 15.84 6.00 6.36 15. Comments on financial indicators, in brief: Other Current Assets : Other Current Assets of Rs 9.38 lacs as of 31.03.09 comprise the following :

- 15. (Rs in lacs) DBK Receivable IGI 8.31 DBK Receivable JNPT 0.64 E.C.G.C. 0.10 VAT 0.33 --------------- Total 9.38 Total Debt Equity Ratio (TDER): The TDER of the Company stood at 2.17 as of 31.03.09, which is under the norms considering Bank’s desirable/benchmark TDER of 4:1 (in case of SSI units). The estimated and projected TDER for the financial year 2009-10 and 2010-11 is found to be 3.03 and 2.40 which is again under the bank’s desirable/benchmark. The same indicates satisfactory long term solvency of the Borrower. Current Ratio : Current Ratio stood at 1.41 as of 31.03.09. The same is above the minimum desirable/benchmark level of 1.10 in terms of Bank’s Loan Policy guidelines. The Current Ratio is estimated at 1.24 as of 31.03.10 and is projected at 1.29 as of 31.03.11, which is above the benchmark level. The same is indicative of satisfactory liquidity position of the borrower. Current Asset to Turnover Ratio: Current Asset to Turnover Ratio is above the desirable level of 1.75.The same is indicative of satisfactory turnover of stocks. I.Positive indicators Sales: Th Net Export Sales projected for the next two years is as under 2009-10---------Rs. 360.00 Lacs

- 16. 2010-11---------Rs. 381.50 Lacs. The Firm projects Export sales of Rs. 360.00 Lacs for the year 2009-10 & Rs. 381.50 Lacs for the FY 2010-11. The Firm has already achieved sales of Rs. 184.01 lacs till 30-11-09 having achievement index 76.67% & have confirmed orders for Rs. 85.87 lacs as on 10.01.2010 to be shipped out by end of January, L/C of which already been received. We have further been informed that they are in final stages of negotiation for further orders of approx. Rs. 50.00 lacs. Thus the Firm is optimistic towards achieving the estimated Turnover. II.Negative indicators, if any, with reasons Unsecured Loans: Borrower has informed that there was an unsecured loan for Rs. 6.32 lacs from Mr. M.C. Gupta, father of the prop. during the FY 2008-09. Unfortunately due to his ill health the same had to be liquidated to him during February- March 2009, consequently the total unsecured loans fell to Rs. 1.29 as on 31.03.2009 as against projections for Rs. 7.50 lacs. At present unsecured loan stood at Rs. 2.66 lacs and Branch to obtain and keep on record an undertaking from the borrower that the same would be continued during the currency of Bank finance. III.Auditor’s remarks and Management replies. Nil as reported by the Branch. IV.Contingent Liabilities: Nil. V.Current performance trends: Rs in lakhs Estimated Net sales turnover for the FY 2009-10 360.00 Achievement till 30.11.2009 184.01 Pro-rata achievement 76.67%

- 17. VI.Comment on current performance trends: The Firm projects Export sales of Rs. 360.00 Lacs for the year 2009-10 & Rs. 381.50 Lacs for the FY 2010-11. The Firm has already achieved sales of Rs. 184.01 lacs till 30-11-09 having achievement index 76.67% & have confirmed orders for Rs. 85.87 lacs as on 10.01.2010 to be shipped out by end of January, L/C of which already been received. We have further been informed that they are in final stages of negotiation for further orders of approx. Rs. 50.00 lacs. Thus the Firm is optimistic towards achieving the estimated Turnover. VII.INTER-FIRM COMPARISON (PEER GROUP) (In case aggregate limit exceeds Rs.5000 lakhs) (Rs in lakhs) Particulars Our borrower Company A Company B Company C Sales N.A. Net Worth Net Profit Borrowing D/E Ratio Current Ratio 16.A. ASSESSMENT OF WORKING CAPITAL REQUIREMENTS : (Rs in lacs) Audited Estimated Projected 31.03.09 31.03.10 31.03.11 Net Sales 312.24 360.00 381.50 1 Total Current Assets 58.73 101.90 105.40 2 Other Current Liabilities (Other than Bank Borrowing and TL installment payable within one year) 20.71 9.40 8.90

- 18. 3 Working Capital Gap (WCG) (1 - 2) 38.02 92.50 96.50 4 Min Stipulated NWC 25% of TCA excluding Export Receivable. 12.50 20.98 21.35 5 Actual/Projected Net WC 17.75 22.50 26.50 6 Item 3 minus 4 25.52 71.52 75.15 7 Item 3 minus 5 20.27 70.00 70.00 8 MPBF (Item 6 or 7 whichever is lower) 20.27 70.00 70.00 9 Excess borrowing 0.00 0.00 0.00 B. INVENTORY AND RECEIVABLE LEVELS: (Rs in lakh) Inventory Audited Projected Estimated Months Value Months Value Months Value 31.03.09 31.03.10 31.03.11 Raw Materials 0.00 0.00 0.00 0.00 0.00 0.00 Work in Progress 0.00 0.00 0.00 0.00 0.00 0.00 Finished Goods 0.83 19.71 2.18 60.00 2.09 60.00 Receivables - Domestic 0.00 0.00 0.00 0.00 0.00 0.00 - Export 0.36 8.72 0.65 18.00 0.69 20.00 Stores & Spares 0.00 0.00 0.00 Creditors 1.43 17.89 0.56 9.00 0.67 8.50 C. TURNOVER METHOD: (Rs. In lacs.) S.No. Last Year Actual Estimates Projections Year Ending 2008-09 2009-10 2010-11 (i) Projected/Accepted Turnover 312.24 360.00 381.50

- 19. (ii) Working Capital Funds @ 25% of (i) 78.06 90.00 95.37 (iii) Of which Bank Finance @20% 62.45 72.00 76.30 (iv) Min. 5% Borrower’s Contribution 15.61 18.00 19.07 (v) Actual/Projected NWC 17.11 19.80 23.90 D. COMMENTS ON ASSESSMENT OF WORKING CAPITAL WITH JUSTIFICATION: The working capital cycle stood at 1.19 months during FY 2008-09 comprising inventory holding of 0.83 months and receivables at 0.36 months’ sales. The borrower has now estimated working capital cycle of 2.83 months during FY 2009-10, comprising inventory holding of 2.18 months and receivables at 0.65 months. Nature of business of the borrower is seasonal considering the fact that most of the garment exports to UK and US for Spring-Summer Season takes place during the period between November to March. Receivables : In Balance Sheet Analysis, receivables have been taken as Rs 8.72 lacs as Rs 102.85 lacs out of them have been excluded since these bills have been negotiated under FLC and accordingly FLC outstanding is also excluded from Bank Borrowings. The Firm exports on L/C-90 days DA/DP basis. Receivables have been estimated at 0.65 months (Rs 18.00 lacs) and projected at 0.69 months (Rs 20.00 lacs), as Rs 50.00 lacs have been excluded from Bank Borrowings towards export bills negotiated under FL/C. The estimated and projected holding of receivables is considered need based and reasonable to achieve the estimated/projected sales turnover.

- 20. Sundry Creditors: The creditors for goods during FY 2008-09 stood at 1.43 months’ purchases (Rs 17.89 lacs) which is estimated at 0.56 months’ (Rs 9.00 lacs) during FY 2009-10. The main reason for low creditors’ level during FY 2009-10 is as under : The Firm has represented that they had received certain goods during the last week of March’09 for their suppliers, which were under checking as on the Audited date (31.03.09) and hence remained unpaid as on that date. The same was paid during 1st week of April out of available PCH limit. The creditors’ level is projected at 0.67 months (Rs 8.50 lacs) during FY 2010-11, which is almost in line with the creditors’ holding level during FY 2009-10. In view of the above, the estimated and projected creditors’ holding period is considered need based and reasonable. Based on the accepted level of holding and receivables, the working capital limit works out to Rs 70.00 lacs under Modified MPBF Method during FY 2009-10 and FY 2010-11. However, the Drawing Power, as of 31.03.10, based on the accepted holding levels as above, works out as under: Particulars Amount (Rs in lacs) Margin Drawing Power (Rs in lacs) 2009-10 2010-11 10.00% 2009- 10 2010-11 Stocks 60.00 60.00 45.90 46.35Less: Sundry Creditors 9.00 8.50 Paid Stock 51.00 51.50 Receivable 18.00 20.00 10.00% 16.20 18.00 Total 62.10 64.35 Say 62.00 Say 65.00

- 21. The D.P. works out to Rs 62.00 lacs during FY 2009-10 and Rs 65.00 lacs during FY 2010- 11. Since only around tow and half months is left before the end of the current financial year, the limits, based on the accepted projections of FY 2010-11 works out to Rs 65.00 lacs. Accordingly and in line with the Branch recommendation, we recommend for enhancement in working capital limits by way of PCH-cum-FBP limit from Rs 55.00 lacs to Rs 65.00 lacs. However, the operative limit would be capped at Rs. 62.00 lacs during FY 2009-10. The full limits i.e. upto Rs. 65.00 lacs may be released only during FY 2010-11, subject to availability of D.P. Renewal of Negotiation of Bills under L/C Limit : The borrower is presently enjoying Bills Negotiation (under L/C) limit of Rs 50.00 lacs, outside the overall MPBF, which it has requested for continuation. The borrower utilizes PC limits basically for stocking purpose, which is evident from the month-wise position of stocks is as under : Date of Stock Statement Total (Rs in lacs) 31.07.08 26.88 31.08.08 57.22 30.09.08 75.53 31.10.08 93.84 30.11.08 109.12 31.12.08 92.85 31.01.09 102.25 28.02.09 75.60 31.03.09 19.17 30.04.09 90.67 31.05.09 80.25 30.06.09 65.20 31.07.09 51.78 31.08.09 62.40 30.09.09 63.75

- 22. 31.10.09 66.44 30.11.09 90.25 In view of the above, the borrower is unable to utilize the FBP limit. The borrower requires separate Bills Negotiation Limit for negotiation of the Bills under L/C, which is outside overall MPBF. The overall record has been satisfactory and no bills have been returned unpaid. Accordingly, Branch has recommended for renewal of the Bills Negotiation under L/C limit of Rs 50.00 lacs and we endorse the Branch recommendation. 17. ASSESSMENT OF TERM LOAN/ DEFERRED PAYMENT GUARANTEE: N.A. 18. ASSESSMENT OF NON-FUND BASED LIMITS A. LETTER OF CREDIT (Rs in lakh) For purchase of raw materials/stocks N.A. Average time taken from date of L/C till the date of shipment (Days) Average time taken from date of shipment to the date of retirement of the bill (Days) (A) Average rotation of letter of credit in one year (360/A) (times B) Projected Purchase Level of L/C limit = {Projected Purchase/Import during the year}/B Say Our share Whether as per Cash Flow statement there will be adequate cash accruals to retire the bills under L/C on first presentation/due dates.

- 23. Names of the Suppliers/beneficiaries in whose favour L/Cs to be opened Whether credit reports on the suppliers obtained from bankers/outside agencies (especially in case of DA L/Cs) B. BANK GUARANTEE : N.A. 1. Views/comments on the conduct of the account A. Comments on utilisation of both fund and Non fund based limits Whether stock statements are submitted every month. If not submitted regularly mention the date of last stock statement Yes, 30.11.2009 Whether operations are within sanctioned limits Yes Whether limits are utilised optimally /satisfactorily Yes Frequency of inspection of stocks. Date of the last inspection and irregularity/adverse features, if any observed and steps taken to set right the same. 30.10.2009, by Sr. Manager. No major/adverse observations. Insurance cover - Whether securities adequately insured and in force Yes All Policies are obtained directly by the Branch from Oriental Insurance Co. Ltd. Whether terms and conditions of previous sanction have been complied with, if not, specify time frame to complete (with explanation) & permission obtained from competent authority Yes

- 24. Whether certificate from Pollution control Board has been obtained. Branch has reported that the Firm falls in category F of PC Band hence certificate is not applicable. Whether the borrower is facing any litigation from banks /FIs/creditors/ Govt. Deptt./ Statutory bodies etc., if so, state in brief. None In case of consortium advance, whether our bank is getting proportionate share of business N.A. Additional / temporary limits sanctioned subsequent to the last regular sanction and whether same is liquidated on due date or not Additional FBNLC limit of Rs. 100.00 lacs sanctioned by DGM,NDR on 02.02.2009 and liquidated on time. Outstanding amount of unhedged Foreign Currency Exposures FC INR Rs in Lakhs Particulars 31.03.2009 31.11.2009 Sales – Actual 312.24 184.01 Purchases 150.46 94.14 Credit Summation 247.72 180.13 Debit Summation 258.09 223.02 Minimum Balance 0.01 14.26 Maximum Balance 57.97 57.98 LC Devolved - Number N.A. N.A.

- 25. Amount Guarantee Invoked: Number Amount N.A. N.A. Whether sales and purchase figures match with the turnover in the account Satisfactory. B. Income value of account (Rs. in Lakh) Last year 08-09 Current year 09-10 Value of account (Deposits) Process Fee recovered 0.28 0.26 Interest earned 6.67 3.29 Exchange income Commission earned Income from Third party products / insurance Others (Lead Bank Fee, Commitment fee, Penal Interest, Syndication fee) Total Turnover in Foreign Exchange Business 179.00 219.00 Deposits placed (Owner Directors/ partners or Family Members, Relatives & Friends) - Current 0.40 0.50 - Savings 1.50 1.50 - Term Deposits 20.00 20.00 a. Adverse features affecting credit decision and action proposed (including non- compliance to terms and conditions of sanction and present position) Sr Pending Matters Present position Steps taken / Remarks

- 26. No N.A. b. MAJOR INSPECTION / AUDIT IRREGULARITIES POINTED OUT IN THE LAST INSPECTION REPORT Brief details of irregularities reported Compliance Status 1 Internal Inspectors Nil as reported by Branch. 2 RBI-AFI Inspectors (i)Credit Rating 2008-09 not on record. (ii)Audited Balance Sheet 08- 09 not on record. Credit Rating carried out as per B/S 31.03.2009. Audited B/S obtained and kept on record. 3 Statutory Auditors Nil as reported by Branch. 4 Stock Auditors 5 Credit Auditor c. Directors’ name figuring in RBI/ Wilful Defaulters’ / CIBIL / SAL – ECGC list and comments thereon. Impact on taking exposure where names are appearing in the defaulters list: Nil d. Position of statutory dues and incentives receivables Provident Fund, ESI and Superannuation contribution paid upto N.A. Wages and salaries paid upto 31.10.2009 Sales Tax paid upto N.A. Service Tax paid upto N.A. Income Tax Assessment completed upto and for the year ending # N.A. Advance Tax paid for the year ending 2010

- 27. Excise duty paid upto N.A. Municipal Tax, Octroi etc. N.A. Incentives from the Government and other agencies N.A. Disputes not acknowledged as debts N.A. Contingent Liabilities (Likely to turn into Liabilities) N.A. Reconciliation of Debtors/ creditors *Before release of enhanced limit Branch to obtain C.A. certificate and ensure that the borrower has paid all its’ Statutory Dues upto date. e. Group dealings/experience & desirability of further exposure: N.A. f. RISK ASSESSMENT Risk Risk Factor Risk Mitigation Industry/Activity Risk Fluctuations in the Forex market. The Firm hedges by Forward Contract. 20. COMPLIANCE OF RBI / BANK LOAN POLICY GUIDELINES : The Proposal is as per RBI/ Bank’s Loan Policy Guidelines. 21. MODIFICATION IN EXISTING TERMS OF SANCTION IF ANY: N.A. 22. VIEWS/RECOMMENDATIONS OF THE CREDIT COMMITTEE: In terms of HO circular No.DCC/GM-Cr/CAD/1249/08 dated 02.06.08, a meeting of the Credit Committee was held on 07.01.10 at Regional Office, New Delhi.

- 28. The Committee cleared the proposal and suggested as under : i. As per the estimates in CMA data submitted by the Borrower the D.P. stood at the level of Rs. 62.10 lacs during FY2009-10 and Rs.64.30 thereafter. Accordingly the operative limit can be capped at Rs. 62.00 lacs during FY 2009-10. The full limits i.e. upto Rs. 65.00 lacs may be released during FY 2010-11 subject to the availability of the Drawing Power. ii. It is also being observed that at the time of last sanction/renewal Capital was estimated at the level of Rs. 22.50 lacs for FY 2008-09, whereas as per the Audited B/S of 31.03.2009 Capital stood at the level of Rs. 19.17 lacs. Therefore it is being stipulated that the Firm has to introduce fresh Capital or Unsecured Loan of Rs. 3.00 lacs before release of the enhanced limits. 23. DISCRETIONARY POWER FOR SANCTION AND FOR APPROVAL OF DEVIATION, IF ANY: The credit proposal falls within the overall discretionary powers of Asst. Gen. Manager- NDR. 24. RECOMMENDATION: It is an Export Credit Account falling under SME sector. Though the Firm was established in April 2008, however the Proprietor, Sh. Mohit Gupta is associated with the Bank since 1999 by virtue of being a Partner in M/s xyz Apparels Inc. Overall conduct of the a/c is Satisfactory, as reported by the Branch. One Time Additional FBNLC limit of Rs. 100.00 lacs sanctioned by DGM, NDR on 02.02.2009 and liquidated on time.

- 29. The family members of the Proprietor are maintaining substantial deposit in the Branch.(O/s as on Nov. 2009 Current A/c 0.50 lacs, Saving A/c 1.50 lacs, Term Deposits 20.00 lacs). Though the borrower has not offered any fresh collateral, however, extension of Equitable Mortgage over the existing property would result in the coverage of 527.99%, which is satisfactory. Overall financial indicators of the borrower are satisfactory as per Bank’s Policy Norms. Branch has recommended the proposal, as requested by the borrower. In view of the foregoing and based on Branch recommendation, we recommend following subject to the terms and conditions enclosed as per Annexure II Release of the limits would be as under : i. The operative limit can be capped at Rs. 62.00 lacs during FY 2009-10. The full limits i.e. upto Rs. 65.00 lacs may be released during FY 2010-11 subject to the availability of the Drawing Power. ii. It is also being observed that at the time of last sanction/renewal Capital was estimated at the level of Rs. 22.50 lacs for FY 2008-09, whereas as per the Audited B/S of 31.03.2009 Capital stood at the level of Rs. 19.17 lacs. Therefore it is being stipulated that the Firm has to introduce fresh Capital or Unsecured Loan of Rs. 3.00 lacs before release of the enhanced limits. Put up for approval. Deepika Kansal J.D. Sinha Devi Singh Chhonkar Officer (SME) Sr. Manager (SME) Chief Manager-Credit

- 30. Annexure 1 FOR EXISTING BORROWERS AND NEW BORROWERS FOR EXISTING UNITS. FOR FUND BASED LIMITS ABOVE RS.10.00 LACS CREDIT RATING REPORT Branch and Region Okhla Borrower M/s XYZ Exim Sanctioning Authority Asst. General Manager Date of Sanction / Renewal Renewal-cum-enhancement Credit Rating as on 26.12.2009 Analysis for Credit Rating done based on the Audited / Unaudited Balance Sheet and Profit and Loss A/c of the borrower for the period ending Audited Balance Sheet as of 31.03.09 Credit facility enjoyed Nature of Arrangement Sanctioned limit (Rs in lacs) Outstanding as on 10.01.2010 i. Fund Based 115.00 78.15 ii. Non Fund Based 0.00 0.00 TOTAL ( i + ii ) 115.00 78.15 Marks secured Credit Risk Grade Interest Slab

- 31. Rating 95%+ AAA High - Prime BPLR 90% - 94% AA Medium - Prime BPLR + 0.25 85% - 89% A Low - Prime BPLR + 0.50 80% - 84% BBB Excellent BPLR + 0.75 75% - 79% BB Best BPLR + 1.00 70% - 74% B Better BPLR + 1.25 65% - 69% C Very Good BPLR + 1.50 60% - 64% D Good BPLR + 1.75 55% - 59% E Satisfactory BPLR + 2.00 Non-Performing Assets NPA – SS Sub-standard Interest to be calculated at agreed rates but not to be charged NPA - D1 Doubtful - 1 NPA - D2 Doubtful - 2 NPA - D3 Doubtful - 3 NPA - Loss Loss Asst. General Manager

- 32. SUMMARY SHEET OF CREDIT RATING MODEL FOR EXISTING BORROWERS AND NEW BORROWERS FOR EXISTING UNITS FOR FUND BASED LIMITS ABOVE RS.10.00 LACS Parameters / Risk factors to be rated for existing projects /units Maximum score Max.score Applicable parameter Score allotted 1 External risk /Gov. Policy Risk/ Environmental risk 5 5 3 2 Industry / Business / Sector risk 20 20 11 3 Management Risk 15 15 13 4 Security (Collateral) 5 5 5 5 Income value to the Bank 5 5 3 6 Past Operating performance vis-a-vis projections and financial position represented by ratios/trends 40 37 33 7 Conduct of the Account 10 8 8 TOTAL MARKS 100 95 76 % age of Marks Scored 77.55% SUMMARY SHEET OF CREDIT RATING MODEL FOR EXISTING BORROWERS AND NEW BORROWERS FOR EXISTING UNITS FOR FUND BASED LIMITS ABOVE RS.10.00 LACS Parameters / Risk factors to be rated for existing projects /units Maximum score Max. score Score allotted

- 33. Applicable parameter 1 External risk /Gov. Policy Risk/ Environmental risk 5 5 3 2 Industry / Business / Sector risk 2.1 Intensiveness of Competition 2 2 1 2.2 Presence of substitute etc. 2 2 1 2.3 Barriers to entry for new players 1 1 0 2.4 Business returns 3 3 0 2.5 Cyclicality in earnings, subject to vagaries of nature technological obsolescence 2 2 1 2.6 Technology adopted by Borrower 3 3 2 2.7 Dependence on a few suppliers for raw material 1 1 1 2.8 Borrower’s dependence on a few customers 1 1 1 2.9 Foreign exchange component of total business 1 1 1 2.10 Whether borrower dealing in perishable commodity 1 1 1 2.11 Demand/supply gap in the business 3 3 2 Total 20 20 11 3 Management Risk 3.1 Ownership pattern 2 2 0 3.2 Past track record of the Management: - a. Sales 1 1 1 b. Financial Discipline 1 1 1 c. Furnishing Information 1 1 1

- 34. 3.3 Quality of the management personnel 1 1 1 3.4 Experience of the Management 2 2 2 3.5 Payment record with banks 2 2 2 3.6 Financial conservatism 1 1 1 3.6 Market standing / credibility 2 2 2 3.7 Support from Group Companies 1 1 1 3.8 Succession risk/plan 1 1 1 Total 15 15 13 4 Security (Collateral) 5 5 5 5 Income value to the Bank 5 5 3 6 Past Operating performance vis-a-vis projections and financial position represented by ratios/trends 6.1 Achievements of borrower’s projections of sales / gross receipts 5 5 5 6.2 Current Ratio 5 5 5 6.3 Trend analysis - variation in Current ratio 1 1 1 6.4 Interest Coverage ratio 5 5 3 6.5 Current Asset to Turnover Ratio 3 3 3 6.6 Debt Equity Ratio 5 5 5 6.7 Trend analysis - variation in Debt Equity ratio 2 2 0 6.8 Achievement of Profit Projections 3 3 2 6.9 Profitability to Net worth (Net Profit/Net worth) i.e. Return on Net Worth 2 2 2 6.1 Profitability to sales (Net profit/sales) 2 2 0 6.11 Contingent Liabilities of the Borrower (Total contingent liabilities to Tangible net worth) 2 2 2 6.12 Qualifications in Audit Report of the 1 1 1

- 35. borrower’s Balance Sheet and Profit & Loss A/c. 6.13 Diversion of funds - No diversion 2 2 2 6.14 Guarantee to Group Companies 1 1 1 6.15 Investment in Group Companies 1 1 1 Total 40 40 33 7 Conduct of the Account 7.1 Timely submission of stock and/or Book debts statement 1 1 1 7.2 Compliance with terms and conditions of sanction 2 2 2 7.3 Timely renewal/review of the account 2 2 2 7.4 Regularity/irregularity of Term Loan A/c. 1 0 0 7.5 Regularity / irregularity of the working capital facilities 2 2 2 7.6 Submission of FFR-I & FFR-II 1 0 0 7.7 Conduct of the Group Account, if any 1 1 1 10 8 8 TOTAL MARKS 100 98 76 % age of Marks Scored 77.55% Annexure II Detailed Terms & Conditions RO/NDR/SME/24/10 12.01.2010 Borrower’s Name : M/s XYZ Exim BRANCH : Okhla Nature of Arrangement : PCH-cum-FBP

- 36. Sanctioned Limit : Rs.65.00 lakhs (Rs. Sixty Five lacs only.) Margin : 10% for PCH Rate of Interest : As per Ho guidelines (Subject to change as per RBI Directives or bank's policy from time to time) TERMS AND CONDITIONS (For PCH) Security : a. Hypothecation of stocks of raw materials, semi-finished goods and finished goods such as fabric, ready-made garments etc, manufactured by the unit for export purpose etc. b. The advance under pre-shipment credit to be covered under Whole Turnover Packing Credit Guarantee of ECGC granted to the Bank as a whole and monthly premium to be recovered from the borrower wherever applicable and remitted to the respective Regional/ Branch Office of ECGC. 2. Other Terms and Conditions a. Lodgment of original irrevocable Letter of Credit/firm contract with the Branch and our rubber stamp to be affixed on it. L/C should not be restricted to other bank. b. The goods to be fully insured against fire, theft, burglary, pilferage, earthquake, flood, SRCC with Bank clause Place of storage is to be mentioned in the Insurance Policy. Transit Risk Policy to be obtained if goods are to be transported to a different centre for shipment. c. Pre-shipment advance to be liquidated within specified period by negotiation/

- 37. purchase/discounting of export bills. d. The borrower shall submit packing credit hypothecation stock statement every month so that periodical inspection can be carried out by the bank. e. Where the goods are given for processing "No Lien Letter" to be obtained from the processors. Insurance policy including transit risk to cover stocks sent to 3rd party for processing be obtained. g. Packing credit for shipment to buyers in the countries placed under Restricted cover by ECGC to be disbursed only with the prior permission from ECGC. h. Preshipment advance will be treated as Cash Credit advance if the export does not take place at all. Penal rate to be charged as per RBI/HO circulars issued from time to time, i. Packing credit to be allowed for a period not exceeding 180 days or till such date shipping documents are tendered in compliance of terms of L/C order, whichever is earlier. Due date diary to be maintained to monitor timely submission of documents. Extension beyond 180 days but upto 360 days can be permitted by concerned General Manager after satisfying about the need for the same. In exceptional cases extension of shipment beyond 360 days can be permitted after obtaining approval from ECGC. j. The advance will be disbursed in phases depending upon cycle of production/procurement period and delivery schedule. Application to be obtained from the exporter client stating FOB value of the goods which will be initially financed. Freight & insurance premium amount would be disbursed at the time of shipment. k. Bank’s name plate stating "GOODS HYPOTHECATED TO DENA BANK, OKHLA BRANCH’ should be prominently displayed where goods are stored. l. No Packing Credit to be disbursed against the goods received under DA Letter of Credit. m. Packing credit advances are to be liquidated only from the proceeds of foreign bill purchased/discounted/negotiated. Repayment of packing credit advance from local funds shall attract interest at commercial rate prevailing at the time. q. In case of failure by the borrower in complying with the terms and conditions

- 38. as stipulated above, advance may attract charging of interest at commercial rates.” Standard terms and conditions for Foreign Bills Purchase/ discounted (DA/DP) (under L/C / confirmed order) 1. Security : a. Export Bills with a maximum tenor of 180 days drawn on overseas buyers accompanied by shipping documents like complete set of Bill of Lading / Consignee copy of Airway Bill, Invoice, Drafts and other documents evidencing the shipment of goods manufactured by the unit. b. The party should obtain a comprehensive policy of ECGC (shipment and contract). Monthly shipment made under the above policy to be declared to ECGC every month. 2. Other Terms and Conditions a. Advances to be covered under whole turnover post shipment guarantee of ECGC taken by the Bank and monthly premium thereon will be paid by the concerned branch to respective Regional/Branch office of ECGC. [Premium to be paid by Branch where Exporter is maintaining the account.] b. In case of Bills drawn under firm contract/order drawing should be allowed to the extent of credit limit approved for each buyer by ECGC. c. In case of bills negotiated under letter of credit, all documents as per terms of L/C must be submitted at the time of negotiation of bills. Export bills should be drawn strictly in conformity with LC terms. d. Branch to ensure that documents tendered are clean. In case of discrepancies and if the amount received is under reserve, it be held in margin/reserve and may be released only against the guarantee signed by the firm and the proprietor in his personal capacity. . f. ECGC to be informed of the limits sanctioned by the Bank within 30 days of sanction. g. Proceeds of the Foreign Bills Purchased/Discounted/negotiated to be credited

- 39. to Packing Credit account if any Packing Credit has been disbursed against the goods exported under such bills. h. In case export proceeds are not received as per tenor, penal rate of interest as per HO circular to be charged. NOTE: while advising the terms of sanction to the borrower please incorporate the details of penal rates. Forward Contract Limit – Rs.200 lac OTHER GENERAL TERMS AND CONDITIONS 1. The prescribed documents to be executed by the Firm and Proprietor, Sh. Mohit Gupta, in his personal capacity. 2. The advance to be guaranteed by Shri Mahesh Chand Gupta & Smt. Shashi Khandelwal and Sh. Vikas Gupta. 3.All the assets charged to the Bank to be fully insured against fire, SRCC, fIood, breakdown of machinery with bank clause. 4. The unit to submit stock statement every month latest by 15th of the next month. 5. The advance is restricted to manufacturing activities. 6. Interest rates are subject to revision as per RBI/HO guidelines or as decided by consortium. 7. Branch to ensure that there are no inter-firm transfer of funds except for genuine sales transactions. 8. Bank will have a right to examine all the times Firm's (borrowers) books of ac- counts, assets etc. and have the Firms workings and operations examined from time to time by the officers of the Bank or technical experts and/or management consultants and/or C.A and fees to be borne by the Firm 9. Bank may charge penal rate of interest over and above the rate applicable under the following circumstances:- a. delay in submission of stock statement.

- 40. b. delay in submission of renewal papers. 10. Guidelines issued by HO/RO from time to time are to be strictly adhered to. 11. The Borrower be informed of the terms and conditions of sanction and the confirmation be obtained to the effect thereof in writing. 12. Date of reconsideration - One year after sanction. 13. In case of Credit Limit of Rs. 25 lakhs and above there will be mandatory audit of annual accounts by Chartered Accounts and the audited accounts of the borrower should be furnished to the Bank latest by 31st October of each year with reference to the position as at 31st march of the same year. 14. Process / Upfront Fee @ 0.25% of the sanctioned limit for Working Capital limit to be charged at applicable rate p.a. plus applicable service tax. 15. Party to pay Supervision Charges @ 0.05% plus Service Tax, subject to maximum of s 50000/- per quarter. 16. There will be mandatory audit of annual accounts by Chartered Accounts and the audited accounts of the borrower should be furnished to the Bank latest by 31st October of each year with reference to the position as at 31st march of the same year. 17. Stock audit may be conducted if bank so desires. The charges for the audit to be borne by the borrower. Reports will be obtained and examined and necessary action will be taken as may be decided by the Bank. 18. Plant and Machinery, equipments, furniture and fixtures to be taken as additional security to cover both the fund based and non-fund based limits. 19. The Borrower to give an undertaking that they are not a defaulter to any Bank / Financial Institution and has not any relation with any Director of the Bank. 20. Bank reserves the right to modify /alter terms and conditions of sanction and cancel the limit at any time without assigning the reason 21. The borrower shall undertake that in case of project cost over-run, it shall arrange funds from its’ own sources to meet the shortfall.

- 41. 22. Date of reconsideration – one year after sanction. The borrower to submit the review/renewal papers 2 months before the due date of sanction/approval. 23. The Borrower be informed of the terms and conditions of sanction and the confirmation be obtained to the effect thereof in writing. 24. Branch to obtain an undertaking from the borrower that it would maintain its’ Capital/ Net Worth as per CMA projections. 25. The documents to be vetted by Advocate on Bank’s Panel (at the borrower’s cost) to ensure that the documents are as per terms of sanction, valid and enforceable. A copy of the Vetting Certificate should be kept on Branch record. 26. As per HO circular No.346/42/99 dated 22.11.1999 the following clause should be incorporated in the sanction letter addressed to the borrower: “ In case you commit default in repayment of the CC/Loan/Overdraft facilities/additional interest or any other dues that may arise out of the loan amount /financial assistance, the bank reserves the right to disclose or publish the names of the directors of the company as defaulters, in such a manner and through such media as the Bank/RBI in their absolute discretion may think fit.” 27. As per HO circular No.346/42/99 dated 22.11.1999, 54/1/2004 dt.22/5/2004, consent letter to be obtained from the borrower for disclosing or publishing their names in the event of borrower becoming defaulters. The said clause should be incorporated as last clause of the respective document: “ I/We hereby agree as pre-condition of the loan/advance( fund based and non-fund based ) given to me/us by the Bank that in case I/We commit default in the repayment of loan/advance or in the repayment of interest thereon or any of the agreed installment of the loan on due dates the Bank and/or RBI will have an unqualified right to disclose or publish my/our name or the name of the company/firm/unit and it’s directors/partners/proprietor as defaulter in such manner and through such media as the bank or RBI in their absolute discretion may think fit.” 28. Declaration about no pending court cases (as per H.O. circular no. 351/02/2003) to be obtained and kept on Branch records.

- 42. 29. An undertaking to be obtained from the borrower, that the Directors/Guarantors are not, in any way, connected with any senior official (Scale-IV and above) of the Bank. 30. Commitment Charges: The utilization of limit should be made within 3 to 6 months of date of communication of sanction to the party for working capital. If average utilization is less than 75% in case of working capital facilities, commitment charges will be levied @ 0.50% p.a. at quarterly rests on the sanctioned amount. 31. Further an undertaking is to be obtained from the borrower that it will not effect any change in neither management nor declare/pay dividend nor encumber any of the securities charged to the Bank, without the express consent of the Bank. 32. Branch to submit certificate of compliance of terms and conditions, as per prescribed format, to Regional Office. 33. General Undertaking as per H.O. Circular No. 54/1/2004 dated 22.05.04 to be submitted by the borrower. 34. Branch Official should visit the site/property offered as collateral and cross-check its’ Valuation/Title/Marketability etc. through discrete / market enquiries and ensure that the valuation done by the valuer is justified. Significant divergence observed, if any, vis-à-vis Reports submitted by Bank’s Approved Valuer and Panel Advocate should be immediately brought to the notice of the sanctioning authority. 35. All legal expenses/other expenses including incidental charges to be incurred during the course of operation in the account and for completion of documentation formalities will be borne by the borrower 36. Declaration to the effect that no court cases are pending against the company, its directors and the group concerns (as per H.O. circular no. 351/02/2003) to be obtained and kept on Branch record. 37. Compliance of terms and conditions should be sent to RO in terms of H.O. circular no.253/41/2002 dated 30.11.2002. 38. The borrower to furnish an undertaking that, where it transpires that the borrower has given a false declaration, the Bank shall forthwith recall the loan.

- 43. 39. The Company to submit full details of all the items of Statutory Dues along with CA Certificate of latest date and Branch to ensure that there are no over dues. 40. Consent clause to be submitted by the borrower & guarantor permitting the Bank for submission of credit information to Credit Information Bureau (India) Ltd. 41. The Branch to ensure that all the suggestions as suggested by the advocate in Non Encumbrance Report / Legal Search Report ought to be complied before disbursement. The Branch Head should personally ensure that if the proposed mortgagor acquired the title from Government then Non Encumbrance Report / Legal Search Report should be at least 30 years and if the proposed mortgagor acquired the title from sources other than the Government then Non Encumbrance Report / Legal Search Report should be at least 13 years. The Branch also obtains all the documents (chain of documents) in original which are mentioned in the Non Encumbrance Report / Legal Search Report. 42. If the last documents of the mortgaged property is Lease Deed / Perpetual Lease Deed then the Branch Manager personally go through the Lease Deed / Perpetual Lease Deed and before creating mortgage obtain the stipulated permission from the lessor and if there is any redemption clause (in case of sale of the property the lessor have the first right in some percentage of the difference between the premium value and market / sale value) in the Lease Deed / Perpetual Lease Deed, then valuation of the property should be computed according to redemption clause. Nature of Security Type of Charge Value Basis / Source Whether eligible under CRM (Basel II Norms)

- 44. The said property is also mortgaged to the Bank for Mortgage Loan of Rs. 10.85 Lacs sanctioned to Sh.. Mahesh C. Gupta, Smt. Shashi Khandelwal, Sh. Vikas Gupta, Sh. Mohit Gupta –O/S as on 10.01.2010 being Rs. 7.95 Lacs and Machinery Term Loan sanctioned to M/s xyz Apparels Inc-O/S as on 10.01.2010 being Rs. 5.89 Lacs. The conduct of the aforesaid accounts are satisfactory as reported by the Branch and both the accounts are classified as Standard. Residential property belonging to Mr. M.C. Gupta situated at 15B Friends Colony (West), New Delhi-65, comprising of 418 sq. yards having construction on Ground, First and Second Floor. Equitable Mortgage 680.26** Valuation Report by Banks’ Panel Advocate Shri K.C. Talwar, as on 20.02.08. As per Legal Opinion-cum- Non-Encumbrance Certificate by our Panel Advocate, Shri Kalim Ur Rehman dated 08-07-08, the subject property bears clear title and is marketable. No Total Collateral Security (considering Realisable Value of property) is Rs 680.26 lacs

- 45. SPECIAL CONDITIONS ON CASE TO CASE BASIS 1. Plant and Machinery, equipments, furniture and fixtures to be taken as additional security to cover both the fund based and non-fund based limits. 2. C.A. certificate confirming Net Worth of the Proprietor and Guarantors to be obtained by the Branch before release of enhanced limit and Branch to ensure that the same is in accordance with Net Worth as mentioned in the Process Note. 3. With a view to ease the liquidity position, we propose a stipulation that the borrower should liquidate the OD facility before release of enhanced limits. 4. The Operative Limit can be capped at Rs. 62.00 lacs during FY 2009-10. The full limits i.e. upto Rs. 65.00 lacs may be released during FY 2010-11 subject to the availability of the Drawing Power. 5. It is also being observed that at the time of last sanction/renewal Capital was estimated at the level of Rs. 22.50 lacs for FY 2008-09, whereas as per the Audited B/S of 31.03.2009 Capital stood at the level of Rs. 19.17 lacs. Therefore it is being stipulated that the Firm has to introduce fresh Capital or Unsecured Loan of Rs.3.00 lacs before release of the enhanced limits. Deepika Kansal J.D. Sinha Devi Singh Chhokar Officer (SME) Sr. Manager (SME) Chief Manager Date: Date: Date:

- 46. Annexure 3 FINANCIAL INDICATORS (Rs in lacs) Audited Audited Estimates Projection As on 31.03.2008 31.03.2009 31.03.2010 31.03.2011 XYZ Apparels XYZ Exim XYZ Exim XYZ Exim A. CURRENT LIABILITIES i. Bank Borrowings 46.01 20.27 70.00 70.00 iii. Term Loan installments due within one year. 1.00 0.64 2.70 2.60 iii. Deposits/Unsecured loans iv. Sundry Creditors 22.36 17.89 9.00 8.50 v. Provision 0.00 0.00 0.00 0.00 vi. Other current liabilities 0.00 2.82 0.40 0.40 Total (A) 69.37 41.62 82.10 81.50 B. TERM LIABILITIES a) Term Loan 7.51 3.50 10.80 8.20 b) Unsecured Loan 11.99 1.29 2.38 1.06 Other Term Liabilities 0.00 0.00 0.00 0.00 Total Term Liability 19.50 4.79 13.18 9.26 C. NET WORTH i. Capital 22.10 15.62 21.17 26.60 ii. Reserves & Surplus 3.55 5.95 7.40 Total (I + ii) 22.10 19.17 27.12 34.00

- 47. Total (C) 22.10 19.17 27.12 34.00 Revaluation Reserve 0.00 0.00 0.00 0.00 Net worth Excluding Revaluation Reserve 22.10 19.17 27.12 34.00 D. TOTAL LIABILITIES 110.97 65.58 122.40 124.76 (A+B+C) E. CURRENT ASSETS i. Cash & Bank Balance 3.01 19.34 17.30 17.40 ii. Receivables – Domestic - Export 17.60 8.72 18.00 20.00 iii. Inventory 53.41 19.71 60.00 60.00 iv. Loans & Advances 3.71 1.58 0.00 0.00 v. Other current asset 11.43 9.38 6.60 8.00 Total (E) 89.16 58.73 101.90 105.40 F. NET FIXED ASSETS (Excluding Revaluation Reserve) 18.16 5.85 19.50 18.36 G. ADVANCES/ INVESTMENT IN SUBSIDIARY/ ASSOCIATE CONCERNS 0.00 0.00 0.00 0.00 H. OTHER NON CURRENT ASSETS 3.65 1.00 1.00 1.00 I. TOTAL ASSETS (E+F+G+H+I) 110.97 65.58 122.40 124.76 J. FINANCIAL PERFORMANCE

- 48. i. Gross Sales Domestic 0.00 0.00 0.00 Export 262.11 287.61 330.00 350.00 Duty Drawback 26.17 24.63 30.00 31.50 Less: Excise Duty 0.00 0.00 0.00 0.00 Net Sales 288.28 312.24 360.00 381.50 Growth (%) 8.31% 15.30% 5.97% ii. Gross Profit 6.49 4.65 8.31 10.64 iii. Depreciation 3.37 1.10 2.36 3.24 iv. Taxation 0.00 0.00 0.00 0.00 v. Net Profit 3.12 3.55 5.95 7.40 vi. Dividend 0.00 0.00 0.00 0.00 - Amount - Percentage vii. Profit retained in business 3.12 3.55 5.95 7.40 ix. Interest 13.86 7.11 9.00 9.50 x. PBDIT 20.35 11.76 17.31 20.14 K. RATIO ANALYSIS i. Current Ratio 1.29 1.41 1.24 1.29 ii. Total Debt/Equity 3.14 2.17 3.03 2.40 iii. Gross Profit/Sales 2.25% 1.49% 2.31% 2.79% iv. Net Profit/Sales 1.08% 1.14% 1.65% 1.94% v. Debtors/Sales 0.73 0.34 0.60 0.63 vi. Creditors/Purchase 2.36 1.43 0.56 0.67 vii. Interest Coverage Ratio 1.47 1.65 1.92 2.12 viii. Current Assets to Turnover Ratio 5.40 15.84 6.00 6.36 Annexure 4

- 49. DETAILS OF CONSORTIUM / MULTIPLE BANKING ARRANGEMENTS (Rs. in lakh) Particulars % Share EXISTING PROPOSED FB NFB FB NFB Our Bank NilOther Member Banks Total (Details as per Annexure) Annexure 5 Limits enjoyed by Associate / Group concerns: (Rs. In lakh) A. With our bank Name Branch Details of limits Last sanction Ass et Cla ssi- fica tion FBWC TL as of 10.01.10 NFB Date Authority Mortgage Loan of Rs. 10.85 lacs sanctioned in Sep.05 to Sh. Mahesh C Gupta,(Borrower) Smt. Shashi Khandelwal, Sh. Vikas Gupta, Sh. Okhla 7.95 11.07.08 DRM (NDR) Stan dard

- 50. Mohit Gupta (Co Borrowers) Machinery Term Loan Sanctioned to M/s xyz Apparels Inc Okhla 5.89 11.07.08 DRM (NDR) Stan dard (Rs. In lakh) B. With other bank/FIs/others Name Bank/FIs /Others Details of limits Outstanding Asset Classi- fication FBWC TL NFB FBWC TL NFB Nil Annexure 6 Profile of the group concerns with brief financial indicators The Firm is having a sister concern under the name and style of M/s xyz Apparels. A machinery Term Loan is still operational having current O/s as of 10.01.2010 being Rs. 5.89. The Account is classified as Standard. Gist of Financial Indicators of M/s Central Agencies (Rs. In lacs.) S.No. Particulars As per Audited B/S of 31.03.2009 1. Net Sales 144.19 2. Gross Profit 6.41 3. Net Profit 0.93

- 51. 4. Capital 5.34 5. Net Worth 5.34 6. Net Fixed Assets 15.43 Annexure 7 Details of properties/assets etc. Under collateral security viz. Valuer, valuation date, encumbrance & marketability status etc. Nature of Security Type of Charge Value Basis / Source Whether eligible under CRM (Basel II Norms) Residential property belonging to Mr. M.C. Gupta situated at 15B Friends Colony (West), New Delhi-65, comprising of 418 sq. yards having construction on Ground, First and Second Floor. Equitable Mortgage 680.26** Valuation Report by Banks’ Panel Advocate Shri K.C. Talwar, as on 20.02.08. As per Legal Opinion-cum- Non-Encumbrance Certificate by our Panel Advocate, Shri Kalim Ur Rehman dated 08-07-08, the subject property bears clear title and is marketable. No Total Collateral Security (considering Realisable Value of property) is Rs 680.26 lacs The said property is also mortgaged to the Bank for Mortgage Loan of Rs. 10.85 Lacs sanctioned to Sh.. Mahesh C. Gupta, Smt. Shashi Khandelwal, Sh. Vikas Gupta, Sh. Mohit Gupta –O/S as on

- 52. 10.01.2010 being Rs. 7.95 Lacs and Machinery Term Loan sanctioned to M/s xyz Apparels Inc-O/S as on 10.01.2010 being Rs. 5.89 Lacs. The conduct of the aforesaid accounts are satisfactory as reported by the Branch and both the accounts are classified as Standard. Annexure 8 Additional comments, if any along with investments details in associate /sister concerns, comments on balance sheet, auditors remarks etc. Nil ______________________ Homework Help

- 53. https://www.homeworkping.com/ Math homework help https://www.homeworkping.com/ Research Paper help https://www.homeworkping.com/ Algebra Help https://www.homeworkping.com/ Calculus Help https://www.homeworkping.com/ Accounting help https://www.homeworkping.com/ Paper Help https://www.homeworkping.com/ Writing Help https://www.homeworkping.com/ Online Tutor https://www.homeworkping.com/ Online Tutoring https://www.homeworkping.com/