MONEY IN THE BANK - bank sector outlook

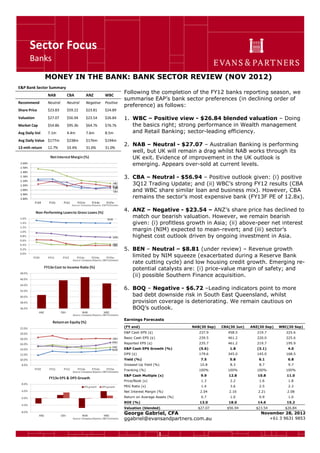

- 1. Sector Focus Banks 1 MONEY IN THE BANK: BANK SECTOR REVIEW (NOV 2012) Following the completion of the FY12 banks reporting season, we summarise EAP‟s bank sector preferences (in declining order of preference) as follows: 1. WBC – Positive view - $26.84 blended valuation – Doing the basics right; strong performance in Wealth management and Retail Banking; sector-leading efficiency. 2. NAB – Neutral - $27.07 – Australian Banking is performing well, but UK will remain a drag whilst NAB works through its UK exit. Evidence of improvement in the UK outlook is emerging. Appears over-sold at current levels. 3. CBA – Neutral - $56.94 – Positive outlook given: (i) positive 3Q12 Trading Update; and (ii) WBC‟s strong FY12 results (CBA and WBC share similar loan and business mix). However, CBA remains the sector‟s most expensive bank (FY13F PE of 12.8x). 4. ANZ – Negative - $23.54 – ANZ‟s share price has declined to match our bearish valuation. However, we remain bearish given: (i) profitless growth in Asia; (ii) above-peer net interest margin (NIM) expected to mean-revert; and (iii) sector‟s highest cost outlook driven by ongoing investment in Asia. 5. BEN – Neutral – $8.81 (under review) – Revenue growth limited by NIM squeeze (exacerbated during a Reserve Bank rate cutting cycle) and low housing credit growth. Emerging re- potential catalysts are: (i) price-value margin of safety; and (ii) possible Southern Finance acquisition. 6. BOQ – Negative - $6.72 –Leading indicators point to more bad debt downside risk in South East Queensland, whilst provision coverage is deteriorating. We remain cautious on BOQ‟s outlook. E&P Bank Sector Summary NAB CBA ANZ WBC Recommend Neutral Neutral Negative Positive Share Price $23.83 $59.22 $23.81 $24.89 Valuation $27.07 $56.94 $23.54 $26.84 Market Cap $54.8b $95.3b $64.7b $76.7b Avg Daily Vol 7.1m 4.4m 7.6m 8.5m Avg Daily Value $177m $238m $176m $194m 12-mth return 12.7% 33.4% 31.6% 31.0% Earnings Forecasts (FY end) NAB(30 Sep) CBA(30 Jun) ANZ(30 Sep) WBC(30 Sep) E&P Cash EPS (¢) 237.9 458.5 219.7 225.6 Basic Cash EPS (¢) 239.5 461.2 220.0 225.6 Reported EPS (¢) 235.7 461.2 219.7 195.9 E&P Cash EPS Growth (%) (5.6) 1.8 (3.1) 4.0 DPS (¢) 179.6 345.0 145.0 168.5 Yield (%) 7.5 5.8 6.1 6.8 Grossed-Up Yield (%) 10.8 8.3 8.7 9.7 Franking (%) 100% 100% 100% 100% E&P Cash Multiple (x) 9.9 12.8 10.8 11.0 Price/Book (x) 1.3 2.2 1.6 1.8 PEG Ratio (x) 1.4 3.6 2.5 2.3 Net Interest Margin (%) 2.04 2.16 2.21 2.08 Return on Average Assets (%) 0.7 1.0 0.9 1.0 ROE (%) 13.0 18.0 14.6 15.2 Valuation (blended) $27.07 $56.94 $23.54 $26.84 George Gabriel, CFA ggabriel@evansandpartners.com.au November 28, 2012 +61 3 9631 9853

- 2. 2 BANK SECTOR SUMMARY ANZ CBA NAB WBC BOQ BEN Regionals Average Bank Majors E&P Current Recommendation NEGATIVE NEUTRAL NEUTRAL POSITIVE NEGATIVE NEUTRAL E&P preferred ranking 4 3 2 1 6 5 Curent Price $23.75 $59.18 $23.74 $24.83 $6.91 $7.89 E&P 12-month weighted valuation $23.54 $56.94 $27.07 $26.84 $6.72 $8.81 Upside/(downside) to E&P valuation -0.9% -3.8% 14.0% 8.1% -2.8% 11.7% 5.9% 3.3% E&P 13F cash dividend yield 6.1% 5.8% 7.6% 6.8% 7.4% 8.1% 7.8% 6.5% 12-mth forecast total shareholder return 5.7% 3.9% 14.6% 10.8% 4.7% 19.8% 13.7% 8.1% 12A Cash EPS $2.27 $4.53 $2.54 $2.17 -$0.07 $0.84 E&P 13F Cash EPS $2.20 $4.61 $2.40 $2.26 $0.79 $0.75 FY13F earnings growth (% change 12-13 EPS) -3.1% 1.8% -5.6% 4.0% -1254% -11% -508.9% -0.1% E&P 14F Cash EPS $2.22 $4.78 $2.49 $2.32 $0.79 $0.80 FY13F earnings growth (% change 13-14 EPS) 0.9% 3.6% 3.8% 3.0% NM 7% 4.1% 2.9% FY13F earnings yield 9.3% 7.8% 10.1% 9.1% 11.4% 9.5% 10.3% 8.9% FY14F earnings yield 9.3% 8.1% 10.5% 9.4% 11.4% 10.2% 10.7% 9.1% 12A Cash DPS $1.45 $3.34 $1.80 $1.66 $0.52 $0.60 E&P 13F Cash DPS $1.45 $3.45 $1.80 $1.68 $0.51 $0.64 FY13F dividend growth (% change 12-13 EPS) 0.0% 3.3% -0.2% 1.5% -1.0% 6.7% 4% 1.4% E&P 14F Cash DPS $1.45 $3.57 $1.80 $1.71 $0.52 $0.64 FY14F dividend growth (% change 13-14 EPS) -0.2% 3.5% 0.0% 1.4% 0.8% -0.3% 0% 1.5% E&P 13F cash dividend yield 6.1% 5.8% 7.6% 6.8% 7.4% 8.1% 7.8% 6.5% E&P 13F grossed up cash yield 8.7% 8.3% 10.8% 9.7% 10.6% 11.6% E&P 14F cash dividend yield 6.1% 6.0% 7.6% 6.9% 7.5% 8.1% 7.9% 6.6% 10-year government bond 3.68% 3.68% 3.68% 3.68% 3.68% 3.68% Target average bank yield/bond yield 1.05x 1.05x 1.05x 1.10x 2.00x 1.20x 1.52x 1.07x Implied FY12F share price target $37.56 $89.36 $46.53 $41.66 $7.00 $14.50 % upside from current price 58.1% 51.0% 96.0% 67.8% 1.3% 83.8% 50.7% 65.5% Implied FY13 share price target $37.48 $92.46 $46.51 $42.26 $7.05 $14.46 % upside from current price 57.8% 56.2% 95.9% 70.2% 2.1% 83.3% 50.8% 67.7% FY13 NTA per share $12.40 $20.18 $14.73 $10.08 $7.47 $6.14 FY13 book value per share $14.94 $26.87 $18.19 $14.14 $9.27 $10.22 Price/FY13F NTA 1.92x 2.93x 1.61x 2.46x 0.92x 1.29x 1.14x 2.34x Price/FY13F book value 1.59x 2.20x 1.31x 1.76x 0.75x 0.77x 0.76x 1.78x Premium/(discount) to sector average FY12F P/B -10.7% 23.7% -26.7% -1.3% -22.7% -7.4% FY12A Price-Earnings ratio 10.5x 13.1x 9.4x 11.5x -101.3x 9.4x -35.0x 11.4x FY13F Price-Earnings ratio 10.8x 12.8x 9.9x 11.0x 8.8x 10.5x 9.8x 11.4x Premium/(discount) to sector average FY13F PE -5% 13% -12.7% -3% -11% 7% FY14F Price-Earnings ratio 10.7x 12.4x 9.6x 10.7x 8.8x 9.8x 9.4x 11.0x Consensus wtd reco rating (1-5, 5 Strong Buy) 3.4 2.5 3.4 3.1 2.8 2.6 No. of broker recommendations (Buy/Hold/Sell) 9B/4H/5S 2B/8H/6S 7B/8H/3S 5B/8H/4S 3B/10H/5S 1B/12H/4S Consensus Target Price $26.11 $56.41 $26.30 $25.86 $6.72 $8.81 Consensus FY12 Net Profit ($m) $5,992 $7,096 $5,367 $6,448 $25 $323 Consensus FY12 EPS $2.18 $4.39 $2.42 $2.06 $0.09 $0.83 Consensus FY13 EPS $2.24 $4.49 $2.49 $2.14 $0.75 $0.81 Consensus FY13 EPS Growth 3.2% 2.3% 3.1% 3.7% 747.2% -2.3% Consensus FY12 DPS $1.46 $3.30 $1.80 $1.66 $0.52 $0.60 1 Jan 12 share price $20.53 $49.22 $23.36 $20.00 $7.09 $8.03 2012 year to date performance 15.7% 20.2% 1.6% 24.2% -2.5% -1.7% -2.1% 16.8% 52 week high $25.96 $59.40 $26.95 $25.95 $7.96 $9.60 Fall from 52 week high (%) -8.5% -0.4% -11.9% -4.3% -13.2% -17.8% -16.0% -5.4% All time high $31.74 $62.16 $44.84 $31.32 $19.32 $17.78 Fall from all time high (%) -25.2% -4.8% -47.1% -20.7% -64.2% -55.6% -59.1% -21.5% Source: Bloomberg, E&P Estimates Earningspershare(EPS)Priceperformance Bond-relative dividendyield Dividendspershare(DPS)E&PForecastsConsensusEarningsandAssetValuation

- 3. 3 ANZ BANKING GROUP (ANZ) - STRUCTURAL HEADWINDS RECOMMENDATION : NEGATIVE (PREV. NEUTRAL) WHAT’s NEW? Underlying cash earnings (post adjustment for cash earnings, capitalised software and hedging gains) are in decline, down 5.2% in 2H12 if we include$220m of capitalised software as an expense and down 11.4% if we normalise excessive hedging gains to 1H12 levels. Adjusted revenue growth (i.e. stripping out hedging gains) is down -0.2% in 2H12 (vs. ANZ reported +2.4%), highlighting the challenging revenue growth outlook. Table 7. Adjusted operating expenses up +5.0%. Table 5. Asian (APEA) investment remains an earnings drag, with APEA cash earnings down 23% as income declined 4% and expenses increased 9%. ANZ’s provisioning is underweight. To match CBA, ANZ requires $146m in provision top-ups. Table 3. Re-allocation of resources away from Australia (FTE down 1,901 to 21,682) to Asia (FTE up by 626 to 17,500) creates medium-term risks for Australian franchise competitiveness. WHAT CHANGED? FY13F EPS down -2.6%; FY14F EPS down -9.1%. WHAT NOW? We downgrade to Negative and blended valuation to $23.54 (prev. $23.30) reflecting carry forward of key medium-term risks: We expect structural decline in net interest margin (NIM) towards mean-reversion. ANZ‟s 2H12 NIM of 2.35% is 20bp above CBA. Profitless growth in Asia to continue in the short-term reflecting ongoing investment costs within a subdued revenue context. Cash earnings down 23% in 2H12. Table 5. Sector implications: No sign of broader asset quality decline across Australia. Net interest margin (NIM) downside pressures remain across the sector (higher funding costs, competition). Trading Data Last Price $25.38 12 month range $18.77 - $25.96 Market Cap $68,970m Free Float $67,680m (98%) Avg. Daily Volume 7.7m Avg. Daily Value $176.7m 12 month return (historical) 24.1% AIEA to grow in line with system. ANZ’s NIM decline is both structural, driven by reversion to its peer-group mean after having increased interest rates out of cycle by more than its peer group post the GFC, and sectoral, with the sector facing rising deposit costs, lower free funds returns, increased competition and rising wholesale funding costs. Earnings Forecasts Yr to September 10A 11A 12A 13E 14E 15E E&P Cash EPS (¢) 199.8 219.8 226.6 219.7 221.6 239.6 Basic Cash EPS (¢) 200.3 220.3 227.1 220.0 221.9 239.8 Reported EPS (¢) 178.9 208.2 213.4 219.7 221.6 239.5 E&P Cash EPS Growth (%) 26.1 10.0 3.1 (3.1) 0.9 8.1 DPS (¢) 126.0 140.0 145.0 145.0 144.7 158.5 Yield (%) 5.0 5.5 5.7 5.7 5.7 6.2 Grossed-Up Yield (%) 7.1 7.9 8.2 8.2 8.1 8.9 Franking (%) 100% 100% 100% 100% 100% 100% E&P Cash Multiple (x) 12.7 11.5 11.2 11.5 11.4 10.6 Price/Book (x) 1.9 1.8 1.7 1.7 1.6 1.5 PEG Ratio (x) 0.9 (298.6) (5.0) 1.3 Net Interest Margin (%) 2.5 2.4 2.3 2.2 2.2 2.1 Return on Average Assets (%) 1.0 1.0 1.0 0.9 0.9 0.9 ROE (%) 15.1 15.7 15.2 14.6 14.4 14.8 Valuation (blended) 23.54 George Gabriel, CFA ggabriel@evansandpartners.com.au November 28, 2012 +61 3 9631 9853

- 4. 4 EAP INVESTMENT VIEW We downgrade ANZ to Negative (prev. Neutral), and our blended valuation to (prev. $23.30) given: (i) underlying 2H12 cash earnings growth was negative and the outlook is for a challenging revenue growth environment; (ii) the competitive position of ANZ’s Australian franchise is at risk given ongoing re-allocation of resources and management attention towards Asia; (iii) increased provisioning outlook given ANZ is underweight provisioning relative to peers; (iv) structural net interest margin (NIM) decline is expected to continue; and (v) profitless growth in ANZ’s Asian investment phase is expected to remain a medium- term earnings drag. We consider these issues in more detail below. 1. STRUCTURAL NET INTEREST MARGIN (NIM) DECLINE We expect ANZ‟s Net Interest Margin (NIM) to continue to mean-revert. There is no apparent reason why ANZ should enjoy an above-peer NIM. Even when compared to NAB, whose business mix is most similar to ANZ, ANZ‟s NIM appears excessive. The key explanation for ANZ‟s above-peer NIM is that it re-priced margins the most aggressively in the post-GFC period (up 44bp from FY08 to 1H10). Its NIM is now down 17bp since then, compared to CBA‟s NIM decline of 9bp. Tables 1-2. Comparing ANZ to peers implies ANZ faces another 10-20bp of NIM decline for mean- reversion, in addition to sector-wide structural NIM decline driven by higher funding costs (both wholesale and deposit costs). Chart 1 summarises the key drivers of 2H12 NIM. We expect these NIM pressures (rising deposit costs, lower “free float” return in a rate cutting cycle and competition partially offset by asset re-pricing) to continue to drive structural decline in NIM. TABLE 1: MAJOR BANKS’ NET INTEREST MARGINS (NIM) NIM FY08 2H09 1H10 2H10 1H11 2H11 1H12 2H12 ANZ 2.01% 2.37% 2.45% 2.50% 2.47% 2.44% 2.35% 2.28% CBA 2.02% 2.16% 2.18% 2.08% 2.12% 2.25% 2.15% 2.09% NAB 2.25% 2.25% 2.26% 2.24% 2.23% 2.28% 2.17% WBC 2.07% 2.39% 2.27% 2.17% 2.21% 2.23% 2.17% Source: Company reports TABLE 2: CHANGE IN NIM NIM change (%) FY09 1H10 2H10 1H11 2H11 1H12 2H12 Total change FY08-1H10 Total change 1H10 - 2H12 ANZ 0.36% 0.08% 0.05% -0.03% -0.03% -0.09% -0.07% 0.44% -0.17% CBA 0.14% 0.02% -0.10% 0.04% 0.13% -0.10% -0.06% 0.16% -0.09% NAB 0.00% 0.01% -0.02% -0.01% 0.05% -0.11% 0.01% WBC 0.32% -0.12% -0.10% 0.04% 0.02% -0.06% 0.20% Average major banks 0.20% -0.13% Source: Company reports

- 5. 5 CHART 1: NIM TRENDS Source: Company reports 2. ASSET QUALITY AND PROVISIONING There are no signs of broader-based asset quality deterioration across Australia, with declines in both gross impaired and new impaired assets. Table 3. Furthermore, ANZ’s mortgage asset quality in Queensland appears to be stable/improving. Chart 2. Accordingly, we infer that Bank of Queensland’s (BOQ) asset quality issues are specific to BOQ’s exposures and credit underwriting standards. (Refer EAP Note, “Leading Indicators Point to More Bad Debt Downside”, 23 October 2012). Key trends are summarised in Table 3. CHART 2: AUSTRALIA 90 DAYS PAST DUE LOANS Source: Company reports

- 6. 6 TABLE 3: ANZ & CBA – COMPARING PROVISIONING LEVELS ANZ 1H10 2H10 1H11 2H11 1H12 2H12 Asset quality summary 90 DPD + impaired/gross loans 2.37% 2.28% 2.12% 1.84% 1.73% 1.60% New impaired loans 3,126 2,319 2,437 1,842 2,356 1,847 % growth in new impaired -26% 5% -24% 28% -22% New impaired/gross loans 0.91% 0.66% 0.66% 0.47% 0.57% 0.43% Source: Company Reports However, although there is no sign of broader based asset quality deterioration, we conclude that ANZ’s provisioning is underweight relative to CBA and that therefore ANZ faces a high risk of increased future provisioning. This conclusion is consistent with the ANZ CEO’s commentary who stated that ANZ has a slightly higher provision outlook. We believe this is due to ANZ‟s underweight provisioning relative to peers such as CBA. Table 4. ANZ has to increase its provisions by $146m in order to match CBA’s level of total provisioning/credit RWA. TABLE 4: ANZ & CBA – COMPARING PROVISIONING LEVELS Credit Quality Summary ANZ CBA CP/Total RWA 0.92% 0.93% CP/Credit RWA 1.08% 1.08% CP/Credit RWA (ex housing) 1.32% 1.56% SP/Gross Impaired Assets 34.12% 44.63% 90 DPD + impaired/gross loans 1.60% 1.40% Total Provision to Credit RWA 1.78% 1.85% Source: Company Reports Source: Company reports CHART 3: ANZ COLLECTIVE PROVISION COVERAGE DECLINING

- 7. 7 3. ASIAN BUSINESS SEGMENT (“APEA”) ANZ has created a new division called “International and Institutional Bank”, subsuming within it Global Institutional Banking (including Institutional Australia and New Zealand), APEA (Asia Pacific, Europe & America) and Institutional APEA. There appears to be little rationale for this conglomeration of business segments into one larger unit and the impact of the disclosure change is that analysts can now only analyse 2011 and 2012 financial data for time series trend analysis. We remain sceptical of the merits of ANZ‟s Asian investment strategy for several reasons: It is not clear how ANZ can add value to non-controlling, minority equity interests without (cost or revenue) synergies. The short-term cost impact of the Asian rollout will continue to act as an earnings drag. In 2H12, APEA cash earnings were down 23% as income declined 4% and expenses increased 9%. TABLE 5: ANZ IN ASIA Divisional Performance Indicators - APEA (IIB) APEA 2H11E 1H12 2H12 1H12 vs 2H11E % 1H12 - 2H12 Net operating income (A$M) 625.0 788.0 755.0 26.1% -4.2% Expenses (A$m) -320.0 -350.0 -380.0 9.4% 8.6% Bad Debts (A$m) -41.0 -55.0 -58.0 34.1% 5.5% Cash earnings (A$M) 201.0 305.0 234.0 51.7% -23.3% Individual Provision Charge/(Release) 36.0 47.0 34.0 30.6% -27.7% Collective Provision Charge/(Release) 5.0 8.0 24.0 60.0% 200.0% Total Provision Charge/(Release) 41.0 55.0 58.0 34.1% 5.5% Source; EAP Research; Company Reports Growth Rates

- 8. 8 FY12 RESULTS OVERVIEW ANZ’s accounting over-states its underlying earnings performance. We believe that it is appropriate to adjust ANZ’s reported cash earnings of $6.011bn down to $5.606bn to reflect the true underlying earnings power of the ANZ business franchise as follows: Deduct capitalised software expense write-downs of $220m as this is a normal business expense for modern banks. Hedging gains. In our view, ANZ‟s large 2H12 hedging gains of $207m (almost 10 times 1H12‟s $22m) do not reflect underlying earnings power since they are highly volatile. For conservatism, our adjustment assumes ANZ only earned $22m in 2H12 (as in 1H12). KEY TRENDS After we adjust ANZ’s earnings to reflect its true underlying earnings power (i.e. removing accounting classification which in our view do not reflect business economics) of ANZ, it is clear that the ANZ business franchise declined in 2H12. ANZ reported cash earnings are up +2.2% in 2H12 (Table 6), but are down -11.4% on an EAP adjusted basis (Table 7). If we only deduct the software capitalisation as an expense, then cash earnings are down -5.2% in 2H12. Operating income is flat/negative in the half. EAP adjusted operating revenue is down -0.2% in 2H12 (vs. ANZ reported +2.4%). Bad debt expenses increased 21% in 2H12 to $681m, driven by an increase in specific provision of $912m but offset by a $231m collective provision release. We expect this to increase as ANZ’s total provisioning is below peers. EAP’s adjusted operating expenses are up +5.0%, compared to ANZ‟s reported expenses of - 0.4%. This partly reflects the cost of the Asian investment program. Group FTE was reduced from 49509 to 48239. Within this, Australian FTE declined from 23,583 to 21,682 (down 1,901) whilst APEA FTE increased by 626 to 17,500. Re-allocation of resources away from Australia to APEA creates a medium term risk of damaging the Australian business franchise. The risks of reallocating resources away from Australia are highlighted by the fact that the only segment to substantially grow in 2H12 was Australia +9.9% cash earnings (Table 8), of which the key driver was the Retail Business Unit +23% to $815m, whilst the Commercial Business Unit was down -8% to $486m. TABLE 6: ANZ REPORTED CASH EARNINGS TRENDS Group Performance Cash earnings (A$M) 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 % 1H11 - 2H10 % 2H11 - 1H11 % 2H11 - 1H12 % 1H12 - 2H12 Net interest income 4,822 4,988 5,239 5,623 5,642 5,839 5,984 6,127 0.3% 3.5% 2.5% 2.4% Other operating income 2,218 2,339 2,328 2,592 2,788 2,543 2,720 2,748 7.6% -8.8% 7.0% 1.0% Operating income 7,040 7,327 7,567 8,215 8,430 8,382 8,704 8,875 2.6% -0.6% 3.8% 2.0% Operating expenses -2,944 -3,124 -3,249 -3,722 -3,821 -3,897 -4,020 -4,002 2.7% 2.0% 3.2% -0.4% Pre-provision operating profit 4,096 4,203 4,318 4,493 4,609 4,485 4,684 4,873 2.6% -2.7% 4.4% 4.0% Bad debt expense -1,435 -1,621 -1,098 -722 -660 -551 -565 -681 -8.6% -16.5% 2.5% 20.5% Cash earnings before tax 2,661 2,582 3,220 3,771 3,949 3,934 4,119 4,192 4.7% -0.4% 4.7% 1.8% Tax expense -749 -720 -920 -1,040 -1,126 -1,096 -1,142 -1,152 8.3% -2.7% 4.2% 0.9% Cash earnings before minorities 1,912 1,862 2,300 2,731 2,823 2,838 2,977 3,040 Minority equity -4 2 -2 -4 -5 -4 -4 -2 Underlying cash earnings 1,908 1,864 2,298 2,727 2,818 2,834 2,973 3,038 3.3% 0.6% 4.9% 2.2% Source; EAP Research; Company Reports Growth ratesCash earnings (A$M)

- 9. 9 TABLE 7: EAP ADJUSTED CASH EARNINGS Group Performance Cash earnings (A$M) 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 % 1H11 - 2H10 % 2H11 - 1H11 % 2H11 - 1H12 % 1H12 - 2H12 Net interest income 4,822 4,988 5,239 5,623 5,642 5,839 5,984 5,942 0.3% 3.5% 2.5% -0.7% Other operating income 2,218 2,339 2,328 2,592 2,788 2,543 2,720 2,748 7.6% -8.8% 7.0% 1.0% Operating income 7,040 7,327 7,567 8,215 8,430 8,382 8,704 8,690 2.6% -0.6% 3.8% -0.2% Operating expenses -2,944 -3,124 -3,249 -3,722 -3,821 -3,897 -4,020 -4,222 2.7% 2.0% 3.2% 5.0% Pre-provision operating profit 4,096 4,203 4,318 4,493 4,609 4,485 4,684 4,468 2.6% -2.7% 4.4% -4.6% Bad debt expense -1,435 -1,621 -1,098 -722 -660 -551 -565 -681 -8.6% -16.5% 2.5% 20.5% Cash earnings before tax 2,661 2,582 3,220 3,771 3,949 3,934 4,119 3,787 4.7% -0.4% 4.7% -8.1% Tax expense -749 -720 -920 -1,040 -1,126 -1,096 -1,142 -1,152 8.3% -2.7% 4.2% 0.9% Cash earnings before minorities 1,912 1,862 2,300 2,731 2,823 2,838 2,977 2,635 Minority equity -4 2 -2 -4 -5 -4 -4 -2 Underlying cash earnings 1,908 1,864 2,298 2,727 2,818 2,834 2,973 2,633 3.3% 0.6% 4.9% -11.4% Source; EAP Research; Company Reports Cash earnings (A$M) Growth rates TABLE 8: SEGMENTAL PERFORMANCE ANZ Divisional Performance Cash earnings (A$M) % 2H12 total FY11 1H12 2H12 FY12 % FY11 - FY12 % 1H12 - 2H12 Australia 43.0% 2,390 1,187 1,305 2,492 4.3% 9.9% International & Institutional 37.4% 2,301 1,235 1,137 2,372 3.1% -7.9% New Zealand 12.4% 662 365 378 743 12.2% 3.6% Wealth & Private Banking 8.1% 457 206 245 451 -1.3% 18.9% Group Centre -0.9% -158 -20 -27 -47 -70.3% 35.0% Total 100.0% 5,652 2,973 3,038 6,011 6.4% 2.2% Source; EAP Research; Company Reports Cash earnings (A$M) Growth rates “BANKING ON AUSTRALIA” PROGRAM ANZ has estimated its “Banking on Australia” program will result in a 36% reduction in its branch property portfolio and will result in savings of 25% in property expenses “over time”. However, timing of expense benefit realisation is not specified. An unspoken upside is the potential for further staff reduction resulting from these initiatives. Our base case analysis assumes these initiatives will save ~$124m in FY15F.

- 10. 10 FINANCIAL SUMMARY Australia and New Zealand Banking Group ANZ As at: 28/11/2012 Recommendation: Negative Share Price $23.81 Year end September 2012A 2013E 2014E 2015E INCOME STATEMENT Interest Income $m 30,538 28,262 31,214 35,238 Interest Expense $m (18,428) (15,928) (18,558) (22,201) Net Interest Income $m 12,110 12,334 12,656 13,037 Non Interest Income Fees & Commissions $m 2,412 2,490 2,540 2,589 Trading Income $m 280 121 121 121 Other Banking Income $m 1,256 1,401 1,506 1,616 Banking Non Interest Income $m 3,948 4,012 4,167 4,327 Wealth Management Income $m 1,203 1,477 2,366 1,800 Income/(Loss) from Associates $m 450 460 469 478 Total operating income $m 17,711 18,283 19,657 19,643 Operating Expenses Personnel Expenses $m (4,765) (3,180) (3,247) (3,362) Occupancy & Equipment $m (2,099) (2,466) (2,591) (2,702) Total Operating Expenses $m (8,519) (7,431) (7,713) (8,020) Pre Prov. Oper. Profit Before Tax $m 9,192 10,852 11,944 11,623 Bad debt charge $m (1,198) (2,133) (3,143) (2,254) Pre Tax Profit $m 7,994 8,718 8,801 9,368 Tax Expense $m (2,327) (2,662) (2,688) (2,860) Minorities $m (6) (7) (7) (7) Reported Profit Statutory $m 5,661 6,050 6,107 6,501 Cash earnings adjustment $m 350 0 0 0 Reported Cash Profit $m 6,011 6,050 6,107 6,501 Preference Share Dividends $m (11) (8) (8) (8) E&P Normalised NPAT $m 6,000 6,042 6,099 6,494 E&P Cash EPS ¢ 226.6 219.7 221.6 239.6 Basic Cash EPS ¢ 227.1 220.0 221.9 239.8 Reported EPS ¢ 213.4 219.7 221.6 239.5 Dividend per Share ¢ 145.0 145.0 144.7 158.5 BALANCE SHEET Gross Loans & Other Receivables $m 432,560 454,353 478,399 503,173 Total Assets $m 642,127 633,581 657,865 683,104 Impaired Assets $m 5,196 5,679 5,980 6,133 Deposits & Other Pub. Borrowing $m 397,123 416,986 438,586 461,714 Bonds, notes & subordinat’d debt $m 63,098 63,098 63,098 63,098 Total Shareholder Equity $m 41,220 41,622 43,047 44,515 Avg housing loans $m 233,268 248,262 258,972 270,275 Avg non-housing loans $m 140,691 149,734 156,194 163,011 Avg total gross loans $m 373,960 397,996 415,166 433,286 Avg Interest Earning Assets $m 523,461 557,106 581,140 606,504 Avg Total Assets $m 627,270 667,587 696,388 726,781 Avg Interest Bearing Liabilities $m 483,594 509,053 531,035 554,699 Avg Total Liabilities $m 587,706 626,166 654,053 683,000 Avg Shareholders’ Equity $m 39,564 41,421 42,335 43,781 GROWTH RATES Per Share E&P Cash EPS % 3.1% (3.1)% 0.9% 8.1% Basic Cash EPS % 3.1% (3.1)% 0.9% 8.1% Dividend Per Share % 3.6% 0.0% (0.2)% 9.5% Profit & Loss Net Interest Income % 5.5% 1.8% 2.6% 3.0% Banking Non Interest Income % (2.0)% 1.6% 3.9% 3.8% Wealth Management Income % 22.9% 22.8% 60.2% (23.9)% Total Non Interest Income % (2.0)% 1.6% 3.9% 3.8% Total Operating Income % 4.6% 3.2% 7.5% (0.1)% Operating Expenses % 6.2% (12.8)% 3.8% 4.0% Pre-Provision Profit % 3.2% 18.1% 10.1% (2.7)% Impairment Charges % (3.2)% 78.1% 47.3% (28.3)% Cash Profit % 6.4% 0.6% 0.9% 6.4% Balance Sheet Gross Loans & Other Receivables % 7.4% 5.0% 5.3% 5.2% Total Shareholders’ Equity % 8.6% 1.0% 3.4% 3.4% Average Balance Sheet Housing Loans % 11.3% 6.4% 4.3% 4.4% Non-Housing Loans % 11.3% 6.4% 4.3% 4.4% Avg Interest Earning Assets % 12.0% 6.4% 4.3% 4.4% Avg Interest Bearing Liabilities % 10.4% 5.3% 4.3% 4.5% Year end September 2012A 2013E 2014E 2015E VALUATION METRICS E&P Cash P/E Multiple x 10.5 10.8 10.7 9.9 Basic P/E Multiple x 10.5 10.8 10.7 9.9 Price/Pre-prov. operating profit x 7.0 6.1 5.4 5.5 NTA per share $ 12.5 12.4 13.2 13.9 Book Value per Share $ 15.2 14.9 15.8 16.5 Price/NTA x 1.9 1.9 1.8 1.7 Price/Book x 1.6 1.6 1.5 1.4 Dividend per Share ¢ 145.0 145.0 144.7 158.5 Dividend Payout Ratio x 0.6 0.7 0.7 0.7 Dividend Yield % 6.1% 6.1% 6.1% 6.7% Grossed Up Yield % 8.7% 8.7% 8.7% 9.5% Issued Shares m 2,717.4 2,782.0 2,722.4 2,699.0 Weighted Average Shares m 2,887.6 2,874.7 2,877.2 2,835.7 PERFORMANCE ANALYSIS Profitability Income / Avg Assets % 2.8% 2.7% 2.8% 2.7% Expense / Avg Assets % 0.4% 0.4% 0.4% 0.4% Return on Average Assets % 1.0% 0.9% 0.9% 0.9% Return on Ordinary Equity % 15.2% 14.6% 14.4% 14.8% Return on Risk Weighted Assets % 2.0% 1.8% 1.7% 1.7% Net Interest Margin Analysis Net Interest Spread % 2.0% 1.9% 1.9% 1.8% Net Interest Margin % 2.3% 2.2% 2.2% 2.1% Non Int. Income to Total Income % 31.6% 32.5% 35.6% 33.6% Efficiency Cost/Income % 48.1% 40.6% 39.2% 40.8% Tax Rate Effective tax rate % 29.1% 30.5% 30.5% 30.5% CAPITAL ADEQUACY Risk Weighted Assets $m 300,119 336,221 354,016 372,348 Tier 1 Capital $m 32,501 33,622 35,402 37,235 Total Capital $m 36,574 40,347 42,482 44,681 Tier 1 Ratio % 10.8% 10.0% 10.0% 10.0% Tier 2 Ratio % 1.4% 2.0% 2.0% 2.0% Total Capital Ratio % 12.2% 12.0% 12.0% 12.0% ACE Ratio % 9.6% 9.0% 9.0% 9.0% Tangible Leverage Ratio % 5.3% 5.4% 5.5% 5.5% ASSET QUALITY 90-day Past Due Loans $m 9,601 10,495 11,050 11,332 Non Performing Loans $m 1,773 1,704 2,272 2,201 NPL / Gross Loans and Other Rec % 0.4% 0.4% 0.5% 0.4% Total Provisions $m 4,538 4,884 5,526 5,472 Total Prov. / Gr. Loans & Oth Rec % 1.0% 1.1% 1.2% 1.1% Individual Provision $m 1,773 1,704 2,272 2,201 Individual Provision Cover % 34.1% 30.0% 38.0% 35.9% Collective Provision $m 2,765 3,180 3,253 3,271 Collective Prov. / Perform. Loans % 0.6% 0.7% 0.7% 0.7% Impairment Charges / Avg RWA % 0.4% 0.6% 0.9% 0.6% Imp Assets / Gr. Loans & Oth Rec % 1.2% 1.3% 1.3% 1.2% Impaired asset coverage % 34.1% 30.0% 38.0% 35.9% Collective Provision / RWA % 0.9% 0.9% 0.9% 0.9% BDD / Gr. loans and Oth Rec % 0.3% 0.5% 0.7% 0.4% WEALTH MANAGEMENT Funds Under Administration $m 51,667 51,270 53,803 56,483 Inforce Premiums $m 1,822 2,221 2,615 3,004 Funds Mgt Revenue Margin % 1.6% 1.6% 2.9% 1.6% Life Insurance Revenue margin % 20.7% 29.7% 30.2% 30.5% Shareholder Invest. Returns % 0.0% 0.0% 0.0% 0.0%

- 11. 11 COMMONWEALTH BANK (CBA) - LOW GROWTH OUTLOOK RECOMMENDATION : NEUTRAL CBA’s FY12 result manifest some key sector-wide trends: (i) subdued/negative revenue growth (CBA 2H12 revenue down -1%); (ii) margin pressure (CBA 2H12 NIM down 6bp to 2.06%) to be partially mitigated in 1H13 by asset re-pricing; (iii) sound asset quality (CBA’s troublesome/impaired assets down from $10.9bn to $10.3bn) and (iv) strong cost control (CBA 2H12 expenses flat), with ongoing cost reduction expected as banks re-align to a lower credit growth outlook (+4.4% annual system growth as at June 2012). We upgrade our blended valuation +2.0% to $59.70 (prev. $58.53). WHAT’s SURPRISED? 2H12 payout ratio of 89% raises sustainability concerns. CBA announced new 70-80% target payout ratio, with 70% interim payout. ROE declined from 19.2% (1H12) to 18.1% (2H12) driven by underperforming Institutional Bank and Markets and higher liquid assets. Business and Private Banking (BPB) margin expansion from 2.04% to 2.14% (FY12). WHAT’s CHANGED? FY13 EPS -1.3%; FY14 EPS -3.6% driven by longer-term impairment expense decline. WHAT NOW? Asset re-pricing to benefit 1H13 with full impact of May (+10bp) and June (+4bp) out-of-cycle rate rises and potential re-pricing of business portfolio to follow NAB‟s lead in this regard. Dividend sustainability will remain in focus. However, CBA can opportunistically release its $847m economic overlay to support earnings (A$123m released in 2H12). Vulnerable to PE de-rating if ROE continues to decline. CBA currently trades at sector premium of x%. However, we believe a more sustained earnings downturn is required before this would occur. Trading Data Last Price $56.05 12 month range $42.93 - $57.59 Market Cap $88,428m Free Float $86,076m (97%) Avg. Daily Volume 4.8m Avg. Daily Value $245.8m 12 month return (historical) 21.5% Slowing growth in AIEA with credit growth outlook remaining subdued. NIM is expected to decline as (i) cheaper pre-GFC debt is refinanced with more expensive wholesale debt; (ii) funding costs continue to rise but mitigated by full- year impact of May and June’s out-of-cycle rate rises. Earnings Forecasts Yr to June 09A 10A 11A 12E 13E 14E E&P Cash EPS (¢) 332.5 395.8 439.7 450.4 457.3 474.6 Basic Cash EPS (¢) 336.5 399.5 442.4 453.1 460.0 477.2 Reported EPS (¢) 336.5 399.5 442.4 453.1 460.0 477.2 E&P Cash EPS Growth (%) (7.5) 19.1 11.1 2.4 1.5 3.8 DPS (¢) 228.0 290.0 320.0 334.0 344.0 357.0 Yield (%) 4.1 5.2 5.8 6.0 6.2 6.4 Grossed-Up Yield (%) 5.9 7.5 8.2 8.6 8.8 9.2 Franking (%) 100% 100% 100% 100% 100% 100% E&P Cash Multiple (x) 16.7 14.0 12.7 12.4 12.2 11.7 Price/Book (x) 2.7 2.5 2.4 2.2 2.1 2.0 PEG Ratio (x) 0.5 1.0 3.2 2.3 Net Interest Margin (%) 2.1 2.1 2.2 2.1 2.2 2.1 Return on Average Assets (%) 0.8 1.0 1.0 1.0 1.0 1.0 ROE (%) 15.9 18.6 19.3 18.0 18.0 18.2 Valuation (blended) 59.70 George Gabriel, CFA ggabriel@evansandpartners.com.au November 28, 2012 +61 3 9631 9853

- 12. 12 EXECUTIVE SUMMARY CBA‟s FY12 result highlighted a number of sector-wide trends: Subdued/negative revenue growth in an environment of low single-digit credit growth and weak markets-facing revenue; Margin pressure driven by extension of term duration of wholesale funding and deposit competition; Sound asset quality; Strong cost control as the cost base is re-structured to align with a structurally low credit growth outlook. Banks face another 2-4 years of structural adjustment to their funding, capital and cost positions to satisfy Basel 3 and adjust to the medium-term low credit growth outlook. At the end of this structural adjustment process, banks will be leaner, less leveraged, and exhibit improved credit quality (with greater focus on return over volume growth). Consequently, we expect banks to trade as regulated utilities, providing low capital growth but a steadily growing dividend stream. FY12 RESULT SUMMARY CBA‟s margin contraction was exacerbated by slight negative revenue growth. The key drivers of CBA‟s underlying 2H12 cash earnings increase of -1.1% HoH were: -1.0% other operating income growth. -0.2% decline in decline in bad debt expenses. -0.6% net interest income growth, which highlights the effect of increased competition and funding cost pressures starting to erode top-line growth. -0.1% decline in wealth management, with ongoing global markets weakness flagged as being a significant challenge to market-facing segments. -0.6% revenue growth overall which is indicative of the revenue growth challenges facing major banks. In a solid result, operating expenses declined 0.2% reflecting lower FTE and productivity gains. NIM down 3bps to 2.09%. TABLE 1: GROUP PERFORMANCE Group Performance Cash earnings (A$M) Cash earnings (A$M) % FY12 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 % 1H11 - 2H10 % 2H11 - 1H11 % 1H12 - 2H11 % 2H12 - 1H12 Net interest income 64.8% 4,543 5,052 6,062 5,806 6,170 6,488 6,551 6,513 6.3% 5.2% 1.0% -0.6% Other operating income 19.9% 2,036 1,972 2,078 2,034 2,059 1,924 2,020 2,000 1.2% -6.6% 5.0% -1.0% Funds Mgt, Insurance & Inv experience15.3% 1,254 1,202 1,552 1,527 1,510 1,508 1,534 1,532 -1.1% -0.1% 1.7% -0.1% Net operating income 100.0% 7,833 8,226 9,692 9,367 9,739 9,920 10,105 10,045 4.0% 1.9% 1.9% -0.6% Operating expenses -45.7% -3,551 -3,731 -4,268 -4,333 -4,408 -4,483 -4,602 -4,594 1.7% 1.7% 2.7% -0.2% Pre-provision operating profit (PPOP)54.3% 4,282 4,495 5,424 5,034 5,331 5,437 5,503 5,451 5.9% 2.0% 1.2% -0.9% Bad debt expense -5.4% -1,607 -1,328 -1,383 -692 -722 -558 -545 -544 4.3% -22.7% -2.3% -0.2% Cash earnings before tax 48.9% 2,675 3,167 4,041 4,342 4,609 4,879 4,958 4,907 6.1% 5.9% 1.6% -1.0% Tax expense* -27.8% -646 -864 -1,089 -1,177 -1,265 -1,372 -1,373 -1,363 -7.5% -8.5% -0.1% 0.7% Cash earnings before minorities 35.3% 2,029 2,303 2,952 3,165 3,344 3,507 3,585 3,544 5.7% 4.9% 2.2% -1.1% Minority equity -16 -14 -9 -7 -9 -7 -9 -7 Other 0 113 0 0 0 0 0 0 Underlying cash earnings 35.2% 2,013 2,402 2,943 3,158 3,335 3,500 3,576 3,537 5.6% 4.9% 2.2% -1.1% Source: CBA Reports Growth rates

- 13. 13 Net Interest Margin (NIM) We expect 2bp NIM decline in 1H13, with rising funding costs (deposit competition, term duration expansion of wholesale debt) supported by (i) May and June 2012 asset re-pricing impacting the full 1H13 period; (ii) recent evidence of diminishing asset price competition;; and (iii) stable liquid assets outlook, having already increased by $40bn to $135bn over FY12. Chart 1 summarises the movements in NIM from 2.12% in 1H12 to 2.06% in 2H12. Key negative drivers were (i) increased funding costs; (ii) higher holdings of liquids assets. CHART 1. GROUP NET INTEREST MARGIN (bps) Source: CBA Cost control Unlike peers, CBA instead manage with natural attrition of approx. 1,200 FTE loss per annum, and increased its investment expenditure to improve technology and processes. It appears that this CBA is now beginning to capitalise on its investment spend as costs declined in 2H12, with strong productivity gains noted in retail sales and business banking. CBA is targeting flat to positive jaws (revenue less expense growth), though this half was slightly negative. o Jaws -0.4% for 2H12, despite operating expenses decreasing 0.2% over the half. o Group cost to income ratio (CTI) increased slightly to 45.7% from 45.5% in 1H12. o Cost-to-income ratio largely rose in all business segments except retail banking, CBA‟s largest cost base, where CTI declined 24bps. Wealth management saw the worst cost management as the CTI ratio increased 692bps due to organic offshore growth in CFSGAM and the acquisition of Count Financial. Asset Quality Impairment Asset quality metrics are improving. o Provisioning continues to normalise as Bankwest individual and collective provisions continued to run-off and management overlays declined.

- 14. 14 o Gross impaired assets/gross loans ratio declined from0.83%, well below peers. o 30+ day home loan arrears declined to 1.69% over the year and 90+ day home loan arrears fell to 0.88%, down from 1.03% over the year. o Impairment expenses was slightly lower over the half, representing 20bps of average gross loans and acceptances (annualised), down from 21bps in 1H12. o CBA‟s economic overlay of in collective provisioning declined to $847m from $970m in 2H12, as CBA continues to runoff higher risk Bankwest loans and amortise BWA fair value provisioning. The economic overlay remains unchanged, providing potential for a future earnings buffers or provision release. o CBA noted that impaired loans includes „hardship‟ loans where repayments have been suspended or altered otherwise. Return on Equity (ROE) Declining ROE, if sustained, is likely to lead to de-rating of CBA‟s peer-relative PE premium. Capital CBA‟s capital position strengthened during the FY, somewhat explaining the decline in ROE as CBA added 9% of capital during the year. CBA set an internal target to achieve a Basel III Internationally Harmonised common equity tier 1 (CET1) target > 9% from Jan 2013. At FY12 CBA has a Basel III CET1 of 9.8%. o Organic capital generation was relatively low, with Basel 2 core Tier 1 ratio increasing to 7.82%, given loan growth was concentrated in higher risk weighted business lending. o Basel 3 common equity Tier 1 of 9.08% in Dec 2011, up from 7.1% in 1H12, comfortably exceeding the minimum of 7.5% required by APRA. CBA now compares well to peers. Chart # CHART 3. BASEL 3 CAPITAL REQUIREMENTS

- 15. 15 Source: EAP Note: Minimum 4.5% Core Tier 1 (comprising common equity and retained profits) target implemented by APRA on 1 Jan 2013 (vs Basel committee phase in by 1 Jan 2015). Capital conservation buffer of 2.5% implemented by APRA on 1 Jan 2016 (vs Basel Committee phased in by 1 Jan 2019). Source: CBA; Morgan Stanley Funding costs

- 16. 16 Funding costs pressured margins as deposit competition intensified and older pre-GFC wholesale funding rolled-off and was replaced with more expensive wholesale funding. o Wholesale funding costs have been steadily increasing since the GFC. Chart 5. o Whilst credit growth has been subdued, CBA has been able to satisfy the bulk of its funding requirement from domestic deposits. o Deposits growth is mitigating exposure to wholesale funding, with strong growth in retail and business deposits maintaining deposits‟ share of 62% of total funding. Chart 4. We have forecast for a further ~2bp decline in NIM for 1H13. We have forecast CBA to capture a full period of benefits from repricing of its lending portfolios from out-of-cycle rate rises in May 2012 and June 2012 and for this to increase NIM by 9.6bps. However, we believe that near-term funding pressures continue, with pricing competition in deposits and term deposits intensifying and long-term wholesale funding continuing to creep up. CHART 4. FUNDING COMPOSITION CHART 5. INDICATIVE WHOLESALE FUNDING COSTS Source: CBA Source: CBA Capital Management CBA announced its total FY12 dividend to be $3.34, up 4% pcp, whilst also flagging a number of changes to its dividend policy: Board will target FY payout ratio of 70-80% on a cash basis (75% in FY12). Payout ratio for interim dividends will be increased to approximately 70% of interim profits to smooth dividend distribution over the FY. The DRP will continue but no discount will be applied. The CEO noted that it could move to buyback DRP shares in the future so as to remove any impact from dilution and also stated that there is a future point where there will be no need for further capital and the DRP may be scrapped entirely. Shares will trade ex-dividend on the 20 August 2012.

- 17. 17 SEGMENT PERFORMANCE TABLE #: DIVISIONAL PERFORMANCE CBA Divisional Performance Cash earnings (A$M) % FY12 total 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 1H11 - 2H10 2H10 - 1H10 1H12 - 2H11 % 2H12 - 1H12 Retail Banking Services 42.3% 1119 988 1,237 1,207 1,383 1,453 1,439 1495 14.6% 5.1% -1.0% 3.9% Business & Private Banking 14.6% 205 531 440 453 506 532 551 516 11.7% 5.1% 3.6% -6.4% Institutional Banking & Markets 14.5% 553 646 512 506 547 513 -20.7% -1.2% 8.1% -6.2% Wealth Management 8.4% 175 111 379 339 359 283 272 297 5.9% -21.2% -3.9% 9.2% New Zealand 6.6% 161 227 234 236 258 232 3.1% 0.9% 9.3% -10.1% Bankwest 7.2% 15 -60 224 239 268 256 n/a 6.7% 12.1% -4.5% Other 6.4% 514 722 158 346 117 251 241 228 -66.2% 114.5% -4.0% -5.4% Totals 100.0% 2,013 2,402 2,943 3,158 3,335 3,500 3,576 3,537 5.6% 4.9% 2.2% -1.1% Source: CBA Reports Cash earnings (A$M) Growth Rates Retail Banking Services (RBS) (42.3% of 2H12 earnings) 5bp net interest margin (NIM) decline did not surprise, but recent out-of-cycle rate rises lated in 2H12 is expected to boost margins early in 1H13. o Cash net profit after tax (NPAT) up 3.9% hoh, driven by strong volume growth in consumer finance offsetting net interest margin contraction of 5bps since December 1H12 result (from 2.30% to 2.25%). Chart 4. o Asset quality remains strong, a reduction in impairment expense by ~30% driving earnings and 30+ days and 90+ days arrears falling across all businesses as trends normalised after natural disasters and collections effectiveness improved. CBA noted that contrary to recent press suggestions hardship cases were factored into arrears. Chart 5. o Cost-to-income (CTI) target remains 35%, with the CTI ratio improving in 2H12 to 38.0% from 38.3%. CHART 4. RBS NET INTERST MARGIN (bps) Source: CBA

- 18. 18 CHART 5. HOME LOAN ARREARS (%) Source: CBA Business & Private Bank (BPB) 15.4% of 1H12 earnings. Cost reductions and productivity gains failed to offset declining business banking income declining equities and margin lending income. o Cash NPAT +3.6% hoh to $551m. o Segment income growth driven by: Banking income down 2% as effective margin management didn‟t mitigate lower sales of risk management products. o Equities and margin lending income decreased 9%, reflecting the decline in equities trading volumes and poor investor sentiment. o CTI +100bps to 43.9% hoh. Institutional Banking & Markets 14.5% of Group 2H12 earnings CBA again flagged cyclical headwinds against their key markets-facing business. o Cash NPAT -6.2% to $513m for 2H12. o Loan impairment expense increased 264% hoh, reflecting not only the low base in 1H12 but an increase in individually assessed provisions. o Income was also hit by unfavourable counterparty fair value adjustments due to widening credit spreads and falling interest rates, but also largely reversing the favourable fair value adjustment in the prior FY. o CTI -50bps to 36.0%. Wealth Management 8.4% of Group 2H12 earnings Performance was mixed as cash profit declined 11% YoY, but 2H12 showed a strong improvement HoH, increasing 9.2% as revenue increased 25% despite significant pressure on investment markets. FUA increased despite poor sentiment, with strong investor flows weighted towards less volatile asset classes. o Cash NPAT +9.2% to $297m. o Average FUA up 3% to $192.3bn. o CTI +690bps in 2H12. Bankwest 7.2% of 1H12 cash earnings

- 19. 19 Cash NPAT declined as repricing initiatives lagged increases in wholesale funding costs. o Cash NPAT -4% to $256m o Business loan balances declined due to pressure from funding costs. o CTI +140bps in 2H12 to 51.9% as funding pressures eroded a decline in operating expenses due to lower IT expenses and cost management. New Zealand 6.6% of Group earnings. Profit decline driven by: (i) margin decrease as loan portfolio shift to higher margin variable rate loans abated; (ii) operating expenses climbed due to increased renewal commission expenses; and (ii) loan impairment expense increased as lending portfolios stabilised in the second half after benefiting from improvement in the rural portfolio in 1H12. o CBA‟s smallest segment o Cash NPAT -10% to NZ$302m. o CTI +145bps to 51.6%.

- 20. 20 FINANCIAL SUMMARY Commonwealth Bank of Australia CBA As at: 28/11/2012 Recommendation: Neutral Share Price $59.22 Year end June 2012A 2013E 2014E 2015E INCOME STATEMENT Interest Income $m 38,258 31,274 33,305 36,377 Interest Expense $m (25,136) (17,915) (19,611) (22,316) Net Interest Income $m 13,122 13,359 13,694 14,061 Non Interest Income Fees & Commissions $m 4,089 3,639 3,572 3,611 Trading Income $m 522 503 429 442 Other Banking Income $m 0 0 0 0 Banking Non Interest Income $m 4,611 4,142 4,001 4,053 Wealth Management Income $m 1,940 2,660 2,822 2,822 Income/(Loss) from Associates $m 0 0 0 1 Total operating income $m 20,384 20,656 21,122 21,783 Operating Expenses Personnel Expenses $m (4,947) (4,961) (4,975) (5,065) Occupancy & Equipment $m (1,056) (1,077) (1,099) (1,132) Total Operating Expenses $m (9,331) (9,433) (9,536) (9,763) Pre Prov. Oper. Profit Before Tax $m 11,053 11,223 11,586 12,020 Bad debt charge $m (1,089) (1,110) (1,000) (1,042) Pre Tax Profit $m 9,964 10,113 10,587 10,978 Tax Expense $m (2,858) (2,832) (2,964) (3,074) Minorities $m (16) (16) (17) (18) Reported Profit Statutory $m 7,090 7,265 7,605 7,887 Cash earnings adjustment $m 23 23 23 23 Reported Cash Profit $m 7,113 7,288 7,628 7,910 Preference Share Dividends $m (42) (42) (42) (42) E&P Normalised NPAT $m 7,071 7,246 7,586 7,869 E&P Cash EPS ¢ 450.4 458.5 475.2 492.4 Basic Cash EPS ¢ 453.1 461.2 477.8 494.9 Reported EPS ¢ 453.1 461.2 477.8 494.9 Dividend per Share ¢ 334.0 345.0 357.0 371.0 BALANCE SHEET Gross Loans & Other Receivables $m 532,380 552,082 574,837 598,698 Total Assets $m 718,229 744,671 775,027 806,821 Impaired Assets $m 2,491 1,679 2,690 1,820 Deposits & Other Pub. Borrowing $m 437,655 453,852 472,557 492,173 Bonds, notes & subordinat’d debt $m 135,268 140,274 146,055 152,118 Total Shareholder Equity $m 41,572 43,343 45,207 47,123 Avg housing loans $m 343,022 358,836 376,405 395,641 Avg non-housing loans $m 185,801 126,562 128,820 131,171 Avg total gross loans $m 528,823 485,399 505,224 526,812 Avg Interest Earning Assets $m 629,685 645,563 668,023 695,810 Avg Total Assets $m 706,746 724,567 749,776 780,963 Avg Interest Bearing Liabilities $m 590,654 605,548 626,616 652,680 Avg Total Liabilities $m 667,497 684,329 708,138 737,592 Avg Shareholders’ Equity $m 39,249 40,239 41,639 43,371 GROWTH RATES Per Share E&P Cash EPS % 2.4% 1.8% 3.6% 3.6% Basic Cash EPS % 2.4% 1.8% 3.6% 3.6% Dividend Per Share % 4.4% 3.3% 3.5% 3.9% Profit & Loss Net Interest Income % 4.1% 1.8% 2.5% 2.7% Banking Non Interest Income % 18.4% (10.2)% (3.4)% 1.3% Wealth Management Income % (5.0)% 37.1% 6.1% 0.0% Total Non Interest Income % 18.4% (10.2)% (3.4)% 1.3% Total Operating Income % 5.1% 1.3% 2.3% 3.1% Operating Expenses % 3.0% 1.1% 1.1% 2.4% Pre-Provision Profit % 6.9% 1.5% 3.2% 3.7% Impairment Charges % (14.9)% 1.9% (9.9)% 4.2% Cash Profit % 4.1% 2.5% 4.7% 3.7% Balance Sheet Gross Loans & Other Receivables % 4.9% 3.7% 4.1% 4.2% Total Shareholders’ Equity % 11.5% 4.3% 4.3% 4.2% Average Balance Sheet Housing Loans % 4.0% 4.6% 4.9% 5.1% Non-Housing Loans % 53.9% (31.9)% 1.8% 1.8% Avg Interest Earning Assets % 9.3% 2.5% 3.5% 4.2% Avg Interest Bearing Liabilities % 9.6% 2.5% 3.5% 4.2% Year end June 2012A 2013E 2014E 2015E VALUATION METRICS E&P Cash P/E Multiple x 13.1 12.8 12.4 12.0 Basic P/E Multiple x 13.1 12.9 12.5 12.0 Price/Pre-prov. operating profit x 8.5 8.4 8.2 7.9 NTA per share $ 19.3 20.2 21.0 21.9 Book Value per Share $ 25.8 26.9 27.9 29.2 Price/NTA x 3.1 2.9 2.8 2.7 Price/Book x 2.3 2.2 2.1 2.0 Dividend per Share ¢ 334.0 345.0 357.0 371.0 Dividend Payout Ratio x 0.7 0.8 0.8 0.8 Dividend Yield % 5.6% 5.8% 6.0% 6.3% Grossed Up Yield % 8.1% 8.3% 8.6% 8.9% Issued Shares m 1,592.0 1,593.1 1,599.8 1,596.4 Weighted Average Shares m 1,674.0 1,668.0 1,668.0 1,668.0 PERFORMANCE ANALYSIS Profitability Income / Avg Assets % 2.9% 2.9% 2.8% 2.8% Expense / Avg Assets % 1.3% 1.3% 1.3% 1.3% Return on Average Assets % 1.0% 1.0% 1.0% 1.0% Return on Ordinary Equity % 18.0% 18.0% 18.2% 18.1% Return on Risk Weighted Assets % 2.3% 2.3% 2.3% 2.3% Net Interest Margin Analysis Net Interest Spread % 1.8% 1.9% 1.9% 1.8% Net Interest Margin % 2.1% 2.2% 2.1% 2.1% Non Int. Income to Total Income % 35.6% 35.3% 35.2% 35.4% Efficiency Cost/Income % 45.8% 45.7% 45.1% 44.8% Tax Rate Effective tax rate % 28.7% 28.0% 28.0% 28.0% CAPITAL ADEQUACY Risk Weighted Assets $m 302,787 320,208 333,405 347,245 Tier 1 Capital $m 30,299 32,021 33,341 34,724 Total Capital $m 33,238 40,026 41,676 43,405 Tier 1 Ratio % 10.0% 10.0% 10.0% 10.0% Tier 2 Ratio % 1.0% 2.5% 2.5% 2.5% Total Capital Ratio % 11.0% 12.5% 12.5% 12.5% ACE Ratio % 7.8% 8.0% 8.2% 8.4% Tangible Leverage Ratio % 4.3% 4.3% 4.3% 4.3% ASSET QUALITY 90-day Past Due Loans $m 2,742 1,848 2,961 2,004 Non Performing Loans $m 2,491 2,082 2,168 2,258 NPL / Gross Loans and Other Rec % 0.5% 0.4% 0.4% 0.4% Total Provisions $m 6,698 6,946 7,232 7,532 Total Prov. / Gr. Loans & Oth Rec % 1.3% 1.3% 1.3% 1.3% Individual Provision $m 2,008 2,082 2,168 2,258 Individual Provision Cover % 80.6% 124.1% 80.6% 124.1% Collective Provision $m 4,690 4,864 5,064 5,274 Collective Prov. / Perform. Loans % 0.9% 0.9% 0.9% 0.9% Impairment Charges / Avg RWA % 0.4% 0.3% 0.3% 0.3% Imp Assets / Gr. Loans & Oth Rec % 0.5% 0.3% 0.5% 0.3% Impaired asset coverage % 80.6% 124.1% 80.6% 124.1% Collective Provision / RWA % 1.5% 1.5% 1.5% 1.5% BDD / Gr. loans and Oth Rec % 0.2% 0.2% 0.2% 0.2% WEALTH MANAGEMENT Funds Under Administration $m 189,699 198,667 210,761 223,677 Inforce Premiums $m 2,276 2,091 2,325 2,538 Funds Mgt Revenue Margin % 0.0% 0.0% 0.0% 0.0% Life Insurance Revenue margin % 0.0% 0.0% 0.0% 0.0% Shareholder Invest. Returns % 0.0% 0.0% 0.0% 0.0%

- 21. 21 NAB - UK BANK CONCEALS AUSTRALIAN BANKING’S HIDDEN VALUE RECOMMENDATION : NEUTRAL (WAS POSITIVE) Downgrade to Neutral (was Positive), blended valuation $27.07 (was $27.83). WHAT’s NEW? The UK has experienced a “double dip” earnings recovery, with a good turnaround coming into 2H11 (up +25.8% in 1H11 and up +36.1% in 2H11), followed by a downturn coming in the last two halves. Chart 3. NAB’s Australian Banking segment is outperforming peers, with earnings up +10.5% in 1H12 and up +2.2% in 2H12 (vs CBA 2.1% and 0%). Table 3. Business Banking loses it growth momentum, up +7.6% in 1H11 and up +7.0% in 2H11, then flat in 1H12 and now down -9.4% in 2H12. Personal Banking price discounting (then re-pricing) strategy is working. Strong cost performance, with 2H12 operating expense down -1.9%, contrasting sharply with ANZ‟s +6.1% 2H12 cost growth. Table 5. WHAT CHANGED? FY13F EPS down 8%, FY14F EPS down 10% WHAT NOW? Positive sector read-through for Australian Banking franchises, particularly for CBA and WBC, given their domestic focus: (i) Australian banking earnings are still growing; and (ii) asset quality leading indicators are benign. NAB‟s Australian banking operations are performing well and asset quality outlook remains benign. Personal Banking re-pricing to continue. CEO would not commit to NAB retaining the lowest standard variable mortgage rate. Table 6. Business Banking turnaround deferred. Despite an increase in system business credit of +3.8%, average interest earning assets only increased +2.9% through FY12. When NAB eventually exits the UK (refer EAP Note, “NAB’s Battle of Britain: Beginning of the End for UK Exit”, 1 May 2012”), we estimate NAB will trade at $28.32, based on a PE-valuations of CBA and WBC and that NAB’s Australian Banking performance metrics are comparable. In the medium-term, we expect the underlying value of NAB‟s Australian franchise to come through. In the short-term, the risk of further asset quality declines in the UK remains, which may cap near-term upside. Trading Data Last Price $25.79 12 month range $21.82 - $26.95 Market Cap $59,246m Free Float $57,599m (97%) Avg. Daily Volume 6.8m Avg. Daily Value $169.9m 12 month return (historical) 9.8% Asset growth supported by NAB’s lower product pricing relative to peers. Funding costs have continued to pressure margins. Earnings Forecasts Yr to September 09A 10A 11A 12A 13E 14E E&P Cash EPS (¢) 190.1 219.4 255.6 251.9 237.9 247.0 Basic Cash EPS (¢) 204.7 221.2 257.3 253.6 239.5 248.6 Reported EPS (¢) 123.4 202.1 244.2 190.2 235.7 245.8 E&P Cash EPS Growth (%) (15.2) 15.4 16.5 (1.4) (5.6) 3.8 DPS (¢) 146.0 152.0 172.0 180.0 179.6 179.6 Yield (%) 5.7 5.9 6.7 7.0 7.0 7.0 Grossed-Up Yield (%) 8.1 8.4 9.5 10.0 10.0 9.9 Franking (%) 100% 100% 100% 100% 100% 100% E&P Cash Multiple (x) 12.6 11.7 10.0 10.2 10.8 10.4 Price/Book (x) 1.4 1.4 1.3 1.3 1.4 1.4 PEG Ratio (x) 0.4 0.8 (1.5) (5.2) Net Interest Margin (%) 2.2 2.2 2.2 2.1 2.0 2.0 Return on Average Assets (%) 0.5 0.7 0.8 0.7 0.7 0.7 ROE (%) 9.8 11.8 13.4 13.0 13.0 13.3 Valuation (blended) 27.07 George Gabriel, CFA ggabriel@evansandpartners.com.au November 28, 2012 +61 3 9631 9853

- 22. 22 DISCOVERING HIDDEN VALUE - WHAT IS NAB WORTH WITHOUT UK BANKING? We conclude that the equity market is attributing a negative value of -$4.3bn to NAB‟s UK Banking franchise. When NAB eventually exits the UK (its exit plan was analysed in EAP Note, “NAB’s Battle of Britain: Beginning of the End for UK Exit”, dated 1 May 2012), we would expect this discount to unwind, resulting in a $28.32 PE-based valuation of NAB. Table 1. We believe NAB Australian Banking warrants a 11.5x PE multiple, the average of WBC and CBA, given NAB Australian Banking‟s profitability is on par with WBC and CBA. Table 2. Furthermore, we believe that NAB UK does have some intrinsic value. Assuming its value is in line with the depressed UK bank sector trading multiples of 0.2-0.4x price/book, this implies a value range of ~$659m to ~$989m, implying a normalised PE multiple of 6.6x - 9.9x. In the medium-term, we expect the underlying value of NAB’s Australian franchise to come through. However, in the short-term, the risk of further asset quality declines in the UK remains, which may cap near-term upside. TABLE 1: NAB AUSTRALIAN BANKING STAND-ALONE VALUATION NAB Australian and New Zealand Banking valuation FY12A Business Banking 2,409 Personal Banking 1,045 Wholesale Banking 1,092 MLC & NAB Wealth 518 Subtotal Australian Banking 5,064 NZ Banking 575 Australian and NZ Banking 5,639 less: normalised Corporate Functions -114 FY12 Normalised Cash Earnings 5,525 PE - average CBA and WBC 11.5x Implied Equity Market Value 63,538 Implied equity value per share of NAB Australia $28.32 Current market value attributed to UK Banking -4,292 % upside excluding UK Banking 7.2% Source: EAP TABLE 2: NAB AUSTRALIAN BANK STAND-ALONE VS AUSTRALIAN BANK PEERS CBA WBC NAB Australian Banking Reported cash NPAT (A$M) 7113 6390 5,525 RWA (A$M) 302,787 300,046 258,331 RoRWA 2.35% 2.13% 2.14% NIM 2.09% 2.17% 2.03% AIEA growth (% LTM) 5.40% 5.99% 9.63% Source: EAP

- 23. 23 SECTOR IMPLICATIONS There are two key sector implications of the NAB result: (i) Australian Banking segments are performing well; and (ii) stable Australian asset quality leading indicators. Australian Banking is actually performing well Australian earnings comprise 93% of CBA‟s total FY12 cash earnings and 89% of NAB‟s total cash earnings. Our analysis indicates NAB’s Australian Banking segment is outperforming. The UK remains the key drag. NAB‟s Australian Banking earnings were up +10.5% in 1H12 and up +2.2% in 2H12. Table 3. CBA Australia‟s cash earnings in Australia were up +2.1% in 1H12 and were flat in 2H12. Table 4. NAB’s positive momentum in Australian Banking implies a positive read-through for domestically focused banks such as WBC and CBA. TABLE 3: NAB CASH EARNINGS TRENDS Divisional Performance Cash earnings (A$M) % FY12 total 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 % 1H11 - 2H10 % 2H11 - 1H11 % 2H11 - 1H12 % 1H12 - 2H12 Business Banking 44.0% 823 776 1,095 1,098 1,181 1,264 1,264 1,145 7.6% 7.0% 0.0% -9.4% Personal Banking 22.3% 408 467 317 426 432 500 464 581 1.4% 15.7% -7.2% 25.2% Wholesale Banking 22.0% 613 535 403 302 393 268 518 574 30.1% -31.8% 93.3% 10.8% MLC & NAB Wealth 9.9% 178 259 263 285 269 234 259 259 -5.6% -13.0% 10.7% 0.0% Subtotal Australian Banking 2,022 2,037 2,078 2,111 2,275 2,266 2,505 2,559 7.8% -0.4% 10.5% 2.2% NZ Banking 10.7% 233 189 202 214 215 254 297 278 0.5% 18.1% 16.9% -6.4% UK Banking -6.8% 110 52 107 97 122 166 -36 -177 25.8% 36.1% -121.7% -391.7% Specialised Group Assets -0.2% -258 -319 -217 -45 77 33 -3 -6 271.1% -57.1% -109.1% -100.0% Great Western Bank 1.9% 40 33 33 41 47 41 48 50 14.6% -12.8% 17.1% 4.2% Subtotal International Businesses 125 -45 125 307 461 494 306 145 50.2% 7.2% -38.1% -52.6% Corporate Functions -0.2% 24 -77 58 56 17 142 92 -5 -69.6% 735.3% -35.2% -105.4% Other -3.6% -144 -101 -68 -86 -85 -110 -75 -94 1.2% -29.4% 31.8% -25.3% Subtotal Other -120 -178 -10 -30 -68 32 17 -99 -126.7% 147.1% -46.9% -682.4% Totals 100.0% 2,027 1,814 2,193 2,388 2,668 2,792 2,828 2,605 11.7% 4.6% 1.3% -7.9% Cash earnings (A$M) Growth rates Source: EAP, company reports TABLE 4: CBA CASH EARNINGS TRENDS CBA Divisional Performance Cash earnings (A$M) % FY12 total 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 % 1H11 - 2H10 % 2H11 - 1H11 % 1H12 - 2H11 % 2H12 - 1H12 Retail Banking Services 42.3% 1119 988 1,237 1,207 1,383 1,453 1,439 1495 14.6% 5.1% -1.0% 3.9% Business & Private Banking 14.6% 205 531 440 453 506 532 551 516 11.7% 5.1% 3.6% -6.4% Institutional Banking & Markets 14.5% 553 646 512 506 547 513 -20.7% -1.2% 8.1% -6.2% Wealth Management 8.4% 175 111 379 339 359 283 272 297 5.9% -21.2% -3.9% 9.2% Bankwest 7.2% 15 -60 224 239 268 256 n/a 6.7% 12.1% -4.5% Subtotal Australia 1,499 1,630 2,624 2,585 2,984 3,013 3,077 3,077 15.4% 1.0% 2.1% 0.0% New Zealand 6.6% 161 227 234 236 258 232 3.1% 0.9% 9.3% -10.1% Other 6.4% 514 772 158 346 117 251 241 228 -66.2% 114.5% -4.0% -5.4% Totals 100.0% 2,013 2,402 2,943 3,158 3,335 3,500 3,576 3,537 5.6% 4.9% 2.2% -1.1% Source: CBAReports Cash earnings (A$M) Growth Rates Source: EAP, company reports Leading indicators of Australian asset quality are benign. NAB’s 90 days past due and impaired assets/total gross loans in Australia have actually declined from 1.5% in 1H12 to 1.43%. However, including the UK, the leading indicators have turned negative, reversing a trend decline from 1.92% in 1H11 to 1.77% to 1.73% then back up to 1.78% in 2H12.

- 24. 24 CHART 1: ASSET QUALITY Source: EAP CHART 2: ASSET QUALITY 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% 2.0% 1H10 2H10 1H11 2H11 1H12 2H12 (Grossimpaired+90dpd)/Gross Loans NAB CBA WBC Source: EAP. Note 2H12 for WBC is a forecast.

- 25. 25 FY12 RESULTS ANALYSIS Our Positive recommendation on NAB has been based on: (i) NAB providing the sector‟s greatest leverage to a turnaround in Business Banking loan volumes, given NAB has a sector leading 24% corporate loan market share, generating 44% of FY12 earnings. (ii) The eventual exit from UK to help unwind NAB‟s valuation discount. Refer EAP Note, “NAB’s Battle of Britain: Beginning of the End for UK Exit”, dated 1 May 2012. (iii) Free option within NAB‟s Personal Banking segment to re-price its standard variable mortgage rates and increase margins. In this result, Personal Banking outperformed, but both Business Banking and UK Banking disappointed. They key 2H12 result drivers were that strong performances in Personal Banking (up +$117m) and Wholesale Banking (+$56m) were offset by declines in Business Banking (down -$114m) and UK Banking (down - $141m). Australian Banking is actually performing well, up +2.2% in 2H12 and up +10.5% in 1H12. Furthermore, it has the potential to outperform as Business Banking volumes increase and MLC & NAB Wealth experiences cyclical growth. Table 5. The UK has experienced a “double dip” earnings recovery, with a good turnaround coming into 2H11 (up +25.8% in 1H11 and up +36.1% in 2H11), followed by a downturn coming in the last two halves. Chart 3. Business Banking has also lost its growth momentum, up +7.6% in 1H11 and up +7.0% in 2H11, then flat in 1H12 and now down -9.4% in 2H12. Wholesale Banking increased +10.8% through higher sales of FX and risk management products to customers and through development of its debt capital raising and distribution capability. Strong cost performance, with 2H12 operating expense down -1.9%. Table 5. Strong growth in other operating income, up +8.0% in 2H12, driven by a substantial increase in sales of risk management products to customers. TABLE 5: CASH EARNINGS TRENDS Group Performance Cash earnings (A$M) % 2H12 total 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 % 1H11 - 2H10 % 2H11 - 1H11 % 2H11 - 1H12 % 1H12 - 2H12 Net interest income 252.9% 5,884 6,188 6,114 6,174 6,304 6,788 6,708 6,589 2.1% 7.7% -1.2% -1.8% Other operating income 68.0% 2,091 1,675 1,375 1,463 1,725 1,291 1,640 1,772 17.9% -25.2% 27.0% 8.0% MLC net operating income 29.0% 539 529 748 764 770 716 760 755 0.8% -7.0% 6.1% -0.7% Net operating income 349.9% 8,514 8,392 8,237 8,401 8,799 8,795 9,108 9,116 4.7% 0.0% 3.6% 0.1% Operating expenses -148.8% -3,770 -3,810 -3,861 -4,001 -3,991 -3,983 -3,952 -3,876 0.2% -0.2% -0.8% -1.9% PPOP 201.2% 4,744 4,582 4,376 4,400 4,808 4,812 5,156 5,240 9.3% 0.1% 7.1% 1.6% Bad debt expense -57.0% -1,811 -2,004 -1,230 -1,033 -988 -834 -1,131 -1,484 4.4% -15.6% 35.6% 31.2% Cash earnings before tax 144.2% 2,933 2,578 3,146 3,367 3,820 3,978 4,025 3,756 13.5% 4.1% 1.2% -6.7% Tax expense -40.6% -725 -726 -884 -893 -1,066 -1,076 -1,121 -1,057 -19.4% -0.9% -4.2% 5.7% Cash earnings pre-minorities 103.6% 2,208 1,852 2,262 2,474 2,754 2,902 2,904 2,699 Minority equity 0.0% -11 11 -1 0 -1 0 -1 0 Other -3.6% -170 -49 -68 -86 -85 -110 -75 -94 1.2% -29.4% 31.8% -25.3% Underlying cash earnings 2,027 1,814 2,193 2,388 2,668 2,792 2,828 2,605 11.7% 4.6% 1.3% -7.9% Source: Company Reports; EAP Cash earnings (A$M) Growth rates PERSONAL BANKING NAB’s Personal Banking strategy has worked, with Personal Bank net interest margin up 2bp to 2.04% (an upside surprise in a tough competitive environment), whilst volumes were also up +4.1% in 2H12, and cash earnings up +25.2%. NAB has gained share through its price discounting strategy, and is slowly unwinding its price discounts to increase earnings. Table 6. Note that NAB remains the sector‟s cheapest on SVR mortgages, and has an embedded option to re-price its home loan back book to continue earnings growth in Personal Banking. The CEO has declined to commit to retaining the lowest standard variable mortgage rate: “We haven’t decided, but we will decide before New Year’s Eve”. NAB‟s out-of-cycle rate rises are driving Personal Banking earnings growth and we expect this to continue as an incremental upside.

- 26. 26 TABLE 6: OUT-OF-CYCLE RATE RISES Standard Variable Mortgage Rates ANZ CBA NAB WBC BEN BOQ Average Out-of-cycle rate rises 11/2011 (RBA 25bp cut) - - 0.05% - - - 0.05% 12/2011 (RBA 25bp cut) - - - - - - - 02/2012 0.06% 0.10% 0.09% 0.10% 0.15% - 0.10% 03/2012 - - - - - 0.10% 0.10% 04/2012 0.06% - - - - - 0.06% 1/05/2012 (RBA 50 bp cut) 0.13% 0.10% 0.18% 0.13% 0.15% 0.15% 0.14% 1/06/2012 (RBA 25bp cut) - 0.04% 0.04% 0.05% 0.05% 0.05% 0.05% 1/10/2012 (RBA 25bp cut) 0.05% 0.05% 0.05% 0.07% 0.06% 0.05% 0.06% Total re-pricing 0.30% 0.29% 0.41% 0.35% 0.41% 0.35% 0.35% Current SVR 6.60% 6.60% 6.58% 6.71% 6.71% 6.71% 6.65% Source: EAP UK BANKING UK exit – Battle of Britain – correct strategy not to fire-sell UK assets, and run them off over time. UK cash earnings have experienced a “double dip” in cash earnings, with large increases in 1H11 +35.1%, +37.7% in 2H11 to negative in 1H12 and 2H12 on increased bad debt expenses. Chart 3. Tables 3-5. Also, despite NAB’s planned exit from the UK, the outlook for its remaining assets is disappointing, with 90 days past due and gross impaired/total loans increased from 1H12 3.68% to 4.76%. CHART 3: UK CASH EARNINGS “DOUBLE DIP” BUSINESS BANKING Business Banking has disappointed on lower margin outcomes (tougher competition and funding markets), with cash earnings down -9.4%. Given Business Bank comprises ~45% of total revenue, its disappointment has more than offset upside in Personal Bank (16% total revenue). Table 3. Despite strong performances in both Personal Banking (up 25.2% in 2H12; 16.4% total revenue) and Wholesale Banking (up +10.8% in 2H12, 18.3% total revenue), the key disappointment is Business Banking (down -9.4% in 2H12). Despite a volume increase, Business Banking margins have been hurt by competition, with the margin result surprising on the downside. Cash earnings in Business Bank down -9.4% in 2H12, driven by declining Net Interest Margin (NIM) of 6bp in 2H12, even though loan assets increased +1% in 2H12.

- 27. 27 TABLE 7: BUSINESS BANKING CASH EARNINGS TRENDS Business Banking Key Metrics Business banking 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 % 1H11 - 2H10 % 2H11 - 1H11 % 2H11 - 1H12 % 1H12 - 2H12 Net operating income (A$M) 2538 2684 2782 2837 2938 3101 3047 3015 3.6% 5.5% -1.7% -1.1% Expenses (A$M) -809 -836 -843 -871 -879 -885 -875 -866 -0.9% -0.7% 1.1% 1.0% Bad debt expense (A$M) -559 -757 -381 -410 -385 -417 -372 -521 6.1% -8.3% 10.8% -40.1% Cash earnings (A$M) 823 776 1095 1098 1181 1264 1264 1145 7.6% 7.0% 0.0% -9.4% Average Interest Earning Assets (A$M) 184 183 185 188 191 194 198 200 1.5% 1.8% 1.9% 1.0% RWA (A$M) 137 136 139 145 148 141 141 141 1.9% -4.2% -0.6% 0.4% Net interest margin (%) 2.24% 2.45% 2.51% 2.50% 2.57% 2.66% 2.56% 2.50% 0.07% 0.09% -0.10% -0.06% Jaws 2.4% 2.8% -1.3% 2.6% 4.9% -0.6% 0.0% Cost to income ratio 31.9% 31.1% 30.3% 30.7% 29.9% 28.5% 28.7% 28.7% -2.6% -4.6% 0.6% 0.0% Cash earning on AIEA (%) 0.89% 0.85% 1.19% 1.17% 1.24% 1.30% 1.28% 1.15% 0.07% 0.06% -0.02% -0.13% Source: Company Reports; EAP Growth rates

- 28. 28 FINANCIAL SUMMARY National Australia Bank NAB As at: 28/11/2012 Recommendation: Neutral Share Price $23.83 Year end September 2012A 2013E 2014E 2015E INCOME STATEMENT Interest Income $m 34,542 32,500 35,305 39,318 Interest Expense $m (21,300) (19,066) (21,291) (24,435) Net Interest Income $m 13,242 13,434 14,014 14,883 Non Interest Income Fees & Commissions $m 2,468 2,718 3,019 3,185 Trading Income $m 626 657 554 479 Other Banking Income $m 0 0 0 0 Banking Non Interest Income $m 3,094 3,374 3,573 3,663 Wealth Management Income $m 1,515 2,066 1,839 1,985 Income/(Loss) from Associates $m 0 0 0 0 Total operating income $m 17,715 18,875 19,426 20,532 Operating Expenses Personnel Expenses $m (4,526) (4,458) (4,457) (4,483) Occupancy & Equipment $m (609) (663) (676) (697) Total Operating Expenses $m (8,822) (8,818) (8,874) (8,985) Pre Prov. Oper. Profit Before Tax $m 8,893 10,057 10,552 11,547 Bad debt charge $m (2,615) (2,119) (2,257) (2,364) Pre Tax Profit $m 6,278 7,939 8,295 9,183 Tax Expense $m (2,077) (2,397) (2,497) (2,752) Minorities $m 0 0 0 0 Reported Profit Statutory $m 4,201 5,542 5,798 6,431 Cash earnings adjustment $m 1,313 12 (11) (49) Reported Cash Profit $m 5,552 5,592 5,825 6,420 Preference Share Dividends $m (38) (38) (38) (38) E&P Normalised NPAT $m 5,514 5,554 5,787 6,382 E&P Cash EPS ¢ 251.9 237.9 247.0 274.4 Basic Cash EPS ¢ 253.6 239.5 248.6 276.1 Reported EPS ¢ 190.2 235.7 245.8 274.9 Dividend per Share ¢ 180.0 179.6 179.6 182.7 BALANCE SHEET Gross Loans & Other Receivables $m 461,983 487,476 514,636 542,682 Total Assets $m 773,399 804,066 839,480 876,096 Impaired Assets $m 6,543 6,876 7,220 7,574 Deposits & Other Pub. Borrowing $m 426,789 447,867 470,377 493,614 Bonds, notes & subordinat’d debt $m 99,768 99,768 99,768 99,768 Total Shareholder Equity $m 42,964 42,484 44,635 46,913 Avg housing loans $m 259,033 276,658 293,809 311,835 Avg non-housing loans $m 186,520 199,986 209,401 218,917 Avg total gross loans $m 445,553 476,645 503,210 530,752 Avg Interest Earning Assets $m 629,972 658,534 687,389 717,285 Avg Total Assets $m 760,223 794,690 829,511 865,588 Avg Interest Bearing Liabilities $m 564,596 572,156 594,050 616,787 Avg Total Liabilities $m 717,647 751,966 785,951 819,814 Avg Shareholders’ Equity $m 42,576 42,724 43,560 45,774 GROWTH RATES Per Share E&P Cash EPS % (1.4)% (5.6)% 3.8% 11.1% Basic Cash EPS % (1.4)% (5.6)% 3.8% 11.1% Dividend Per Share % 4.7% (0.2)% 0.0% 1.8% Profit & Loss Net Interest Income % 1.6% 1.5% 4.3% 6.2% Banking Non Interest Income % 12.9% 9.1% 5.9% 2.5% Wealth Management Income % 2.0% 36.4% (11.0)% 8.0% Total Non Interest Income % 12.9% 9.1% 5.9% 2.5% Total Operating Income % 5.2% 6.5% 2.9% 5.7% Operating Expenses % 5.5% 0.0% 0.6% 1.3% Pre-Provision Profit % 4.9% 13.1% 4.9% 9.4% Impairment Charges % 49.4% (19.0)% 6.5% 4.7% Cash Profit % 1.7% 0.7% 4.2% 10.2% Balance Sheet Gross Loans & Other Receivables % 5.2% 5.5% 5.6% 5.4% Total Shareholders’ Equity % 1.8% (1.1)% 5.1% 5.1% Average Balance Sheet Housing Loans % 8.9% 6.8% 6.2% 6.1% Non-Housing Loans % 6.4% 7.2% 4.7% 4.5% Avg Interest Earning Assets % 8.5% 4.5% 4.4% 4.3% Avg Interest Bearing Liabilities % 9.0% 1.3% 3.8% 3.8% Year end September 2012A 2013E 2014E 2015E VALUATION METRICS E&P Cash P/E Multiple x 9.4 9.9 9.6 8.6 Basic P/E Multiple x 9.5 10.0 9.6 8.7 Price/Pre-prov. operating profit x 5.9 5.5 5.3 4.8 NTA per share $ 16.1 14.7 15.4 16.3 Book Value per Share $ 19.6 18.2 19.0 20.2 Price/NTA x 1.5 1.6 1.5 1.5 Price/Book x 1.2 1.3 1.3 1.2 Dividend per Share ¢ 180.0 179.6 179.6 182.7 Dividend Payout Ratio x 0.7 0.8 0.7 0.7 Dividend Yield % 7.6% 7.5% 7.5% 7.7% Grossed Up Yield % 10.8% 10.8% 10.8% 11.0% Issued Shares m 2,188.9 2,334.9 2,343.4 2,325.5 Weighted Average Shares m 2,188.9 2,334.9 2,343.4 2,325.5 PERFORMANCE ANALYSIS Profitability Income / Avg Assets % 2.3% 2.4% 2.3% 2.4% Expense / Avg Assets % 0.3% 0.3% 0.3% 0.3% Return on Average Assets % 0.7% 0.7% 0.7% 0.7% Return on Ordinary Equity % 13.0% 13.0% 13.3% 13.9% Return on Risk Weighted Assets % 1.7% 1.6% 1.6% 1.6% Net Interest Margin Analysis Net Interest Spread % 1.7% 1.6% 1.6% 1.5% Net Interest Margin % 2.1% 2.0% 2.0% 2.1% Non Int. Income to Total Income % 25.2% 28.8% 27.9% 27.5% Efficiency Cost/Income % 49.8% 46.7% 45.7% 43.8% Tax Rate Effective tax rate % 33.1% 30.2% 30.1% 30.0% CAPITAL ADEQUACY Risk Weighted Assets $m 331,336 349,620 369,099 389,214 Tier 1 Capital $m 35,000 34,962 36,910 38,921 Total Capital $m 39,636 40,429 42,681 45,007 Tier 1 Ratio % 10.6% 10.0% 10.0% 10.0% Tier 2 Ratio % 1.4% 1.6% 1.6% 1.6% Total Capital Ratio % 12.0% 11.6% 11.6% 11.6% ACE Ratio % 8.6% 8.1% 8.2% 8.3% Tangible Leverage Ratio % 4.6% 4.3% 4.3% 4.3% ASSET QUALITY 90-day Past Due Loans $m 2,203 2,315 2,431 2,550 Non Performing Loans $m 6,543 6,876 7,220 7,574 NPL / Gross Loans and Other Rec % 1.4% 1.4% 1.4% 1.4% Total Provisions $m 4,221 4,432 4,653 4,766 Total Prov. / Gr. Loans & Oth Rec % 0.9% 0.9% 0.9% 0.9% Individual Provision $m 1,875 1,970 2,069 2,119 Individual Provision Cover % 28.7% 28.7% 28.7% 28.0% Collective Provision $m 2,346 2,461 2,584 2,647 Collective Prov. / Perform. Loans % 0.5% 0.5% 0.5% 0.5% Impairment Charges / Avg RWA % 0.8% 0.6% 0.6% 0.6% Imp Assets / Gr. Loans & Oth Rec % 1.4% 1.4% 1.4% 1.4% Impaired asset coverage % 28.7% 28.7% 28.7% 28.0% Collective Provision / RWA % 0.7% 0.7% 0.7% 0.7% BDD / Gr. loans and Oth Rec % 0.6% 0.4% 0.4% 0.4% WEALTH MANAGEMENT Funds Under Administration $m 122,026 127,804 134,850 143,062 Inforce Premiums $m 1,524 1,574 1,703 1,893 Funds Mgt Revenue Margin % 0.8% 1.2% 0.9% 0.9% Life Insurance Revenue margin % 31.6% 37.9% 39.9% 39.9% Shareholder Invest. Returns % 0.0% 0.0% 0.0% 0.0%

- 29. 29 WESTPAC (WBC) - BREAD AND BUTTER BANKING DELIVERS THE DOUGH RECOMMENDATION : POSITIVE WHAT’s NEW? Focus on banking basics has driven the banking sector’s leading 2H12 result. Net operating income showing good momentum in 2 halves, up 3.1% 1H12 and 3.4% 2H12, driven by strong momentum in BT Financial Group, up +10.2% in 1H12 and 7.0% in 2H12. Focus on profitable business drove 2H12 net interest margin (NIM) outperformance (up 1bp to 2.18% 2H12), defying sector-wide NIM decline trends. Deposit market share gains supports customer cross-sell and strong balance sheet. Sector-leading efficiency and profitability metrics. Charts 2-4. WHAT’s CHANGED? FY13F EPS +4%, FY14F EPS +6%. Retain Positive view, blended valuation +7.2% to $26.84 (prev. $25.03) WHAT NOW? Sector preferences: 1. WBC - Positive (upgrade from #2), $26.84 val; 2. NAB – Neutral (downgrade from #1), $27.07 val; 3. CBA –Neutral, $56.94; 4. ANZ – Negative, $23.54 Out-of-cycle rate rises and cost reduction to continue supporting Australian Banking earnings. WBC’s sector-leading franking account balance ($1,029m; CBA $390m) and common equity Tier 1 ratio (Chart 6) provide medium-term flexibility for a special fully-franked dividend up to 78cps. We expect WBC will wait for further clarity on bad debt outlook and potentially extra capital charges for domestic systemically important banks. SECTOR IMPLICATIONS WBC’s relatively strong result is positive for CBA given its asset and business mix most closely resemble WBC. Higher payout ratios and subdued revenue growth highlight the sector’s vulnerability to external shocks (e.g. a bad debt cycle or higher funding costs). NAB has turnaround/growth potential in New Zealand and Wealth given its underperformance relative to WBC. Institutional Banking margin pressure is evident across the sector. Trading Data Last Price $25.59 12 month range $19.50 - $25.95 Market Cap $78,103m Free Float $76,291m (98%) Avg. Daily Volume 8.4m Avg. Daily Value $189.7m 12 month return (historical) 18.5% WBC is targeting profitable business acquisition (rather than volume per se) and so maintaining relatively high Net Interest Margin. Out-of-cycle repricing continues to support Australian Banking margins. Earnings Forecasts Yr to September 10A 11A 12A 13E 14E 15E E&P Cash EPS (¢) 198.6 210.2 216.8 225.6 232.4 248.0 Basic Cash EPS (¢) 198.6 210.2 216.8 225.6 232.4 248.0 Reported EPS (¢) 214.4 233.3 196.2 195.9 202.3 217.2 E&P Cash EPS Growth (%) 17.9 5.9 3.1 4.0 3.0 6.7 DPS (¢) 139.0 156.0 166.0 168.5 170.9 171.6 Yield (%) 5.5 6.2 6.5 6.6 6.7 6.8 Grossed-Up Yield (%) 7.8 8.8 9.4 9.5 9.6 9.7 Franking (%) 100% 100% 100% 100% 100% 100% E&P Cash Multiple (x) 12.9 12.2 11.8 11.3 11.0 10.3 Price/Book (x) 2.0 1.9 1.8 1.8 1.8 1.8 PEG Ratio (x) 1.4 1.7 1.6 1.1 Net Interest Margin (%) 2.2 2.2 2.2 2.1 2.0 2.0 Return on Average Assets (%) 1.0 1.0 1.0 1.0 1.0 1.1 ROE (%) 15.3 15.3 14.7 15.2 15.5 16.7 Valuation (blended) $26.84 George Gabriel, CFA ggabriel@evansandpartners.com.au November 28, 2012 +61 3 9631 9853

- 30. 30 EAP VIEW WBC’s focus on the fundamentals of banking (eg. deposit accounts, product cross-sell, margin retention, costs) has helped it deliver the sector’s strongest 2H12 results. Good underlying earnings momentum. Underlying cash earnings growth is now up +2.0% in 1H12 and +6.5% in 2H12, following a decline of -1.1% in 1H11. Deposit market share acquisition provides basis for product cross-sell WBC has gained +2.3% market share in business deposits, strongly outperforming peers. It has good momentum in deposits acquisitions, up 12% in the year, with a high 2H12 exit run-rate of 9%. TABLE 1: CHANGE IN MARKET SHARES IN LAST TWELVE MONTHS Cross-sell Cross-sell continues to improve wealth management penetration in insurance and funds management. Chart 1. CHART 1: CUSTOMER CROSS SELL TRENDS CHART 2: WBC LEADING WEALTH PENETRATION Notes: 1. Westpac Retail and Business Bank (WRBB) and St George Bank (SGB) Costs WBC‟s efficiency metrics are improving as its ongoing productivity focus is bears fruit. We analyse further (i) sector efficiency and profitability metrics; (ii) capital adequacy; and (iii) dividend payout ratio trends.

- 31. 31 1. SECTOR EFFICIENCY AND PROFITABILITY WBC is leading the sector on several key metrics: Efficiency metrics. o Highest average loan value per staff member (FTE). Chart 3. o Highest revenue per staff member (FTE). Chart 2. Profitability metrics. o Highest cash profit per staff member (FTE). Chart 4. o Lowest cost-to-income ratio. Chart 5. CHART2: REVENUE TO STAFF NUMBERS (FTE) CHART 3: AVERAGE LOAN VALUE PER STAFF MEMBER 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 ANZ CBA NAB WBC AIEAtoFTE($m) 1H07 2H12 Source:Company Reports Source: EAP, company reports. CHART 4: CASH PROFIT PER FTE CHART 5: COST-TO-INCOME RATIO (%) 30% 35% 40% 45% 50% 55% 60% 65% 70% ANZ CBA NAB WBC BOQ BEN Cost-to-IncomeRatio(%) 1H07 2H12 Source: E&P ResearchCost /Income (%) Source: EAP, company reports. 2. CAPITAL WBC leads the sector on capital adequacy. This positions WBC well for potential flexibility around active capital management. CHART 6: BASEL 3 COMMON EQUITY TIER 1 CAPITAL Source: EAP, company reports.

- 32. 32 3. DIVIDEND PAYOUT RATIOS We remain alert to the risk of dividend cuts across the sector, though at this stage our base case outlook is flat dividends in FY13F for ANZ and NAB, with some growth for WBC. Higher payout ratios combine with low earnings growth to create a vulnerability to an external shock such as a (i) bad debt expense cycle; or (ii) funding shocks. Either scenario could be the catalyst for bank sector dividend cuts. History illustrates that as payout ratios approach 100% in any half, banks are likely to cut dividends in subsequent halves. ANZ Bank‟s payout ratio in 2H08 reached 97% and then cut its dividend by 26% in 1H09, with the rest of the sector following. TABLE 2: DIVIDEND PAYOUT RATIOS Payout Ratios 1H08 2H08 1H09 2H09 1H10 2H10 1H11 2H11 1H12 2H12 ANZ 71% 97% 106% 54% 58% 68% 58% 69% 58% 69% EPS cash 0.87 0.76 0.43 1.03 0.90 1.09 1.11 1.10 1.13 1.14 DPS 0.62 0.74 0.46 0.56 0.52 0.74 0.64 0.76 0.66 0.79 growth % -26% -24% 13% 32% 23% 3% 3% 4% CBA 63% 87% 84% 74% 63% 84% 62% 84% 60% 89% EPS cash 1.79 1.76 1.35 1.55 1.90 2.02 2.13 2.26 2.27 2.22 DPS 1.13 1.53 1.13 1.15 1.20 1.70 1.32 1.88 1.37 1.97 growth % 0% -25% 6% 48% 10% 11% 4% 5% NAB 70% 96% 68% 80% 72% 71% 67% 70% 70% 79% EPS cash 1.38 1.01 1.08 0.92 1.03 1.10 1.25 1.26 1.29 1.14 DPS 0.97 0.97 0.73 0.73 0.74 0.78 0.84 0.88 0.90 0.90 growth % -25% -25% 1% 7% 14% 13% 7% 2% WBC 71% 72% 71% 76% 65% 76% 72% 77% 78% 76% EPS cash 0.99 1.00 0.79 0.79 1.00 0.97 1.06 1.04 1.05 1.11 DPS 0.70 0.72 0.56 0.60 0.65 0.74 0.76 0.80 0.82 0.84 growth % -20% -17% 16% 23% 17% 8% 8% 5% BEN 54% 64% 69% 66% 68% 71% 67% 63% 68% 74% EPS cash 0.52 0.58 0.41 0.23 0.41 0.42 0.45 0.48 0.44 0.40 DPS 0.28 0.37 0.28 0.15 0.28 0.30 0.30 0.30 0.30 0.30 growth % 0% -59% 0% 100% 7% 0% 0% 0% BOQ 78% 79% 108% 36% 65% 70% 130% 54% NM 50% EPS cash 0.45 0.48 0.24 0.73 0.40 0.37 0.20 0.52 -0.39 0.52 DPS 0.35 0.38 0.26 0.26 0.26 0.26 0.26 0.28 0.26 0.26 growth % -26% -32% 0% 0% 0% 8% 0% -7% Source: Company Reports, EAP