Adveritas (AV1) - Is Adveritas the next Dubber (DUB)

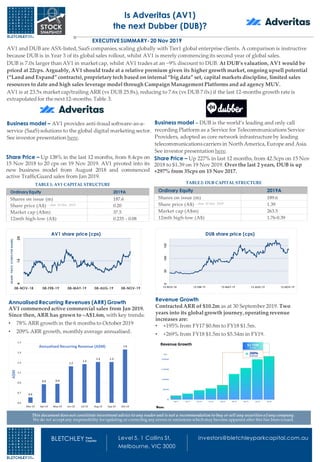

- 1. Level 5, 1 Collins St, Melbourne, VIC 3000 investors@bletchleyparkcapital.com.auBLETCHLEY Park Capital This document does not constitute investment advice to any reader and is not a recommendation to buy or sell any securities of any company. We do not accept any responsibility for updating or correcting any errors or omissions whichmay become apparent after this has been issued. OrdinaryEquity 2019A Shares on issue (m) 187.6 Share price (A$) – close 19 Nov 2019 0.20 Market cap (A$m) 37.5 12mth high-low (A$) 0.235 - 0.08 TABLE 1: AV1 CAPITAL STRUCTURE Is Adveritas (AV1) the next Dubber (DUB)? Share Price – Up 138% in the last 12 months, from 8.4cps on 15 Nov 2018 to 20 cps on 19 Nov 2019. AV1 pivoted into its new business model from August 2018 and commenced active TrafficGuard sales from Jan 2019. Business model – DUB is the world’s leading and only call recording Platform as a Service for Telecommunications Service Providers, adopted as core network infrastructureby leading telecommunicationscarriers in North America, Europe and Asia. See investor presentation here. Business model – AV1 provides anti-fraudsoftware-as-a- service (SaaS) solutions to the global digital marketing sector. See investor presentation here. Share Price – Up 227% in last 12 months, from 42.5cps on 15 Nov 2018 to $1.39 on 19 Nov 2019. Over the last 2 years, DUB is up +297% from 35cps on 15 Nov 2017. TABLE2: DUB CAPITAL STRUCTURE Annualised Recurring Revenues (ARR) Growth AV1 commenced active commercial sales from Jan 2019. Since then, ARR has grown to ~A$1.6m, with key trends: • 78% ARR growth in the 6 months to October 2019 • 209% ARR growth, monthlyaverage annualised. Ordinary Equity 2019A Shares on issue (m) 189.6 Share price (A$) – close 19 Nov 2019 1.39 Market cap (A$m) 263.5 12mth high-low (A$) 1.76-0.39 050100150 12-NOV-18 12-FEB-19 12-MAY-19 12-AUG-19 12-NOV-19 DUB share price (cps) 41424 08-NOV-18 08-FEB-19 08-MAY-19 08-AUG-19 08-NOV-19 SHAREPRICE(CENTSPERSHARE) AV1 share price (cps) Revenue Growth ContractedARR of $10.2m as at 30 September 2019. Two years into its global growth journey, operating revenue increases are: • +195% from FY17 $0.8m to FY18 $1.5m. • +269% from FY18 $1.5m to $5.54m in FY19. EXECUTIVE SUMMARY-20 Nov 2019 AV1 and DUB are ASX-listed, SaaS companies, scaling globally with Tier1 global enterprise clients. A comparison is instructive because DUB is in Year 3 of its global sales rollout, whilst AV1 is merely commencingits second year of global sales. DUB is 7.0x larger than AV1 in market cap, whilst AV1 trades at an ~9% discount to DUB. At DUB’s valuation, AV1 would be priced at 22cps. Arguably, AV1 should trade at a relative premium given its higher growth market, ongoing upsell potential (“Land and Expand” contracts), proprietary tech based on internal “big data” set, capital markets discipline, limited sales resources to date and high sales leverage model through Campaign Management Platforms and ad agency MUV. AV1 is at 23.5x market cap/trailing ARR (vs DUB 25.8x), reducing to 7.6x (vs DUB 7.0x) if the last 12-months growth rate is extrapolatedfor the next 12-months. Table 3. 0.6 0.9 0.9 1.2 1.3 1.3 1.3 1.6 0.5 0.7 0.9 1.1 1.3 1.5 1.7 Mar-19 Apr-19 May-19 Jun-19 Jul-19 Aug-19 Sep-19 Oct-19 A$M Annualised Recurring Revenue (A$M)

- 2. Level 5, 1 Collins St, Melbourne, VIC 3000 investors@bletchleyparkcapital.com.auBLETCHLEY Park Capital LEGAL DISCLAIMER Thiscontent is provided on an as is basis, without warranty (express or implied). Whilst theContent hasbeen prepared with all reasonable care from sources we believe to be reliable, no responsibility or liability shall be accepted by BPC for any errors or omissions or misstatementshowsoever caused. Any opinions, forecasts or recommendationsreflect our judgment andassumptionsat thedate of publication andmay changewithout notice. BPC will not accept any responsibility for updating any advice, views, opinions or recommendationscontained in this document. TheContent isintended to provide background information only anddoes not purport to makeany recommendation upon which you may reasonably rely without takingfurther andmore specific advice. You should makeyour own decision whether to participate or take any investment action based on your own enquires. Potential investors must maketheir own independent assessment and investigation of theopportunity and should not rely on any statement or theadequacy or accuracy of the information provided. Small company securities in early growth stage typically involve higher risk and more volatility than securities of more established companies. As such, an investment in theCompany must beconsidered as speculative. GENERAL ADVICE WARNING TheContent hasbeen prepared for general information purposes only and is not (and cannot be construed or relied upon as) personal advice nor as an offer to buy/sell/subscribe to any of thefinancial products mentioned herein. Theinformation provided does not purport to cover all relevant information about any potential investment in theCompany. Noinvestment objectives, financial circumstances or needs of any individual or other potential investor have been taken intoconsideration in thepreparation of theContent. Financial products are complex, entail risk of loss, may rise andfall, and are impacted by a range of market andeconomic factors, and you should alwaysobtain professional advice to ensure trading or investing in such products is suitable for your circumstances, and ensure you obtain, read andunderstandany applicable offer document. Accordingly, potential investors are advised to seek appropriate independent advice, if necessary, to determinethe suitability of this investment. DISCLOSURES Theinformation containedherein (Content) hasbeen prepared and issued by Bletchley Park Capital, a Corporate Authorised Representatives (CAR) of BR Securities Australia Pty Ltd ACN 168 734 530, holder of an Australian Financial Services Licence (AFSL No. 456663). TheDirectors of BPC advise that they andpersons associated with them do have an interest in theabove securities and that they earn brokerage, commissions, fees and other benefitsand advantages, whether pecuniary or not and whether direct or indirect, in connection with themakingof a recommendation or a dealing by a client in these securities, and which may reasonably be expected to be capable of havingan influencein themakingof any recommendation, andthat someor all of our representatives may beremuneratedwholly or partly by way of commission. Tier 1, high quality, low credit risk clients Go-Jek –US$9.5 bn valuation, based in SE Asia, backed by Temasek, Google, Blackrock, KKR and others Rappi – Latin-American US$2.5 billion food-delivery business MUV (WPP) – subsidiary of world’s largest ad agency, WPP (US$12.3 billion market capitalisation) Large and Rapidly Growing Addressable Market TrafficGuard® addresses a large and rapidly growing global market of digital marketing fraud, such as “human click fraud farms”, which defrauded advertisers of US$42 bn in 2019³, forecast to grow to US$100 bn fraud by 2023. This fraud is a subset of the total digital marketing market, forecast to rise from US$294bn in 2019 to US$520bn by 2023 (Juniper Research). Highly scalable global B2B Software-as-a-Service (SaaS) product called TrafficGuard® . Upsell Potential Upgradedclient contractsis a growth option across AV1 the customer portfolio. Recent upgrades include Rappi (up from US$15k to US$22.5k/mth)and MUV (up from US$2k to US$10k/mth), demonstrating client satisfaction and upsell potentialacross the customer portfolio. Proprietary tech - patent-pending, 100% owned. Proprietary big data from previous marketing campaigns creates competitive entry barriers and sustainable competitive advantage. Disruption - A disruptive innovator in the multi-billion dollar call recording industry, removing the need for hardware, productization or capital expenditurevia a Software as a Service model. Disruptive businessmodel – Disrupting the mobile digital marketingsegment, leading the world in blocking attempted mobile phone all install fraud at the click level (per client contract wins in competitive processes to date). Until now, the industry merely acts to measure ad fraud “after the event” throughMobile MeasurementPlatforms. TrafficGuard’s disruption is to block attempted ad fraud “at the click level”, rather than simply measuring fraud after the event. Highly scalable BroadCloud platform – described as “the world’s most scalable call recording service…removes the customer’s need for hardware, prodctsation or capex Proprietary tech – provides call recording for compliance and voice dara for AI, analytics and “big data” applications. Artificial intelligencewill be enabled for every phone. Large and Rapidly Growing Addressable Market Disrupting the multi-billion dollar call recording industry. Limited data publicly available in relation to industry size and growth rates. Tier 1, high quality, low credit risk clients DUB has been chosen by 113 telco service providers globally. AT&T Collaborate – a flexible unified communications solution that blends voice, video, IM and conferencing. Cisco Systems - DUB is a core service provider for Cisco, the world’s largest networking company. IBM – capture voice data for Insights, sentiment, AI and value added services Upsell Potential Limited commentaryin DUB ASX releases in relation to upsell revenue generation. Is Adveritas (AV1) the next Dubber (DUB)?

- 3. Level 5, 1 Collins St, Melbourne, VIC 3000 investors@bletchleyparkcapital.com.auBLETCHLEY Park Capital LEGAL DISCLAIMER Thiscontent is provided on an as is basis, without warranty (express or implied). Whilst theContent hasbeen prepared with all reasonable care from sources we believe to be reliable, no responsibility or liability shall be accepted by BPC for any errors or omissions or misstatementshowsoever caused. Any opinions, forecasts or recommendationsreflect our judgment andassumptionsat thedate of publication andmay changewithout notice. BPC will not accept any responsibility for updating any advice, views, opinions or recommendationscontained in this document. TheContent isintended to provide background information only anddoes not purport to makeany recommendation upon which you may reasonably rely without takingfurther andmore specific advice. You should makeyour own decision whether to participate or take any investment action based on your own enquires. Potential investors must maketheir own independent assessment and investigation of theopportunity and should not rely on any statement or theadequacy or accuracy of the information provided. Small company securities in early growth stage typically involve higher risk and more volatility than securities of more established companies. As such, an investment in theCompany must beconsidered as speculative. GENERAL ADVICE WARNING TheContent hasbeen prepared for general information purposes only and is not (and cannot be construed or relied upon as) personal advice nor as an offer to buy/sell/subscribe to any of thefinancial products mentioned herein. Theinformation provided does not purport to cover all relevant information about any potential investment in theCompany. Noinvestment objectives, financial circumstances or needs of any individual or other potential investor have been taken intoconsideration in thepreparation of theContent. Financial products are complex, entail risk of loss, may rise andfall, and are impacted by a range of market andeconomic factors, and you should alwaysobtain professional advice to ensure trading or investing in such products is suitable for your circumstances, and ensure you obtain, read andunderstandany applicable offer document. Accordingly, potential investors are advised to seek appropriate independent advice, if necessary, to determinethe suitability of this investment. DISCLOSURES Theinformation containedherein (Content) hasbeen prepared and issued by Bletchley Park Capital, a Corporate Authorised Representatives (CAR) of BR Securities Australia Pty Ltd ACN 168 734 530, holder of an Australian Financial Services Licence (AFSL No. 456663). TheDirectors of BPC advise that they andpersons associated with them do have an interest in theabove securities and that they earn brokerage, commissions, fees and other benefitsand advantages, whether pecuniary or not and whether direct or indirect, in connection with themakingof a recommendation or a dealing by a client in these securities, and which may reasonably be expected to be capable of havingan influencein themakingof any recommendation, andthat someor all of our representatives may beremuneratedwholly or partly by way of commission. Is Adveritas (AV1) the next Dubber (DUB)? Sales & marketing resources AV1 appearsto have a much lower level of sales resources compared to DUB. Following its 14 August 2018 capital raising, AV1 added 4 sales staff in the USA and Brazil. Sales & marketing resources Sept Quarter 2019 – DUB hire 26 additional full-time staff, with 15 in sales and 11 in technology. Funding 18 Sep 2017 - $7m capital raising at $0.35 per share 14 Dec 2017 - $6.5m capital raising at $0.35 per share 28 Nov 2018 - $5m capital raising at $0.38 per share 3 April 2019 - $22m raising at $0.75 per share (9.6% discount to 5-day VWAP) Total = $40.5m raised Funding AV1 has raised much less than DUB and appears to have managed capital markets conservatively, with a track record of only raising small sums of capital at par or a premium. 23 Oct 2018 - $2.4m capital raising at $0.045 per share 9 April 2019 - $2.0m capital raising at $0.165 per share (in line with 14-day VWAP) 14 Aug 2018 - $2.8m capital raising at $0.10 per share (13.6% premium to last close share price) Total = $7.2m raised CONCLUSION AV1 and DUB are both ASX-listed, SaaS companies, scaling globally with Tier1 global enterprise clients. Given DUB is in Year 3 of its global sales rollout, compared to AV1 commencingits second sales year, a comparison provides insights into AV1’s outlook. AV1 compares favourably to DUB on many levels. Both companies have high quality, enterprise level clients and are servicing multi-billion dollar markets. However, AV1 appears to have superior capital market discipline, proprietary tech based on internally captured big data, sales efficiency, a larger and faster growing addressable market and greater upsell contract potential(AV1 calls this its “land and expand” strategy). AV1 trades at an ~9% discount to DUB, with 22 cps being the AV1 share price which equates to DUB’s revenue multiple. AV1 is trading at 23.7x market cap/trailing ARR (vs DUB 25.7x), which reduces to 7.3x (vs DUB 7.0x) if the last 12-monthsARR/revenue growth rate is extrapolatedfor 12-months. Table 2. AV1 has grown with limited sales resources, limited capital and only recently set the foundations for growth throughnew sales staff and integrating with new partnersfor sales leverage (ie. Campaign ManagementPlatforms and ad agency MUV). DUB demonstrates it is possible for emergingcompanies like AV1 to scale globally whilst servicing global enterprise level clients. TABLE 3: AV1 vs DUB COMPARISON TABLE Ordinary Equity AV1 DUB Shares on issue (m) 187.6 189.6 Share price (A$) – close 19 Nov 2019 0.20 1.39 Market cap (A$m) 37.5 263.5 ARR (A$M) 1.6 10.2 Market cap/trailing ARR (x) 23.5x 25.8x Last 12-months ARR growth (%) 209% 269% Extrapolating ARR using last 12-months growth rate (1) (A$M) 4.9 37.6 Note (1): This is not a forecast. This is merely mathematical extrapolation.