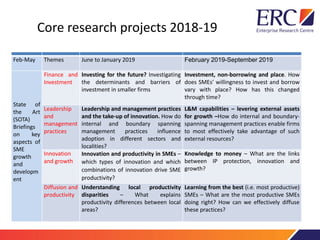

This document summarizes research on skills, management practices, and productivity in small and medium enterprises (SMEs). The main points are:

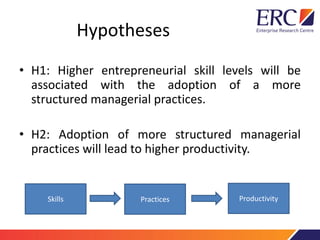

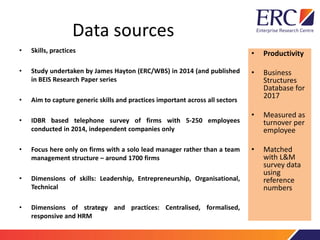

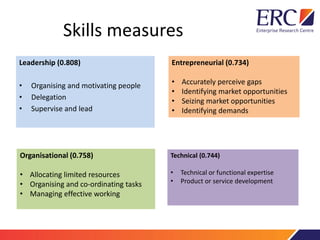

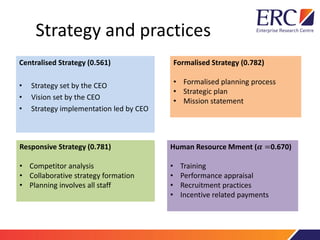

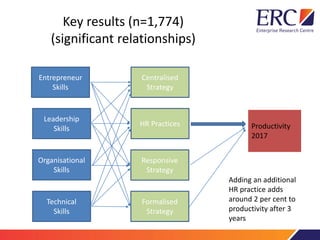

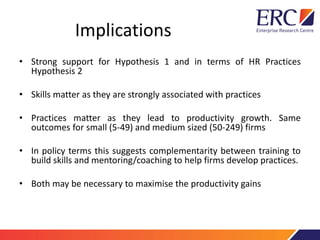

1. The research examines the links between managerial skills, practices adopted by SMEs, and productivity using survey and longitudinal data. It finds that higher entrepreneurial skills are associated with more structured managerial practices, and adopting more practices leads to higher productivity.

2. Key results show entrepreneurial skills, leadership skills, and organizational skills are positively correlated with productivity. Adopting additional human resource practices is also linked to around 2% higher productivity after 3 years.

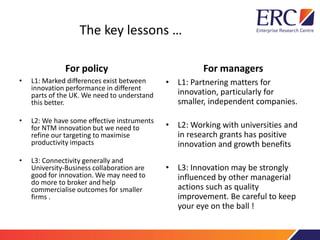

3. The implications are that both skills development and coaching to help firms adopt practices are needed to