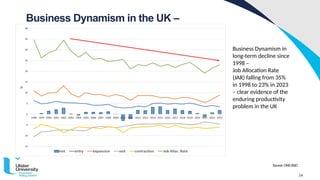

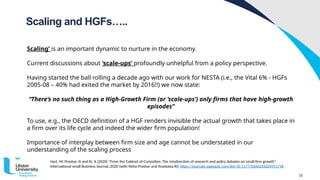

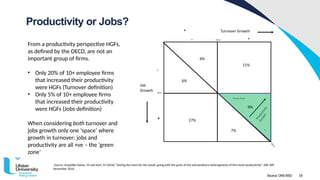

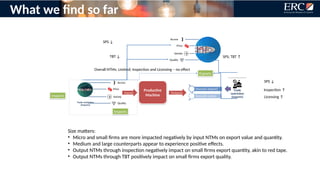

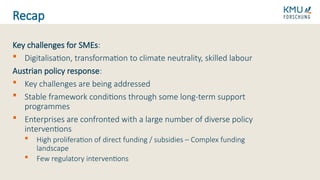

The document outlines the agenda and key discussions from the State of Small Business Britain Conference 2024, focusing on challenges and support for small businesses in the UK. It highlights concerns about declining business dynamism, productivity issues, and the impact of non-tariff barriers post-Brexit, particularly affecting SMEs. Recommendations include policy adjustments to support SME resilience and adaptation to new trade dynamics while addressing productivity gaps.