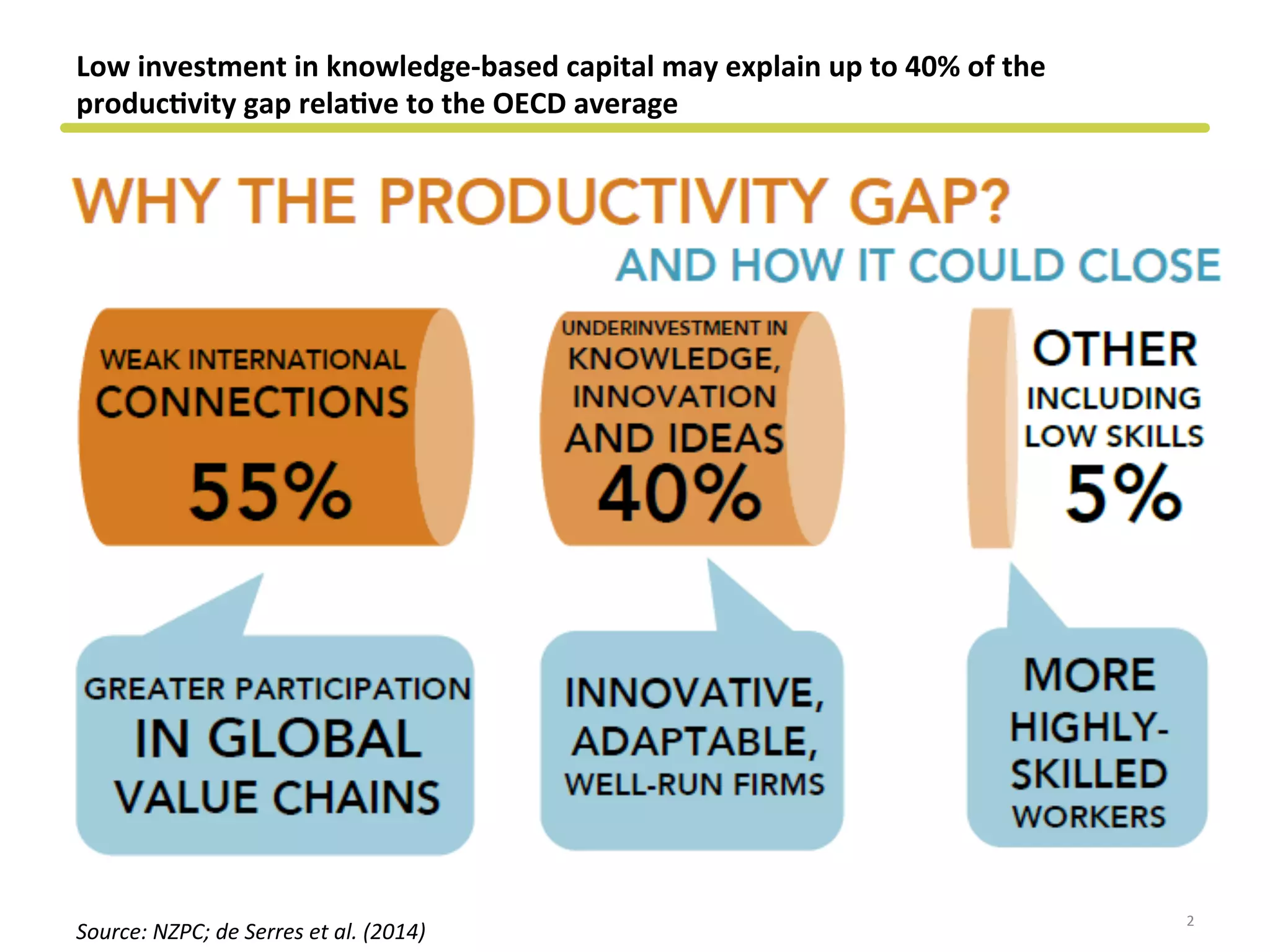

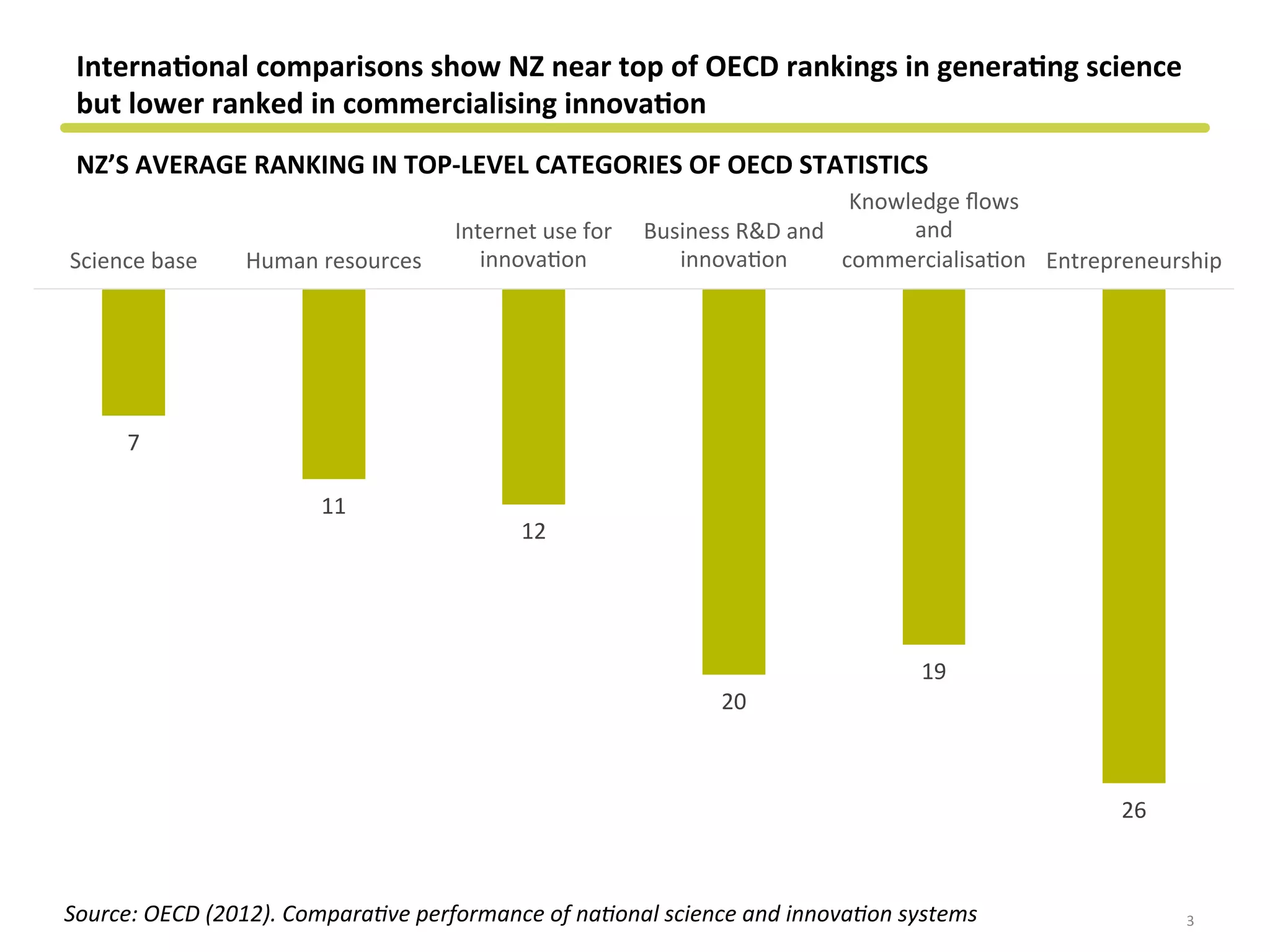

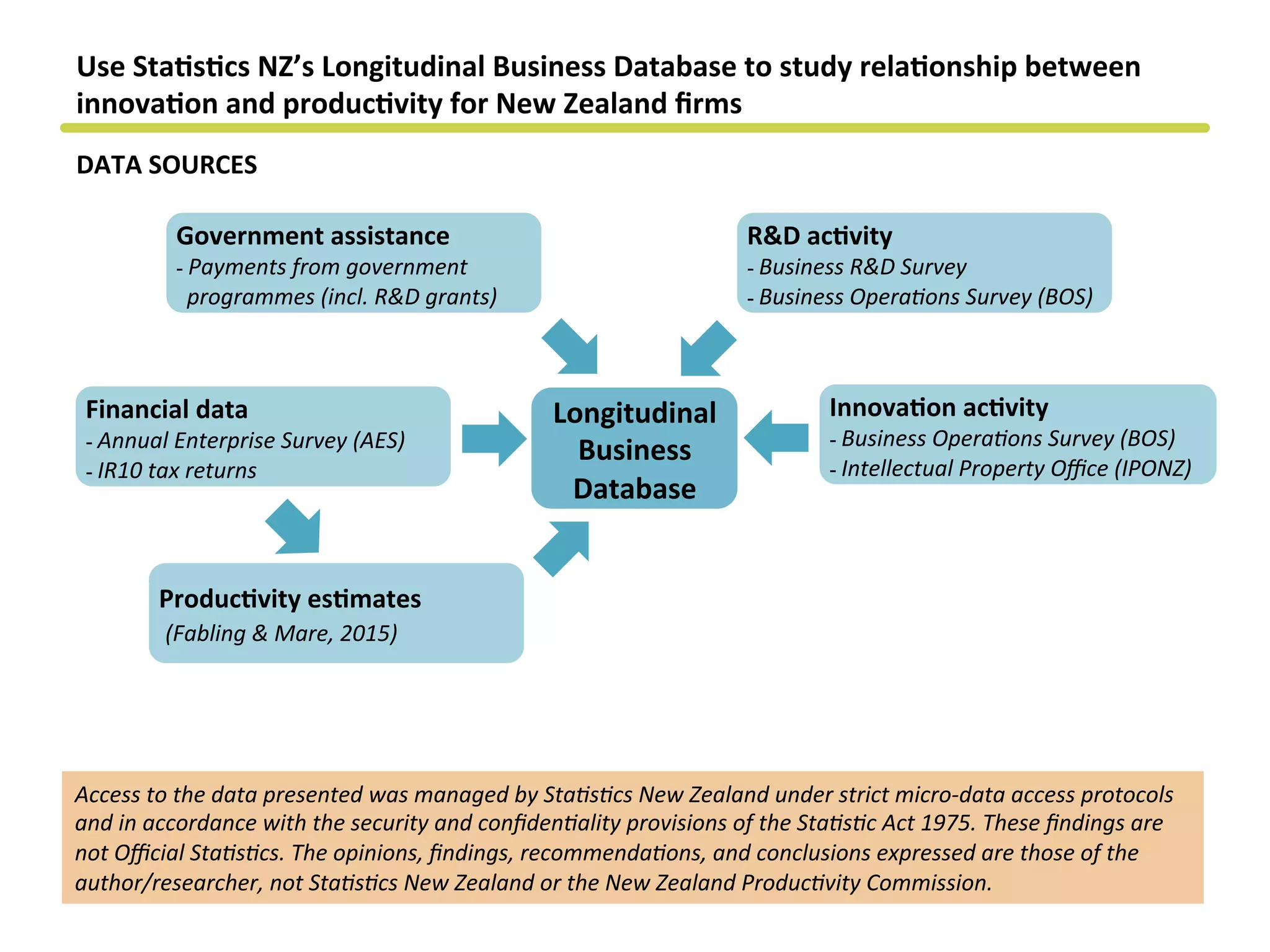

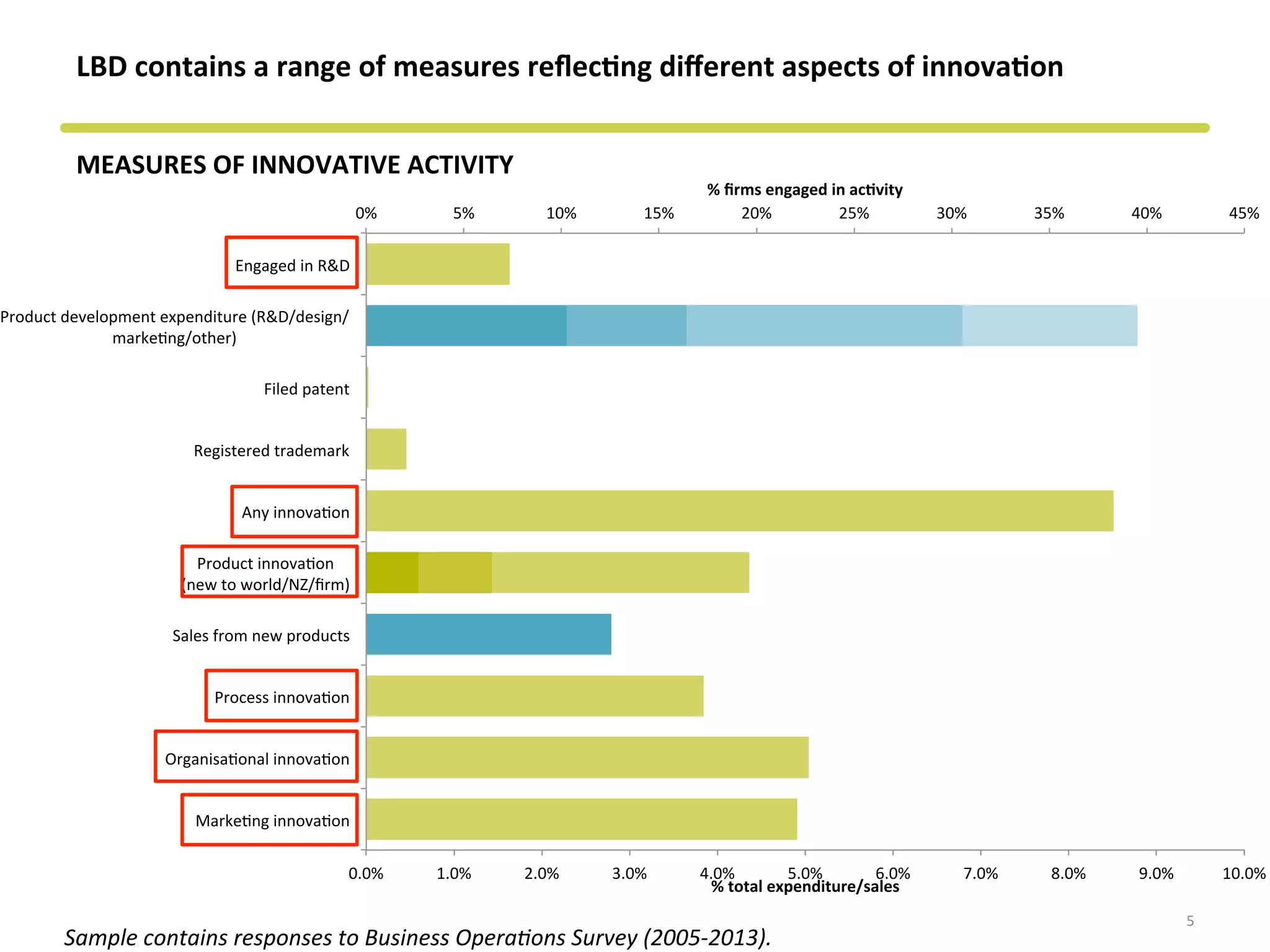

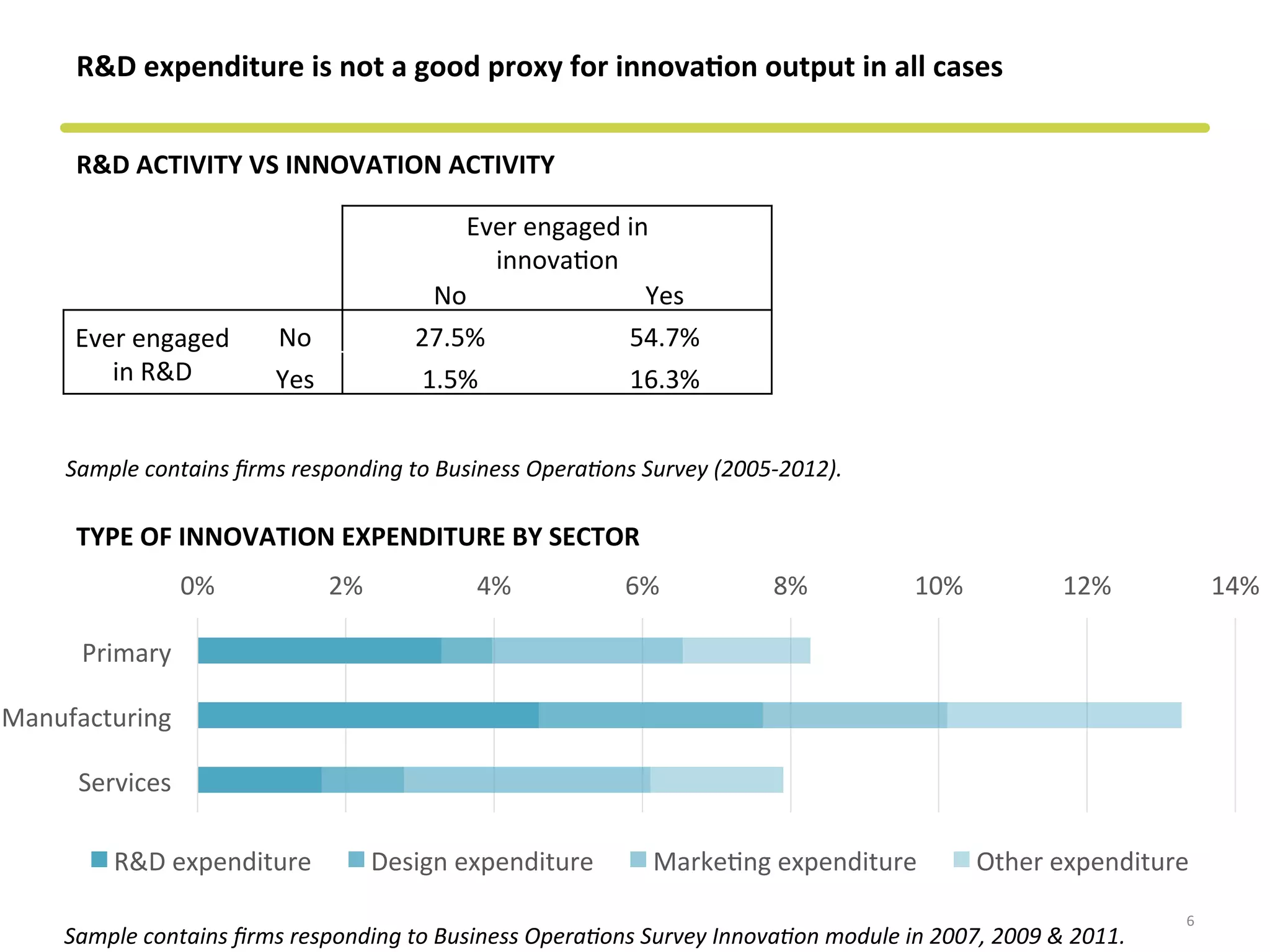

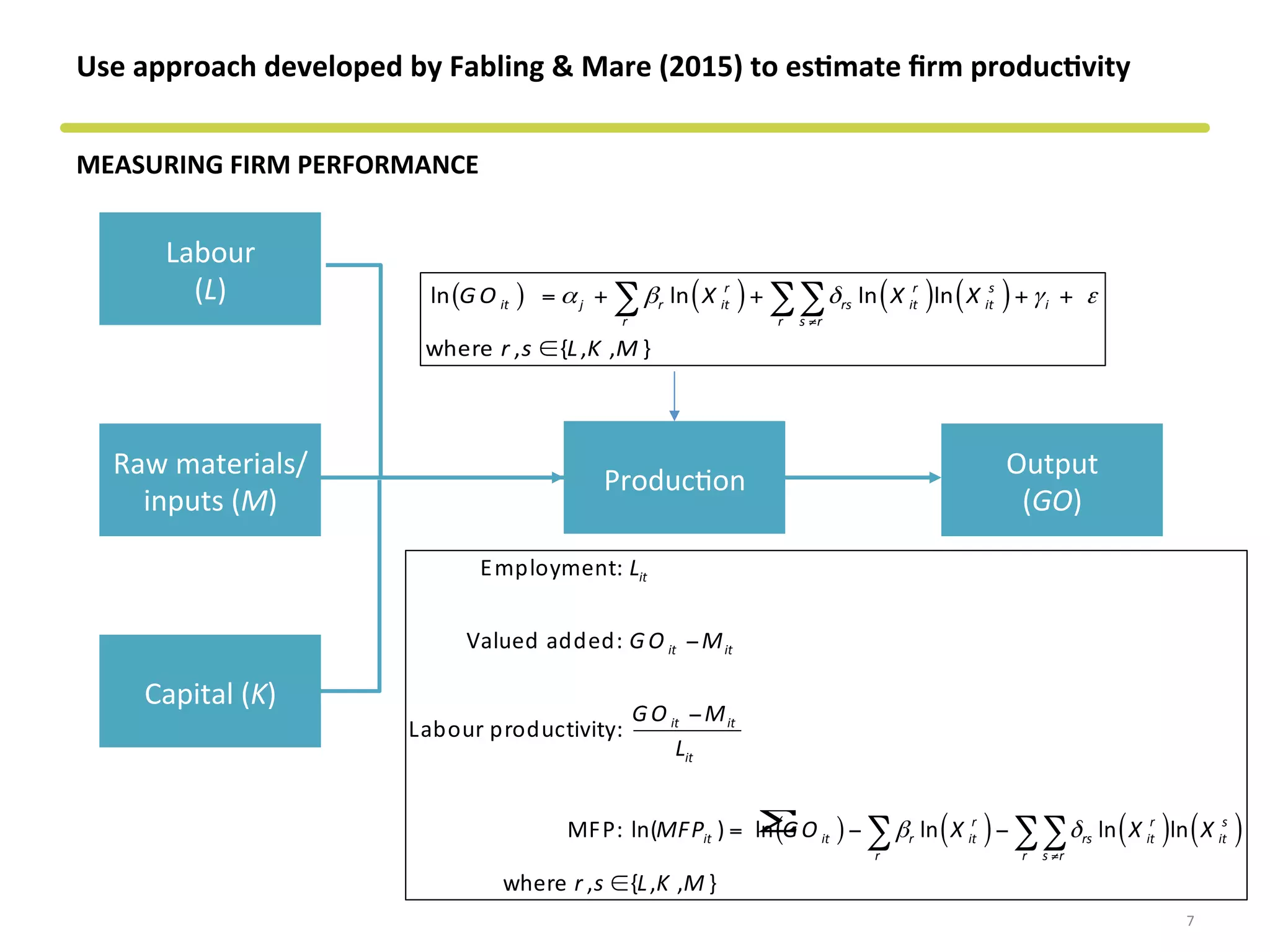

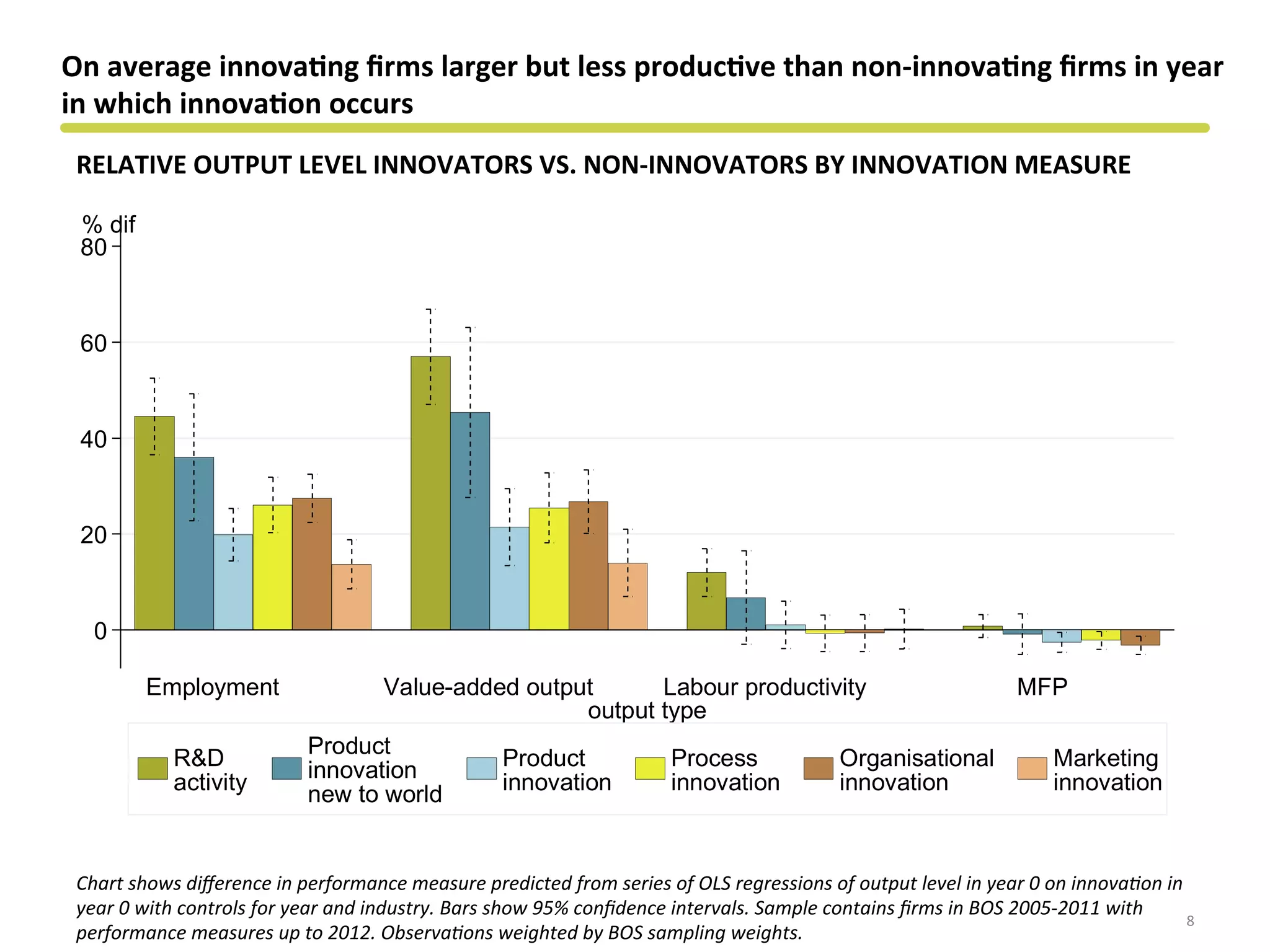

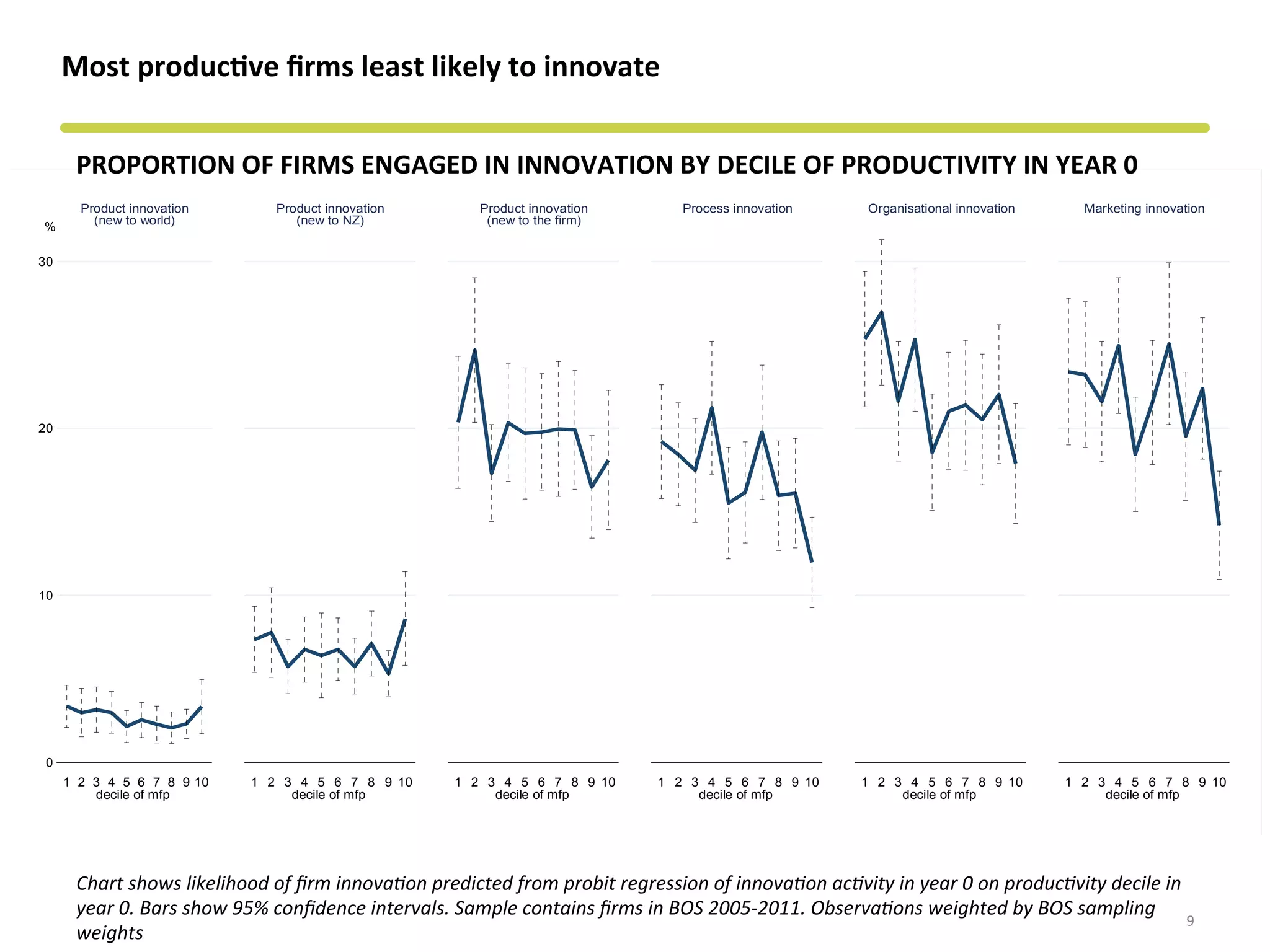

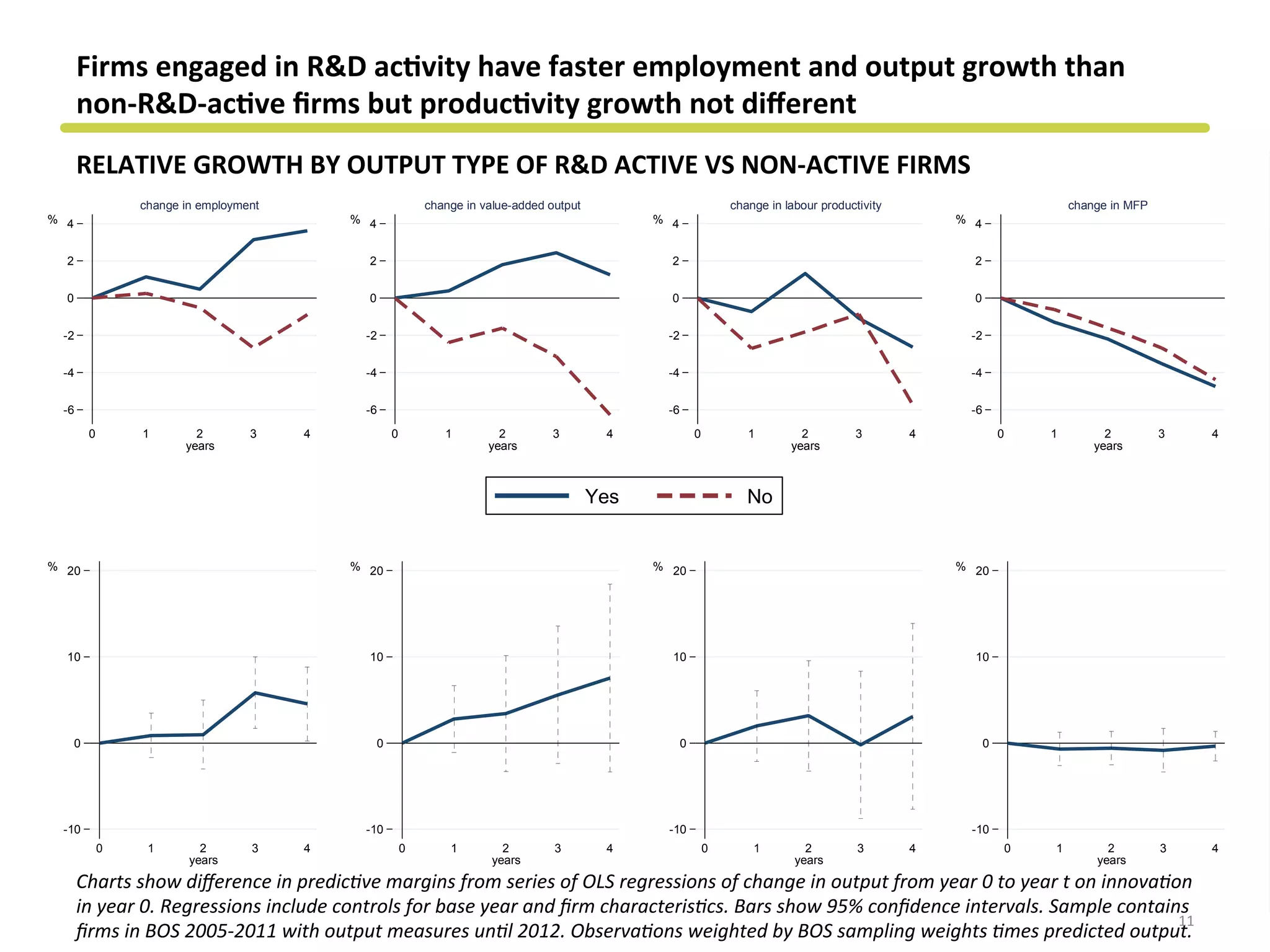

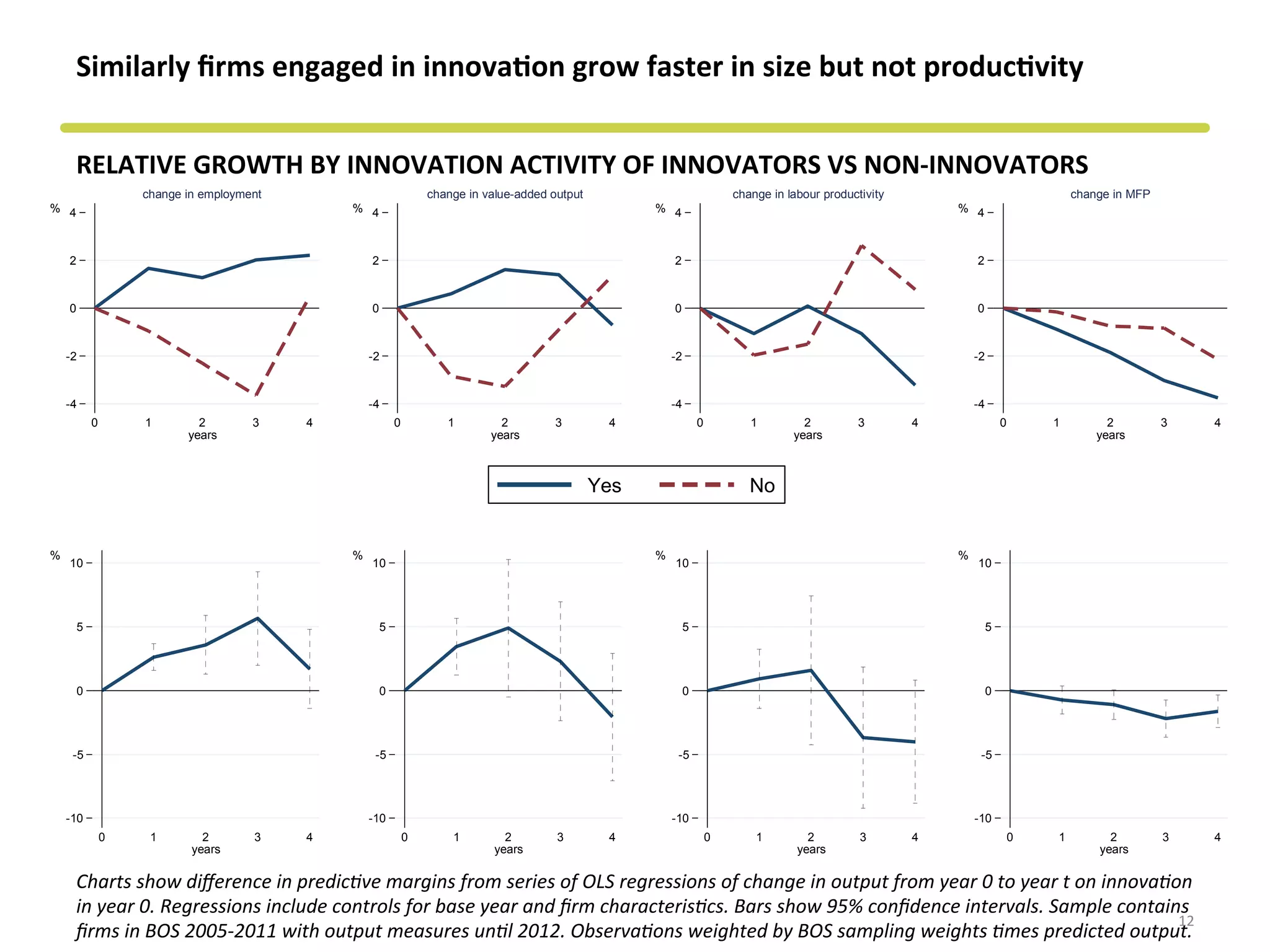

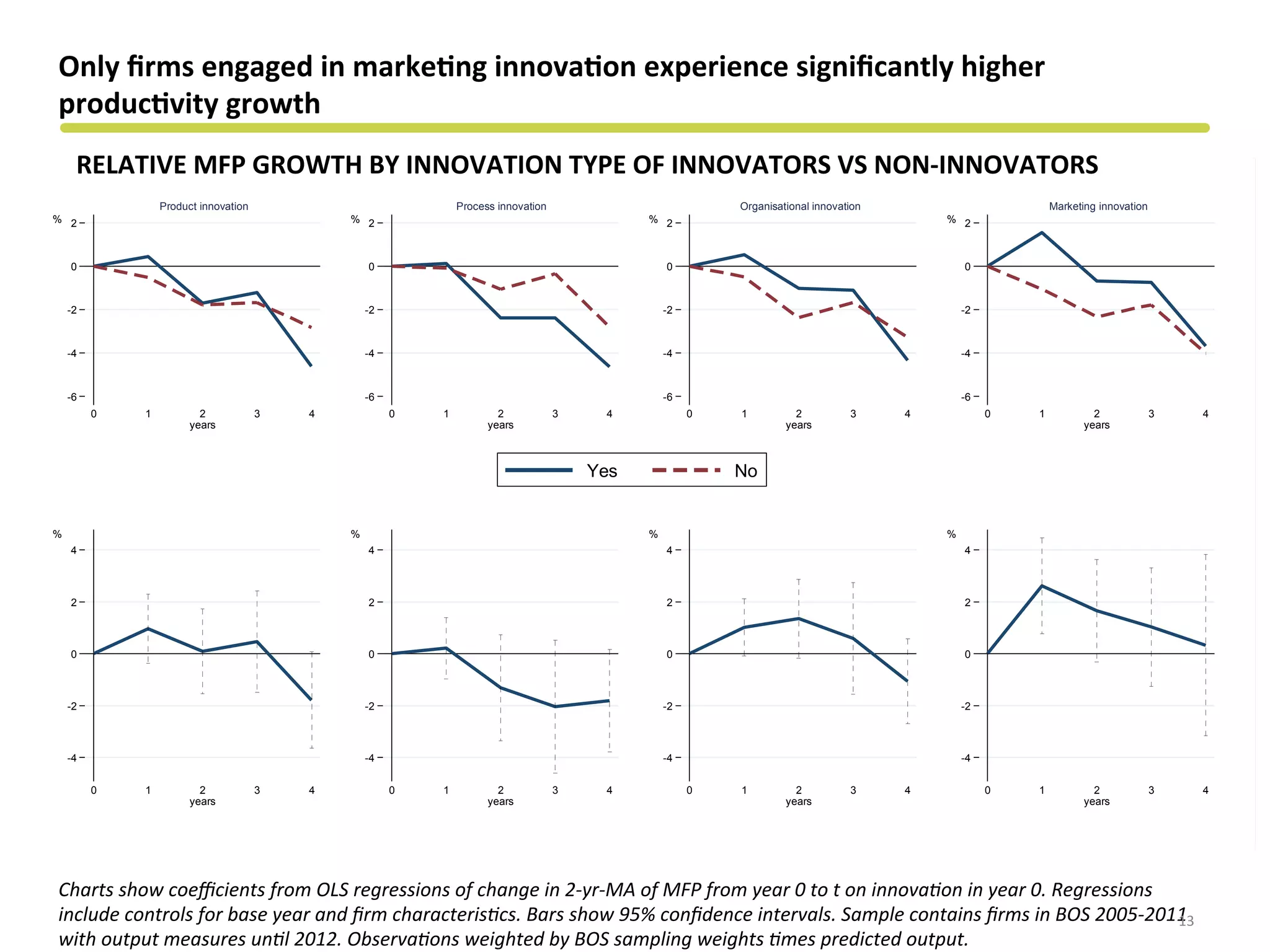

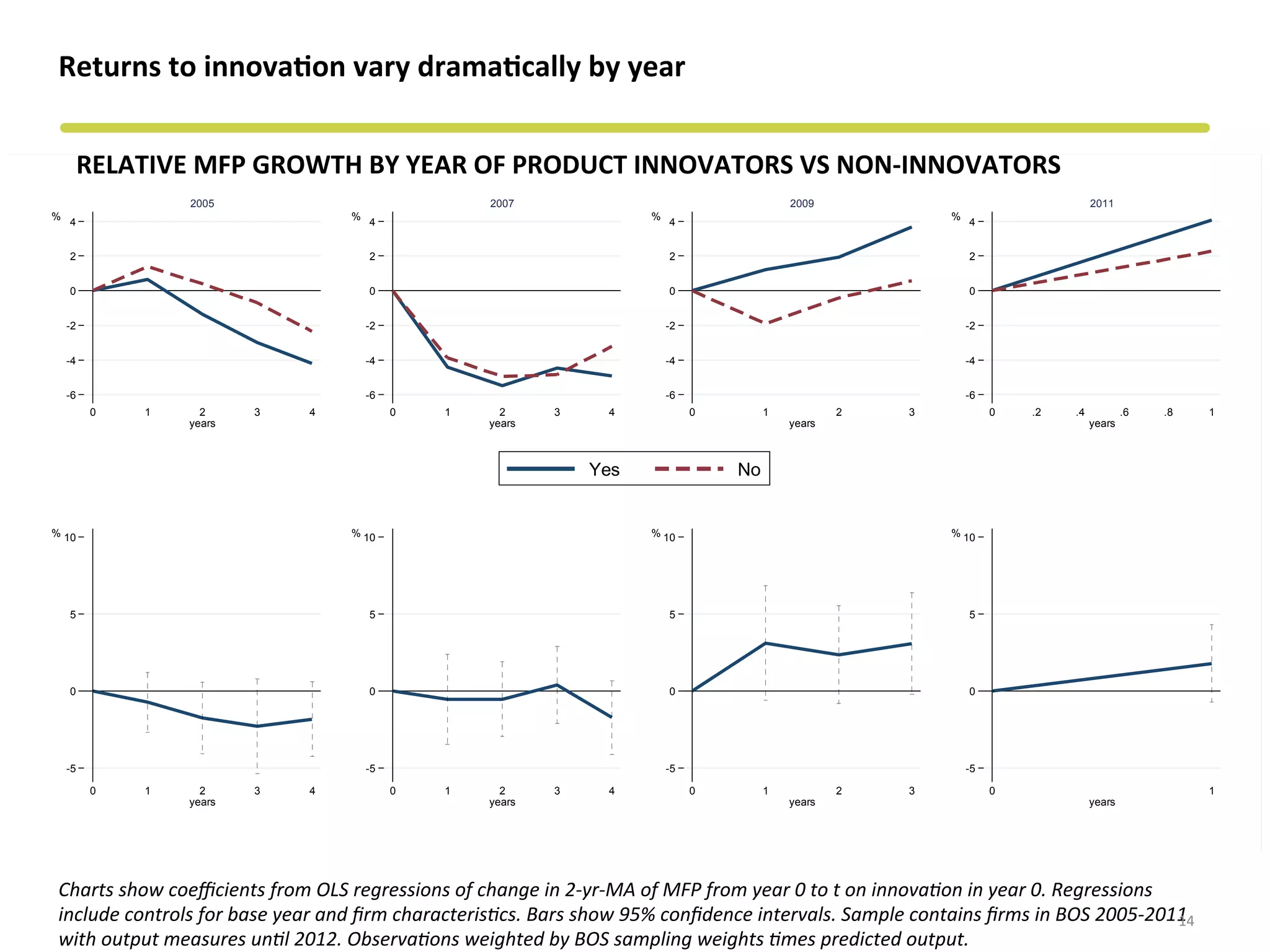

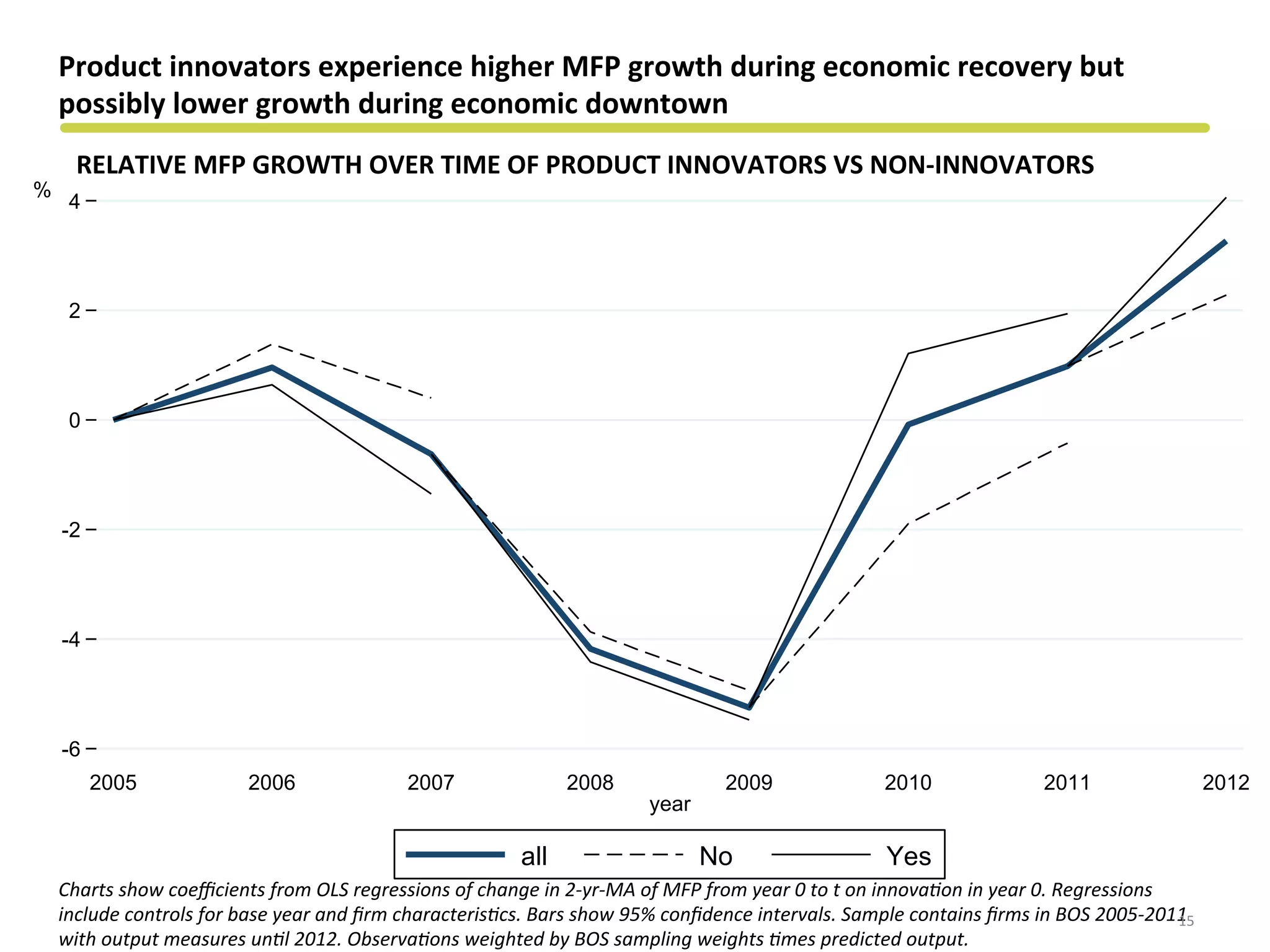

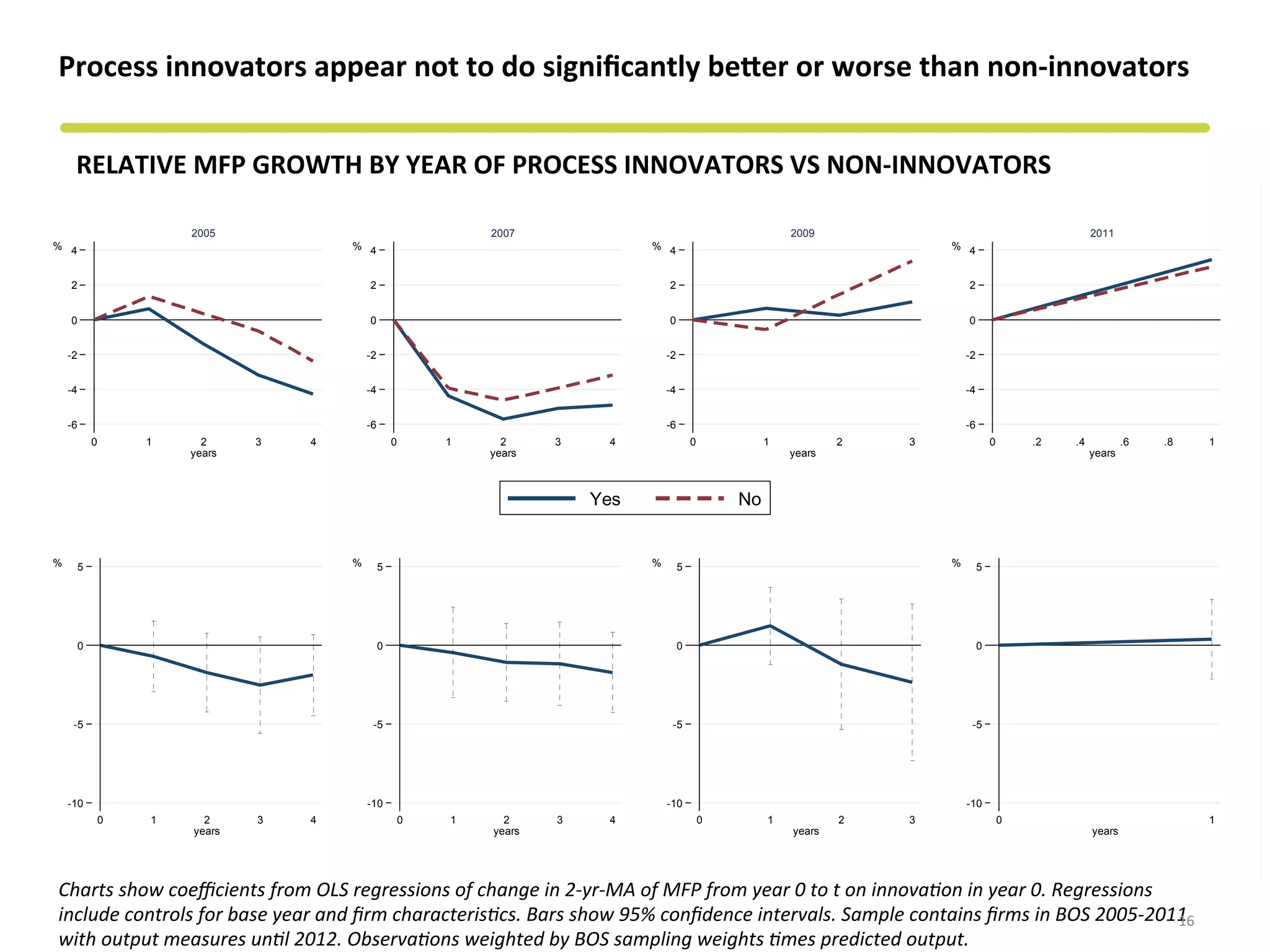

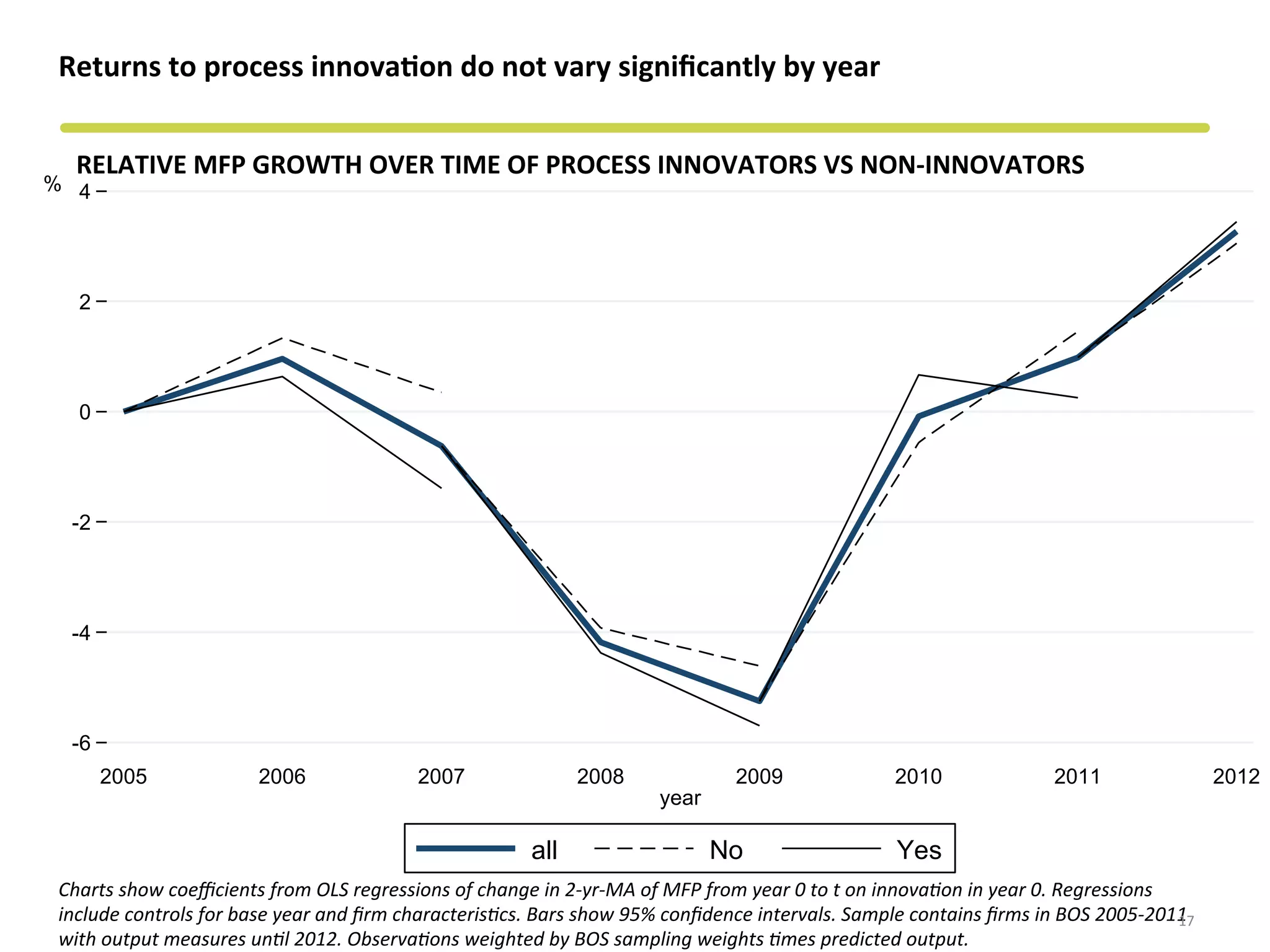

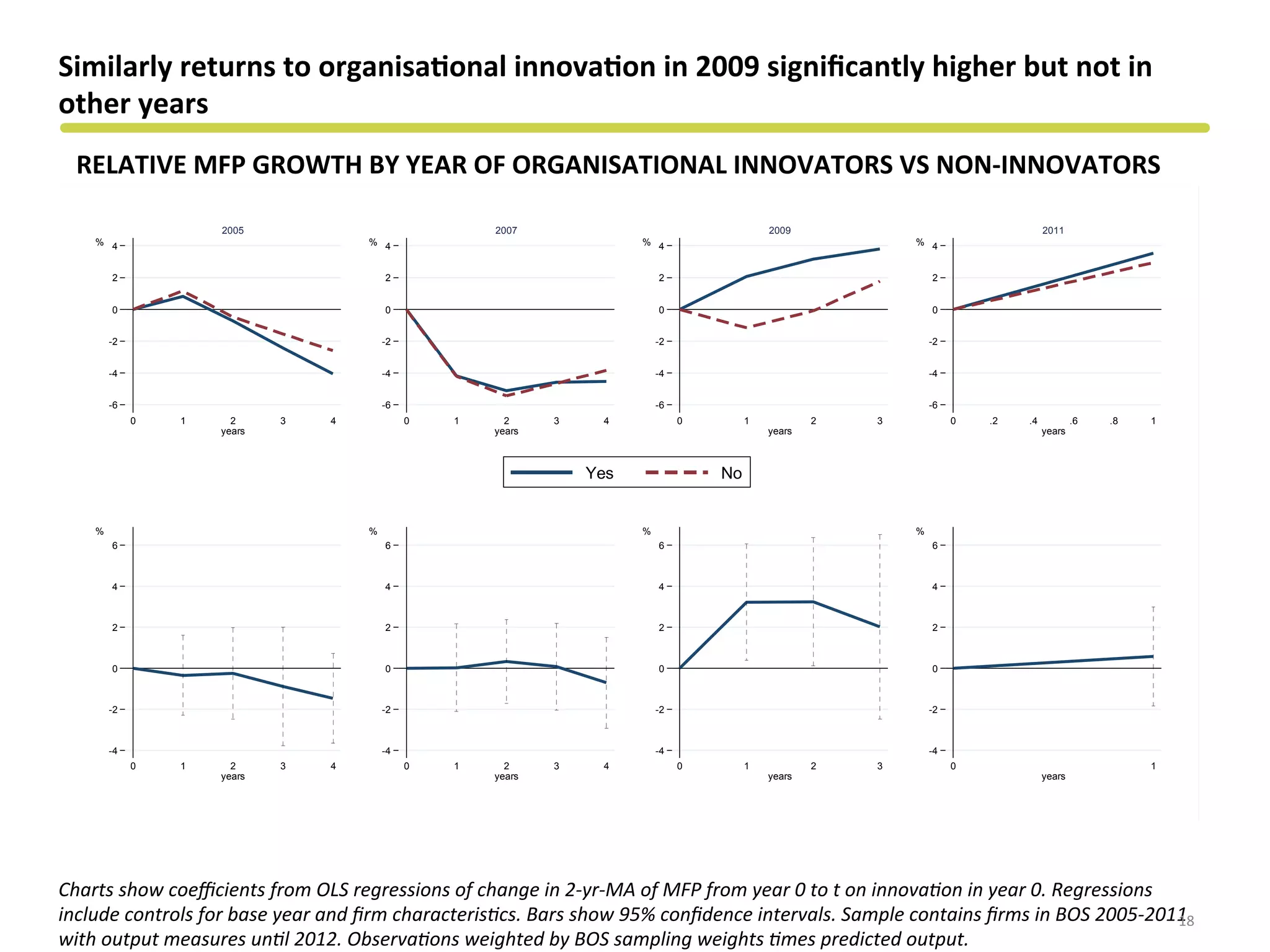

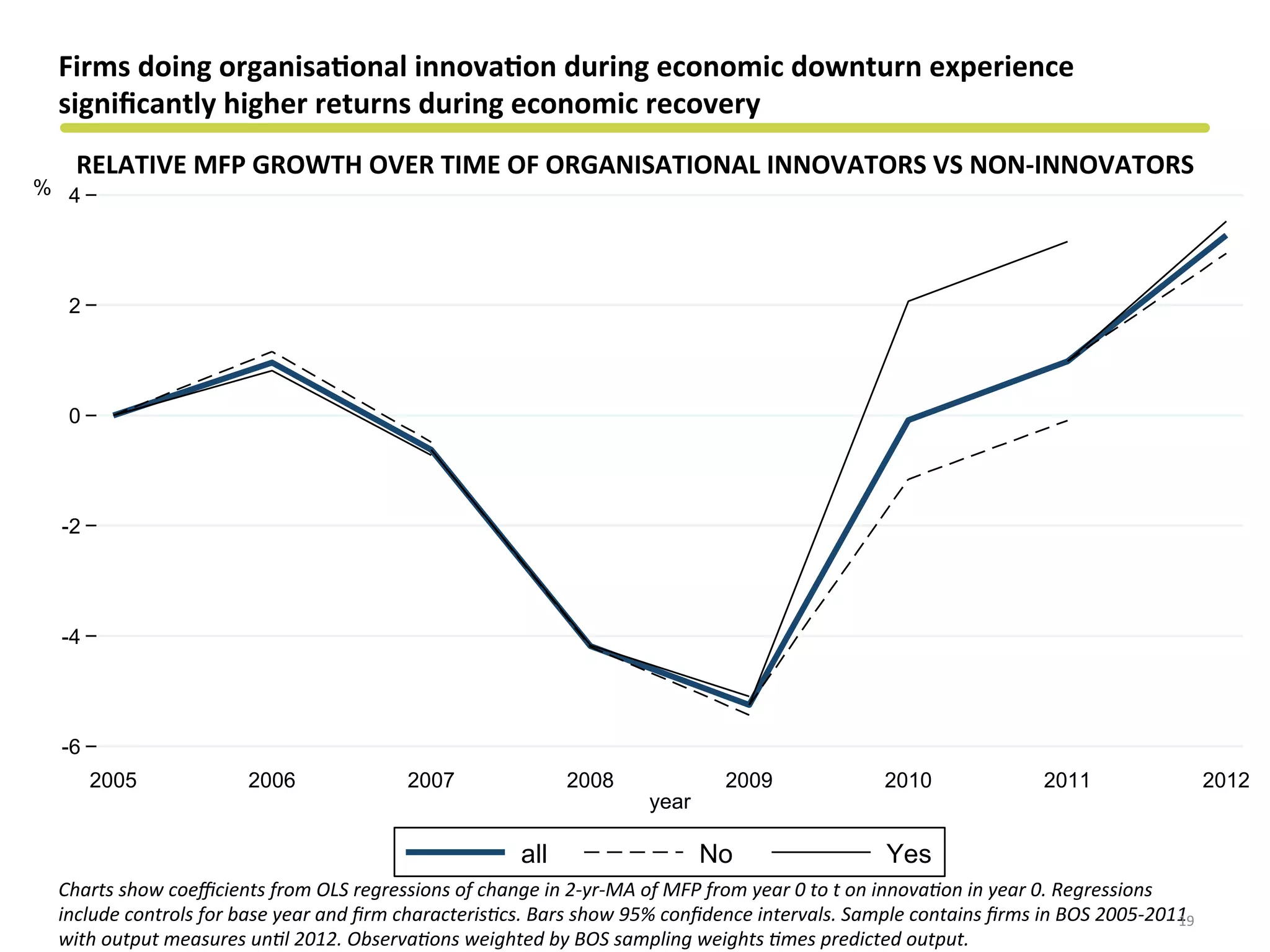

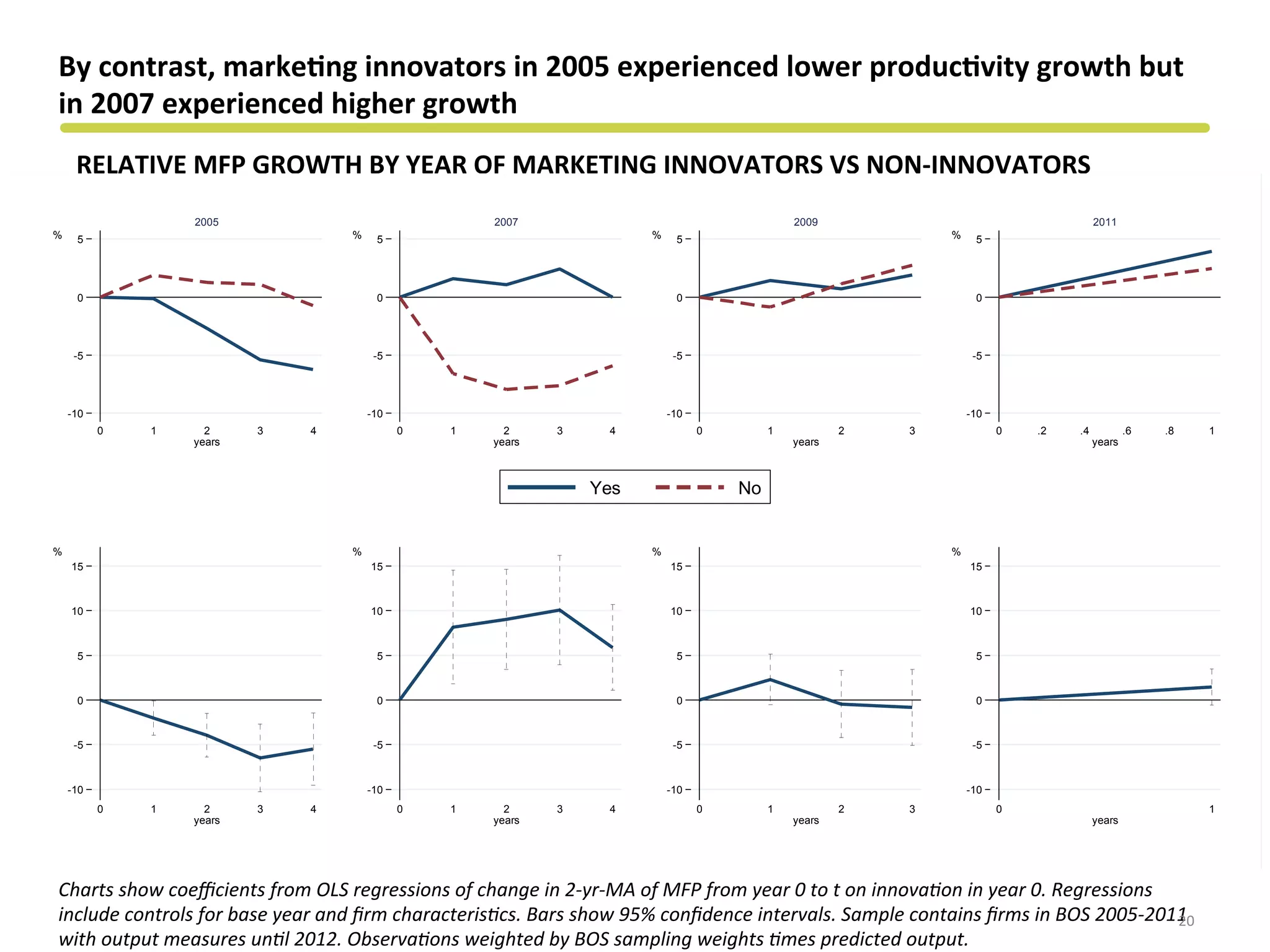

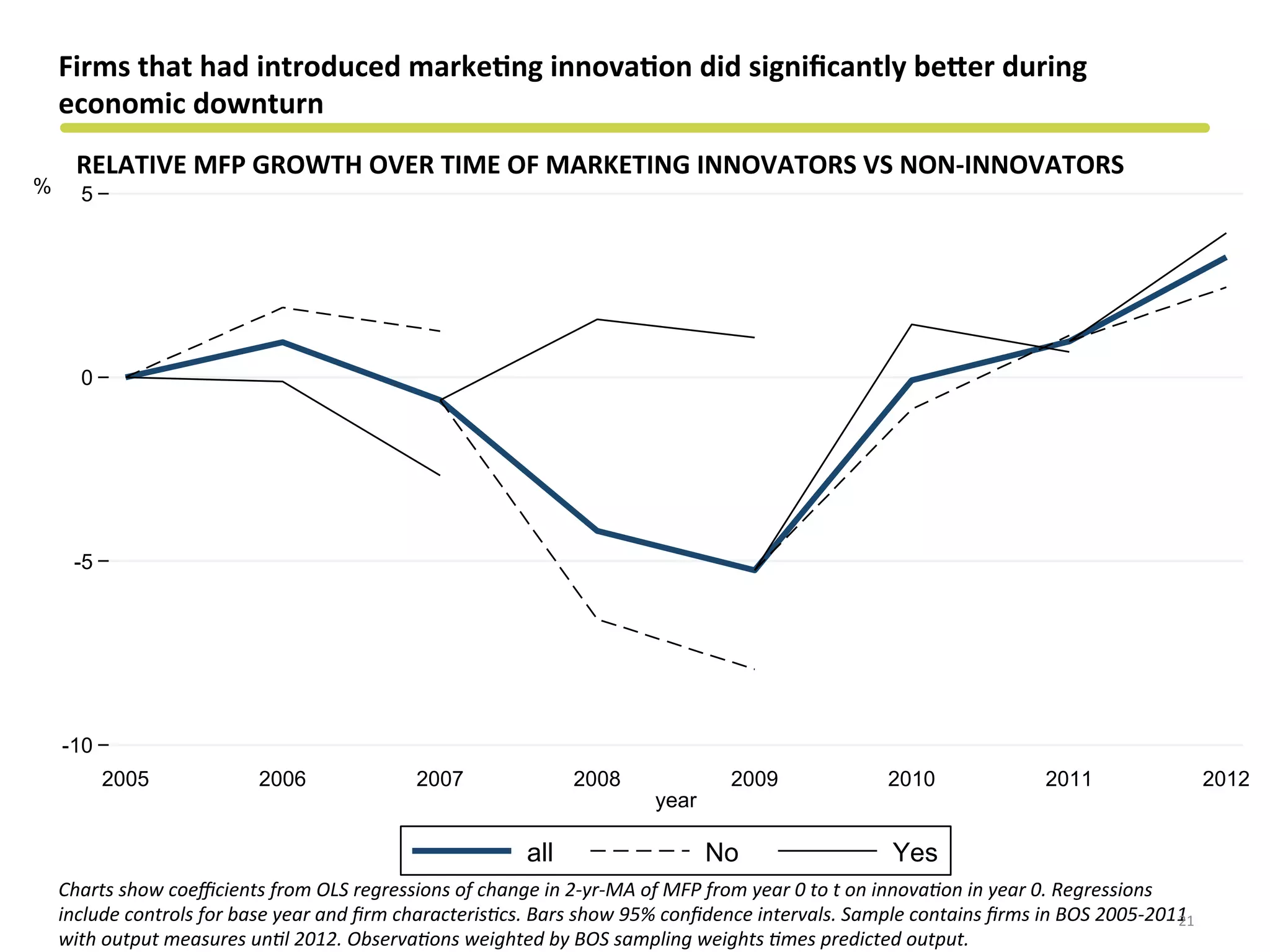

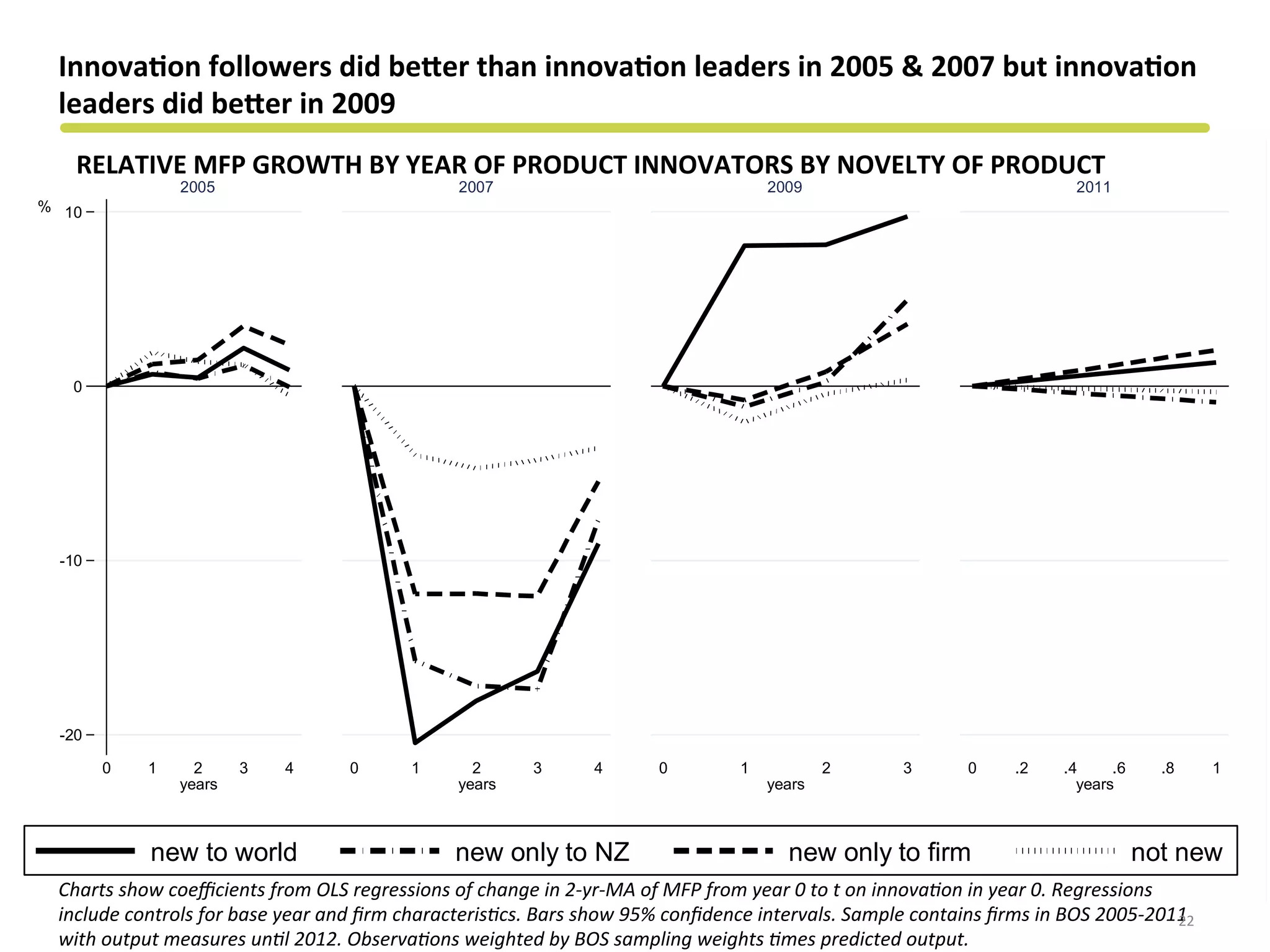

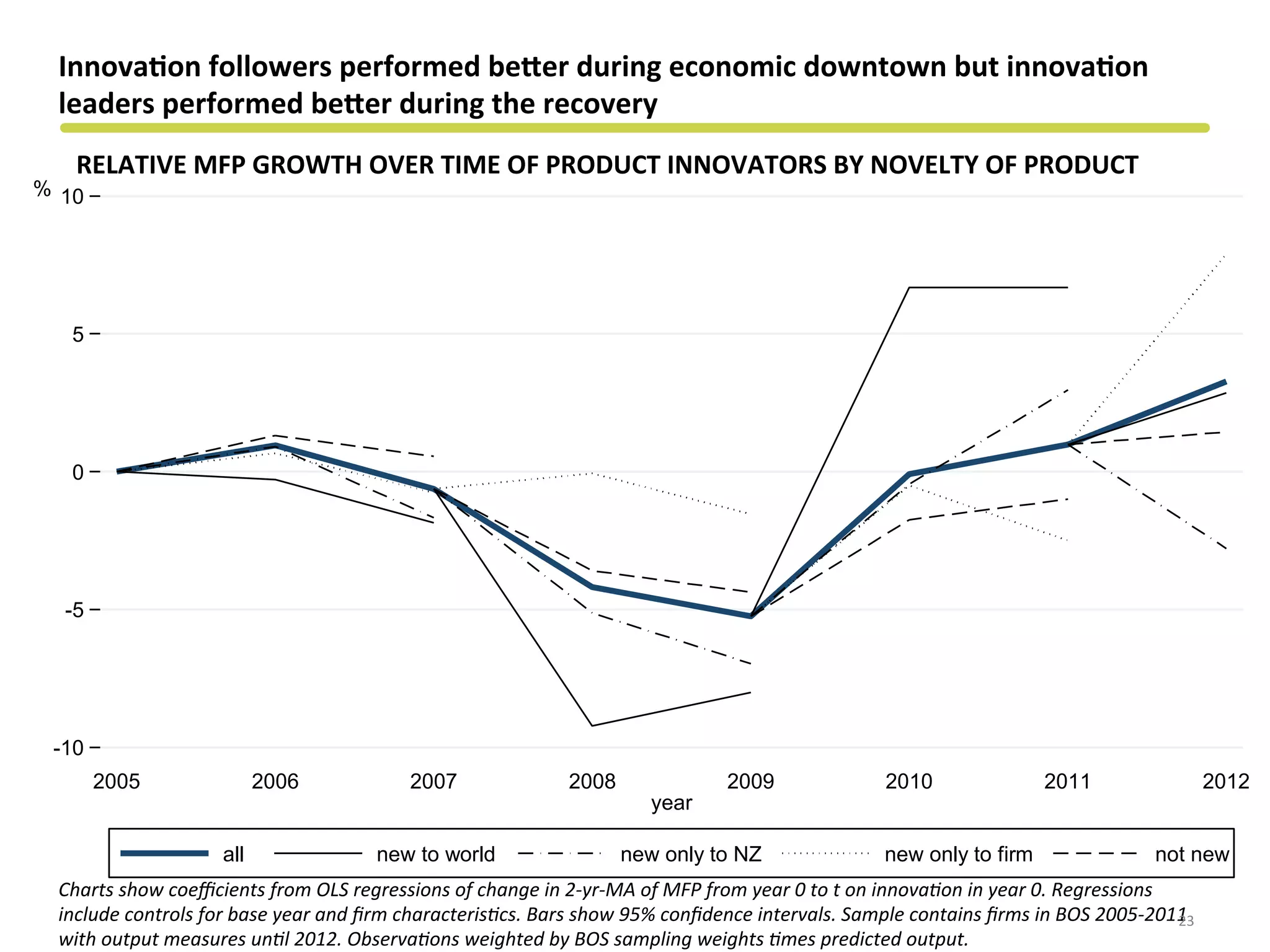

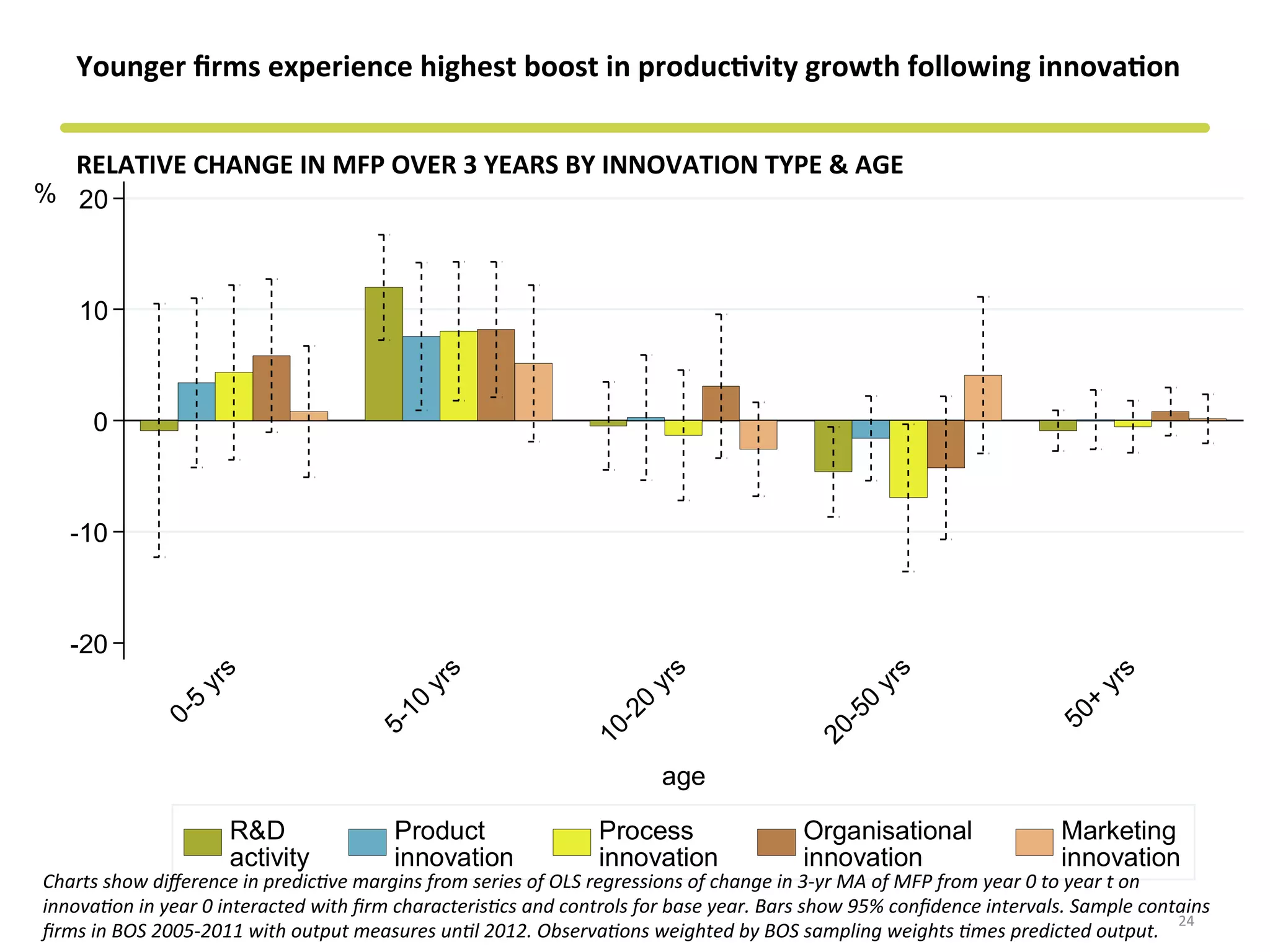

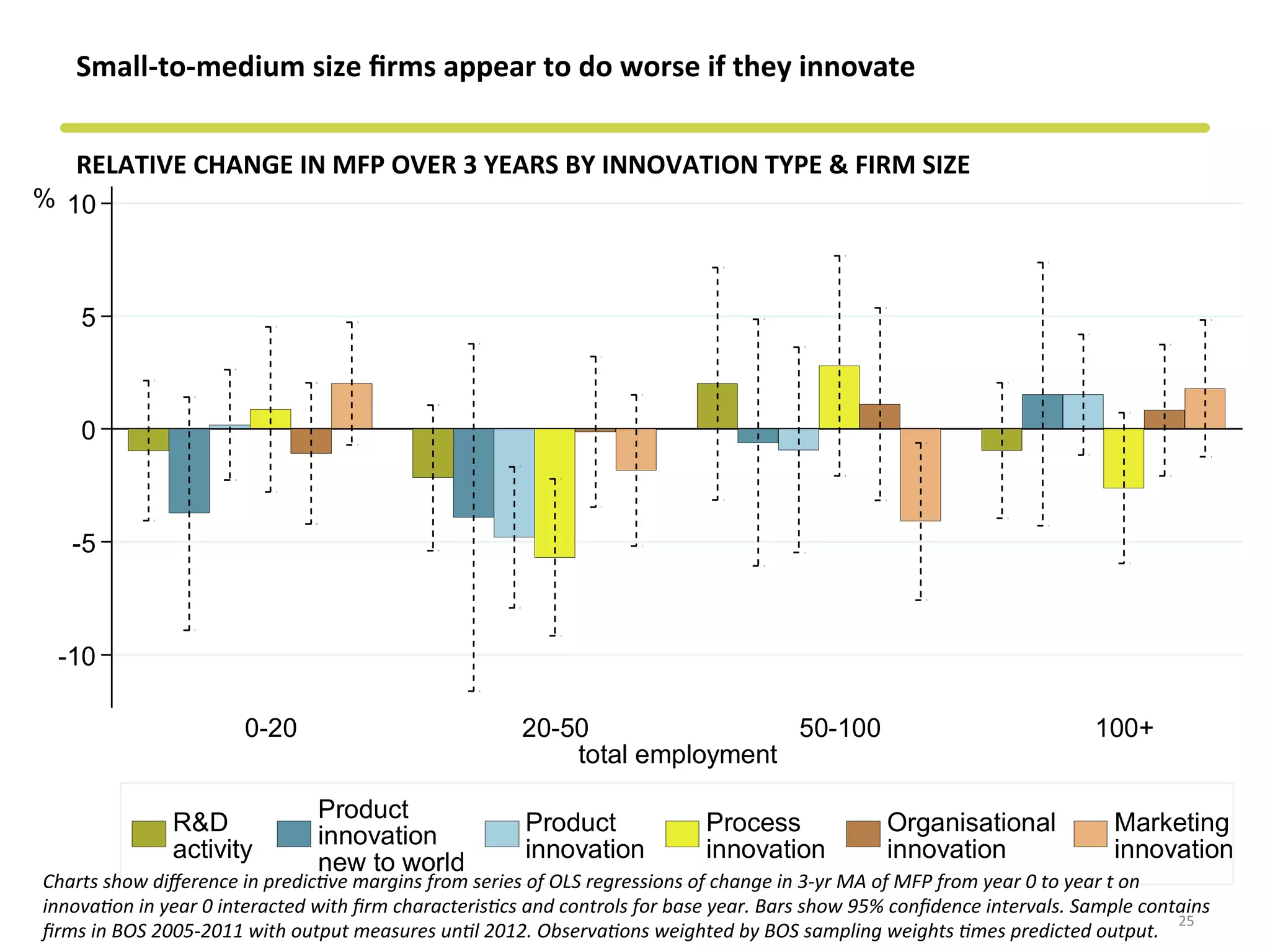

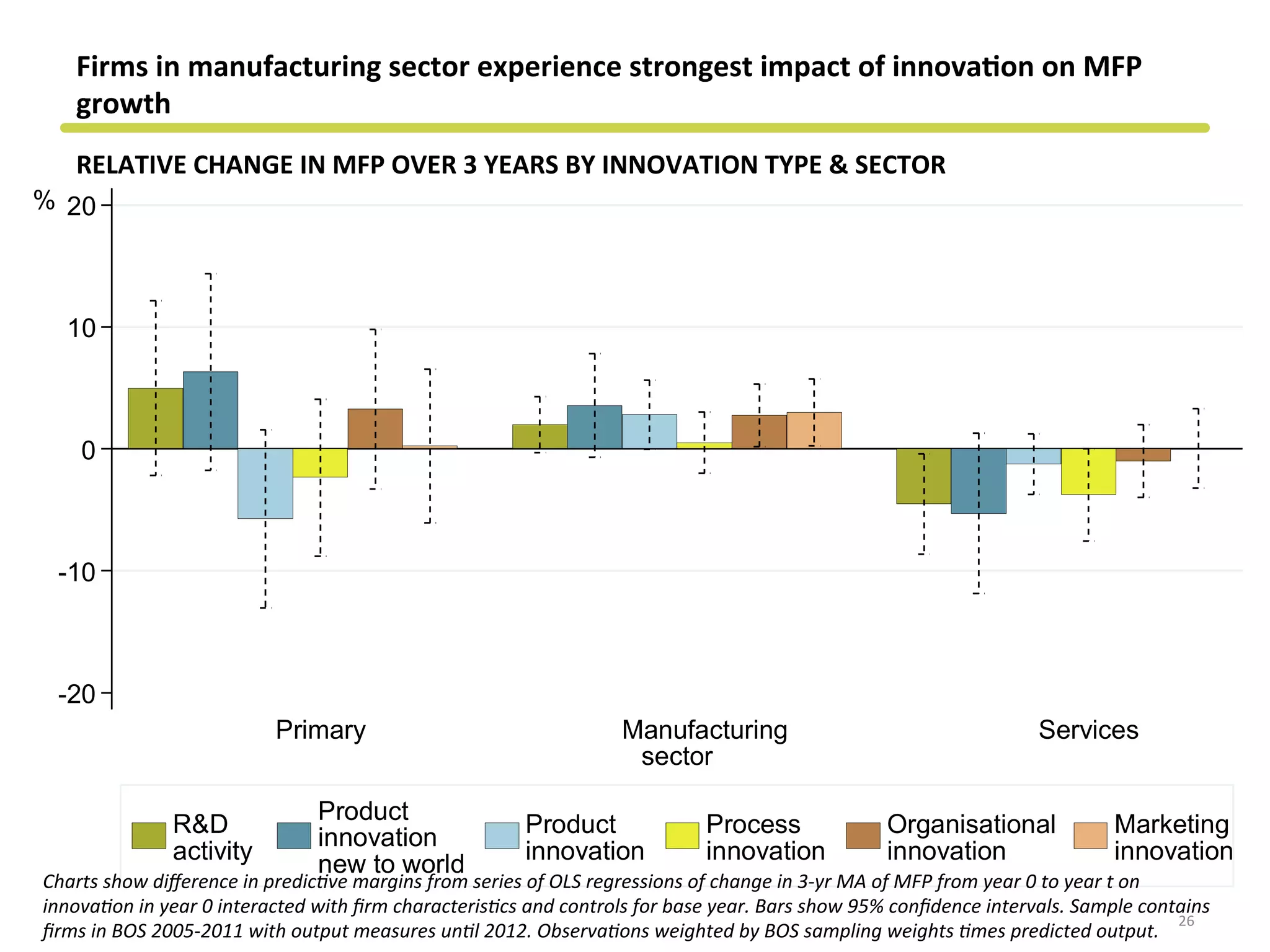

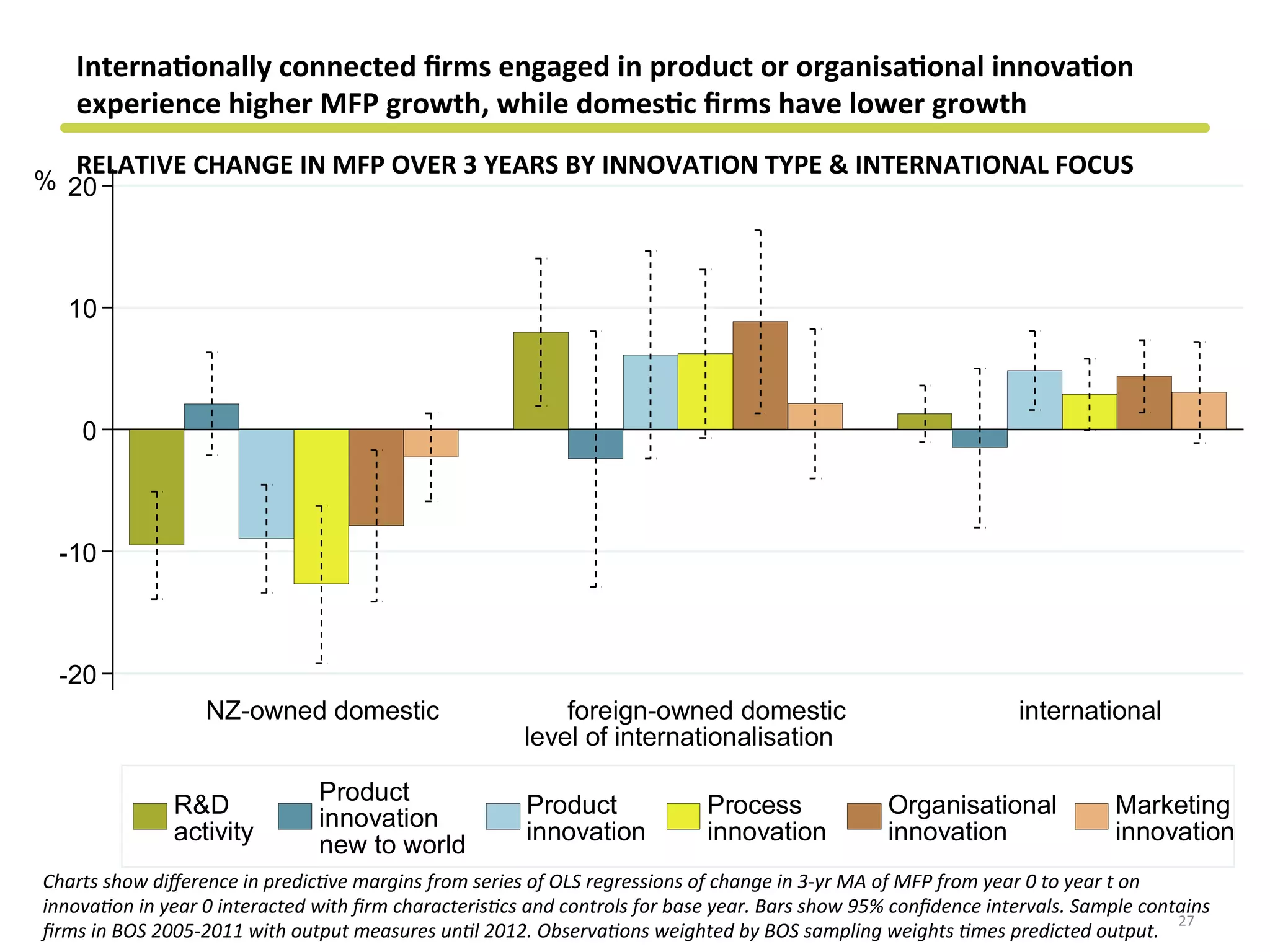

The document discusses the relationship between innovation and productivity for New Zealand firms, revealing that low investment in knowledge-based capital can account for a significant part of the productivity gap relative to the OECD average. It highlights the importance of various types of innovation, such as product, process, and organizational innovations, in influencing firm performance and productivity. Additionally, the findings indicate trends in how engaging in R&D and other innovative activities impacts employment, value-added output, and overall productivity growth.