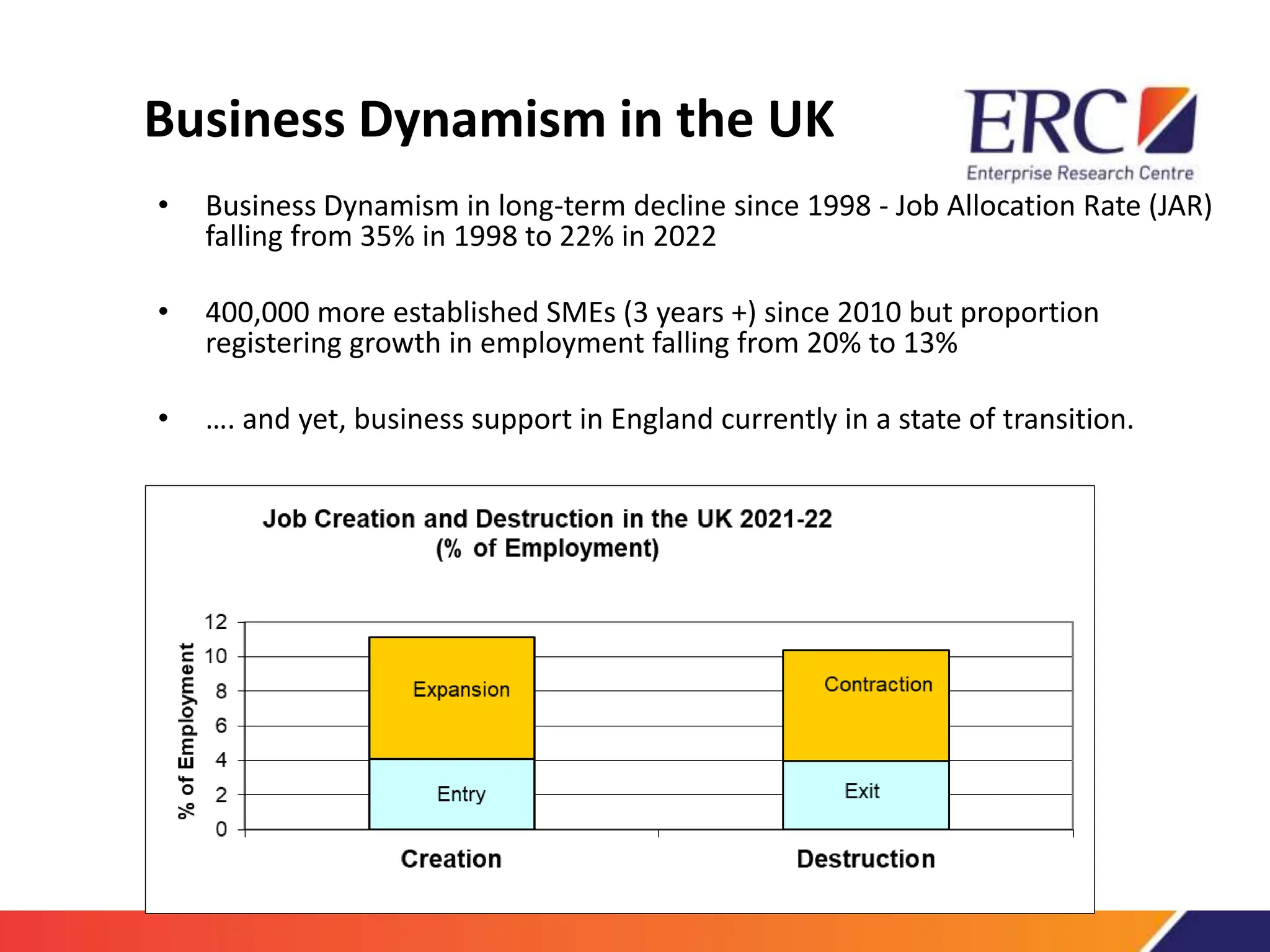

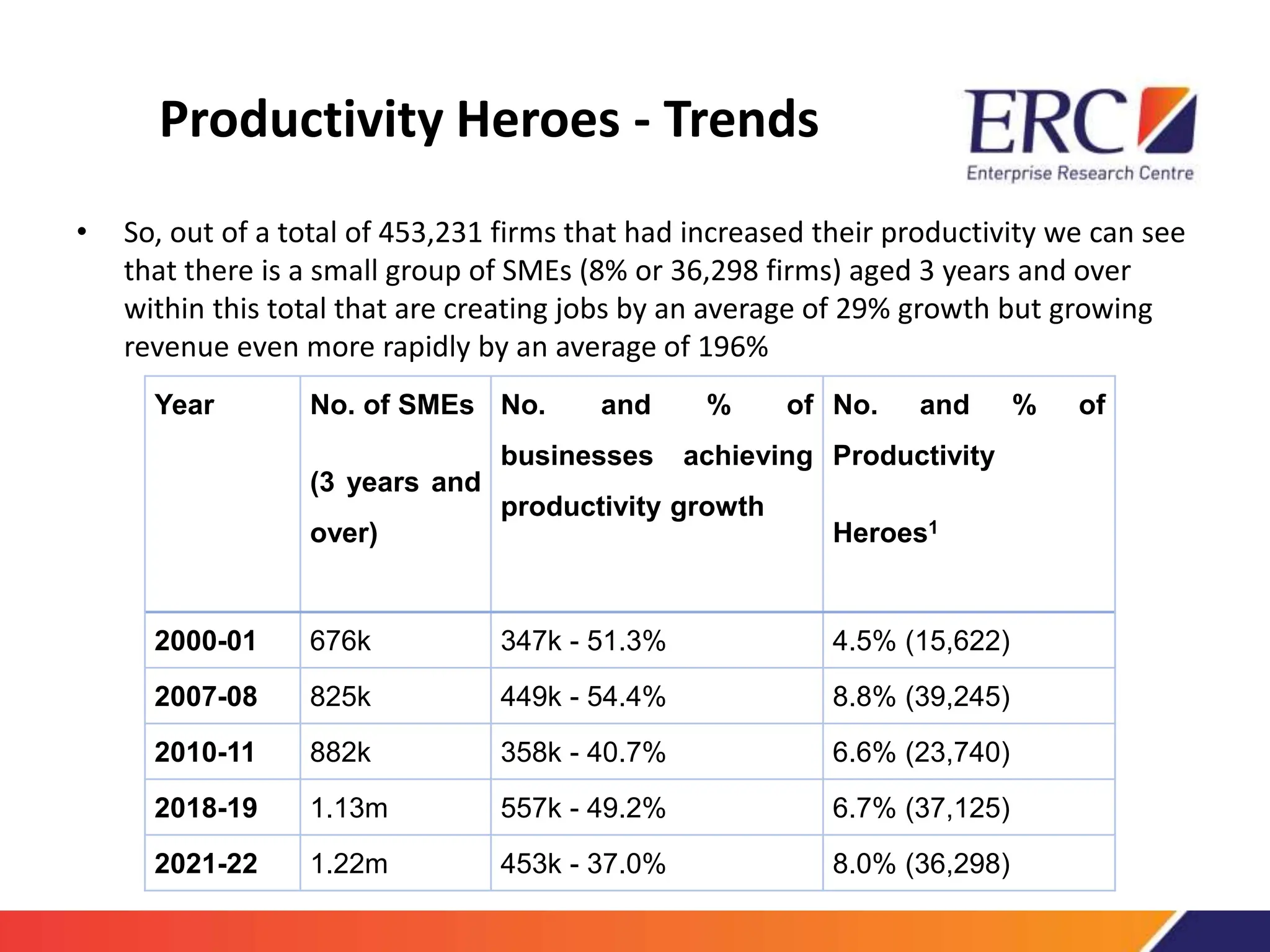

The document discusses research into small businesses in the UK called "Productivity Heroes" - defined as SMEs aged 3+ years that are growing both revenues and headcount, with revenues increasing at a faster rate. Out of over 1 million SMEs in 2021-22, around 8% or 36,298 firms qualified as Productivity Heroes, growing revenue by 196% on average while increasing jobs by 29%. The document recommends focusing policy support on these firms to better understand how to address the UK's productivity problem and long tail of unproductive small businesses. It also plans to track the performance of Productivity Heroes over time and understand the drivers of their productivity gains through future research.