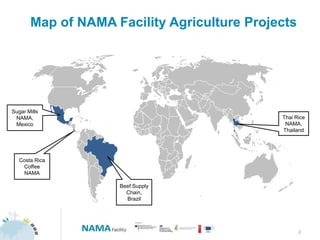

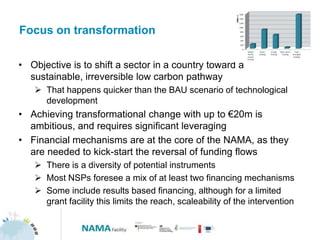

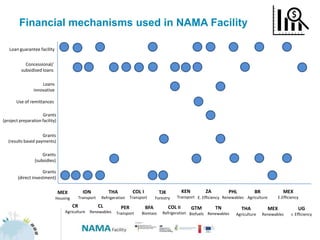

The document discusses the NAMA Facility's efforts in climate finance for agriculture, focusing on transformative projects aimed at achieving low carbon pathways. It emphasizes the importance of diverse financial mechanisms, sustainable business models, and the need for careful consideration of affordability and replication for successful implementation. The role of policy reform and regulatory change is also highlighted as essential for long-term financial sustainability.