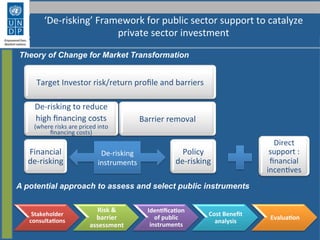

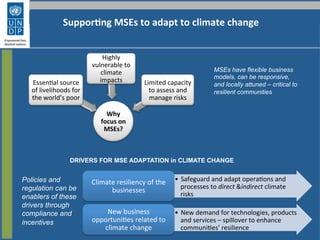

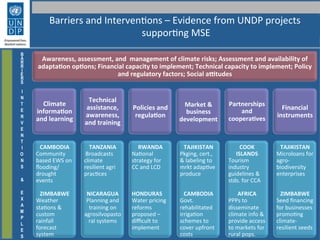

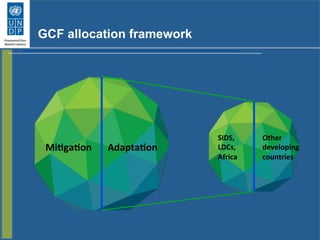

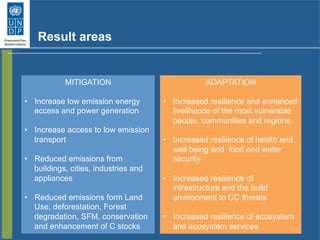

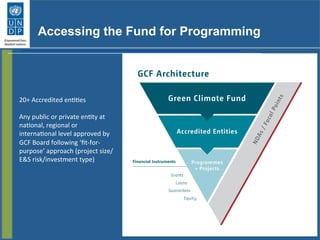

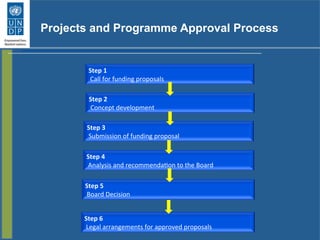

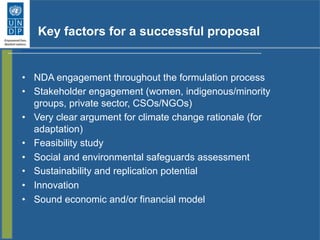

The document outlines a framework for mobilizing adaptation finance focused on supporting micro and small enterprises (MSEs) to adapt to climate change through public sector investment. It discusses de-risking strategies, stakeholder engagement, and various projects aimed at enhancing climate resilience in vulnerable communities across different countries. It also highlights funding mechanisms, successes, and the criteria for accessing financial resources from the Green Climate Fund.