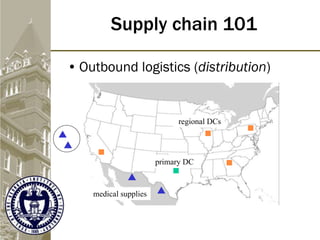

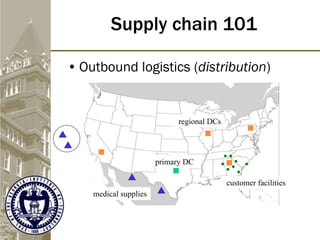

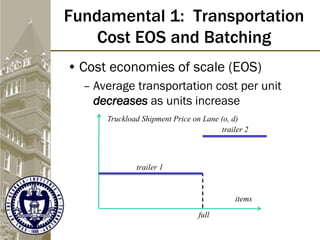

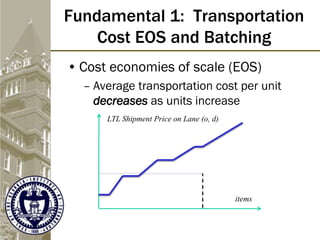

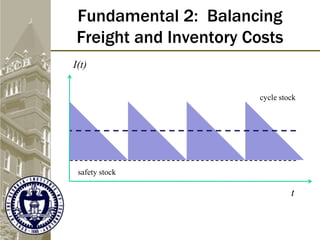

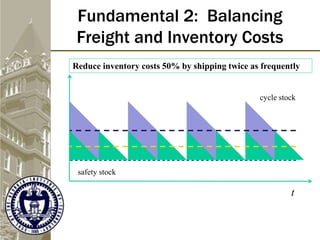

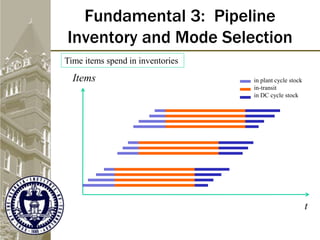

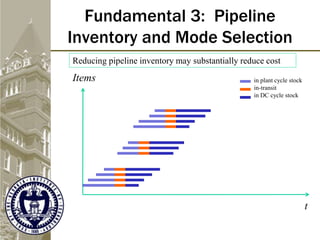

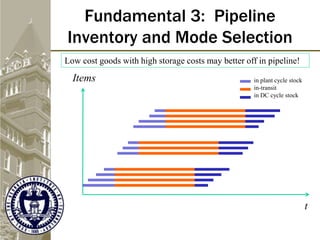

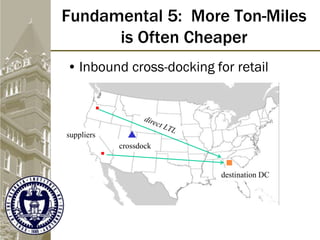

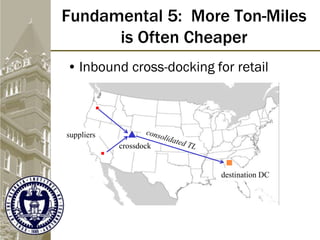

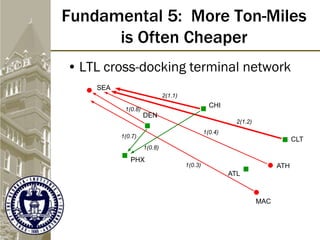

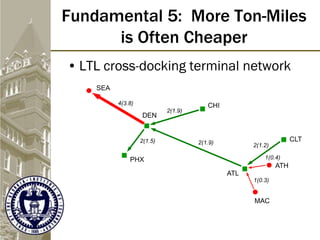

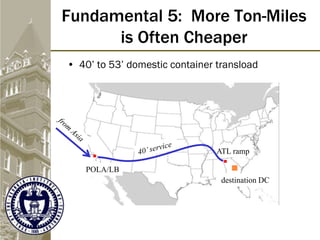

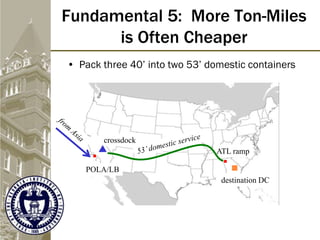

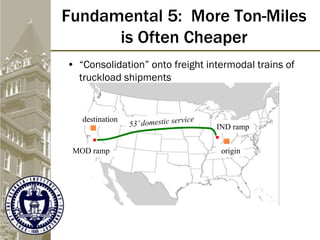

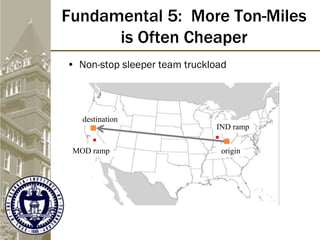

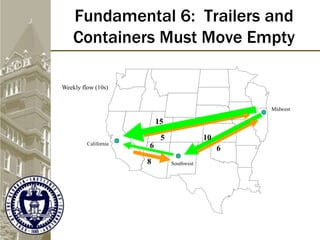

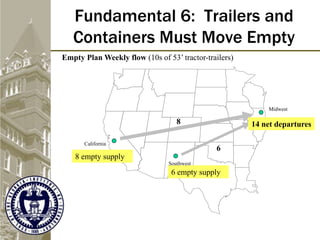

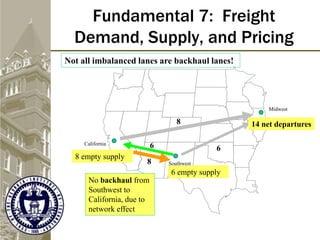

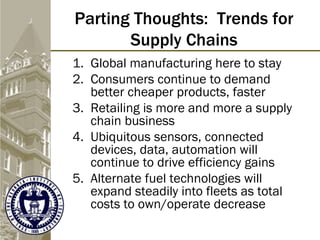

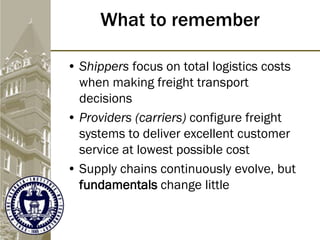

The document discusses the fundamentals of freight logistics and strategies. It outlines 8 key fundamentals, including balancing freight and inventory costs, pipeline inventory and mode selection, safety stock and mode selection, and last-mile freight efficiency being the hardest. Overall, it emphasizes that while supply chains continuously change, the underlying fundamentals of minimizing total logistics costs remain the same.