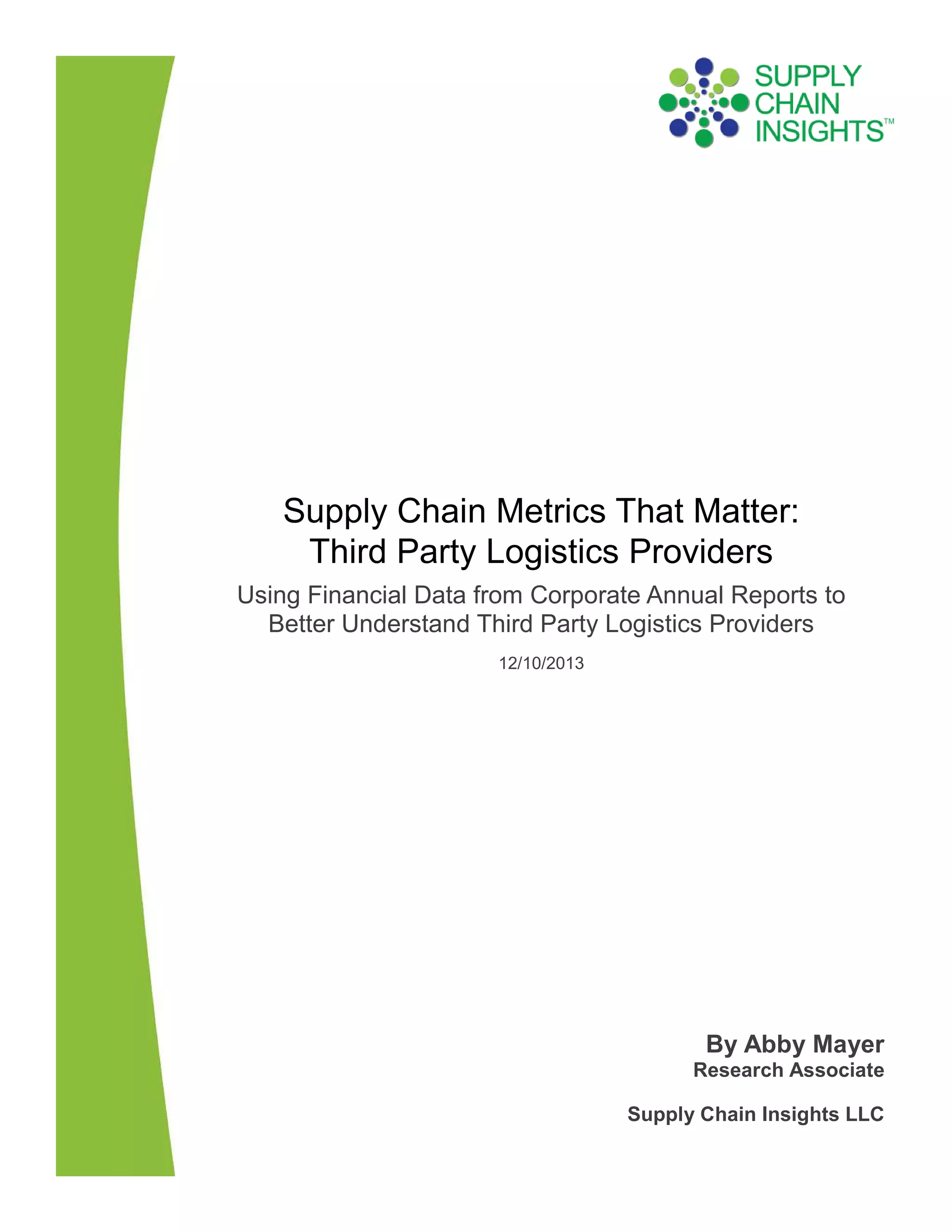

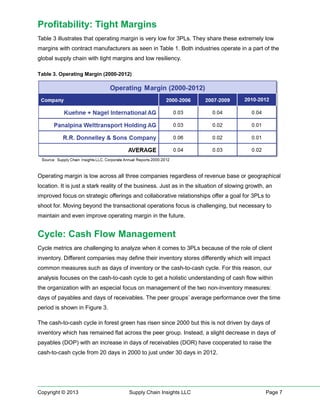

This report analyzes the third-party logistics (3PL) industry's growth, profitability, and operational complexity using financial data from 2000-2012. The 3PL market, which has matured and is now valued at $148 billion, faces challenges with low operating margins and fierce competition but holds opportunities for differentiation and strategic partnerships. Recommendations include focusing on building resilient business models, enhancing brand loyalty, and improving cash flow management.