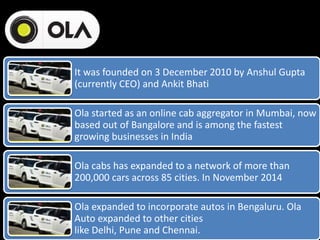

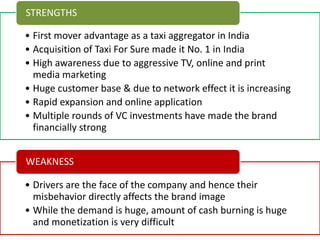

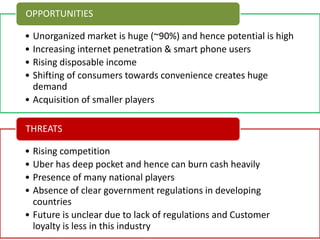

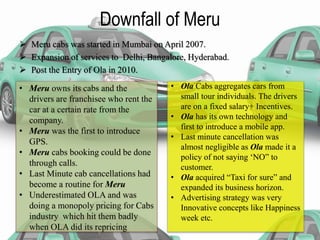

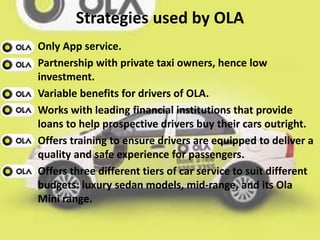

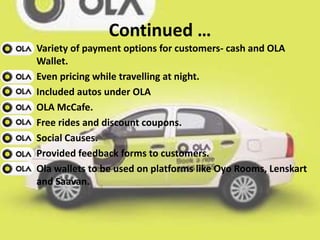

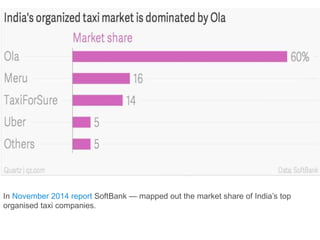

Ola Cabs was founded in 2010 in Mumbai and is now headquartered in Bangalore. It has expanded to over 200,000 vehicles across 85 cities in India. Ola started as an online cab aggregator, partnering with private taxi owners to provide its service through mobile apps. This allowed it to grow rapidly while requiring low investment. Ola acquired TaxiForSure in 2015, making it the largest cab aggregator in India with over 1 million rides booked per day. While Ola faces threats from increasing competition and lack of regulations, its aggressive expansion and partnerships position it for continued growth in India's developing ridesharing market.