Daily market report

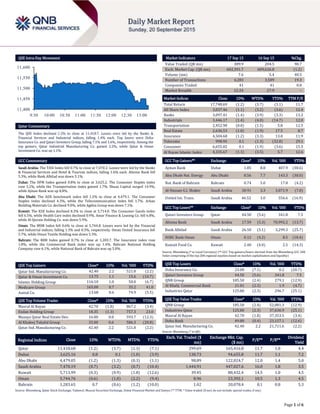

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 1.2% to close at 11,418.7. Losses were led by the Banks & Financial Services and Industrial indices, falling 1.4% each. Top losers were Doha Insurance Co. and Qatari Investors Group, falling 7.1% and 5.6%, respectively. Among the top gainers, Qatar Industrial Manufacturing Co. gained 2.2%, while Qatar & Oman Investment Co. was up 1.1%. GCC Commentary Saudi Arabia: The TASI Index fell 0.7% to close at 7,470.2. Losses were led by the Banks & Financial Services and Hotel & Tourism indices, falling 1.6% each. Alinma Bank fell 5.3%, while Bank Albilad was down 5.1%. Dubai: The DFM Index gained 0.8% to close at 3,625.2. The Consumer Staples index rose 5.2%, while the Transportation index gained 1.7%. Shuaa Capital surged 14.9%, while Ajman Bank was up 8.8%. Abu Dhabi: The ADX benchmark index fell 1.2% to close at 4,479.1. The Consumer Staples index declined 6.3%, while the Telecommunication index fell 1.7%. Arkan Building Materials Co. declined 9.0%, while Agthia Group was down 7.1%. Kuwait: The KSE Index declined 0.3% to close at 5,714.0. The Consumer Goods index fell 6.5%, while Health Care index declined 0.9%. Amar Finance & Leasing Co. fell 6.8%, while Al-Qurain Holding Co. was down 5.9%. Oman: The MSM Index fell 0.6% to close at 5,744.8. Losses were led by the Financial and Industrial indices, falling 1.3% and 0.3%, respectively. Oman United Insurance fell 5.7%, while Oman Textile Holding was down 5.3%. Bahrain: The BHB Index gained 0.7% to close at 1,283.7. The Insurance index rose 1.8%, while the Commercial Bank index was up 1.4%. Bahrain National Holding Company rose 6.1%, while National Bank of Bahrain was up 5.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Ind. Manufacturing Co. 42.40 2.2 521.8 (2.2) Qatar & Oman Investment Co. 13.75 1.1 15.6 (10.7) Islamic Holding Group 116.10 1.0 50.0 (6.7) Medicare Group 165.00 0.7 35.2 41.0 Aamal Co. 13.68 0.6 74.9 (5.5) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Masraf Al Rayan 42.70 (1.8) 867.2 (3.4) Ezdan Holding Group 18.35 (1.3) 757.3 23.0 Mazaya Qatar Real Estate Dev. 16.00 0.0 593.7 (12.3) Al Khaleej Takaful Group 35.00 0.6 586.3 (20.8) Qatar Ind. Manufacturing Co. 42.40 2.2 521.8 (2.2) Market Indicators 17 Sep 15 16 Sep 15 %Chg. Value Traded (QR mn) 389.9 204.5 90.7 Exch. Market Cap. (QR mn) 602,391.7 609,626.8 (1.2) Volume (mn) 7.6 5.4 40.5 Number of Transactions 4,283 3,589 19.3 Companies Traded 41 41 0.0 Market Breadth 12:24 27:9 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,748.69 (1.2) (3.7) (3.1) 11.7 All Share Index 3,037.46 (1.1) (3.2) (3.6) 12.4 Banks 3,097.41 (1.4) (3.9) (3.3) 13.2 Industrials 3,446.17 (1.4) (4.0) (14.7) 12.0 Transportation 2,452.90 (0.0) (1.5) 5.8 12.5 Real Estate 2,636.53 (1.0) (1.9) 17.5 8.7 Insurance 4,504.68 (1.2) (3.3) 13.8 11.9 Telecoms 998.95 0.1 (1.3) (32.8) 29.1 Consumer 6,655.82 0.1 (1.9) (3.6) 15.5 Al Rayan Islamic Index 4,335.67 (1.1) (3.5) 5.7 12.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Ajman Bank Dubai 1.85 8.8 407.9 (30.6) Abu Dhabi Nat. Energy Abu Dhabi 0.56 7.7 143.3 (30.0) Nat. Bank of Bahrain Bahrain 0.74 5.0 17.8 (4.2) Al-Hassan G.I. Shaker Saudi Arabia 30.91 3.3 3,071.9 (7.0) United Int. Trans. Saudi Arabia 46.52 3.0 556.6 (16.9) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Qatari Investors Group Qatar 44.50 (5.6) 341.8 7.5 Alinma Bank Saudi Arabia 17.59 (5.3) 70,992.2 (13.7) Bank Albilad Saudi Arabia 26.50 (5.1) 3,299.3 (25.7) HSBC Bank Oman Oman 0.12 (4.2) 8.5 (18.4) Kuwait Food Co. Kuwait 2.40 (4.0) 2.5 (14.3) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Doha Insurance Co. 23.00 (7.1) 0.2 (20.7) Qatari Investors Group 44.50 (5.6) 341.8 7.5 QNB Group 185.50 (2.4) 279.1 (12.9) Al Khalij Commercial Bank 21.01 (2.3) 1.9 (4.7) Industries Qatar 125.80 (2.3) 296.7 (25.1) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 185.50 (2.4) 52,081.3 (12.9) Industries Qatar 125.80 (2.3) 37,636.9 (25.1) Masraf Al Rayan 42.70 (1.8) 37,353.5 (3.4) Doha Bank 49.80 (0.4) 23,157.1 (12.6) Qatar Ind. Manufacturing Co. 42.40 2.2 21,711.6 (2.2) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,418.68 (1.2) (3.7) (1.3) (7.1) 299.69 165,416.8 11.7 1.8 4.4 Dubai 3,625.16 0.8 0.1 (1.0) (3.9) 138.73 94,655.8 11.7 1.1 7.2 Abu Dhabi 4,479.05 (1.2) (1.3) (0.3) (1.1) 98.89 122,024.7 12.0 1.4 5.0 Saudi Arabia 7,470.19 (0.7) (3.2) (0.7) (10.4) 1,444.91 447,027.6 16.0 1.8 3.5 Kuwait 5,713.99 (0.3) (0.9) (1.8) (12.6) 39.45 88,432.4 14.5 1.0 4.5 Oman 5,744.76 (0.6) (1.0) (2.2) (9.4) 8.96 23,392.1 10.5 1.3 4.5 Bahrain 1,283.65 0.7 (0.6) (1.2) (10.0) 1.02 20,078.4 8.1 0.8 5.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,400 11,450 11,500 11,550 11,600 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 1.2% to close at 11,418.7. The Banks & Financial Services and Industrial indices led the losses. The index fell on the back of selling pressure from GCC and non-Qatari shareholders despite buying support from Qatari shareholders. Doha Insurance Co. and Qatari Investors Group were the top losers falling 7.1% and 5.6%, respectively. Among the top gainers, Qatar Industrial Manufacturing Co. gained 2.2%, while Qatar & Oman Investment Co. was up 1.1%. Volume of shares traded on Thursday rose by 40.5% to 7.6mn from 5.4mn on Wednesday. However, as compared to the 30-day moving average of 7.7mn, volume for the day was 1.3% lower. Masaraf Al Rayan and Ezdan Holding Group were the most active stocks, contributing 11.4% and 10.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 9/17 US BLOOMBERG Bloomberg Consumer Comfort 13-September 40.2 – 41.4 9/17 US Department of Labor Initial Jobless Claims 12-September 264K 275K 275K 9/17 SP INE Labor Costs YoY 2Q2015 0.40% – 0.50% 9/17 IT ISTAT Trade Balance Total July 8,026M – 2,806M 9/17 IT ISTAT Trade Balance EU July 3,010M – 594M Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar Qatar to spend $220bn on major projects – Qatar is prioritizing existing development projects in view of falling oil prices and plans to award large-scale investment projects worth $220bn over the next 10 years. Global credit rating agency Standard and Poor's (S&P) said the investment program will focus on infrastructure, education and health. S&P said it expects the majority of the projects to be completed ahead of the 2022 FIFA World Cup slated to be held in Qatar. The program will support medium-term real economic growth, although it will contribute to deterioration in fiscal and external balances, exacerbated by a large fall in oil prices. Meanwhile, S&P affirmed its 'AA' long-term and 'A-1+' short-term foreign and local currency sovereign credit ratings on Qatar with a stable outlook. They also affirmed 'AA' long-term issue ratings on the bonds issued by Qatari Diar Finance and SoQ Sukuk A. (Zawya) QNB Group holds preliminary talks for KFH’s Malaysia unit – QNB Group (QNBK) said it is in preliminary talks to buy Kuwait Finance House's (KFH) Malaysia unit. QNBK said no agreements had been reached over a potential deal and it would make any necessary disclosures to the Qatar stock market in the future. (QSE, Bloomberg, Reuters) Alkhalij Cement invests QR800mn on new production line – Qatari Investors Group (QIGD) Chief Administration Officer, Firas Tayssir Ibrahim said Qatar’s expansion projects have prompted its subsidiary Alkhalij Cement Company, to invest around QR800mn on a new production line to keep up with the growing cement demand. He said the new line is expected to be operational by 1Q2016, increasing cement production by 50% and doubling clinker production. While the production of clinker will reach around 2mn tons and cement around 3mn tons by the end of 2015, QIGD expects to produce close to 4mn tons of clinker and 4.5mn tons of cement (Gulf-Times.com) UDCD successfully completes limited auction of townhouses – United Development Company (UDCD) has successfully completed its first limited auction offering of nine Qanat Quartier townhouses. Through the envelope bidding method, UDCD had auctioned some of the finest and most luxurious townhouses in the Venice-like community of Qanat Quartier. In what was considered to be a competitive process with a set minimum opening price of QR25,000 per square meter, a number of bids exceeded this amount, consequently setting a new benchmark for future sale rates at The Pearl-Qatar. Further, real estate investment opportunities are expected to be offered in 4Q2015, which is expected to impact UDCD’s outlook and further its growth for FY2015 and beyond. (Gulf-Times.com) QFC establishes independent Employment Standards Office – The Qatar Financial Centre (QFC) has established an independent Employment Standards Office (ESO). The ESO, which previously operated under the Legal department, is the new statutory compliance office for businesses registered under the QFC. The office has been established with the aim to protect both employers and employees through robust regulations, codes and procedures. Its objectives include enforcing compliance with regulations, ensuring fair treatment of employers and employees, encouraging communication between its members, facilitating dispute resolution and developing a productive QFC workforce. (Gulf- Times.com) New center at HIA for immigration services – The Airport Immigration Department of the General Directorate of Nationality, Borders and Expatriates Affairs has opened a new office for the issuance of travel permits and other services at the Hamad International Airport (HIA). The office is located at the departures terminal close to the luggage weighing counter. (Gulf-Times.com, Peninsula Qatar) Qatar, France look to strengthen bilateral economic relations – Qatar and France have explored options on mutual cooperation in the areas of capital market in a bid to strengthen the bilateral economic relations between the two countries. These were discussed by the visiting delegation from France with the Qatar Stock Exchange (QSE) officials at their recent meeting. French Ambassador Eric Chevallier and Agathe Demarais, Economic Overall Activity Buy %* Sell %* Net (QR) Qatari 51.31% 25.29% 101,459,801.34 GCC 9.56% 21.67% (47,248,902.19) Non-Qatari 39.14% 53.03% (54,210,899.15)

- 3. Page 3 of 6 Adviser on Middle East Affairs at the French Ministry of Economy & Finance; and the head of the Economic Department of the French Embassy were part of the French delegation. (Gulf-Times.com, QSE) ORDS wins ‘Best operator’ and ‘Best telecom CEO’ awards – Ooredoo (ORDS) has won the ‘Best operator’ at the Telecoms World Middle East Awards 2015 and ‘Telecoms CEO of the Year’ for Dr. Nasser Marafih at the CEO Middle East Awards in Dubai. The company has delivered impressive results in 2015, reaching an all-time high of more than 114mn customers across its footprint, increasing its leadership position in data services (now worth 34% of the Group’s revenue), and enhancing its portfolio of solutions for business and enterprise customers. In addition, the company has taken the lead in network performance, delivering 4G+ in Qatar and Kuwait, 4G in Oman, Tunisia and the Maldives, and providing 3G services in Algeria and Myanmar. (Gulf- Times.com) Thailand offers to share agriculture expertise with Qatar – Thailand Ambassador to Qatar Piroon Laismit said Thailand is ready to provide its expertise in the fields of agriculture and aquaculture, including hydroponics, to support Qatar’s food security program. (Gulf-Times.com) Qatar ranked fifth in Global Innovation Index – Qatar has been ranked fifth in Northern Africa and Western Asia region in the Global Innovation Index (GII) by leading business schools and World Intellectual Property Organization. Meanwhile, Qatar has been ranked third in the GCC region. In the category of Northern Africa and Western Asia region, which has 19 countries, Cyprus is second, Saudi Arabia third and the UAE fourth. In the overall ranking of 141 countries around the world, Qatar has secured 50th rank. (Peninsula Qatar) Qatargas EMS section gets US accreditation – Qatargas’ Fire & Rescue Emergency Management Services (EMS) Department has been awarded “Accredited Agency” status by the US-based Centre for Public Safety Excellence (CPSE), making it the first CPSE- accredited agency in the Middle East region. The CPSE provides the only accreditation program for Fire & Rescue Emergency Management Service organizations in the world. Qatargas said that with the new status, the EMS department joins the line-up of 218 accredited agencies worldwide. (Gulf-Times.com) International US Fed defers interest rate liftoff on global weakness – The Federal Reserve left short-term interest rates unchanged after weeks of market-churning debate on September 17, putting off a historic move to end an era of ultra-cheap credit amid worries about weak growth overseas. While central-bank officials do not believe recent global economic and market turbulence will throw the US economy off track, they want to be sure before they push rates higher. Most of the policy makers at the meeting (13 out of 17) indicated they still expect the Fed to move rates this year, but that was down from the 15 who held that view in June. The Fed had cut its benchmark interest rate—called the federal funds rate—to near zero in December 2008 and has kept the rate there ever since, in an effort to encourage borrowing, spending and investing to boost economic growth more broadly. The central bank has two more scheduled policy meetings, in late October and mid-December 2015. (WSJ) Moody’s downgrades France, raises outlook to stable – Moody’s Investors Service downgraded France’s credit rating by one rung to Aa2 from Aa1, citing issues that include weakness in the nation’s medium-term growth outlook. Moody’s changed its outlook for France to stable from negative. Moody’s said it believes low medium-term growth will be an obstacle for any material reversal in France’s elevated debt burden in the foreseeable future. However, the rating firm said that France’s credit worthiness remains extremely high and the nation has a large, wealthy and well-diversified economy. (WSJ) China home prices gain for fourth month in August – Home prices in China rose for a fourth consecutive month in August, offering hope that the ailing property sector is becoming less of a drag on the slowing economy. However, analysts do not expect a full-blown turnaround any time soon, as a huge overhang of unsold homes discourages new construction and investment in all but the biggest cities. The National Bureau of Statistics’ (NBS) survey recorded price gains in 35 of the 70 cities, up from 31 in July. According to Reuters’ calculations, based on data released by the NBS, average new home prices inched up 0.3% MoM in August, the same pace as in July. The NBS said that, on a nationwide basis, prices rose 1.7% YoY in August, marking the first increase since September 2014. The property sector accounts for 15% of China's GDP, so even modest signs of improvement would relieve some pressure on the economy, which is expected to expand at its slowest pace in a quarter of a century in 2015. (Reuters) Russian FM: Pension money could help to fund budget deficit – Russia’s Finance Minister (FM) Anton Siluanov said pension savings would be a good source of funding to help finance the country’s budget deficit. His comments came ahead of a government decision on whether to divert pension savings to fund the budget directly. He said that pension funds were expected to buy around RUB345-350bn in government bonds next year, helping to fund the one trillion rubles in domestic borrowing penciled in by the government. The government is debating whether obligatory contributions which employers’ pay into pension funds should be frozen for the third year running so the money can be diverted to the state to help fill budget holes. Siluanov said he expected the government to take a decision next week on the fate of the obligatory pension contributions in 2016. Russia’s economy is under pressure from low oil prices and the impact of Western economic sanctions imposed over the country’s role in the Ukraine crisis. (Reuters) Regional Saudi Aramco names President & CEO – Saudi Arabian Oil Company (Saudi Aramco) has appointed Amin al-Nasser as President and Chief Executive Officer (CEO), as part of leadership changes at the world’s biggest oil company overseen by a newly-created supreme council headed by the Saudi King’s son. Saudi Aramco’s supreme council also approved a five-year business plan at its first meeting in Jeddah. Al Nasser was named interim CEO in May, replacing Khalid Al-Falih, who became Chairman and Health Minister. The supreme council is restructuring the Dhahran-based company, which is no longer under the oil ministry. Al Nasser is also on the board, below the supreme council. (Bloomberg) SAMA approves Bawan’s SR100mn capital increase request via bonus shares – Bawan Company has obtained the Saudi Arabian Monetary Agency’s (SAMA) approval to increase its capital from SR500mn to SR600mn through one-for-five bonus shares distribution. Such an increase will be paid by transferring an amount of SR100mn from the retained earnings account to the company's capital. This will increase the company’s outstanding shares from 50mn to 60mn. Those shareholders, who are registered in the shareholders register at the close of trading on the day of the extraordinary general assembly meeting (EGM), would be eligible for this bonus shares. The date of the EGM will be determined later by the company's board, which needs to be held within six months from the approval date. (Tadawul) Almarai successfully completes Sukuk issue – Saudi-based Almarai Company has completed its Sukuk issue amounting to SR1.6bn on September 16, 2015. This issue was made on a floating rate basis

- 4. Page 4 of 6 with a term of seven years and was a private offering to sophisticated investors in the Kingdom. (Tadawul) BlackRock introduces first Saudi Arabia exchange-traded fund – BlackRock Inc. has introduced an exchange-traded fund investing in Saudi Arabia, marking the first of its kind. The iShares MSCI Saudi Arabia Capped ETF has top exposures to financials, materials and telecommunications. BlackRock’s Head of iShares America’s institutional business, Daniel Gamba said while BlackRock anticipates pension funds, foundations and endowments will be among the first investors in the ETF, it believes that ultimately mutual funds will use it to access the Saudi Arabian market. Meanwhile, New York-based Van Eck also has two Saudi Arabia- based ETFs in registration with the Securities and Exchange Commission. (Reuters) EA, partners raise further $200mn with reopening of joint bond – Etihad Airways (EA) has increased the amount of cash it raised with its first joint bond issue by 40% after it restarted fundraising. The Abu Dhabi-based carrier and six partners said they had raised an extra $200mn from their first joint bond issue after reaching an initial target of $500mn, taking the size of the issue to $700mn. Goldman Sachs, ADS Securities and Anoa Capital reopened the fundraising for Etihad, Etihad Airport Services, Air Berlin, Air Serbia, Air Seychelles, Alitalia and Jet Airways. They used a financial instrument known as a tap, which enables an existing transaction to reopen for subscription using the same documentation as before. (GulfBase.com) UAE signs cooperation agreement with Hungary – The UAE and Hungary have signed an economic and technical cooperation agreement aimed at placing an institutional and legal framework for bilateral relations, especially in economic trade and investment fields. The agreement will work toward establishing a joint economic committee to promote cooperation in the fields of scientific research, training for small & medium-sized enterprises and establish joint ventures in a number of sectors, including trade, industry, tourism and agriculture. (GulfBase.com) SNAM, Daewoo to establish joint automobile plant – South Korean ambassador to Saudi Arabia, Kim Jong-yong said the Saudi National Automobile Manufacturing Company (SNAM) and South Korea-based Daewoo International will establish the first Saudi Arabia-based car manufacturing firm. The ambassador said that the venture will be a quantum leap for the Saudi market and will provide jobs to Saudi nationals. He stated that 17% of the new vehicles that entered the Saudi market in 1H2015 were made in South Korea. He also point out that Saudi investments in South Korea had totaled $192mn in 2014 and expects this figure to increase in the coming period. (GulfBase.com) Nakheel inks AED819mn Dubai tower contract – Nakheel has awarded a contract worth AED819mn for the construction of The Palm Tower, its 52-storey, five star hotel and residential complex on Dubai’s Palm Jumeirah. The company has signed up UAE-based Trojan General Contracting and National Projects & Construction to jointly build the luxury landmark. The Palm Tower comprises 504 luxury residences and a five star, 290-room hotel with an array of dining and leisure facilities, including a rooftop infinity pool, restaurant and viewing deck. The hotel will occupy the first 18 floors of the building. (Bloomberg) DP World plans to launch major solar energy project in Dubai – Dubai-based DP World is planning to launch a major renewable energy project with the installation of photovoltaic solar panels to generate electricity, allowing it to reduce its carbon footprint while exporting surplus energy to the national grid. Emirates News Agency (WAM) reported that the project, launched in cooperation with Economic Zones World, a DP World subsidiary, involves rooftop solar panel mountings on its Jebel Ali free zone buildings, parking sheds, and several of its cruise terminal buildings in Port Rashid. (Bloomberg) HSBC Middle East to move head office to Dubai from Jersey in 2016 – Mohammad al-Tuwaijri, Deputy Chairman & CEO of HSBC in the MENA region said HSBC Holdings' Middle East business will move its head office from Jersey to Dubai's financial free zone in 2016. The bank said the move, which means it will be regulated by the Dubai Financial Services Authority, would not affect its customers or its regulatory relationships in other countries outside of the UAE. The Dubai International Financial Centre, set up in 2004, has its own labor laws and court system separate from the wider UAE. (Reuters) Huawei signs IT operations contract with Ooredoo Kuwait – Ooredoo Kuwait, a member of Ooredoo Group, and Huawei have jointly signed a ‘Future Mode of Operation (FMO)’ IT and Network Managed Services contract. Under the terms of the contract, Huawei will provide managed IT and network operations, network performance management and service quality improvement for Ooredoo Kuwait. Huawei will provide an ICT converged operation solution to manage IT and telecom equipment through converged operation processes, resources and tools. It aims to help Ooredoo Kuwait achieve digital transformation, operational excellence and to improve the customer experience. (GulfBase.com) KPI aims to boost fuel outlets in Europe – Kuwait Petroleum International (KPI) is planning more investments in Europe, including investments in storage terminals and other oil-related facilities to help to provide more outlets for the fuels it produces. KPI Vice President Europe Khaled Al-Mushaileh said that his company sees Europe as an important market and plans to expand in retail and downstream sectors. (Reuters) Kuwait says oil market will balance itself – Kuwait's OPEC Governor Nawal al-Fuzaia said that the oil market would balance itself but the members needs to be patient, indicating support for the producer group's policy of defending market share despite falling prices. Fuzaia said the current imbalance in the market stemmed from several factors and not just an economic slowdown in China. She feels the weakening demand in China is a short-term issue and it will not have an effect on OPEC’s market share. The OPEC had shifted policy in November 2014 by deciding not to support prices by cutting output, in order to defend market share against US shale oil and other higher-cost supply sources. The shift, led by Saudi Arabia and its Gulf allies, has proved controversial within OPEC as oil prices have more than halved from above $100 in June 2014, hurting the economies of less wealthy members such as Venezuela. (Reuters) MoTC floats tender for eight road maintenance contracts – The Ministry of Transport and Communications (MoTC) has floated eight tenders for road maintenance in different parts of the country, including Dakliah, North Batinah, North Sharqiah and Musandam regions. MoTC has invited bids from companies for maintenance work, while only companies registered with the tender board is eligible for bidding some of the projects. According to a tender board announcement, three maintenance contracts are for paved roads in Dakliah, Sharqiyah and North Batinah regions and the first two are for annual maintenance. Another five maintenance contracts are for track roads in North Dakliah, North Sharqiyah, North Batinah, Musandam and Dahirah regions. The tender documents for bidding firms will be distributed till October 8, 2015, while the opening date is October 26, 2015. (GulfBase.com) Oman signs pact to enhance GCC market integration – Oman and other Gulf states have signed a multilateral MoU to achieve uniformity in laws and regulations in the GCC stock markets. This will also help to enhance economic integration among GCC

- 5. Page 5 of 6 countries. The MoU would act as regulatory framework in a move to enhance the relations among such bodies to facilitate exchange of information. The MoU was signed on the sidelines of the sixth Ministerial Committee meeting of the chairmen of GCC securities commissions. (GulfBase.com) UK-based Petrofac wins $100mn gas contract in Bahrain – According to sources, UK-based Petrofac has won a contract worth around $100mn from Bahrain-based Tatweer Petroleum to build a gas dehydration facility. The capacity of the gas facility would be 500mn standard cubic feet per day (scfd). This project is the first among those planned by Tatweer to add gas capacity to meet the rising domestic demand. (GulfBase.com) Bahrain, Saudi sign $300mn deals for new oil pipeline – Bahrain’s energy minister, Abdul-Hussain bin Ali Mirza said Saudi Arabia and Bahrain have signed contracts worth around $300mn to lay a new 350,000 barrel per day (bpd) oil pipeline between the two countries, with the link due to be operational in 2018. Bahrain relies on output from the Abu Safa oilfield that it shares with Saudi Arabia for the vast majority of its oil and the new pipeline will replace an ageing 230,000 bpd link and enable Bahrain Petroleum Company (Bapco) expand the processing capacity of its 267,000 bpd Sitra refinery. Eventually the new pipeline's capacity could be increased to 400,000 bpd. (GulfBase.com)

- 6. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Index S&P Pan Arab S&P GCC (0.7%) (1.2%) (0.3%) 0.7% (0.6%) (1.2%) 0.8% (1.6%) (1.2%) (0.8%) (0.4%) 0.0% 0.4% 0.8% 1.2% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,139.02 0.7 2.8 (3.9) MSCI World Index 1,630.69 (1.3) 0.2 (4.6) Silver/Ounce 15.18 0.2 3.9 (3.3) DJ Industrial 16,384.58 (1.7) (0.3) (8.1) Crude Oil (Brent)/Barrel (FM Future) 47.47 (3.3) (1.4) (17.2) S&P 500 1,958.03 (1.6) (0.2) (4.9) Crude Oil (WTI)/Barrel (FM Future) 44.68 (4.7) 0.1 (16.1) NASDAQ 100 4,827.23 (1.4) 0.1 1.9 Natural Gas (Henry Hub)/MMBtu 2.63 (1.9) (1.5) (12.3) STOXX 600 354.77 (1.2) (0.1) (2.7) LPG Propane (Arab Gulf)/Ton 45.75 (1.1) 2.8 (6.6) DAX 9,916.16 (2.5) (1.9) (5.4) LPG Butane (Arab Gulf)/Ton 57.25 (1.3) 3.2 (8.8) FTSE 100 6,104.11 (0.9) 0.8 (7.0) Euro 1.13 (1.2) (0.4) (6.6) CAC 40 4,535.85 (2.0) (0.1) (0.3) Yen 119.98 (0.0) (0.5) 0.2 Nikkei 18,070.21 (1.1) (0.4) 3.2 GBP 1.55 (0.4) 0.7 (0.3) MSCI EM 829.86 0.3 3.4 (13.2) CHF 1.03 (0.9) 0.1 2.7 SHANGHAI SE Composite 3,097.92 0.4 (3.1) (6.6) AUD 0.72 0.2 1.4 (12.1) HANG SENG 21,920.83 0.3 1.9 (7.1) USD Index 94.86 0.3 (0.3) 5.1 BSE SENSEX 26,218.91 1.7 3.3 (8.3) RUB 66.50 1.5 (2.2) 9.5 Bovespa 47,264.08 (3.4) 0.9 (36.1) BRL 0.25 (1.2) (1.9) (32.8) RTS 816.56 (0.8) 2.2 3.3 136.7 115.3 111.1