7 July Daily market report

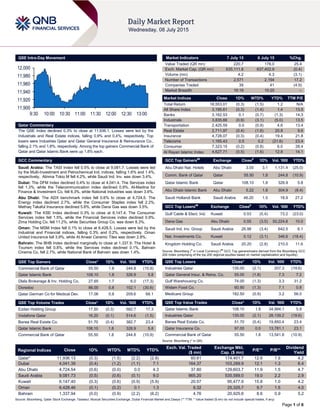

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.3% to close at 11,936.1. Losses were led by the Industrials and Real Estate indices, falling 0.9% and 0.4%, respectively. Top losers were Industries Qatar and Qatar General Insurance & Reinsurance Co., falling 2.1% and 1.8%, respectively. Among the top gainers Commercial Bank of Qatar and Qatar Islamic Bank were up 1.8% each. GCC Commentary Saudi Arabia: The TASI Index fell 0.5% to close at 9,081.7. Losses were led by the Multi-Investment and Petrochemical Ind. indices, falling 1.6% and 1.4%, respectively. Alinma Tokio M fell 4.2%, while Saudi Ind. Inv. was down 3.4%. Dubai: The DFM Index declined 0.4% to close at 4,041.4. The Services index fell 1.3%, while the Telecommunication index declined 0.9%. Al-Madina for Finance & Investment Co. fell 6.3%, while National Industries was down 3.6%. Abu Dhabi: The ADX benchmark index fell 0.6% to close at 4,724.5. The Energy index declined 2.7%, while the Consumer Staples index fell 2.2%. Methaq Takaful Insurance declined 5.6%, while Dana Gas was down 3.5%. Kuwait: The KSE Index declined 0.3% to close at 6,147.4. The Consumer Services index fell 1.5%, while the Financial Services index declined 0.9%. Zima Holding Co. fell 11.2%, while Securities Group Co. was down 8.3%. Oman: The MSM Index fell 0.1% to close at 6,428.5. Losses were led by the Industrial and Financial indices, falling 0.3% and 0.2%, respectively. Oman United Insurance fell 3.9%, while Al Anwar Ceramic Tiles was down 2.8%. Bahrain: The BHB Index declined marginally to close at 1,337.9. The Hotel & Tourism index fell 0.8%, while the Services index declined 0.1%. Bahrain Cinema Co. fell 2.7%, while National Bank of Bahrain was down 1.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Commercial Bank of Qatar 55.50 1.8 244.8 (10.9) Qatar Islamic Bank 108.10 1.8 326.9 5.8 Dlala Brokerage & Inv. Holding Co. 27.65 1.7 6.0 (17.3) Ooredoo 86.00 0.8 102.1 (30.6) Qatar German Co for Medical Dev. 17.06 0.8 209.6 68.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 17.50 (0.3) 582.7 17.3 Vodafone Qatar 16.20 (0.1) 514.6 (1.5) Barwa Real Estate Co. 51.70 (0.4) 382.7 23.4 Qatar Islamic Bank 108.10 1.8 326.9 5.8 Commercial Bank of Qatar 55.50 1.8 244.8 (10.9) Market Indicators 7 July 15 6 July 15 %Chg. Value Traded (QR mn) 220.7 176.0 25.4 Exch. Market Cap. (QR mn) 635,111.8 637,402.9 (0.4) Volume (mn) 4.2 4.3 (3.1) Number of Transactions 2,571 2,194 17.2 Companies Traded 39 41 (4.9) Market Breadth 16:19 10:25 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,553.01 (0.3) (1.5) 1.2 N/A All Share Index 3,195.61 (0.3) (1.4) 1.4 13.5 Banks 3,162.53 0.1 (0.7) (1.3) 14.3 Industrials 3,835.66 (0.9) (3.1) (5.0) 13.5 Transportation 2,425.59 0.0 (0.9) 4.6 13.4 Real Estate 2,711.97 (0.4) (1.6) 20.8 9.6 Insurance 4,728.07 (0.3) (0.4) 19.4 21.8 Telecoms 1,165.43 0.5 0.2 (21.6) 23.4 Consumer 7,323.15 (0.2) (0.8) 6.0 28.4 Al Rayan Islamic Index 4,627.71 (0.5) (1.6) 12.8 14.1 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Hotels Abu Dhabi 3.00 3.1 1,131.4 (25.0) Comm. Bank of Qatar Qatar 55.50 1.8 244.8 (10.9) Qatar Islamic Bank Qatar 108.10 1.8 326.9 5.8 Abu Dhabi Islamic Bank Abu Dhabi 5.22 1.8 304.9 (8.4) Saudi Hollandi Bank Saudi Arabia 46.20 1.5 18.9 27.2 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Gulf Cable & Elect. Ind. Kuwait 0.53 (5.4) 73.2 (23.0) Dana Gas Abu Dhabi 0.55 (3.5) 50,224.6 10.0 Saudi Ind. Inv. Group Saudi Arabia 26.98 (3.4) 642.5 6.1 Nat. Investments Co. Kuwait 0.12 (3.1) 346.6 (18.4) Kingdom Holding Co. Saudi Arabia 20.20 (2.8) 210.0 11.6 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Industries Qatar 135.00 (2.1) 207.3 (19.6) Qatar General Insur. & Reins. Co. 55.00 (1.8) 7.3 7.2 Gulf Warehousing Co. 74.00 (1.3) 3.3 31.2 Widam Food Co. 60.90 (1.3) 7.1 0.8 Medicare Group 182.50 (0.9) 3.2 56.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Islamic Bank 108.10 1.8 34,994.1 5.8 Industries Qatar 135.00 (2.1) 28,139.2 (19.6) Barwa Real Estate Co. 51.70 (0.4) 19,850.4 23.4 Qatar Insurance Co. 97.00 0.0 13,781.1 23.1 Commercial Bank of Qatar 55.50 1.8 13,541.8 (10.9) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,936.13 (0.3) (1.5) (2.2) (2.8) 60.61 174,401.7 12.6 1.9 4.2 Dubai 4,041.39 (0.4) (1.2) (1.1) 7.1 164.37 103,289.9 12.1 1.3 6.4 Abu Dhabi 4,724.54 (0.6) (0.0) 0.0 4.3 37.80 129,603.7 11.9 1.5 4.7 Saudi Arabia 9,081.73 (0.5) (0.6) (0.1) 9.0 965.20 535,589.0 19.0 2.2 2.9 Kuwait 6,147.40 (0.3) (0.6) (0.9) (5.9) 20.57 95,477.9 15.8 1.0 4.2 Oman 6,428.46 (0.1) (0.2) 0.1 1.3 8.32 25,325.7 9.7 1.5 4.0 Bahrain 1,337.94 (0.0) (0.9) (2.2) (6.2) 4.76 20,925.6 8.6 0.9 5.2 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,900 11,920 11,940 11,960 11,980 12,000 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.3% to close at 11,936.1. The Industrials and Real Estate indices led the losses. The index fell on the back of selling pressure from non-Qatari and GCC shareholders despite buying support from Qatari shareholders. Industries Qatar and Qatar General Insurance & Reinsurance Co. were the top losers, falling 2.1% and 1.8%, respectively. Among the top gainers Commercial Bank of Qatar and Qatar Islamic Bank were up 1.8% each. Volume of shares traded on Tuesday fell by 3.1% to 4.2mn from 4.3mn on Monday. Further, as compared to the 30-day moving average of 10.7mn, volume for the day was 60.9% lower. Ezdan Holding Group and Vodafone Qatar were the most active stocks, contributing 13.9% and 12.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 2Q2015 % Change YoY Operating Profit (mn) 2Q2015 % Change YoY Net Profit (mn) 2Q2015 % Change YoY A' Sharqiya Investment Holding Co. Oman OMR 1.2 -8.4% – – 0.7 -8.6% Al Omaniya Financial Services Co. (AOFS)* Oman OMR 9.3 0.5% – – 3.1 5.8% Source: Company data, DFM, ADX, MSM (*1H2015 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/07 US Census Bureau Trade Balance May -$41.87B -$42.70B -$40.90B 07/07 US Bloomberg IBD/TIPP Economic Optimism July 48.1 48.9 48.1 07/07 France Ministry of the Economy Budget Balance YTD May -63.9B – -59.8B 07/07 France Ministry of the Economy Trade Balance May -4,020M -3,600M -3,008M Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar GISS subsidiary to repair damaged barge – Gulf International Services (GISS) announced that its subsidiary, Gulf Drilling International (GDI), will carry out repair & maintenance of its accommodation jack-up Rumailah after an accident in Al Shaheen field on July 5, 2015. The barge will be taken to Nakilat shipyard for repair & maintenance. (QSE) ORDS to disclose financials on July 29 – Ooredoo (ORDS) will announce its financial reports for the period ending June 30, 2015 on July 29, 2015. (QSE) AKHI to publish financials on August 2 – Al Khaleej Takaful Group (AKHI) will announce the financial reports for the period ending June 30, 2015 on August 2, 2015. (QSE) ABQK prepones financial disclosure date to July 9 – Ahli Bank (ABQK) has preponed the disclosure date of the financial statement for the period ending June 30, 2015, to July 9, 2015 instead of July 12, 2015. (QSE) MPHC appoints new GM for Q-Chem and Q-Chem II – Mesaieed Petrochemical Holding Company (MPHC) has appointed Mr. Saad Rashid Mohammed Al-Muhannadi as the new General Manager (GM) for Qatar Chemical Company Limited (Q-Chem) and Qatar Chemical Company II Limited (Q- Chem II), effective September 1, 2015. (QSE) QNB Group: Qatar crude output to average 709,000 bpd in 2015 – According to QNB Group’s (QNBK) Monthly Monitor report, Qatar’s crude oil production is expected to rebound and average around 709,000 bpd in 2015. Qatar’s crude oil production rose to 642,000 bpd in May 2015 as compared to 635,000 bpd in April 2015. Over the same period, Brent crude oil price stabilized at $65.6 at May-end as compared to $66.8 in April. QNBK said Qatar’s international reserves rose to $41.8bn in May as compared to $41bn in April. In months of prospective import cover, international reserves were stable at 7.4 months of imports. QNBK expects the accumulation of international reserves to continue, reaching $46bn or eight months of import cover at 2015-end. Qatar’s current account surplus narrowed to $10.5bn in 4Q2014 on lower hydrocarbon exports. QNBK expects the current account surplus to shrink to $3.7bn in 2015 (4.6% of GDP) due to lower oil prices, before recovering slightly in 2016-17 in line with the recovery in oil prices. Moreover, QNBK forecasts bank lending to grow by 9% in 2015, increasingly driven by project lending and the expanding population. As a result, the loan-to-deposit ratio is expected to decline gradually to reach 106.5% in 2015. (Gulf-Times.com) Moody’s: Qatar banks’ outlook stable – According to Moody’s Investors Service, robust government spending will enable Qatari banks to maintain their strong financial metrics, including strong earnings, sound capital buffers and low levels of non- performing loans (NPL) in the next 12 to 18 months. The ratings agency, which forecast a stable outlook for Qatar’s banking system, however, noted that Qatari banks’ strengths would be moderated by funding pressures owing to a reduction in the flow of government deposits, increasing dependence on confidence- sensitive capital market funding and continued high concentrations of loans and deposits. Despite expecting a stable asset quality performance, Moody’s expect that Qatari banks will Overall Activity Buy %* Sell %* Net (QR) Qatari 72.33% 58.61% 30,289,079.53 GCC 4.63% 9.39% (10,510,712.82) Non-Qatari 23.03% 32.00% (19,778,366.71)

- 3. Page 3 of 6 remain exposed to event risk over the outlook horizon, owing to high single borrower concentrations and the limited transparency of large private sector companies. Qatari banks are also expected to face funding declines as lower oil prices reduce the flow of deposits from the government and its related entities. Recently introduced regulatory limits on the ratio of gross loans to deposits will pose additional funding pressures. In response, Moody’s expected the banks to increase their reliance on longer term and costlier market funding to support growth over the outlook period. Moody’s projected that Qatar’s real GDP will expand by 7% in 2015 as a combination of vast sovereign wealth funds, which is an estimated 147% of its GDP. A relatively low fiscal breakeven oil prices will help the government maintain its extensive public spending program. Government spending is expected to translate into 10.7% growth in the non-hydrocarbon sector, offsetting weakened liquefied natural gas (LNG) output and fostering domestic loan growth of 10-15%. (Peninsula Qatar) Qatar’s highway design, traffic manuals now match global standards – The Ministry of Transport (MoT), in cooperation with key partners, has updated the Qatar Highway Design Manual and Qatar Traffic Manual taking into account the latest developments in technology and global best practices. HE the Minister of Transport Jassim Seif Ahmed Al-Sulaiti has released two manuals and stressed the need & importance of upgrading the country’s land transport infrastructure to comply with the globally acclaimed standards in health, safety and environment. The two manuals were prepared by officials of the MoT, jointly with their counterparts from the Ministry of Municipality and Urban Planning, the Ministry of Interior (MoI) and the Public Works Authority (Ashghal). Meanwhile, according to HE the Prime Minister and Interior Minister Sheikh Abdullah bin Nasser bin Khalifa Al-Thani, the transport sector has accounted for the largest share of the major infrastructure projects in the country and this has posed major challenges to the MoT. HE the Prime Minister said the project of updating traffic manuals to the international standards was in line with the growing requirements of the country’s road users at a time of large-scale economic development. While highlighting the role of the transport sector in accelerating economic development, he said it is extremely difficult for any country to achieve sustainable development without the support of an effective and efficient transport system. (Gulf-Times.com) Expats can change jobs after serving double the contract term – According to the latest amendments and recommendations of the Advisory Council’s Internal and External Affairs Committee (IEAC) regarding entry, exit and stay of expatriates, an expatriate will be allowed to transfer his/her sponsorship after spending a period that is twice the employment duration mentioned in the contract with the current employer, or after a 10-year period in case of open contracts with the approval of the Ministry of Labor and Social Affairs (MoLSA). However, the committee suggested that if the employee's nature of job grants him or her direct access to the employer's client base and/or sensitive information that could affect the employer's competitiveness in the market, the employer can oblige the employee not to transfer employment to a direct competitor or establish their own business that directly competes with the current employer. (Qatar Tribune) Real estate deals stood at QR3.48bn during June 28-July 2 – The real estate transactions between June 28, 2015 and July 2, 2015 registered at the Land Registry Department of the Ministry of Justice were worth QR3.48bn. The list of properties that were sold includes plots, homes, shopping centers and buildings in Ain Khalid, Dafna, Al Saad and Unaiza. (Peninsula Qatar) International IMF: Global political, economic upheaval threaten US growth – The International Monetary Fund said that a global slowdown in economic growth, together with political and economic upheaval in places like Greece, the Middle East and Ukraine, could hurt US growth going forward. The IMF also reiterated that the Federal Reserve should delay its rate hike until 1H2016, until there are signs of a pick-up in wages and inflation. IMF staff said weaker global growth, including in China, would sap US exports and investment in certain sectors, and also push down equity market valuations. Meanwhile, the figures released by the US Commerce Department showed trade deficit widened in May as exports declined the most in three months, showing businesses were having trouble drumming up sales to overseas customers. The gap grew 2.9% to $41.9bn from April’s revised $40.7bn. Exports dropped 0.8% on declining demand for commercial aircraft and industrial equipment. Imports were little changed at $230.5bn in May from $230.8bn in April as American companies bought less crude oil, chemicals and capital goods, including drilling equipment. (Reuters, Bloomberg) Greece faces July 12 deadline for reforms or face eurozone exit – European leaders have set a July 12 deadline for Greece to accept a rescue, saying otherwise they will take the unprecedented step of propelling the country out of the Eurozone. Greece’s anti-austerity government was ordered to make new economic reform proposals at a Brussels summit that could earn it another aid package and head off financial ruin. Greece must spell out how it will make the economy more competitive and save money in the process by 8:30 a.m. on Friday, which would require it to stomach many of the reforms that Tsipras’s left-leaning Syriza party has resisted since coming to power in January 2015. Expert assessment of that package would feed into a final set of meetings, culminating in summits of both Eurozone leaders and the broader 28-nation European Union on July 12. With shortages of medicine turning Greece’s fiscal crisis into a humanitarian one and Russia sizing up the country as a potential ally inside the European Union, the consequences of shutting off funding to Europe’s most debt- stricken nation go far beyond the narrow economic stakes. (Bloomberg) Japan current account surplus exceeds forecast in May – Japan posted a current account surplus for the 11th straight month in May as lower oil prices narrowed trade deficit, suggesting companies have more leeway to increase investment as the costs to power their plants and factories drop. The Ministry of Finance said the current account surplus stood at ¥1.88tn, against a median forecast for a ¥1.54tn surplus. The current account data showed exports fell an annual 0.1% in May for the first time in 27 months, while imports tumbled an annual 10.3% in May as oil prices were down by almost half from the same period a year ago. The current account surplus also got a boost as the income balance grew 38.0% on-year due to higher earnings on overseas investments. (Reuters) China stock decline continue despite fresh regulator support – Chinese stock markets tumbled again on Wednesday as investors shrugged off a series of support measures by Chinese regulators, including the central bank’s first public statement in support of the market since it cut interest rates in late June. Losses on the mainland also weighed heavily on Hong Kong shares, with the Hang Seng Index down 3.3% and shares of Chinese companies listed in the city falling 4.2%. The People’s Bank of China said on Wednesday before stock

- 4. Page 4 of 6 markets opened that it would support market stability by providing liquidity through borrowing, bond issuance, collateral- backed financing and re-lending, while guarding against systemic financial risk. Further, the China Securities Regulatory Commission (CSRC) said it would provide liquidity to brokerages via the China Securities Finance Corp, a state- controlled industry body, and would also monitor conditions in the small-cap CSI500 futures market. The China Financial Futures exchange announced it would raise requirements for short positions against CSI500 index futures, which would make it more difficult to short that index, while the insurance regulator chimed in by allowing insurers to buy more blue chip stocks. (Reuters) Australia holds interest rate as currency weakens – Australia left its key interest rate unchanged after Greece’s drama drove the currency below 75 US cents and Sydney’s property bubble argued against a further cut. The Reserve Bank of Australia Governor Glenn Stevens kept the cash rate at a record-low 2% on Tuesday as predicted by markets and economists, after cutting in May and February. He identified 75 cents in December as a level that would help the economy. Stevens said further depreciation of the Australian dollar seems both likely and necessary, particularly given the significant declines in key commodity prices. Cheap borrowing costs have also boosted the property market: prices in Sydney soared 16.2% YoY in June, the fastest pace since regulators announced plans to crack down on lending to investors. (Bloomberg) Regional Sadara inks SR14.13bn power supply agreement with SEC – Sadara Basic Services Company, indirectly owned (100%) by Sadara Chemical Company (Sadara), has announced that Sadara has signed an electricity supply agreement with Saudi Electricity Company (SEC). Under the terms of the agreement, SEC will supply electricity to the Sadara chemicals complex, which is to be located at Jubail Industrial City II in the Eastern Province of Saudi Arabia. The agreement has a 20 years renewable term and an estimated contract value of around SR14.13bn. The other terms of the supply agreement are substantially consistent with material terms of the power supply implementation agreement previously entered into between Sadara and SEC on April 7, 2012. (Tadawul) Spain-based Isolux Corsan JV named preferred bidder for $2.6bn Mecca metro – The Spain-based contractor Isolux Corsan has been named as the preferred bidder for a $2.59bn contract to build two lines (B and C) of the new Mecca Metro in Saudi Arabia. The company said its joint venture (JV), which includes the Turkish contracting company Kolin and Saudi Arabia’s Haif Company, is expected to sign a contract for the project in the coming months. The scope of the contract includes tunneling as well as building of stations and interchange stations and associated works. The 11.9-km Line B section of the contract involves construction of three stations while the 13-km Line C section will involve execution of six stations besides completion of two big interchange stations. The scope of the contract also includes execution of stations and interchange stations with their civil works, access ramps, grand roofs and canopies, and tunnels. (GulfBase.com) ATMC seeks shareholders’ nod for capital increase – Alinma Tokio Marine Company (ATMC) has invited its shareholders to consider and approve a capital increase by issuing of rights worth SR250mn based on details and mechanism defined in the prospectus issued by the company and approved by the Capital Market Authority. Shareholders will also consider approving the amendment to Article (7) and Article (8) of the by-laws of the company to reflect the proposed increase in the capital of the ATMC. The capital increase will enable ATMC to maintain its solvency margin and support the future growth of the company. (Tadawul) SADAFCO AGM approves SR113.75mn dividend – Saudia Dairy and Foodstuff Company’s (SADAFCO) annual general meeting (AGM) has approved distribution of SR113.75mn (SR3.5 per share) dividend for the financial year ended on March 31, 2015. Shareholders on Tadawul shareholders' list at the closing of trade on the AGM date of June 30, 2015 will be eligible to receive the dividend, which will be distributed on July 15, 2015. (Tadawul) Bank Albilad reports SR206.5mn net profit in 2Q2015 – Bank Albilad reported a net profit of SR206.5mn in 2Q2015 as compared to SR204.3mn in 2Q2014, reflecting an increase of 1.08% on a YoY basis. The bank’s total assets rose 19.9% YoY to SR49.14bn in 2Q2015. Bank Albilad’s loans & advances reached SR31.68bn, showing an increase of 18.42% YoY, while customer deposits stood at SR38.3bn. The bank’s EPS amounted to SR0.76 in 2Q2015 versus SR0.76 in 2Q2014. (Tadawul) SFG BoD recommends SR0.45 per share dividend for 1H2015 – Samba Financial Group’s (SFG) board of directors (BoD) has recommended paying SR0.45 per share dividend for 1H2015. The proposed figure is lower than the SR0.65 per share, which the bank had paid for 1H2014. (Reuters) McDermott International signs LTA with Saudi Aramco – McDermott International, Inc. has announced that it has been selected by Saudi Arabian Oil Company (Saudi Aramco) for a new long-term agreement (LTA) for the future brownfield work in various fields in offshore Saudi Arabia. Under the terms of the agreement, McDermott can bid on future engineering, procurement, construction and installation (EPCI) opportunities in various fields in offshore Saudi Arabia. The signing is the second LTA between McDermott and Saudi Aramco. Currently, McDermott executes work under an existing LTA with Saudi Aramco, which has been in place since June 28, 2007. (Businesswire) HFZ-based ATS Terminal increased storage capacity from 22,000CBM to 42,000CBM – Hamriyah Free Zone (HFZ)-based ATS Terminal has increased its storage capacity from 22,000CBM to 42,000CBM. The company offering services like storage and transport of liquid chemicals and fuel, recently completed its Phase II expansion. Currently, ATS Terminal is utilizing only 30% of the existing plot and has plans to triple the capacity in the future. The facility, with six piggable pipelines (SS and MS) from the deep harbor and inner harbor respectively, is equipped to handle, store and distribute all kinds of Class 1, 2 and 3 products on behalf of its customers in the UAE and the GCC region. After the expansion its capacity is 42,000CBM. (GulfBase.com) Tasweek: UAE property sector's 2Q2015 performance exceeded expectations – According to a report released by Tasweek Real Estate Development, the UAE property sector’s 2Q2015 performance exceeded expectations, with industry-wide economic diversification seen as the key driver to sustained growth. Moving forward, Abu Dhabi rents are expected to maintain growth, while Dubai is expected to challenge and eventually overcome price fluctuations. As predicted by Tasweek’s 1Q2015 report, the Abu Dhabi and Dubai markets experienced price corrections specifically for freehold units. Based on the 2Q2015 results, Tasweek forecasted a moderate 5- 10% correction in the UAE’s residential real estate prices after 18 months of sharp appreciations. Overall, the domestic

- 5. Page 5 of 6 property market is set to sustain its performance after peaking in 2014, with operating conditions likely to temper performance. Tasweek’s 2Q2015 market research showed that Abu Dhabi’s residential market sustained the 1Q2015 trend of landlords protecting rental levels by reducing supply. Demand softened in 2Q2015, although with the stable prices reflecting no changes over 1Q2015. Overall, rental prices were flat in Abu Dhabi Island and in the outlying freehold areas. (GulfBase.com) Fitch cites DP World in ratings upgrade of Jafza – The ratings agency Fitch has upgraded its default rating for Jebel Ali Free Zone (Jafza), saying that its new parent, DP World, will help to improve its operations in Dubai’s largest trade district. Fitch said Jafza would benefit from its strong legal, operational and strategic links with DP World. However, the ratings agency warned that profit margins could decline to “historical levels” in 2015. Fitch stressed that any downgrade or negative revision of its outlook for DP World would affect DP World’s subsidiaries such as Jafza. (GulfBase.com) Abraaj sells 13.6% stake in UAP Holdings – Abraaj Group has sold its 13.6% stake in UAP Holdings, an East African insurance company to London-listed Old Mutual. (GulfBase.com) Tom Aikens plans to set up new project in Dubai – Tom Aikens is planning to set up an unusual new project in Dubai. Pots, Pans & Boards will open in the autumn and offer a family- style experience that allows guests to serve themselves at their table. Tom is set to open his fourth restaurant in London in 2015 and managing two others in Hong Kong and Istanbul. (Reuters) ADIB consumer loan rejections soar 10% after bank adopts credit bureau – Abu Dhabi Islamic Bank (ADIB) rejection that rates on consumer loans have increased by 10% after the bank started using credit bureau data. ADIB CEO Tirad Al Mahmoud has warned that over-indebtedness in the UAE will not be reduced until all banks start to use the recently launched credit bureau. Al Etihad Credit Bureau had started its operations in 2014, and was designed to help keep credit growth in check and prevent consumers and corporations from overstretching themselves. However, its progress has been slowed by concerns over the accuracy of its information and questions of legal liability. The bureau’s database of credit history of all retail borrowers enables banks to build an accurate picture of a potential borrower’s indebtedness, and allow them to assess their ability to honor the debt. (GulfBase.com) SCAD: Abu Dhabi hotel price index down 17.8% in March 2015 as rates drop – According to the Statistics Centre Abu Dhabi (SCAD), the hotel establishment’s price index decreased 17.8% during March 2015 as compared to February 2015 on the back of a 20.2% fall in the hotel room rates index during that period. SCAD said that the hotel price index slid 0.7% in March 2015 as compared to March 2014 as the hotel room rates index fell 1.5% during that period. Hotel apartment’s room rates index also fell 7.4% during March 2015 as compared to February 2015, but showed an increase of 2.2% as compared to March 2014. Falling room rates pushed hotel revenues down 11.1% in March 2015 over February 2015, though revenues registered an increase of 10.4% as compared to March 2014. (GulfBase.com) S&P classify Kuwaiti banking sector in group '4' under its BICRA methodology – Standard & Poor's Ratings Services (S&P), in its ‘Banking Industry Country Risk Assessment: Kuwait’ report, has classified the banking sector of Kuwait (AA/Stable/A-1+) in group '4' under its Banking Industry Country Risk Assessment (BICRA) methodology. A BICRA for a country covers rated and not rated financial institutions that take deposits, extend credit, or engage in both activities. S&P highlighted that a wealthy population, with high GDP per capita and strong funding profiles of domestic banks, with large net external asset bases and stable deposits is the strength of the Kuwaiti banking sector. However, risks to the sector emanate from the fact that the banking sector's exposure to the real estate and construction sectors is traditionally very high, regulation and supervision are weak and regional capital markets are underdeveloped. (Bloomberg) Renaissance Services EGM approves repurchase of MCBs – Renaissance Services’ extraordinary general meeting (EGM) has approved the scheme for repurchase of 423,141,678 Mandatory Convertible Bonds (MCBs) of OMR43.16mn issued in 2012, subject to the availability of financing. The EGM also approved the issuance of perpetual Cumulative Capital Certificates by the company’s wholly-owned overseas subsidiary, with a coupon to be determined at the time of issue based on market conditions to raise up to $200mn or its equivalent in Omani Riyal through conventional or Sukuk financing. (MSM) AER issues license for Oman’s first solar power plant – Authority for Electricity Regulation (AER) has issued license for Oman’s first solar power plant to Bahwan Astonfield Solar Energy Company. The 303-kilowatt solar power plant is located in the wilayat of Al Mazyounnah in Dhofar Governorate, and the power from solar project will be sold to the Rural Areas Electricity Company (Raeco) as per the agreement signed between the two companies. (GulfBase.com) Garmco partners with Fives for building casthouse – Bahrain-based aluminum rolling mill Garmco has partnered with Fives, an industrial engineering firm, for the construction of a new casthouse costing $55mn. The new re-melt and casting facility will add 120,000 metric tonnes (mt) to Garmco’s current aluminum slab production capacity of 165,000 mt. Under the terms of the agreement, Fives has been tasked with the engineering, procurement and construction (EPC) of the project on a turnkey basis. This agreement will enable Garmco to develop its metal recycling capability and lower the cost of metal casting. The project is expected to be completed in about 21 months, starting from September 2015. (GulfBase.com)

- 6. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market closed on 7 July 2015) Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 QSE Index S&P Pan Arab S&P GCC (0.5%) (0.3%) (0.3%) (0.0%) (0.1%) (0.6%) (0.4%) (2.0%) (1.5%) (1.0%) (0.5%) 0.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,155.37 (1.3) (1.1) (2.5) MSCI World Index 1,724.95 (0.3) (1.1) 0.9 Silver/Ounce 15.08 (4.3) (4.0) (4.0) DJ Industrial 17,776.91 0.5 0.3 (0.3) Crude Oil (Brent)/Barrel (FM Future) 56.85 0.5 (5.8) (0.8) S&P 500 2,081.34 0.6 0.2 1.1 Crude Oil (WTI)/Barrel (FM Future) 52.33 (0.4) (8.1) (1.8) NASDAQ 100 4,997.46 0.1 (0.2) 5.5 Natural Gas (Henry Hub)/MMBtu 2.73 (0.4) (2.0) (8.8) STOXX 600 372.74 (2.8) (4.0) (1.6) LPG Propane (Arab Gulf)/Ton 39.50 (0.6) (7.6) (19.4) DAX 10,676.78 (3.2) (4.6) (2.0) LPG Butane (Arab Gulf)/Ton# 48.00 0.0 (11.1) (23.5) FTSE 100 6,432.21 (2.8) (3.3) (3.0) Euro 1.10 (0.4) (0.9) (9.0) CAC 40 4,604.64 (3.5) (5.4) (2.6) Yen 122.54 (0.0) (0.2) 2.3 Nikkei 20,376.59 1.5 (0.4) 14.1 GBP 1.55 (0.9) (0.7) (0.7) MSCI EM 930.25 (1.4) (3.5) (2.7) CHF 1.06 (0.4) (0.6) 5.0 SHANGHAI SE Composite 3,727.13 (1.3) 1.0 15.2 AUD 0.75 (0.7) (1.0) (8.9) HANG SENG 24,975.31 (1.1) (4.2) 5.8 USD Index 96.87 0.6 0.8 7.3 BSE SENSEX 28,171.69 (0.6) 0.2 2.0 RUB 56.71 (0.3) 1.3 (6.6) Bovespa 52,343.71 (1.1) (2.0) (13.1) BRL 0.31 (1.5) (1.6) (16.8) RTS 885.78 (1.9) (3.7) 12.0 143.3 120.6 115.1