QNBFS Daily Market Report September 26, 2018

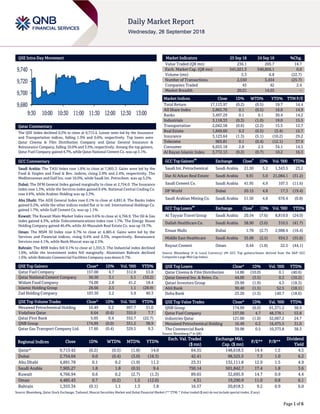

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.2% to close at 9,713.4. Losses were led by the Insurance and Transportation indices, falling 1.3% and 0.6%, respectively. Top losers were Qatar Cinema & Film Distribution Company and Qatar General Insurance & Reinsurance Company, falling 10.0% and 3.5%, respectively. Among the top gainers, Qatar Fuel Company gained 4.7%, while Qatar National Cement Co. was up 3.1%. GCC Commentary Saudi Arabia: The TASI Index rose 1.8% to close at 7,905.3. Gains were led by the Food & Staples and Food & Bev. indices, rising 2.9% and 2.4%, respectively. The Mediterranean and Gulf Ins. rose 10.0%, while Saudi Int. Petrochem. was up 5.2%. Dubai: The DFM General Index gained marginally to close at 2,754.0. The Insurance index rose 1.3%, while the Services index gained 0.4%. National Central Cooling Co. rose 4.6%, while Arabtec Holding was up 3.3%. Abu Dhabi: The ADX General Index rose 0.1% to close at 4,891.8. The Banks index gained 0.2%, while the other indices ended flat or in red. International Holdings Co. gained 1.7%, while Gulf Cement Co. was up 1.1%. Kuwait: The Kuwait Main Market Index rose 0.6% to close at 4,766.9. The Oil & Gas index gained 4.3%, while Telecommunications index rose 1.7%. The Energy House Holding Company gained 46.4%, while Al-Massaleh Real Estate Co. was up 19.7%. Oman: The MSM 30 Index rose 0.7% to close at 4,485.4. Gains were led by the Services and Financial indices, rising 0.4% and 0.3%, respectively. Renaissance Services rose 4.1%, while Bank Muscat was up 2.5%. Bahrain: The BHB Index fell 0.1% to close at 1,355.3. The Industrial index declined 1.6%, while the Investment index fell marginally. Aluminium Bahrain declined 1.6%, while Bahrain Commercial Facilities Company was down 0.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Fuel Company 157.00 4.7 312.8 53.8 Qatar National Cement Company 56.50 3.1 5.1 (10.2) Widam Food Company 74.00 2.8 41.2 18.4 Islamic Holding Group 26.66 2.5 1.1 (28.9) Zad Holding Company 103.30 2.2 5.9 40.3 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 16.49 0.2 997.7 31.0 Vodafone Qatar 8.64 (0.6) 355.0 7.7 Qatar First Bank 5.05 0.4 352.7 (22.7) QNB Group 174.99 (0.0) 351.2 38.9 Qatar Gas Transport Company Ltd. 17.60 (0.4) 329.5 9.3 Market Indicators 25 Sep 18 24 Sep 18 %Chg. Value Traded (QR mn) 236.1 205.7 14.7 Exch. Market Cap. (QR mn) 541,021.3 540,856.1 0.0 Volume (mn) 5.3 6.8 (22.7) Number of Transactions 2,550 3,434 (25.7) Companies Traded 43 42 2.4 Market Breadth 20:21 14:25 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,113.97 (0.2) (0.5) 19.7 14.4 All Share Index 2,865.70 0.1 (0.5) 16.8 14.9 Banks 3,497.29 0.1 0.1 30.4 14.2 Industrials 3,118.33 (0.3) (1.0) 19.0 15.5 Transportation 2,042.58 (0.6) (2.2) 15.5 12.7 Real Estate 1,849.60 0.3 (0.5) (3.4) 15.7 Insurance 3,123.64 (1.3) (5.1) (10.2) 29.2 Telecoms 965.81 0.1 (0.4) (12.1) 37.9 Consumer 6,655.18 2.8 2.5 34.1 14.5 Al Rayan Islamic Index 3,772.13 (0.2) (0.7) 10.2 16.3 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Saudi Int. Petrochemical Saudi Arabia 21.50 5.2 1,343.5 23.2 Dar Al Arkan Real Estate Saudi Arabia 9.91 5.0 21,084.1 (31.2) Saudi Cement Co. Saudi Arabia 41.95 4.9 107.5 (11.6) DP World Dubai 20.15 4.8 17.3 (19.4) Saudi Arabian Mining Co. Saudi Arabia 51.50 4.8 676.4 (0.8) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Al Tayyar Travel Group Saudi Arabia 20.54 (7.6) 8,819.0 (24.0) Dallah Healthcare Co. Saudi Arabia 58.90 (3.0) 310.5 (41.7) Emaar Malls Dubai 1.78 (2.7) 2,988.4 (16.4) Middle East Healthcare Saudi Arabia 35.00 (2.5) 934.3 (35.0) Raysut Cement Oman 0.44 (1.8) 22.5 (44.1) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Cinema & Film Distribution 14.86 (10.0) 0.1 (40.6) Qatar General Ins. & Reins. Co. 44.00 (3.5) 0.2 (10.2) Qatari Investors Group 29.90 (1.9) 4.3 (18.3) Ahli Bank 30.40 (1.5) 52.5 (18.1) Doha Bank 23.20 (1.3) 140.7 (18.6) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 174.99 (0.0) 61,371.2 38.9 Qatar Fuel Company 157.00 4.7 48,378.1 53.8 Industries Qatar 121.00 (1.0) 32,067.2 24.7 Mesaieed Petrochemical Holding 16.49 0.2 16,475.5 31.0 The Commercial Bank 39.98 0.5 10,373.8 38.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,713.42 (0.2) (0.5) (1.8) 14.0 64.55 148,618.5 14.4 1.5 4.5 Dubai 2,754.04 0.0 (0.4) (3.0) (18.3) 42.41 98,525.5 7.3 1.0 6.2 Abu Dhabi 4,891.78 0.1 0.2 (1.9) 11.2 23.31 132,111.8 12.9 1.5 4.9 Saudi Arabia 7,905.27 1.8 1.8 (0.5) 9.4 750.14 501,842.7 17.4 1.8 3.6 Kuwait 4,766.94 0.6 0.2 (2.7) (1.3) 89.65 32,695.9 14.7 0.9 4.4 Oman 4,485.43 0.7 (0.2) 1.5 (12.0) 4.31 19,290.9 11.0 0.8 6.1 Bahrain 1,355.34 (0.1) 1.1 1.3 1.8 16.57 20,818.3 9.2 0.9 6.0 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,680 9,700 9,720 9,740 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.2% to close at 9,713.4. The Insurance and Transportation indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from GCC and non-Qatari shareholders. Qatar Cinema & Film Distribution Company and Qatar General Insurance & Reinsurance Company were the top losers, falling 10.0% and 3.5%, respectively. Among the top gainers, Qatar Fuel Company gained 4.7%, while Qatar National Cement Company was up 3.1%. Volume of shares traded on Tuesday fell by 22.7% to 5.3mn from 6.8mn on Monday. Further, as compared to the 30-day moving average of 6.1mn, volume for the day was 12.8% lower. Mesaieed Petrochemical Holding Company and Vodafone Qatar were the most active stocks, contributing 18.9% and 6.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/25 France INSEE Business Confidence September 106 105 105 09/25 France INSEE Manufacturing Confidence September 107 109 110 09/25 France INSEE Production Outlook Indicator September 9 – 11 09/25 Japan Bank of Japan PPI Services YoY August 1.3% 1.1% 1.1% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 3Q2018 results No. of days remaining Status QNBK QNB Group 10-Oct-18 14 Due QIBK Qatar Islamic Bank 17-Oct-18 21 Due DHBK Doha Bank 17-Oct-18 21 Due UDCD United Development Company 17-Oct-18 21 Due ABQK Ahli Bank 21-Oct-18 25 Due QIGD Qatari Investors Group 21-Oct-18 25 Due KCBK Al Khalij Commercial Bank 23-Oct-18 27 Due CBQK The Commercial Bank 23-Oct-18 27 Due Source: QSE News Qatar QATI is establishing a new QR1.8mn company in QFC – Qatar Insurance Company (QATI) is establishing a new company ‘Epicure Investment’ with an initial capital of QR1.8mn in the Qatar Financial Centre (QFC). The official spokesperson of QATI, Abdulla Yousef Al-Mulla, confirmed that the directors’ board, during their meeting, approved the establishment of a limited liability company in accordance with the rules set out by the QFC. The new company will be named ‘Epicure Investment Management’ or any other name that is approved by the Qatar Financial Markets Authority (QFMA). The new company will carry out investment business consultation, the spokesman added. (Gulf-Times.com) QIBK to disclose 3Q2018 financial statements on October 17 – Qatar Islamic Bank (QIBK) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 17, 2018. (QSE) KCBK to disclose 3Q2018 financial statements on October 23 – Al Khalij Commercial Bank (KCBK) announced its intent to disclose 3Q2018 financial statements for the period ending September 30, 2018, on October 23, 2018. (QSE) KCBK to conduct EMTN program in Asia and Europe – Al Khalij Commercial Bank (KCBK) will be conducting a series of fixed income investor meetings under its EMTN program in Asia and Europe, commencing on September 27, 2018. Barclays, QNB Capital, Standard Chartered Bank and The Commercial Bank of Qatar were mandated as Joint Lead Managers and Joint Bookrunners to arrange meetings on KCBK’s behalf. A benchmark USD-denominated RegS Registered bond offering under KCBK’s $2.5bn EMTN Program may follow subject to market conditions. (QSE) New FDI law proposes game changing incentives for investors – Qatar’s soon to be launched amended Foreign Direct Investment (FDI) law is expected to transform the country’s investment ecosystem. The new law, which proposes to open Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 26.66% 47.52% (49,242,798.44) Qatari Institutions 23.65% 24.47% (1,921,356.30) Qatari 50.31% 71.99% (51,164,154.74) GCC Individuals 0.41% 0.39% 47,922.70 GCC Institutions 4.30% 1.46% 6,685,539.61 GCC 4.71% 1.85% 6,733,462.31 Non-Qatari Individuals 4.82% 5.27% (1,064,866.90) Non-Qatari Institutions 40.16% 20.89% 45,495,559.33 Non-Qatari 44.98% 26.16% 44,430,692.43

- 3. Page 3 of 6 all sectors to 100% foreign investment (banking and insurance with direct permission from the Prime Minister’s Office), will get the preferential treatment exactly in line with Qatari companies. These companies will be eligible for all the incentives that Qatari companies are currently enjoying, including the permission to participate in government contracts, a top official from the Ministry of Economy and Commerce said. (Peninsula Qatar) Ooredoo announces leadership transition in Indosat Ooredoo in Indonesia – Ooredoo announced that Indosat Ooredoo announced the upcoming transition of its leadership team. The current President Director and CEO, Joy Wahjudi, is stepping down from his role for personal reasons, but is working closely with Indosat Ooredoo and Ooredoo Group to help ensure a smooth transition for ongoing projects and that business continues as usual during this period of change. The upcoming change in leadership coincides with the company’s plan to undertake an important transformation program to drive growth in the Indonesian market. Further details on the new leadership and the transformation program will be announced in the upcoming Indosat Ooredoo Extraordinary General Meeting scheduled for October 17, 2018. (QSE) Foreign trade grew by a ‘remarkable’ 16% in 2017, says Sheikh Ahmed – Qatar’s foreign trade has shown remarkable growth, increasing by 16% in 2017, according to HE the Minister of Economy and Commerce Sheikh Ahmed bin Jassim bin Mohamed Al-Thani. Qatar’s total exports also increased by 18%, contributing to a total trade surplus of 49%, he said, while chairing a roundtable with businessmen during a working lunch on the sidelines of Qatar’s participation in the 73 rd session of the United Nations General Assembly in New York. Sheikh Ahmed said international trade and investment form a key part of Qatar’s future growth and diversification, adding that the US is one of Qatar’s most valued and largest global partners. The US and Qatar are bound by several agreements and Memorandums of Understanding, especially the TIFA Agreement, which led to the establishment of a joint council since 2004. On bilateral trade, Sheikh Ahmed said $24bn worth of goods were traded in the last five years; 84% of the trade balance was in favor of the US. The US is also Qatar’s top destination for imports with 16% of Qatar’s imports coming from the US in 2017. Financial transactions from Qatar to the US reached $26.5bn in 2017 alone, including business profit, salaries, and payments. Qatari investments in the US have also exceeded $45bn, the equivalent of 23% of Qatar’s GDP, he said. (Gulf-Times.com) India’s exports to Qatar jump 87% in 2018 – India has recorded an 87% jump in exports to Qatar in one year from April 2017 to March 2018, reaching nearly $1.5bn according to the country’s envoy. In the previous year, Indian exports to Qatar had totaled close to $800mn, P Kumaran said on the sidelines of a business meeting between Qatari companies and an Indian trade delegation at the Qatar Chamber. “Our analysis showed that the main increase was in the area of food and food products, iron and steel, aluminum, and transport machines and cars from Suzuki and Tata Motors,” the Ambassador said. In the next 12 years, Kumaran said India needs around $2tn in investments for various infrastructure development projects, adding that Qatar is welcome to participate in various projects in different sectors. (Gulf-Times.com) Qatar’s construction sector leads in using technology for sustainable cities – Experts speaking at “Big 5 Qatar” free CPD (Continuing Professional Development) certified courses have noted that Qatar’s construction sector is leading in adopting technologies for sustainable cities. Big 5 Qatar, concludes today (September 26, 2018) at the Doha Exhibition and Convention Center (DECC). Roberto Molinos, a Professor at Instituto De Empresa in Spain, said, “Technology in buildings is crucial to enable the sustainable management of a city. Great opportunities arise by adopting these technologies in the construction industry, and we see that Qatar is extremely keen in doing so.” Amal Yousuf Al-Mulla, Quality and Sustainability Engineer Technical Office at Ashghal, added that, “adopting lean methods in construction, health and safety, waste recycling are examples of the commitment already made to meet the Qatar National Vision 2030, utilizing the latest technology in project management, recycling, and BIM (Building Information Modeling). Al-Mulla added, “Tech, digital, and BIM all have important contributions to make, to improve productivity, and also disrupt the current delivery model through innovation to deliver superior performance.” (Gulf-Times.com) Talks underway for high-tech farm in Qatar, says Spanish envoy – Before long, Qatar could start growing any type of vegetable all-year round and small fruits, such as strawberries as talks are nearing the final stages for the setting up of a 100- hectare greenhouse in the country, Spanish Ambassador Ignacio Escobar said. With the technology supplied by Spanish joint venture AgriQatar, produce from the greenhouse project “is affordable, making it a profitable venture,” Escobar said at the sidelines of The Big 5 Qatar. (Gulf-Times.com) Qatar & Spain to set up QR850mn fund to invest in Latin America – Qatar and Spain have agreed to set up joint fund of about QR850mn to invest in Latin American countries, Ambassador of Spain to Doha, Ignacio Escobar said. The Ambassador noted that due to the common culture, language, years of experience in doing business in Latin America, know- how, and many other factors, Spain is the natural gateway to the region. (Peninsula Qatar) International US consumer confidence hits 18-year high; house prices slowing – US consumer confidence index increased to 18-year high in September, as households grew more upbeat about the labor market, pointing to sustained strength in the economy despite an increasingly bitter trade dispute between the US and China. While other data showed a moderation in house price increases in July, the gains probably remain sufficient to boost household wealth and continue to support consumer spending, as well as making home purchasing a bit more affordable for first-time buyers. The Conference Board stated its consumer confidence index increased to a reading of 138.4 this month from an upwardly revised 134.7 in August. That was the best reading since September 2000, and the index is not too far from an all-time high of 144.7 reached that year. (Reuters) ELFA: US business borrowing for equipment jumps 14% in August – Borrowing by US companies to spend on capital

- 4. Page 4 of 6 investments rose 14% in August from a year earlier, according to the Equipment Leasing and Finance Association (ELFA). The companies signed up for $8.9bn in new loans, leases and lines of credit last month, up from $7.8bn a year earlier, ELFA stated. Washington-based ELFA, which reports economic activity for the $1tn equipment finance sector, said credit approvals totaled 76.4% in August, up slightly from 76.2% in July. (Reuters) UK’s inflation expectations hit five-year high – The British public’s expectations for inflation have risen to their highest level in five years, according to a monthly YouGov survey for Citi. Public inflation expectations for the next 12 months rose to 2.9% in September from 2.7% in August. Longer-run inflation expectations for the next 5 - 10 years rose to 3.4% from 3.3%. Both readings were the highest in five years. Official data published earlier this month showed that consumer price inflation unexpectedly rose in August to 2.7%, a six-month high. (Reuters) German institutes to cut 2018 growth forecast to 1.7% – Germany’s economic institutes will lower their 2018 growth forecast for Europe’s largest economy to 1.7% from their spring prediction of 2.2%, two government sources told Reuters. The sources said the institutes will also cut their 2019 growth forecast to 1.9% from 2.0%, they had previously predicted. The sources also said the institutes will predict 2020 growth of 1.8%. (Reuters) French industry morale fell in September to lowest level since March 2017 – Morale in the French industrial sector fell in September to its lowest level since March 2017, according to data from the INSEE state statistics agency, in a further sign that Eurozone’s second-biggest economy is going through a sluggish period. The reading for industrial confidence in September fell to 107 points from 110 points in August - worse than a Reuters forecast, which predicted a September reading of 109.40 points. There was, however, a slightly better reading for the levels of confidence in the services sector, which edged up to 105 points in September from 104 in August. Data published earlier this month showed that the French economy had meager growth of 0.2%, the same as in the first quarter. The French government is expecting economic growth of 1.7% for 2018 overall. (Reuters) BoJ's Kuroda highlights need to look at downside of easy policy – Bank of Japan’s (BoJ) Governor, Haruhiko Kuroda said the central bank has entered a phase where it must consider not just the merits but the side-effects of its massive stimulus program in a “balanced manner”. He also said the BoJ’s new commitment to keep interest rates very low for an “extended period” did not mean near-zero rates will be maintained permanently, reminding markets that the central bank could raise rates, if the inflation rate picks up. “We hope to achieve 2% inflation at the earliest date possible by maintaining our powerful monetary easing, so that we can begin normalizing monetary policy,” Kuroda said. Kuroda said that while he would not rule out changing the commitment, it was an appropriate one for now, as inflation remains distant from BoJ’s target. (Reuters) Regional Kuwait, Saudi Arabia in positive talks to re-start shared oil fields – Kuwait is holding positive talks with Saudi Arabia about resuming production at shared oil fields in their border area, according to Kuwait’s Oil Minister, Bakheet Al-Rashidi. Once shared fields including Khafji, Wafra begin pumping again, their combined production could reach ~400k bpd within three months. (Bloomberg) Saudi Electricity Company announces successful closing of $2.0bn dual tranche international Sukuk issuance – Saudi Electricity Company announced that it has successfully completed the issuance of a dual tranches Sukuk in Reg S format in the international markets on September 20, 2018. The first tranche is in the value of $800mn and has a tenor of long five years, maturing on January 27, 2024, and has a fixed profit rate of 4.222% per annum (p.a.), while the second tranche is in the value of $1,200mn and has a tenor of ten years, maturing on September 27, 2028, and has a fixed profit rate of 4.723% p.a. (GulfBase.com) Tenaris to acquire significant stake in Saudi Steel Pipe Company – Luxembourg-based Tenaris announced that it has entered into a definitive agreement to acquire from a private group 47.79% of the shares of Saudi Steel Pipe Company for an aggregate price of $144mn. The transaction is subject to regulatory approvals, including approval by the Capital Market Authority (CMA) of Saudi Arabia, and other customary conditions and is expected to close in 1Q2019. Tenaris has been serving Saudi Arabia’s oil and gas industry and Saudi Aramco for decades. With this transaction, Tenaris will significantly expand its industrial presence in the Kingdom and the range of products it supplies to Saudi Aramco. (Bloomberg) CMA approves IPO of Gulf Steel Works Factory Company – Saudi Arabia’s CMA approved the listing of 30%, or 6mn shares, of Gulf Steel Works Factory Company. The company’s prospectus will be published within sufficient time prior to the start of the subscription period. The prospectus includes all relevant information that the investor needs to know before making an investment decision, including the share price, the company's financial statements, activities and management. (Tadawul) UAE banks’ gross assets rise to AED2.8tn in August – UAE banks’ gross assets amounted to AED2.8tn by the end of August 2018, 4% up from AED2.694tn by the end of December 2017. Gross credit increased to around AED1.633tn by the end of August, a growth of 3.3% from AED1.58tn during December last year, the official news agency Wam reported, citing the Central Bank of the UAE’s statistics. Domestic loans received by the private sector rose from AED1.086tn in December 2017 to around AED1.123tn by the end of August 2018, with credit provided to individuals amounting to AED339bn by the end of August from AED337.5bn from December. Total deposits amounted to AED1.703tn, during August, an increase of 4.6% of AED76bn from AED1.627tn in December 2017. The growth recorded in gross credit reflects the robust financial solvency enjoyed by UAE banks as a result of the significant improvement recorded across all operating indicators during the first eight months of the year. (GulfBase.com) Fitch: UAE’s Islamic banks see higher returns but weaker asset quality – Fitch Ratings earnings and profitability metrics are improving for UAE’s Islamic banks, but asset quality should remain under pressure in the near to medium term, according to

- 5. Page 5 of 6 Fitch Ratings (Fitch). FY2017 results showed that the operating environment for the sector has been improving, with financing growth above the mid-single-digit range, supported by deposits gathered at a faster rate. Funding and liquidity for Islamic banks continued to improve. Higher oil prices eased pressures in 2017, with strong deposit growth fuelled by Islamic banks' proportionately larger branch networks and a broader adoption of Shari’ah-compliant products. Gross financing as a percentage of deposits fell by approximately 300 bps to 91.7% during 2017, 320 bps below conventional banks. Funding for Islamic banks continues to be primarily domestic deposits at 84%, higher than conventional banks, with these deposits accounting for 27% of sector deposits at the end of last year. (Bloomberg) FTA: VAT on entertaining staff ‘non-recoverable’ – Entertainment services supplied to employees, such as staff parties and retirement gifts, should not be exempt from Value Added Tax (VAT), the UAE’s Federal Tax Authority (FTA) stated. The authority noted that according to the federal law on VAT, the 5% tax incurred on goods or services purchased to be given away to staff free of charge, in order to reward them for long service, should be blocked from recovery. Examples of these gifts include long service awards, Eid gifts and gifts for other festivals and special occasions, or a dinner to reward service. (GulfBase.com) Union Properties hands over AED450mn Dubai Motor City project – Union Properties, a leading property developer in the UAE, announced the delivery of all the residential units at its OIA Residences project, developed at the cost of AED450mn, within Dubai Motor City. A motor-sport theme destination developed over a 38mn square feet area on Emirates Road, the Dubai Motor City features residential units, business towers, motor-sports facilities, retail and a theme park. (GulfBase.com) Majid Al Futtaim raises $1bn revolving credit facility – Dubai’s Majid Al Futtaim, a company that owns and operates shopping centers in the Middle East and North Africa, raised a $1bn loan from a group of regional and international banks, the firm stated. The loan, a revolving credit facility, has a six-year maturity and refinances an $800mn loan raised in 2014 for general corporate purposes. A number of companies in the Gulf are refinancing their debt obligations ahead of maturity, or adding new leverage to their balance sheets, to avoid having to pay higher debt costs at a later stage due to expected increases in global interest rates. (Reuters) Abu Dhabi Islamic Bank to open subscription for new shares – Abu Dhabi Islamic Bank stated it will open subscription for its new shares on September 25 until October 9. The bank received approval from its shareholders last month to raise AED1bn through a rights issue to meet regulatory capital requirements. Under the plan for the rights issue, each shareholder will have the right to subscribe to 29 new shares for every 198 shares held on September 12. The rights issue will increase Abu Dhabi Islamic Bank’s share capital to AED3.63bn from AED3.168bn. (GulfBase.com) Kuwaiti banking sector tackles low oil prices – The Kuwaiti banking system succeeded in 2017 in confronting pressure caused by low oil prices period between 2014-2016, Central Bank of Kuwait’s Governor, Mohammad Al-Hashel said, noting that the Kuwaiti Dinar appreciated vis-à-vis the US Dollar by 1.4% in 2017. Al-Hashel said the banking sector remained sound and stable in 2017, with an increased credit, thanks in part to counter-cyclically built precautionary provisions supporting the requisite write-offs in 2017. As for the Financial Intermediation, the banking system posted visibly healthier growth in 2017 with its consolidated assets increasing by 7.4% on the back of higher private sector credit off-take and growing investments. Increase in domestic credit, by 3.9%, was marginally better than the year before though partly dampened by some corporate loan repayments. Bank’s consolidated deposits also picked up to 7%, with domestic deposits posting 6.6% growth in assets and credit off-takes moderately picked up. Al-Hashel said asset quality of the banking system has visibly improved over the years, exhibited by a steady decline in both the gross and net nonperforming loan ratio (NPLR). The gross NPLR, on a consolidated basis, has further dropped to a historically low level of 1.9% (1.3% on domestic, Kuwait-only basis) as of December 2017, well below the 3.8% observed in 2007 before the global financial crisis struck. (GulfBase.com) Oman's Renaissance Services to mull $1.5bn Topaz Energy IPO – Oman’s Renaissance Services, a service provider to the oil and gas industry, is considering an initial public offering (IPO) for its Topaz Energy & Marine unit, according to sources. Renaissance Services, which has a market capitalization of about $379mn, could seek a valuation of about $1.5bn for the Dubai-based business. Goldman Sachs Group Inc. and Morgan Stanley are advising on the share sale, which could take place next year in London. Valuation and location are still being discussed and no final decisions have been made, sources added. Renaissance Services may also choose to retain its stake in the division for now. (Bloomberg) Mandatory health insurance set for early 2019 roll-out in Oman – An estimated 2.09mn Omani and expatriate employees of private sector establishments in the Sultanate will be eligible for Mandatory Health Insurance coverage, which is proposed to be implemented in a series of stages starting from early next year. The Capital Market Authority’s Executive President, Abdullah Salim Al Salmi said the compulsory health insurance scheme will be rolled out gradually in as many as five stages encompassing Omanis and expatriate employees of private firms. However, for dependants of these employees, health insurance coverage will be the prerogative of the employers concerned and subject to negotiation between the two parties. (GulfBase.com)

- 6. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market was closed on September 25, 2018) Source: Bloomberg (*$ adjusted returns; # Market was closed on September 25, 2018) 50.0 75.0 100.0 125.0 Aug-14 Aug-15 Aug-16 Aug-17 Aug-18 QSEIndex S&P Pan Arab S&P GCC 1.8% (0.2%) 0.6% (0.1%) 0.7% 0.1% 0.0% (0.5%) 0.0% 0.5% 1.0% 1.5% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,201.30 0.2 0.2 (7.8) MSCI World Index 2,194.20 0.1 (0.3) 4.3 Silver/Ounce 14.46 1.5 1.3 (14.6) DJ Industrial 26,492.21 (0.3) (0.9) 7.2 Crude Oil (Brent)/Barrel (FM Future) 81.87 0.8 3.9 22.4 S&P 500 2,915.56 (0.1) (0.5) 9.0 Crude Oil (WTI)/Barrel (FM Future) 72.28 0.3 2.1 19.6 NASDAQ 100 8,007.47 0.2 0.3 16.0 Natural Gas (Henry Hub)/MMBtu# 3.04 0.0 0.7 (14.1) STOXX 600 383.89 0.5 0.2 (3.4) LPG Propane (Arab Gulf)/Ton# 105.75 0.0 1.4 6.8 DAX 12,374.66 0.3 (0.2) (6.2) LPG Butane (Arab Gulf)/Ton 120.50 1.5 2.8 11.1 FTSE 100 7,507.56 1.0 0.9 (4.9) Euro 1.18 0.2 0.2 (2.0) CAC 40 5,479.10 0.1 (0.0) 1.0 Yen 112.97 0.2 0.3 0.2 Nikkei 23,940.26 0.0 0.0 4.8 GBP 1.32 0.5 0.9 (2.4) MSCI EM 1,041.78 (0.1) (0.9) (10.1) CHF 1.04 (0.0) (0.7) 1.0 SHANGHAI SE Composite 2,781.14 (0.7) (0.7) (20.4) AUD 0.73 (0.0) (0.5) (7.2) HANG SENG# 27,499.39 0.0 (1.6) (8.1) USD Index 94.13 (0.1) (0.1) 2.2 BSE SENSEX 36,652.06 1.1 (1.1) (5.5) RUB 65.86 0.0 (0.9) 14.3 Bovespa 78,630.14 (0.2) (2.9) (17.4) BRL 0.25 0.4 (0.6) (18.7) RTS 1,169.04 0.5 1.7 1.3 80.7 78.1 75.4