13 September Daily market report

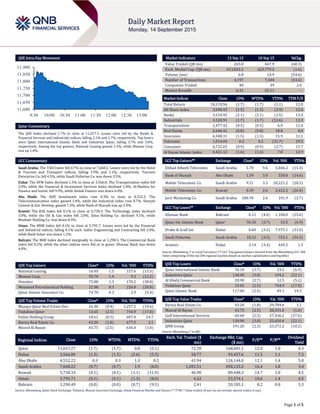

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 1.7% to close at 11,657.3. Losses were led by the Banks & Financial Services and Industrials indices, falling 2.1% and 1.7%, respectively. Top losers were Qatar International Islamic Bank and Industries Qatar, falling 3.7% and 3.0%, respectively. Among the top gainers, National Leasing gained 1.5%, while Mannai Corp. was up 1.4%. GCC Commentary Saudi Arabia: The TASI Index fell 0.7% to close at 7,668.2. Losses were led by the Hotel & Tourism and Transport indices, falling 1.9% and 1.1%, respectively. Tourism Enterprise Co. fell 4.5%, while Saudi Fisheries Co. was down 3.5%. Dubai: The DFM Index declined 1.5% to close at 3,566.8. The Transportation index fell 2.0%, while the Financial & Investment Services index declined 1.8%. Al-Madina for Finance and Invest. fell 9.9%, while Amlak Finance was down 6.0%. Abu Dhabi: The ADX benchmark index rose 0.3% to close at 4,552.2. The Telecommunication index gained 1.4%, while the Industrial index rose 0.7%. Sharjah Cement & Ind. Develop. gained 7.3%, while Bank of Sharjah was up 3.9%. Kuwait: The KSE Index fell 0.1% to close at 5,758.3. The Technology index declined 3.0%, while the Oil & Gas index fell 2.0%. Zima Holding Co. declined 9.1%, while Mashaer Holding Co. was down 8.3%. Oman: The MSM Index fell 0.1% to close at 5,795.7. Losses were led by the Financial and Industrial indices, falling 0.1% each. Galfar Engineering and Contracting fell 2.0%, while Bank Sohar was down 1.2%. Bahrain: The BHB Index declined marginally to close at 1,290.5. The Commercial Bank index fell 0.2%, while the other indices were flat or in green. Ithmaar Bank was down 4.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% National Leasing 16.95 1.5 157.6 (15.3) Mannai Corp. 95.70 1.4 9.3 (12.2) Ooredoo 75.80 1.3 170.2 (38.8) Mesaieed Petrochemical Holding 21.00 0.3 226.0 (28.8) Qatar Islamic Insurance Co. 74.70 0.3 2.9 (5.4) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 16.30 (0.4) 1,257.2 (10.6) Vodafone Qatar 13.65 (2.5) 744.9 (17.0) Ezdan Holding Group 18.61 (0.5) 687.0 24.7 Barwa Real Estate Co. 43.20 (1.8) 677.5 3.1 Masraf Al Rayan 43.75 (2.5) 636.4 (1.0) Market Indicators 13 Sep 15 10 Sep 15 %Chg. Value Traded (QR mn) 265.0 667.9 (60.3) Exch. Market Cap. (QR mn) 613,832.2 623,779.2 (1.6) Volume (mn) 6.8 14.9 (54.6) Number of Transactions 4,197 7,444 (43.6) Companies Traded 40 39 2.6 Market Breadth 6:31 25:11 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,119.56 (1.7) (1.7) (1.1) 12.0 All Share Index 3,090.43 (1.5) (1.5) (1.9) 12.6 Banks 3,154.92 (2.1) (2.1) (1.5) 13.4 Industrials 3,528.91 (1.7) (1.7) (12.6) 12.3 Transportation 2,477.42 (0.5) (0.5) 6.9 12.6 Real Estate 2,666.42 (0.8) (0.8) 18.8 8.8 Insurance 4,588.31 (1.5) (1.5) 15.9 12.1 Telecoms 1,014.04 0.2 0.2 (31.7) 29.5 Consumer 6,722.02 (0.9) (0.9) (2.7) 15.7 Al Rayan Islamic Index 4,421.12 (1.6) (1.6) 7.8 12.9 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Etihad Atheeb Telecomm. Saudi Arabia 5.70 9.6 5,846.2 (15.4) Bank of Sharjah Abu Dhabi 1.59 3.9 550.0 (14.6) Mobile Telecomm. Co. Saudi Arabia 9.51 3.3 20,221.2 (20.3) Mobile Telecomm. Co. Kuwait 0.39 2.6 2,422.2 (26.4) Jarir Marketing Co. Saudi Arabia 180.78 2.6 101.9 (2.7) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Ithmaar Bank Bahrain 0.12 (4.0) 1,100.0 (25.0) Qatar Int. Islamic Bank Qatar 76.10 (3.7) 33.5 (6.9) Drake & Scull Int. Dubai 0.60 (3.5) 7,975.1 (33.0) Saudi Fisheries Saudi Arabia 18.12 (3.5) 755.1 (34.3) Aramex Dubai 3.14 (3.4) 449.2 1.3 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar International Islamic Bank 76.10 (3.7) 33.5 (6.9) Industries Qatar 130.90 (3.0) 194.2 (22.1) Al Khalij Commercial Bank 20.90 (2.7) 12.5 (5.2) Vodafone Qatar 13.65 (2.5) 744.9 (17.0) Qatar Islamic Bank 117.00 (2.5) 49.1 14.5 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Barwa Real Estate Co. 43.20 (1.8) 29,784.4 3.1 Masraf Al Rayan 43.75 (2.5) 28,331.0 (1.0) Gulf International Services 60.60 (2.3) 27,436.2 (37.6) Industries Qatar 130.90 (3.0) 25,650.4 (22.1) QNB Group 191.20 (2.3) 23,372.2 (10.2) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,657.27 (1.7) (1.7) 0.8 (5.1) 72.78 168,681.1 12.0 1.8 4.3 Dubai 3,566.80 (1.5) (1.5) (2.6) (5.5) 58.77 93,457.6 11.5 1.1 7.3 Abu Dhabi 4,552.22 0.3 0.3 1.3 0.5 41.94 124,144.0 12.1 1.4 5.0 Saudi Arabia 7,668.22 (0.7) (0.7) 1.9 (8.0) 1,281.51 458,133.2 16.4 1.8 3.4 Kuwait 5,758.33 (0.1) (0.1) (1.1) (11.9) 46.90 89,448.3 14.7 1.0 4.5 Oman 5,795.71 (0.1) (0.1) (1.3) (8.6) 4.22 23,574.1 10.6 1.4 4.5 Bahrain 1,290.49 (0.0) (0.0) (0.7) (9.5) 2.41 20,185.1 8.2 0.8 5.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,600 11,650 11,700 11,750 11,800 11,850 11,900 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index declined 1.7% to close at 11,657.3. The Banks & Financial Services and Industrials indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non- Qatari and GCC shareholders. Qatar International Islamic Bank and Industries Qatar were the top losers, falling 3.7% and 3.0%, respectively. Among the top gainers, National Leasing gained 1.5%, while Mannai Corp. was up 1.4%. Volume of shares traded on Sunday fell by 54.6% to 6.8mn from 14.9mn on Thursday. Further, as compared to the 30-day moving average of 7.2mn, volume for the day was 6.2% lower. Mazaya Qatar Real Estate Development and Vodafone Qatar were the most active stocks, contributing 18.5% and 11.0% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Warba Bank (Warba) Moody’s Kuwait LT LCR/ST LCR/ LT FCR/ ST FCR/BCA/CRA – Baa2/Prime-2/ Baa2/Prime-2/ ba3/Baa1(cr)/ Prime-2(cr) – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, LCR – Local Currency Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, BCA – Baseline Credit Assessment, CRA – Counterparty Risk Assessment ) News Qatar QCB announces result of government Sukuk, bonds auction – The Qatar Central Bank (QCB) has announced the results of government Sukuk and bonds’ auction conducted on September 2, 2015. The QCB issued government Sukuk worth QR4.9bn and bonds worth QR10.6bn with a maturity period of three, five, seven and ten years (yrs). Sukuk worth QR1.7bn (3 yrs), QR1.7bn (5 yrs), QR750mn (7 yrs) and QR750mn (10 yrs) were issued at yields of 2.25%, 2.75%, 3.25% and 3.75%, respectively. Government bonds worth QR4.15bn (3 yrs), QR4.15bn (5 yrs), QR1.45bn (7 yrs) and QR850mn (10 yrs) were issued at yields of 2.25%, 2.75%, 3.25% and 3.75%, respectively. (QCB) GWCS to raise QR458mn through rights issue – Gulf Warehousing Company (GWCS) has received shareholders’ nod for a rights issue through which it is aiming to raise as much as QR458mn to shore up its capital base and part-fund its expansion. The company will issue 11.89mn shares at QR38.5 (QR10 at par and a premium of QR28.5). The proposal for the rights issue was approved at the extraordinary general assembly meeting, which was presided over by GWCS’ Chairman Sheikh Abdulla bin Fahad bin Jassem bin Jabor al-Thani. Masraf Al Rayan Group has been mandated as the issue manager. However, the company did not specify by when the issue will hit the market. All shareholders, as of October 12, will be eligible for the rights issue pending approval from authorities. According to a GWCS spokesman, both the subscription period and terms & conditions will be announced in local newspapers at the beginning of October. GWCS will also ensure that the process will be completed by the end of November with more details and updates available at the company’s website. Earlier, the Corporate Supervision Department at the Ministry of Economy & Commerce (MEC) approved the GWCS board’s proposal to increase the company’s capital by 25%, which is equivalent to 11.89mn shares at QR38.50 per share for existing shareholders. According to GWCS, the rights issue will fund a variety of its projects, particularly the GWCS Bu Sulba Logistics Park, which was awarded in December 2014 by the Economic Zones Company (Manateq). (Gulf-Times.com) MERS to replace QIGD on QSE Index – Al Meera Consumer Goods Company (MERS) will replace Qatari Investors Group (QIGD) on the QSE Index of the Qatar Stock Exchange with effect from October 1, 2015. Further, Zad Holding Company (ZHCD) will join the QSE Al Rayan Islamic Index, taking the number of its constituents to 18. Ahli Bank (ABQK) recording a velocity less than 1% will be removed from both the QSE All Share Index and Banks & Financial Services index. (QSE) 10 Gulf banks apply for Qatar license – Around 8 to 10 banks from the GCC countries have applied for license to operate in Qatar and are likely to get approval before 2015-end. Some of the banks are seeking the Qatar Financial Centre (QFC) route to enter Qatar while others want to operate outside of it. Since Qatar Central Bank (QCB) is the pivotal licensing authority, all the banks have made their applications to the banking regulator. Once approval is granted, they are expected to meet the necessary requirements, complete the paperwork and begin their operations by early 2016. Al Sharq reported, quoting sources from QCB that the banks aspiring to operate in Qatar are from Saudi Arabia, the UAE, Kuwait, Bahrain and Oman. The top applicants include First Gulf Bank from the UAE, and Bank Muscat from Oman, in addition to some Saudi and Kuwaiti banks. Qatar’s decision to allow GCC banks to open branches in its territory is part of a GCC-wide policy to bolster regional economic cooperation in all fields. (Peninsula Qatar) QDB unveils new equity fund for start-ups, SMEs – Qatar Development Bank (QDB), the 100% government entity which plays an active role in developing investments within the local industries, has launched a direct equity investment (Istithmar) to support Qatari entrepreneurs and SMEs. QDB also announced a ‘SME Equity Fund’, the first product under ‘Istithmar’. The ‘SME Equity Fund,’ worth QR365m, is designed to provide valuable investment to innovative start-up companies and SMEs. QDB CEO Abdulaziz bin Nasser Al Khalifa said the initiative will play a Overall Activity Buy %* Sell %* Net (QR) Qatari 53.58% 59.75% (16,353,881.78) GCC 13.00% 11.65% 3,598,664.97 Non-Qatari 33.41% 28.60% 12,755,216.81

- 3. Page 3 of 5 significant role in developing private sector business opportunities for Qatar. The aim of the fund is to provide the capital needed for Qatari entrepreneurs or start-up owners. The initiative is designed to encourage new and innovative projects that will contribute to the country’s economic diversification, generating value neutral returns that can be reinvested in subsequent funds to help and support the economy. (Peninsula Qatar) The First Investor buys stake in Shater Abbas – The First Investor, the investment banking arm of Barwa Bank Group, has acquired a 49% stake in Shater Abbas Restaurants International Group, a leading restaurant chain headquartered in Qatar. Established in Qatar in 1998 by Hussain Al Emadi, the Shater Abbas Restaurants concept features a variety of Persian and Gulf contemporary cuisine. The company operates nine branches, a central kitchen and offers home delivery & catering services and has more than 270 employees. (Peninsula Qatar) International BIS: China, Brazil among developing nations at risk of banking crisis – Switzerland-based the Bank for International Settlements (BIS) said credit growth in China, Brazil and Turkey does not only risk spurring a hangover in bad debt – it also signals a banking crisis is on the horizon. According to the BIS report, a ratio of credit to GDP, a measure of how much private-sector credit has deviated from its long-term trend, stands at 25.4% in China. That is the highest of any major economy and compares with 16.6% in Turkey and 15.7% in Brazil. BIS said that historically, a country with a ratio above a 10% threshold has a two-thirds chance of “serious banking strains” occurring within three years. Meanwhile, the biggest banks in Brazil, which are in the midst of the worst contraction in a quarter century, are boosting provisions to cover their bad loans. The report showed that like China, Indonesia, Singapore and Thailand also have credit-to-GDP ratios that exceed 10% and are therefore vulnerable to banking strains. (Bloomberg) China reveals reform details for state-firms as growth sputters – China unveiled details of how it would restructure its state-owned enterprises (SOEs), including partial privatization, as data pointed to a cooling in the world’s second-largest economy. The official Xinhua news agency said the guidelines, jointly issued by the Communist Party’s Central Committee and the State Council, China’s cabinet, included plans to clean up and integrate some state firms. Xinhua said the plans included introducing “mixed ownership” by bringing in private investment, and decisive results were expected by 2020. The news agency said the government will not force “mixed ownership”, nor will it set a timetable, giving each firm the go-ahead only when conditions are mature. SOEs will be divided into commercial and public welfare-related businesses during the reform process. Oil & gas, electricity, railways and telecommunications were identified as sectors that could be suitable for limited non-state investment. Meanwhile, data published by the National Bureau of Statistics showed growth in fixed-asset investment, a crucial economic driver, slowed to 10.9% in the first eight months of 2015 - the weakest pace in nearly 15 years. Annual growth in real estate investment also continued to cool to 3.5% in the first eight months, the weakest since early 2009, from 4.3% in January-July. Retail sales were the single positive surprise, growing 10.8% YoY in August and above forecasts of 10.5%, the same as July. The government is aiming for 2015 economic growth of around 7%, which would be the slowest in a quarter century. (Reuters) Economy Minister: Spain to grow 3.5% YoY in 3Q2015 – Spain’s Economy Minister, Luis de Guindos said the Spanish economy will expand by around 3.5% YoY in 3Q2015, putting it on course to achieve overall growth of 3.3% in 2015. De Guindos said job creation has slowed down in the last months but indicators signal that the growth will be close to 3.5% in the third quarter. De Guindos dismissed the idea that a heated debate over a potential split of Catalonia from Spain was hurting international investments in the country. He said direct international investments in Catalonia in 1H2015 were close to €2bn and were slightly above €6.3bn in Spain. De Guindos added that political instability or a government that would cancel the reforms passed since 2011 were posing the main risks for the economy. (Economic Times) Regional APC BoD recommends SR123mn dividend for 3Q2014 – Advanced Petrochemical Company’s (APC) board of directors (BoD) has recommended the distribution of 7.5% dividend (SR0.75 per share), amounting to SR123mn for 3Q2014. Shareholders, who are registered in the registers of the Securities Depository Center (Tadawul) on September 30, 2014, will be eligible to receive the dividend. The dividend will be distributed on October 12, 2015. (Tadawul) Saudi joins FTSE watch list for possible addition to secondary emerging market status – FTSE has added Saudi Arabia to its watch list for possible inclusion in the emerging markets category, following the opening of its stock market to qualified institutional investors in June 2015. An inclusion in FTSE and MSCI indexes could drive billions of dollars in passive fund investments into Saudi Arabia, although the process is likely to take years. FTSE will engage with the market as it works toward meeting the requirements for the Secondary Emerging status. (CPI, Reuters) Apollo in race to acquire Al-Raya for Foodstuff – According to sources, US-based Apollo is bidding for Saudi Arabian supermarket chain Al-Raya For Foodstuff Company. Dubai-based Frontier Management sourced the deal for Apollo, which would be the US firm’s first Mideast investment. Reportedly, Abraaj Group, Fajr Capital and Gulf Capital are among the potential bidders for the supermarket chain. Al-Raya may be valued at as much as SR1.7bn. (Bloomberg) UAE consumer paper, packaging market valued at $500mn – According to Al Fajer Information & Services, organizers of the Paper Arabia 2015 which commences in Dubai on September 14, the UAE consumer paper and board packaging market is valued at $500mn. The industry represents around 0.5% of the global demand which is expected to increase as the UAE economy develops further. Al Fajer’s Exhibition Manager, Lamyae Zafati said that the packaging sales in the UAE will continue to show strong growth as both increased consumption and demand for consumer goods drives the need for more sophisticated packaging. (GulfBase.com) CBD shareholders reject $750mn Tier 1 bond plan – Commercial Bank of Dubai’s (CBD) shareholders have rejected a proposal to issue $750mn Tier 1 capital perpetual securities. Earlier, in August 2015, the bank’s board of directors has proposed the Basel III compliant bond, subject to shareholder and regulatory approval. The proposal was rejected by 39.24% of shareholders present at the meeting. (Reuters) UP sets date for Oia contract bids – Union Properties (UP) General Manager Ahmad Al Marri has said that the developer will send tender documents out to contractors for its AED400mn, 271-unit Oia project in November 2015. The company has decided to move its AED680mn Green Community West project forwards first, while Oia will be the next to be brought forward. Mr. Al Marri said off-plan sales for the project, which comprises 152 villas and 127 apartments ranging from one to four bedrooms, will get under way in 1Q2016. Oia is one of three projects that Union Properties announced at Cityscape 2014. Together, they are worth AED2.18bn. (GulfBase.com)

- 4. Page 4 of 5 DEWA to award solar power contracts for third phase worth $3.3bn in 1Q2016 – Dubai Electricity & Water Authority (DEWA) is expected to award contracts for the third phase of a $3.3bn solar energy park in 1Q2016. DEWA CEO Saeed Mohammed Al Tayer said the project will produce 800 megawatts (MW) of solar electricity. It will probably be awarded to more than one company. He said the company is still deciding whether to build the plant all at once or at different times to take advantage of lower costs. In January 2015, DEWA tripled its target for solar energy production to take advantage of lower building costs. (Bloomberg) Americana in talks for stake sale, no binding offers – Kuwait Food Company (Americana) has confirmed that talks are under way with several parties interested in buying a stake in it. Earlier, Americana board had said that it was not aware of any bids for a stake in the company and there had been no developments that would cause unusual trading in its shares. Earlier, in 2014, Americana’s shareholders were in talks with private equity funds KKR and CVC regarding selling a stake in the company. (Reuters) KIPCO plans $5bn real estate project – Kuwait Projects Company (KIPCO) is planning a $5bn real estate scheme on the outskirts of Kuwait City. United Real Estate, a unit of KIPCO, will be responsible for its implementation, along with other unnamed entities. The 380,000 square-meter project is planned for the Al- Daiya area, where several foreign embassies are located. It will include both residential and commercial spaces, as well as infrastructure such as roads, parks, walkways and electricity. The company aims to present its plans to regulators in the coming days and to begin implementing them in 2015. (Reuters) Al Jazeera CEO resigns – Al Jazeera Steel Products Company (Al Jazeera) has announced that its Chief Executive Officer (CEO) Dr. Bhaskar Dutta has tendered his resignation for personal reasons and is awaiting the approval from the board of directors. (MSM) GCC-Stat: Oman registers lowest inflation rate in GCC states – According to latest statistics issued by the GCC-Stat, Oman registered the lowest inflation rate of 0.46% among the GCC states in July 2015. Among the GCC member states, the highest inflation rate was recorded in the UAE at 4.43%, followed by Kuwait at 3.62%, Saudi Arabia at 2.2%, Qatar at 1.6%, Bahrain at 1.1%, and Oman at 0.46%. As compared to the general index of June 2015, the inflation index of July 2015 showed a slight increase in Qatar by 0.6%, in the Sultanate by 0.53%, in Saudi Arabia by 0.3%, the UAE by 0.29% and Kuwait by 0.07%. In contrast, Bahrain registered a fall of 0.2%. The prices of commodities in the 'food & beverage' group increased in July 2015 in most of the GCC countries as compared to July 2014. (GulfBase.com) Oman Rail evaluating EPC prequalification bids – Oman Rail is evaluating the prequalification offers submitted by a number of international railway contractors for the engineering procurement construction (EPC) of a further three segments of Oman’s National Rail Project. The project is being carefully planned, structured and executed to deliver long-term and sustainable economic benefits in the form of employment generation, commercial opportunities for Omani companies and SMEs, and In Country Value (ICV). (GulfBase.com) BTech, Chinese Association ink e-commerce deal – The Bahrain Technology Companies Society (BTech) has signed an agreement with a Chinese Association to make Bahrain a center for development of e-commerce projects in the region and enhance its role as a global hub for trade and services. This agreement will enhance mutual cooperation between the two countries in the field of e-commerce and the exchange of experiences between Chinese, Arab and Middle Eastern enterprises in this field. As per the agreement, the Bahraini side will organize the first annual "conference in the field of e-commerce." This event is expected to attract thousands of those interested in developing e-commerce industry and achieve a positive impact on trade in general in the Kingdom of Bahrain and the region. (GulfBase.com)

- 5. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Index S&P Pan Arab S&P GCC (0.7%) (1.7%) (0.1%) (0.0%) (0.1%) 0.3% (1.5%) (2.0%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,107.78 (0.3) (1.4) (6.5) MSCI World Index 1,626.99 0.1 2.0 (4.8) Silver/Ounce 14.61 (0.5) 0.2 (6.9) DJ Industrial 16,433.09 0.6 2.1 (7.8) Crude Oil (Brent)/Barrel (FM Future) 48.14 (1.5) (3.0) (16.0) S&P 500 1,961.05 0.4 2.1 (4.8) Crude Oil (WTI)/Barrel (FM Future) 44.63 (2.8) (3.1) (16.2) NASDAQ 100 4,822.34 0.5 3.0 1.8 Natural Gas (Henry Hub)/MMBtu 2.66 (1.6) (0.2) (11.0) STOXX 600 355.72 (0.3) 2.6 (2.6) LPG Propane (Arab Gulf)/Ton 44.62 (0.3) 3.2 (8.9) DAX 10,123.56 (0.1) 2.7 (3.7) LPG Butane (Arab Gulf)/Ton 57.00 (0.4) 1.8 (13.0) FTSE 100 6,117.76 (0.7) 2.8 (7.7) Euro 1.13 0.5 1.7 (6.3) CAC 40 4,548.72 (0.3) 2.4 (0.2) Yen 120.59 (0.0) 1.3 0.7 Nikkei 18,264.22 (0.3) 1.2 3.6 GBP 1.54 (0.1) 1.7 (1.0) MSCI EM 802.49 (0.2) 1.8 (16.1) CHF 1.03 0.4 0.2 2.6 SHANGHAI SE Composite 3,200.23 0.1 1.0 (3.7) AUD 0.71 0.3 2.7 (13.2) HANG SENG 21,504.37 (0.3) 3.2 (8.9) USD Index 95.19 (0.3) (1.1) 5.5 BSE SENSEX 25,610.21 0.1 2.2 (11.3) RUB 68.00 0.4 (0.7) 12.0 Bovespa 46,400.50 (1.4) (1.3) (36.7) BRL 0.26 (0.5) (0.7) (31.5) RTS 799.10 (0.2) 0.7 1.1 139.6 117.3 112.7