QSE gains 0.5% led by Banks & Financials

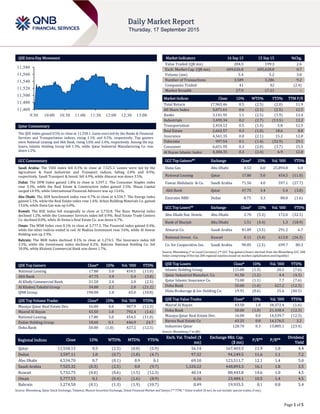

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index gained 0.5% to close at 11,558.1. Gains were led by the Banks & Financial Services and Transportation indices, rising 1.1% and 0.5%, respectively. Top gainers were National Leasing and Ahli Bank, rising 5.0% and 3.4%, respectively. Among the top losers, Islamic Holding Group fell 1.3%, while Qatar Industrial Manufacturing Co. was down 1.2%. GCC Commentary Saudi Arabia: The TASI Index fell 0.3% to close at 7,525.3. Losses were led by the Agriculture & Food Industries and Transport indices, falling 2.0% and 0.9%, respectively. Saudi Transport & Invest. fell 4.9%, while Almarai was down 3.5%. Dubai: The DFM Index gained 1.8% to close at 3,597.1. The Consumer Staples index rose 3.3%, while the Real Estate & Construction index gained 2.5%. Shuaa Capital surged 14.9%, while International Financial Advisors was up 13.6%. Abu Dhabi: The ADX benchmark index rose 0.7% to close at 4,534.7. The Energy index gained 5.1%, while the Real Estate index rose 1.6%. Arkan Building Materials Co. gained 13.6%, while Dana Gas was up 6.0%. Kuwait: The KSE Index fell marginally to close at 5,732.8. The Basic Material index declined 1.2%, while the Consumer Services index fell 0.9%. Real Estate Trade Centers Co. declined 8.0%, while Al-Enma'a Real Estate Co. was down 6.7%. Oman: The MSM Index rose 0.1% to close at 5,777.5. The Financial index gained 0.4%, while the other indices ended in red. Al Madina Investment rose 3.6%, while Al Anwar Holding was up 2.9%. Bahrain: The BHB Index declined 0.1% to close at 1,274.5. The Insurance index fell 3.3%, while the Investment index declined 0.2%. Bahrain National Holding Co. fell 10.0%, while Khaleeji Commercial Bank was down 1.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% National Leasing 17.80 5.0 454.5 (11.0) Ahli Bank 47.75 3.4 5.4 (3.8) Al Khalij Commercial Bank 21.50 2.4 2.0 (2.5) Al Khaleej Takaful Group 34.80 2.1 2.0 (21.2) QNB Group 190.00 1.8 65.0 (10.8) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mazaya Qatar Real Estate Dev. 16.00 0.0 907.9 (12.3) Masraf Al Rayan 43.50 1.0 792.4 (1.6) National Leasing 17.80 5.0 454.5 (11.0) Ezdan Holding Group 18.60 0.1 446.9 24.7 Doha Bank 50.00 (1.0) 427.2 (12.3) Market Indicators 16 Sep 15 15 Sep 15 %Chg. Value Traded (QR mn) 204.5 199.3 2.6 Exch. Market Cap. (QR mn) 609,626.8 605,628.8 0.7 Volume (mn) 5.4 5.2 3.8 Number of Transactions 3,589 3,286 9.2 Companies Traded 41 42 (2.4) Market Breadth 27:9 17:21 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,965.46 0.5 (2.5) (2.0) 11.9 All Share Index 3,071.61 0.6 (2.1) (2.5) 12.5 Banks 3,141.95 1.1 (2.5) (1.9) 13.4 Industrials 3,495.34 0.2 (2.7) (13.5) 12.2 Transportation 2,454.12 0.5 (1.4) 5.8 12.5 Real Estate 2,662.57 0.3 (1.0) 18.6 8.8 Insurance 4,561.35 0.0 (2.1) 15.2 12.0 Telecoms 997.54 0.1 (1.4) (32.9) 29.1 Consumer 6,651.95 0.3 (2.0) (3.7) 15.5 Al Rayan Islamic Index 4,384.35 0.3 (2.4) 6.9 12.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Dana Gas Abu Dhabi 0.53 6.0 25,894.8 6.0 National Leasing Qatar 17.80 5.0 454.5 (11.0) Fawaz Abdulaziz & Co. Saudi Arabia 71.56 4.0 597.1 (27.7) Ahli Bank Qatar 47.75 3.4 5.4 (3.8) Emirates NBD Dubai 8.75 3.3 80.0 (1.6) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Hotels Abu Dhabi 2.70 (5.3) 172.0 (32.5) Bank of Sharjah Abu Dhabi 1.51 (4.4) 1.3 (18.9) Almarai Co. Saudi Arabia 81.89 (3.5) 291.2 6.7 National Invest. Co. Kuwait 0.11 (3.4) 613.0 (26.3) Co. for Cooperative Ins. Saudi Arabia 90.05 (2.5) 699.7 80.3 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 115.00 (1.3) 20.5 (7.6) Qatar Industrial Manufact. Co. 41.50 (1.2) 4.4 (4.3) Qatar Islamic Insurance Co. 73.00 (1.1) 7.7 (7.6) Doha Bank 50.00 (1.0) 427.2 (12.3) Dlala Brokerage & Inv Holding Co. 19.91 (0.6) 25.6 (40.5) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 43.50 1.0 34,372.4 (1.6) Doha Bank 50.00 (1.0) 21,438.4 (12.3) Mazaya Qatar Real Estate Dev. 16.00 0.0 14,539.7 (12.3) Barwa Real Estate Co 43.25 0.8 14,176.5 3.2 Industries Qatar 128.70 0.3 13,885.1 (23.4) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,558.13 0.5 (2.5) (0.0) (5.9) 56.14 167,403.5 11.9 1.8 4.4 Dubai 3,597.11 1.8 (0.7) (1.8) (4.7) 97.32 94,249.5 11.6 1.1 7.2 Abu Dhabi 4,534.70 0.7 (0.1) 0.9 0.1 69.10 123,511.7 12.1 1.4 5.0 Saudi Arabia 7,525.32 (0.3) (2.5) 0.0 (9.7) 1,320.22 448,893.3 16.1 1.8 3.5 Kuwait 5,732.75 (0.0) (0.6) (1.5) (12.3) 40.14 88,443.8 14.6 1.0 4.5 Oman 5,777.53 0.1 (0.4) (1.6) (8.9) 6.16 23,484.1 10.5 1.4 4.5 Bahrain 1,274.50 (0.1) (1.3) (1.9) (10.7) 0.49 19,935.5 8.1 0.8 5.4 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,460 11,480 11,500 11,520 11,540 11,560 11,580 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index gained 0.5% to close at 11,558.1. The Banks & Financial Services and Transportation indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. National Leasing and Ahli Bank were the top gainers, rising 5.0% and 3.4%, respectively. Among the top losers, Islamic Holding Group fell 1.3%, while Qatar Industrial Manufacturing Co. was down 1.2%. Volume of shares traded on Wednesday rose by 3.8% to 5.4mn from 5.2mn on Tuesday. However, as compared to the 30-day moving average of 7.5mn, volume for the day was 27.5% lower. Mazaya Qatar Real Estate Development and Masraf Al Rayan were the most active stocks, contributing 16.8% and 14.6% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/16 US Mortgage Bankers Association MBA Mortgage Applications 11-September -7.00% – -6.20% 09/16 US Bureau of Labor Statistics CPI MoM August -0.10% -0.10% 0.10% 09/16 US Bureau of Labor Statistics CPI YoY August 0.20% 0.20% 0.20% 09/16 US Bureau of Labor Statistics CPI Ex Food and Energy YoY August 1.80% 1.90% 1.80% 09/16 US Bureau of Labor Statistics CPI Index NSA August 238.3 238.4 238.7 09/16 US Bureau of Labor Statistics CPI Core Index SA August 242.7 242.8 242.5 09/16 US Bureau of Labor Statistics Real Avg Weekly Earnings YoY August 2.30% – 2.00% 09/16 EU Eurostat CPI MoM August 0.00% 0.00% -0.60% 09/16 EU Eurostat Labour Costs YoY 2Q2015 1.60% – 1.90% 09/16 UK ONS Average Weekly Earnings 3M/YoY July 2.90% 2.50% 2.60% 09/16 UK ONS Weekly Earnings ex Bonus 3M/YoY July 2.90% 2.90% 2.80% 09/16 UK ONS ILO Unemployment Rate 3Mths July 5.50% 5.60% 5.60% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar IHGS seeks shareholders’ nod for QR20mn capital increase – Islamic Holding Group (IHGS) has invited its shareholders to attend the extraordinary general assembly meeting (EGM) on October 6, 2015. The EGM will consider increasing the company's capital by 50% from QR40mn to QR60mn through the issuance of 2mn new shares. The shares will be offered for subscription to the eligible shareholders that have the right to subscribe at a rate of one new share for each two existing shares at a nominal value of QR10 plus a share premium of QR40 per share. Shareholders will consider assigning a date of the initial public offering (IPO) in accordance with the regulations of the Qatar Financial Markets Authority or authorize the board of directors to determine the initial date, dates of payment, eligibility for subscription and to assign an issuance manager and auditor in charge to follow up the IPO process. The EGM will also consider a recommendation to amend Article (6) of the Articles of Association after finalizing the increase in capital. (QSE) Qatar begins work at 2022 FIFA World Cup final venue – According to the tournament officials, Qatar has begun construction work in Lusail, where the 2022 FIFA World Cup final will be played. Preparatory work, including the stationing of site offices and five kilometers of hoarding, have gone up at the site in Lusail, north of the capital, Doha. The opening game of the 2022 tournament will also be staged at the 80,000-seater Lusail Stadium. The Stadium's Project Director, Mubarak Al-Khulaifi said that organizers were pleased to have initiated a presence on the site, which has a special significance for Qataris. Lusail is the sixth venue currently under construction for the 2022 FIFA World Cup, the first to be played in the Middle East. The Stadium is being designed by British architects Foster and Partners. (Gulf-Times.com) Banks worried over payment default by real estate developers – According to a survey conducted by Qatar Central Bank (QCB), payment default by real estate developers and contractors are causing major concerns to Qatar’s conventional banks. The QCB survey on ‘risk perception of banks’ for the years 2014, 2015 and 2016 has revealed that defaults by infrastructure sector is equally a matter of concern for these banks, but not a major problem for Islamic and foreign banks. The risk average that ranges between 1- 6, shows the risk of default by real estate developers and contractors has been ranked the highest (One) for the year 2014 and “2” for 2015 and 2016. The risk average for default in infrastructure are ‘2’,’3’ and ‘3’ for the year 2014, 2015 and 2016, respectively. Variations in oil prices have been projected highly risky for foreign banks and Islamic banks. For the conventional banks, the risk average is ‘3’,’2’ and ‘1’ for the years 2014, 2015 and 2016, respectively. Foreign banks see the decline in fiscal balance as a problem. The survey that forms a part of the central bank’s latest financial stability report showed most of the banks expect overall credit, market, liquidity and systemic risk to remain unchanged or increase during 2015 and 2016. (Peninsula Qatar) Qatar will remain stable LNG supplier to Japan – HE the Minister of Energy and Industry Dr. Mohamed bin Saleh al-Sada said that the volatile situation in global energy markets along with low oil and gas prices currently prevailing in the market do not encourage producers to invest in the development of resources that the world needs in the future, a matter which may lead to future crises in supply and demand. Speaking at the Fourth Liquefied Natural Gas (LNG) Producer-Consumer Conference, held in Japan, Dr. Al Sada Overall Activity Buy %* Sell %* Net (QR) Qatari 52.38% 52.57% (378,324.73) GCC 4.24% 8.93% (9,594,550.97) Non-Qatari 43.37% 38.50% 9,972,875.70

- 3. Page 3 of 5 said that the State of Qatar harnessed huge investments to provide clean energy for consumers across the world, contributed to reducing release of harmful emissions into the environment and developed environmental projects to reduce emissions such as those from the gas recovery project, which was opened in April with a cost of more than a billion dollars. Dr. Al-Sada touched on the bilateral relations between Qatar and Japan in the field of energy supply and LNG in particular, stressing that despite the volatility in global energy markets, the State of Qatar will remain a stable and reliable supplier of energy to Japan that can be relied upon in all circumstances. He expressed Qatar’s readiness to contribute to activate and intensify constructive dialogue between energy producers and consumers and work with them in order to stabilize global energy markets for the benefit of all. (Gulf- Times.com) UnionPay International, DHBK enter into strategic partnership – Doha Bank (DHBK) has partnered with UnionPay International to be the first issuer of UnionPay cards in the country. DHBK and UnionPay International entered into a strategic relationship during a MoU signing ceremony. This relationship will allow prospective cardholders to freely transact in more than 150 countries and regions including China, without worrying about restricted acceptance and unsatisfactory exchange rates. (Bloomberg) Katara Hospitality buys Westin Excelsior Rome – Katara Hospitality, the global hotel developer, owner and operator announced the expansion of its global portfolio with the acquisition of the Westin Excelsior Rome from Starwood Hotels & Resorts Worldwide, Inc. As part of the deal, the historic hotel will be renovated over the next five years, including a top-to-bottom transformation of all guestrooms, as well as the upgrade of the hotel’s public areas, and will continue to be operated by Starwood Hotels & Resorts under a new long-term management agreement. (Peninsula Qatar) International US household incomes slip, poverty rate up slightly in 2014 – American household incomes lost ground last year as the poverty rate remained flat, a sign the US economic expansion is yet to result in gains for many Americans five years after the 2007-2009 recession. The data released by the US Census Bureau, which showed the inflation-adjusted median income slipping to $53,657 in 2014 from $54,462 in 2013, offered a reminder of the tepid nature of the economy's recovery. According to Census researchers, real median household income was 6.5% lower in 2014 than in 2007, the year before the most recent recession. At the same time, the poverty rate held steady at 14.8%. Census researchers said the change in the median income was not statistically significant. The Census Bureau also said the number of people in the US without health insurance coverage fell to 33mn in 2014, or 10.4% of the population, from 41.8mn, or 13.3% in 2013. (Reuters) OECD trims growth outlook but urges Fed action this week – The Paris-based Organisation for Economic Cooperation and Development (OECD) said the global economic outlook has grown darker than it was only a few months ago, but the US is doing well enough that its central bank should go ahead with its first rate increase since the financial crisis. The world economy is set to grow 3.0% in 2015 and 3.6% in 2016. It trimmed its estimates from 3.1% and 3.8% in June, citing primarily a slowdown in emerging market economies like China and Brazil. (Reuters) ECB gives central banks power to announce emergency funding – The European Central Bank (ECB) said national central banks in the Eurozone will now have the power to make announcements about any emergency funding that they provide to their banks. Official announcements about the supply of Emergency Liquidity Assistance (ELA), such as in the case of Greek banks, had so far been made by the ECB itself. The ECB said that Governing Council of the European Central Bank has decided that national central banks will from now on have the option to communicate publicly about the provision of Emergency Liquidity Assistance (ELA) to the banks in their country, in cases where they deem that such communication is necessary. Central banks will still have to seek ECB approval to provide ELA and to make any announcement about it. Meanwhile, the European Union's statistics office Eurostat said consumer prices in the Eurozone were flat on the month and up just 0.1% YoY, slowing down from a 0.2% annual rise logged in July. In its first estimate, Eurostat estimated the YoY increase in August at 0.2%. The ECB wants to keep consumer inflation below but close to 2% over the medium-term and started a QE program of buying 60bn euros worth of government bonds in August 2015 to inject more cash into the economy and maker prices rise faster. (Reuters) China says a rise in US interest rates would have limited effect on its economy – Ministry of Commerce, Deputy China International Trade Representative, Zhang Xiangchen said a rise in US interest rates would have limited effect on China's economy. The Federal Reserve will decide later in the day whether to wait or raise interest rates for the first time in nearly a decade. (Reuters) Japan's export growth hit by strains in China, puts BOJ on notice – Japan's exports slowed for the second straight month in August in an increasingly worrying sign that China's economic slowdown is hurting the world's third-biggest economy, increasing the chance that policy makers will inject fresh stimulus before too long. The 3.1% annual increase in exports in August was smaller than the median estimate for 4.0% growth expected by Reuters, and less than July's 7.6% YoY rise. Slowing exports could increase the chance of additional monetary easing from the Bank of Japan (BOJ), because this could lead to lower factory output, less economic activity and less momentum needed to offset deflationary pressure caused by a collapse in oil prices. Finance Ministry data showed exports destined for China, Japan's largest trading partner, fell 4.6% YoY in August, compared with July's 4.2% annual increase. The decline was the first since February due to falling shipments of car parts and electronics. Exports to Asia rose 1.1% YoY in August, versus a 6.1% increase in July. Exports to the US have been a bright spot, but in August growth slowed. Exports rose an annual 11.1% August versus an 18.8% rise in July. Imports fell 3.1% YoY in August, more than the median estimate for a 2.2% annual decrease as the cost of crude and liquefied natural gas fell. The trade balance was a deficit of 569.7bn yen, versus the median estimate for a 541.3bn yen deficit. (Reuters) S&P downgrades Japan, doubts Abenomics can soon reverse deterioration – Ratings agency Standard & Poor's (S&P) downgraded Japan's credit rating by one notch to A+, saying economic support for the country's sovereign creditworthiness had continued to weaken in the past three or four years. S&P cut its rating on Japan from AA- to A+, which is four notches below its top rating of AAA. The agency raised its outlook from negative to stable. It was the first Japan downgrade by S&P since January 2011 and came 4-1/2 years after it last lowered its outlook, from stable to negative. The downgrade brings its Japan rating into line with rival Moody's Investors Service, which downgraded Japan to A1 in December 2014. Fitch Ratings cut its rating on Japan by one notch to A in April. (Reuters) Regional SABB: Saudi banks still strong despite oil slump – Saudi British Bank (SABB) has said that Saudi Arabian banks’ financial cushion and the government’s commitment to keep spending should

- 4. Page 4 of 5 enable them to weather a prolonged slump in oil prices, even though loan growth is slowing. SABB Managing Director David Dew said he saw no possibility of the government abandoning the riyal's peg to the dollar. He said the economic cost of lower crude prices in a country, whose economy depends on oil exports, means Saudi banks will witness lower lending growth than the double- digit figures of recent years. Dew said he expects more private financing of infrastructure projects and that he saw little scope for more foreign banks in the Kingdom. SABB is the Kingdom’s fifth- largest lender by assets and is 40% owned by HSBC, Europe’s biggest bank. (GulfBase.com) Mobily OGM approves dividend distribution, freeze – Etihad Etisalat Company’s (Mobily) ordinary general assembly meeting (OGM) has approved the board of directors’ (BoD) recommendation to distribute SR2.5 per share dividend, amounting to SR1.925bn for 2Q2014 and 1Q2014. The OGM also approved withholding dividend for 3Q2014 and 4Q2014. Further, the meeting approved Mobily’s engagement into an annual contract with United Electronics Company (eXtra) as a distributor for Mobily. (Tadawul) Al Khodari to auction surplus equipment – Abdullah A. M. Al Khodari Sons Company (Al Khodari) has signed an agreement with Abdullah Fouad Holding Company (Auction Division) to conduct an auction of its surplus equipment. The auction will be held during October 27-29, 2015 at Al Khodari yard in Dammam, and will have a positive impact on Al Khodari’s 4Q2015 financials. This move is in line with Al Khodari’s plan to upgrade its plant and equipment. (Tadawul) Gasco awards UAE pipeline contract to Voestalpine – Austria-based Voestalpine Group has been awarded a major contract to build a 114-km high-pressure Integrated Gas Development (IGD-E) pipeline for a gas plant in Abu Dhabi, UAE. The contract, awarded by UAE-based National Gas & Industrialization Company (Gasco), also includes the supply of 95,000 tons of premium line pipe plates for the project. The pipeline will be instrumental in supplying natural gas extracted in the Gulf region to the capital Abu Dhabi, thus catering to the surging demand for natural gas. Once ready, Gasco will be able to produce and pipe an additional 11mn cubic meters of natural gas on a daily basis. (GulfBase.com) EA, partners complete $500mn financing – Etihad Airways (EA), its airport services business and five of its equity partners have completed a financing transaction, raising $500mn in international markets. The funds have been raised through a special purpose vehicle, EA Partners IBV. EA, Etihad Airport Services, Air Berlin and Alitalia will get 20% each of funds, while 16% will be allocated to Jet Airways and the remainder to Air Serbia and Air Seychelles. The funds raised by the transaction will be used largely for capital expenditure and investment in fleet, as well as for refinancing, depending on each individual airline’s needs. Goldman Sachs International, ADS Securities and Anoa Capital acted as joint lead book-running managers for the offering. (GulfBase.com) Damac Properties OGM approves cash, stock dividend – Damac Properties Dubai Company’s ordinary general assembly meeting (OGM) has approved the board of directors’ recommendation to distribute 10% cash dividend from the paid-up capital (10 fils per share) and 10% bonus shares. (DFM) TAQA sells Bergermeer storage capacity – Abu Dhabi National Energy Company (TAQA) has sold all five terawatt hours (TWh) for all three years of capacity through auction at its Dutch Gas Storage Bergermeer facility. TAQA sold the available capacity with a cut-off multiplier of 1.22 and a weighted average multiplier of 1.29. Participants could submit up to five bids, for one, two or three years starting from April 2016. In advance of the auction TAQA revealed a reserve multiplier of 1.1, based on the Netherlands’ Title Transfer Facility (TTF) summer-winter spread, the difference between wholesale gas prices for the summer and winter seasons. TAQA has now sold 95% of all capacity for the 2016-17 storage year. (Bloomberg) UNB ranks 22nd safest bank in Emerging Markets 2015 – Global Finance has ranked Union National Bank (UNB) as the 22nd safest bank in the Emerging Markets for 2015. The ranking highlights those banks that have built strong foundations providing safety and security in this rapidly-changing market landscape. (GulfBase.com) OSC plans to acquire 10 new vessels – Oman Shipping Company (OSC) is planning to acquire 10 new medium-range product tankers, taking the total strength of the fleet to 53 from the current 43. OSC acting CEO Tarik Mohammed Al Junaidi said that the vessels will be managed by Oman Ship Management Company – a wholly-owned subsidiary of OSC. He said the total project cost for the 10 vessels is around $320mn, and as much as 80% of the funding will be by way of term lending from financial institutions. Al Junaidi said the aggregate capacity of OSC’s fleet will go up to 8.5mn deadweight tons (DWT), once the new ships join the fleet, from 8mn DWT now. Each mid-range tanker has deadweight of 50,000 tons. (GulfBase.com) ABG’s Turkish subsidiary concludes $450mn syndicated Murabaha financing – Al Baraka Banking Group (ABG) announced that its Turkish subsidiary, Al Baraka Turk Participation Bank, had concluded a syndicated Shari’ah-compliant Murabaha financing, raising a total of $278mn and €154.5mn with total financing of $450mn. A number of 17 international banks from 11 countries participated in the facility, managed by the lead arrangers Standard Chartered Bank, ABC Islamic Bank (E.C.), Barwa Bank, Emirates NDB Capital and Kuwait International Bank. The facility comprises two tranches representing a total of $87.5mn and €98.25mn for the tenure of 367 days while $190.5mn and €56.25mn for the tenure of two years and three days. (Bahrain Bourse) NBB to provide card acceptance services to 790 Dragon City outlets – National Bank of Bahrain (NBB) has signed a deal to provide card acceptance services to 790 Dragon City outlets in Bahrain. Dragon City Bahrain is an upcoming shopping and wholesale distribution centre at Diyar Al Muharraq, managed and operated by Chinamex. NBB will install its point of sale terminals at all tenants’ premises, significantly boosting the bank’s already substantial share of the Bahrain market. (Bahrain Bourse) Bahrain to float tender for $6bn projects – Bahrain will start tendering major oil & gas projects worth over $6bn over the next few months. Minister of Energy and National Oil & Gas Authority (NOGA) Chairman Dr. Abdulhussain Mirza said the tendering process for the expansion and modernization of the Bahrain Petroleum Company (Bapco) refinery would begin in 1H2016. He said Bapco’s modernization program would increase the production capacity of the GCC’s first refinery from 260,000 to 360,000 barrels per day. Various estimates have put the cost of the project in the range between $3 and $5bn. Bahrain is also in the final stages to award a contract for the construction of an LNG terminal with 400mn standard cubic feet per day (cfpd) capacity, with an option to increase the capacity to 800mn cfpd. (GulfBase.com)

- 5. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Index S&P Pan Arab S&P GCC (0.3%) 0.5% (0.0%) (0.1%) 0.1% 0.7% 1.8% (0.8%) (0.4%) 0.0% 0.4% 0.8% 1.2% 1.6% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,119.52 1.3 1.1 (5.5) MSCI World Index 1,653.81 1.2 1.6 (3.3) Silver/Ounce 14.92 3.4 2.1 (5.0) DJ Industrial 16,739.95 0.8 1.9 (6.1) Crude Oil (Brent)/Barrel (FM Future) 49.75 6.7 3.3 (13.2) S&P 500 1,995.31 0.9 1.7 (3.1) Crude Oil (WTI)/Barrel (FM Future) 47.15 5.7 5.6 (11.5) NASDAQ 100 4,889.24 0.6 1.4 3.2 Natural Gas (Henry Hub)/MMBtu 2.68 (1.7) 0.7 (10.4) STOXX 600 361.87 1.8 1.4 (1.3) LPG Propane (Arab Gulf)/Ton 46.25 3.9 3.9 (5.6) DAX 10,227.21 0.6 0.7 (3.0) LPG Butane (Arab Gulf)/Ton 58.13 4.7 4.7 (7.4) FTSE 100 6,229.21 2.3 2.2 (5.7) Euro 1.13 0.2 (0.4) (6.7) CAC 40 4,645.84 1.9 1.8 1.6 Yen 120.57 0.1 (0.0) 0.7 Nikkei 18,171.60 0.5 (0.5) 3.1 GBP 1.55 1.0 0.4 (0.5) MSCI EM 822.71 2.0 2.5 (14.0) CHF 1.03 0.3 (0.2) 2.4 SHANGHAI SE Composite 3,152.26 4.9 (1.5) (5.1) AUD 0.72 0.8 1.5 (12.0) HANG SENG 21,966.66 2.4 2.1 (6.9) USD Index 95.42 (0.2) 0.2 5.7 BSE SENSEX 25,963.97 1.2 1.6 (9.9) RUB 65.40 (2.0) (3.8) 7.7 Bovespa 48,553.10 3.6 6.1 (32.8) BRL 0.26 0.8 1.0 (30.8) RTS 837.39 3.7 4.8 5.9 138.4 116.1 111.8