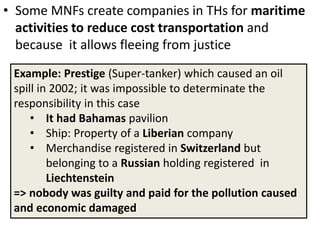

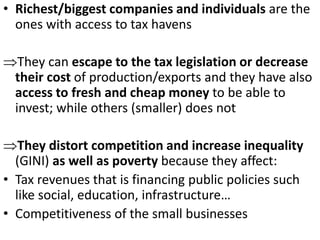

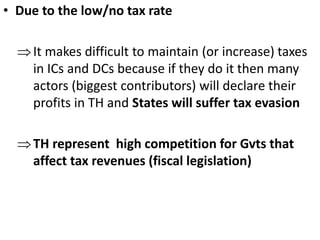

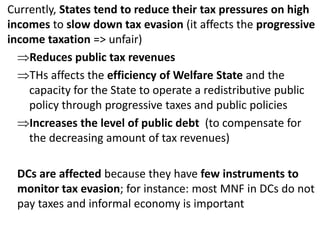

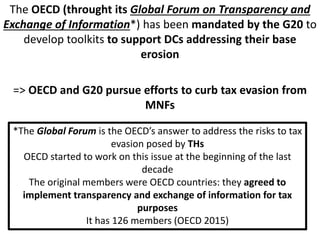

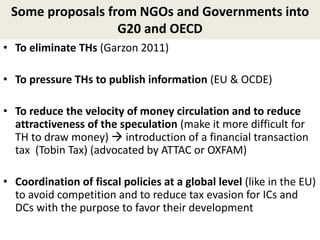

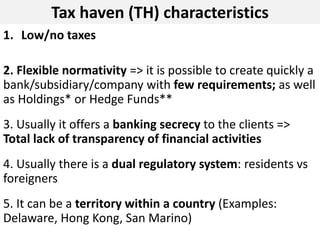

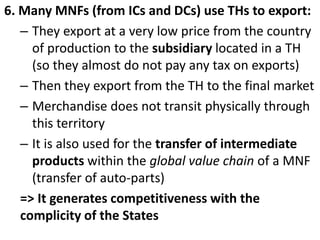

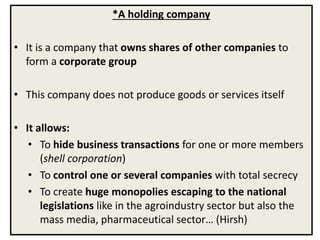

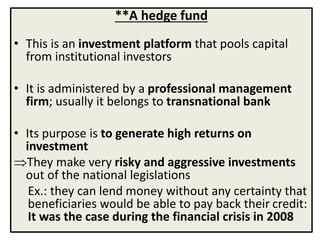

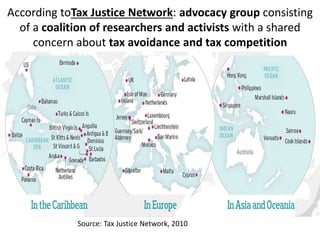

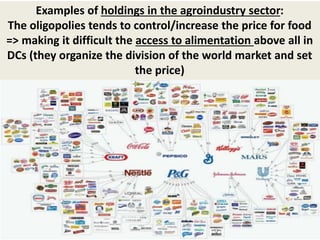

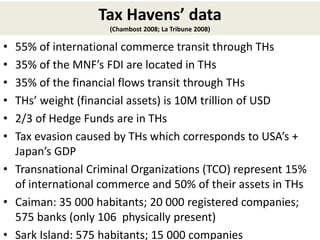

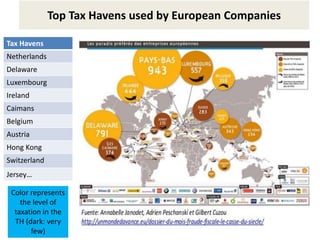

Tax havens are countries that offer low or no tax rates to foreign individuals and businesses in order to attract capital. They provide secrecy and flexibility in business regulations. Many multinational corporations and wealthy individuals use tax havens to avoid paying taxes in their home countries by routing profits through shell companies in havens. This reduces government tax revenues and allows corporations and individuals to escape legal accountability. Critics argue tax havens exacerbate inequality and financial instability, while supporters view them as legitimate tools for business competitiveness and individual choice.

![*Large inflows of petrodollars into a country often

has an impact on the value of the national currency

(=Dutch Disease)

Ex.: it was shown in the case of Canada that if the

price of oil increases by 10% => Canadian dollar

value Vs USD by 3% [when the authority or private

sector change the currency: there is a supply of USD

and a Demand of CAD] (The Economist 2012); consequences:

- National firms lose competitiveness

(unemployment)

- Imports increase => Deficit of the Trade balance…](https://image.slidesharecdn.com/taxhavens-150807191226-lva1-app6892/85/Tax-havens-26-320.jpg)