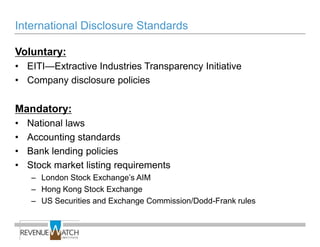

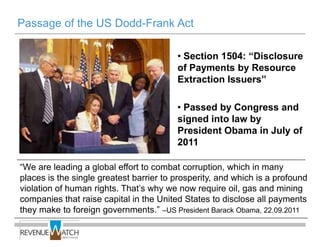

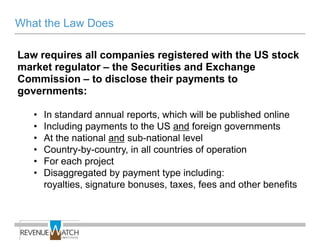

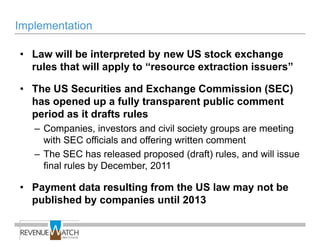

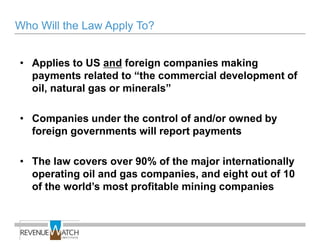

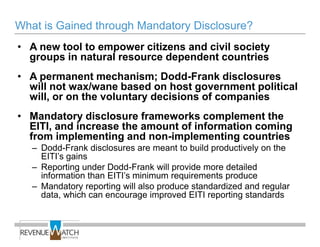

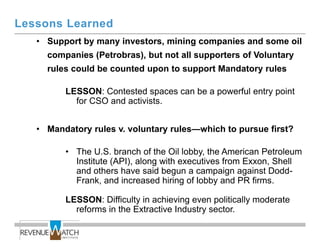

The US Dodd-Frank Act mandates disclosure of payments related to extractive industries. It requires companies registered with the SEC to disclose country-by-country payments to governments for oil, gas, and mining projects. This will provide citizens and civil society new tools to increase transparency. While voluntary initiatives like EITI are important, mandatory rules provide standardized data that can strengthen transparency globally and help combat corruption. Improved transparency of revenue flows supports good governance, stability and sustainable development.