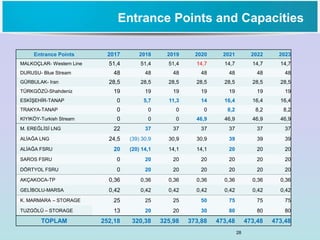

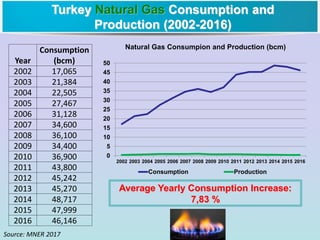

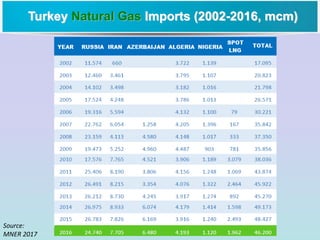

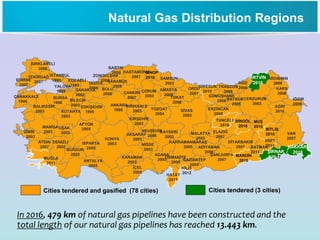

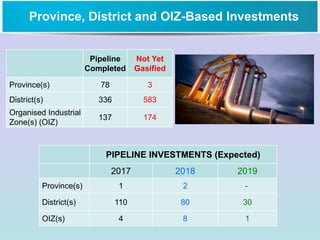

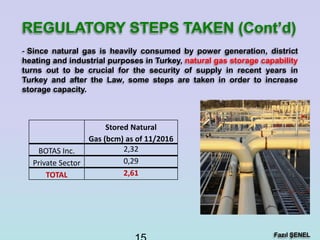

Turkey has experienced strong economic growth in recent years, with GDP increasing by 8.5% in 2011. It aims to become one of the top 10 global economies within the next decade. The document discusses Turkey's growing natural gas market, including consumption trends, sources of imports, storage and transportation infrastructure. It outlines regulatory steps taken to liberalize the market and plans to further increase domestic storage and transportation capacity to ensure security of supply.

![Trans-Caspian

Trans-Iranian–

Turkmen Gas

via Arab Gas P/L

Egyptian Gas

Iraqi Gas

(ITGEP)

Shah Deniz BTE

Nabucco

ITGI

Arab Gas P/L

Phase-III

Blue

Stream-I

Blue Stream-II

[Medstream]

West Line

Trans-Caspian

Kazakh Gas

ITG

Iranian

Gas

South Pars

Map: Google Map

TAP

Iraqi Gas

(South)

Iraqi Gas

(Akkas)

Medstream

West-Balkan

Corridor (IAP)

Iraq-Turkey

Oil Pipeline

BTC

Samsun

Ceyhan

Turkish

Stream

TANAP

A Modern Day Silk Road](https://image.slidesharecdn.com/emra-170606063704/85/EMRA-20-320.jpg)