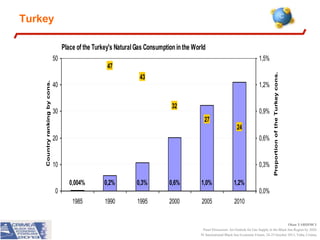

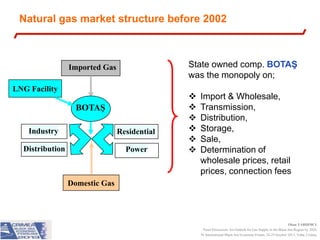

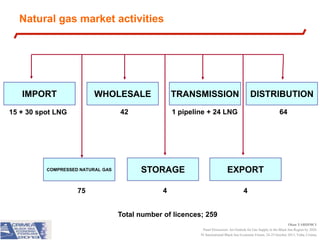

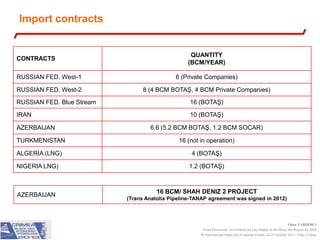

Okan Yardimci presented an outlook for natural gas supply in the Black Sea region by 2020. He discussed Turkey's growing natural gas demand and reliance on imports, particularly from Russia. Turkey has liberalized its natural gas market since 2002 and over 250 companies now operate across the supply chain. Yardimci also outlined Turkey's existing and planned natural gas infrastructure like pipelines and LNG facilities. He noted potential for increased natural gas production from discoveries in the Turkish, Bulgarian, Romanian and Ukrainian sections of the Black Sea.