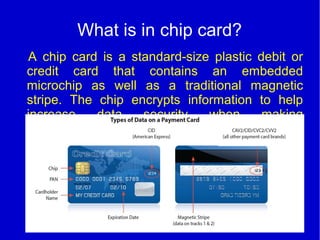

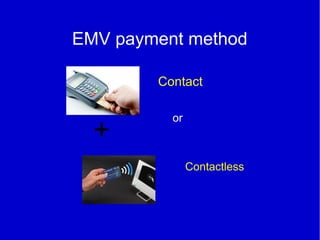

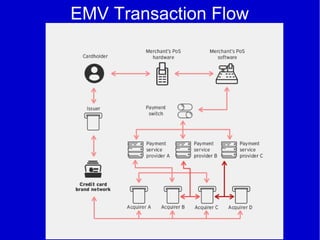

This document provides an introduction to EMV technology for electronic payment cards. It describes EMV as a global standard for credit and debit cards that uses chip card technology for added security compared to magnetic stripe cards. The document outlines the key aspects of EMV, including how it gets its name from Europay, Mastercard, and Visa, the standards organization EMVCo, how EMV chip cards and transactions work, challenges with EMV implementation, and how EMV provides more security than magnetic stripe cards through unique transaction codes. Methods of cardholder verification and authentication in EMV are also summarized.