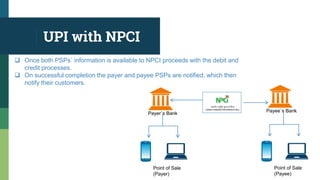

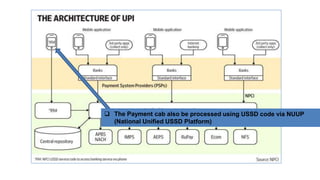

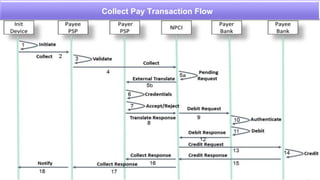

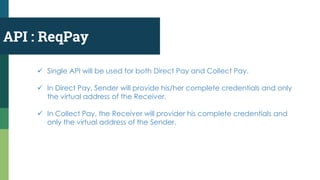

The document discusses the Unified Payments Interface (UPI) system in India. It provides the following key points:

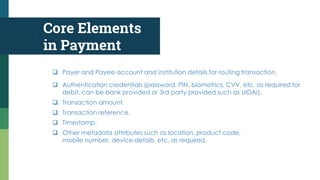

- UPI is an instant real-time payment system developed by NPCI that allows money transfers between bank accounts using a virtual payment address.

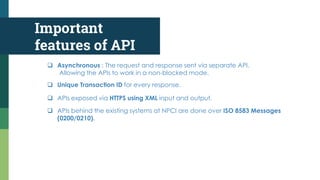

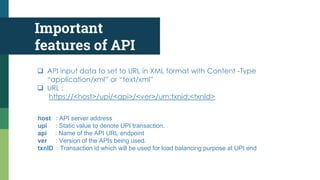

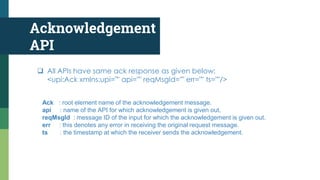

- UPI offers features like being open source, mobile-first, interoperable, instantaneous, secure, cheap, simple, innovative and easily adaptable.

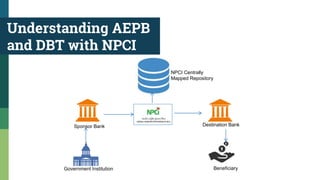

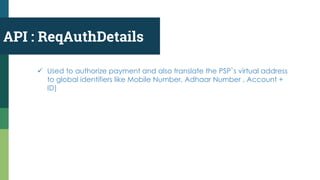

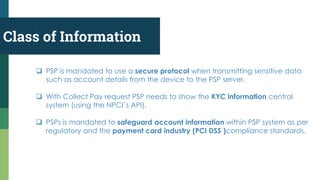

- NPCI's central repository maps customers' Aadhaar numbers, mobile numbers and bank accounts to route payments based on these identifiers.

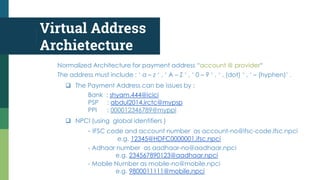

- The UPI system uses a virtual payment address architecture to facilitate payments between parties using identifiers like bank account numbers, Aad