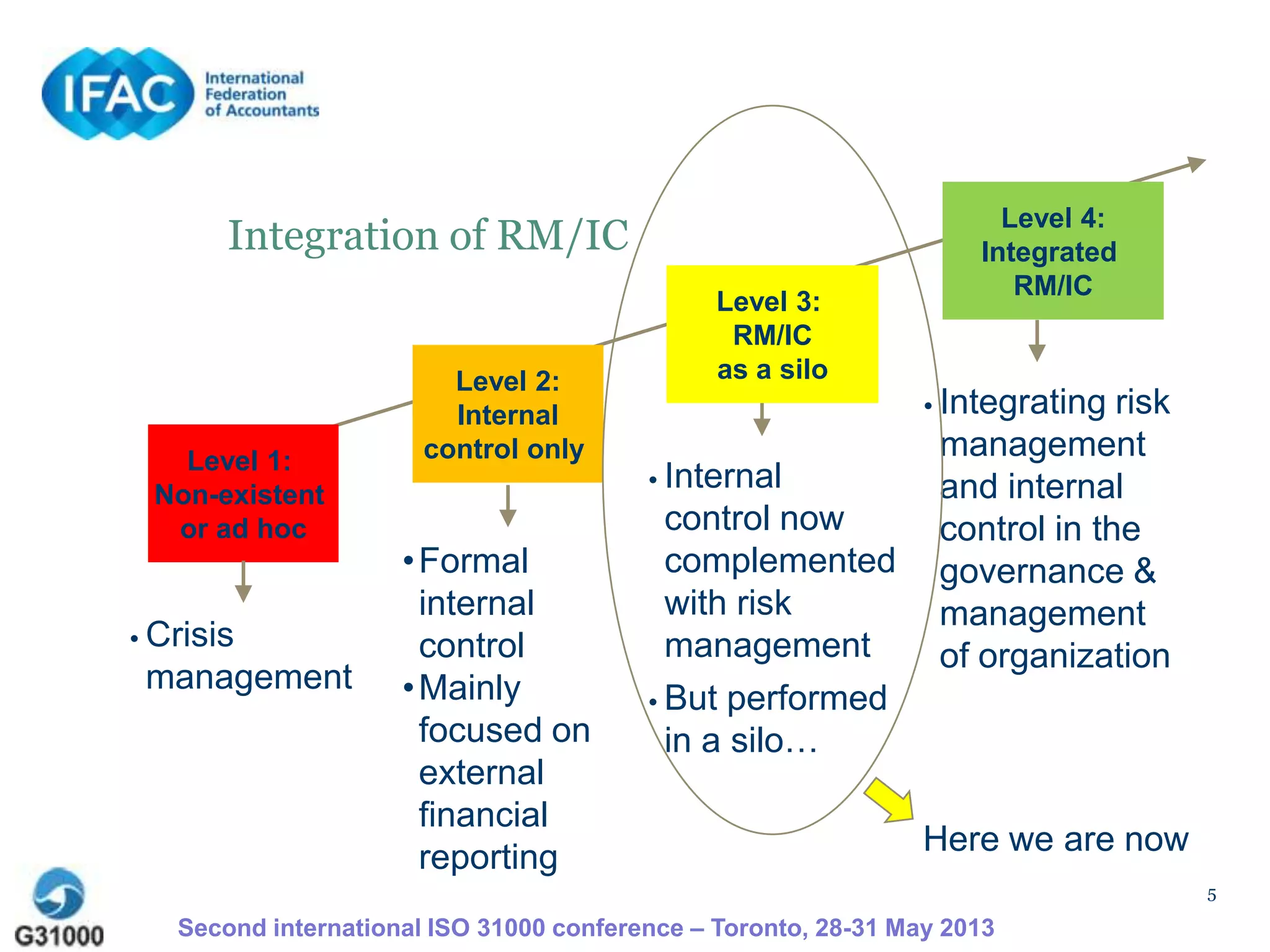

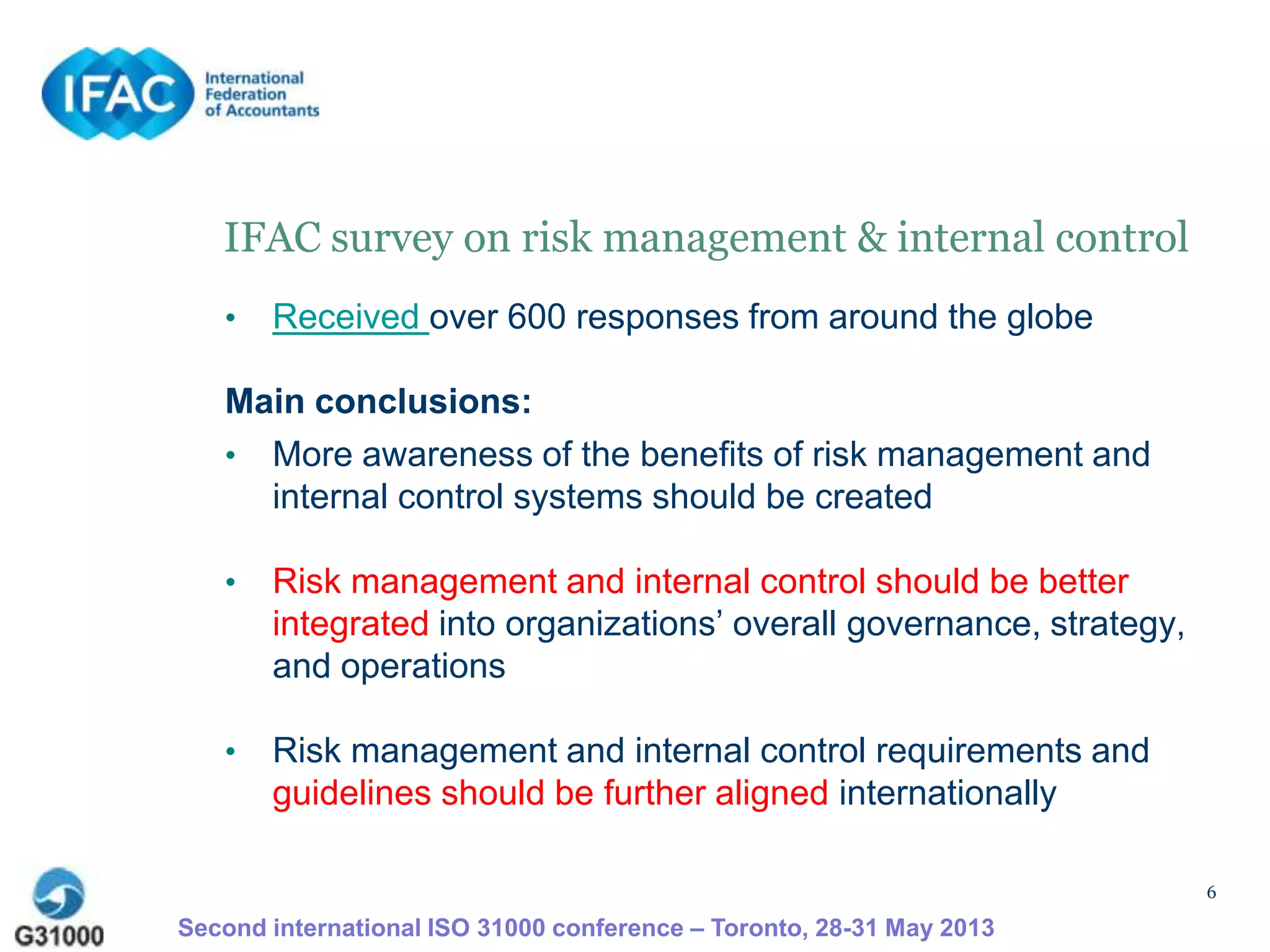

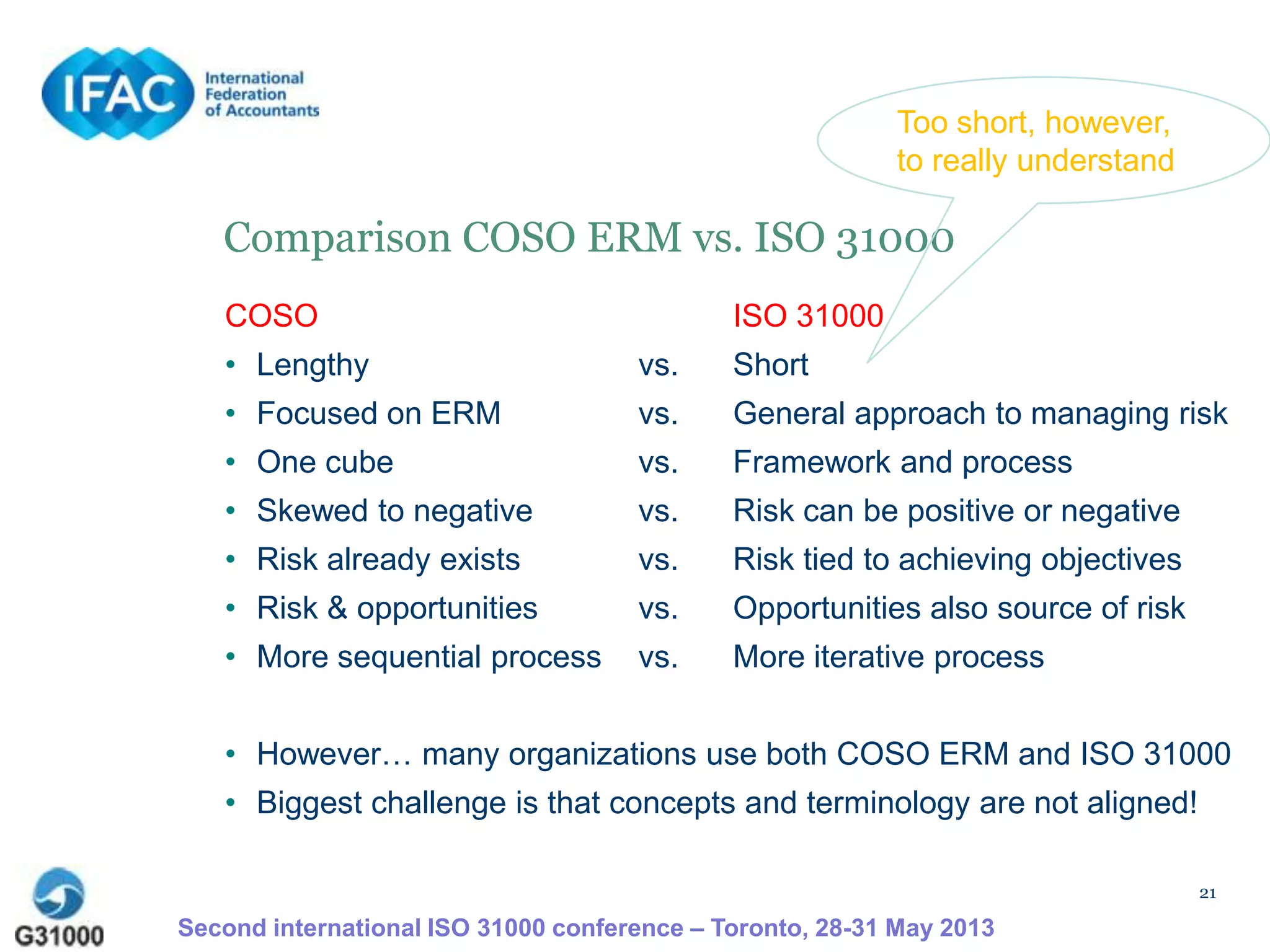

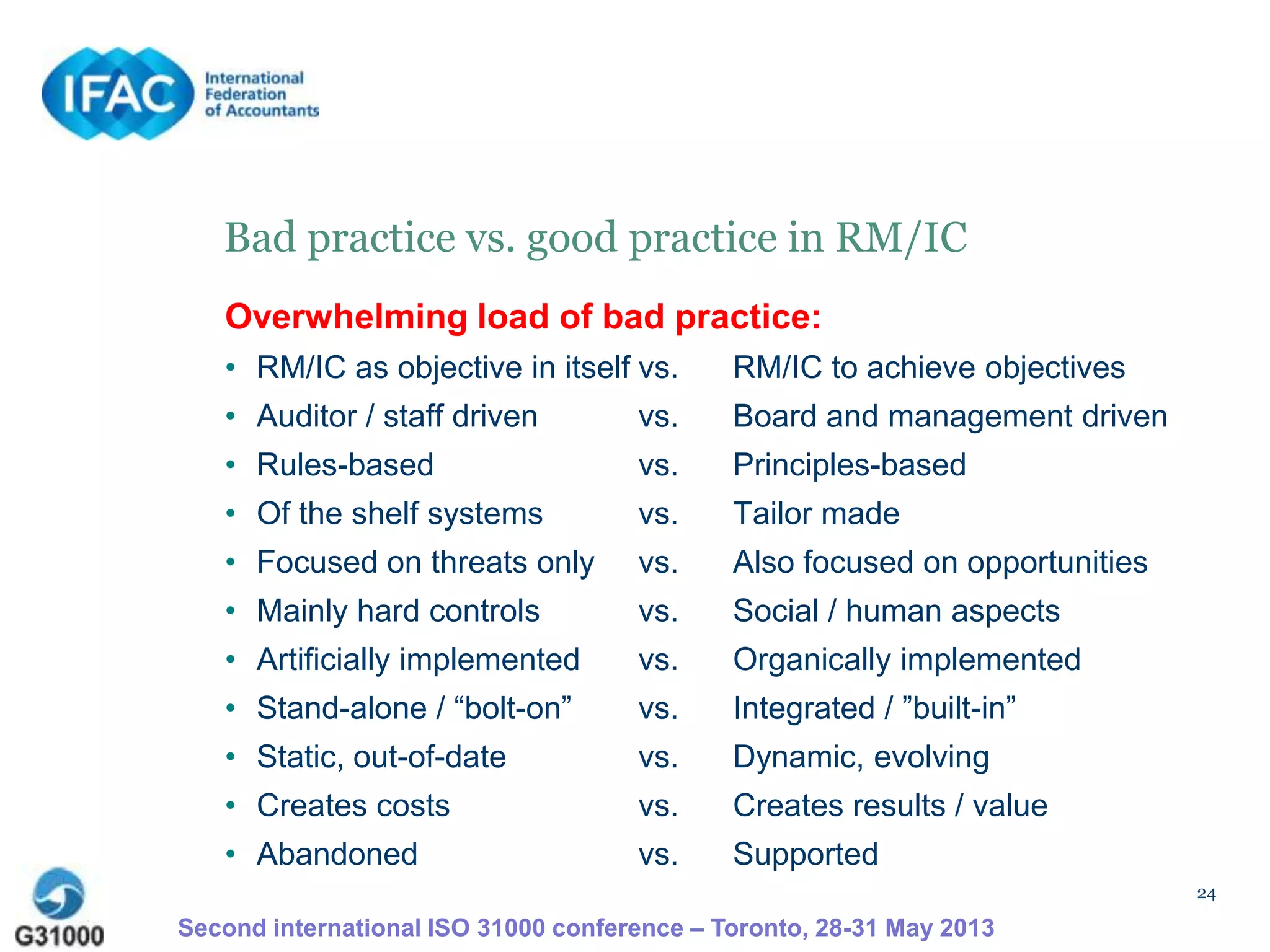

The document presents insights from the IFAC's second international ISO 31000 conference, focusing on the integration of risk management (RM) and internal control (IC) within organizations. It highlights the need for a broader approach that aligns RM and IC with organizational objectives and emphasizes the collaboration among standard-setting entities to enhance guidelines and practices. The findings suggest improving awareness of RM and IC benefits, fostering their integration into governance, and addressing existing flaws in application across various sectors.