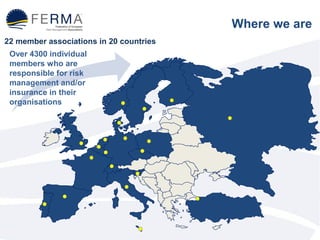

- FERMA is an organization with 22 member associations in 20 countries representing over 4,300 risk management professionals.

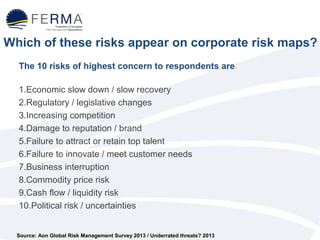

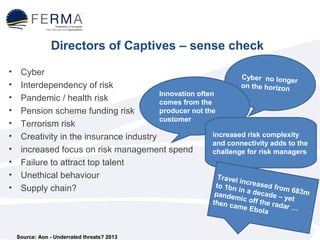

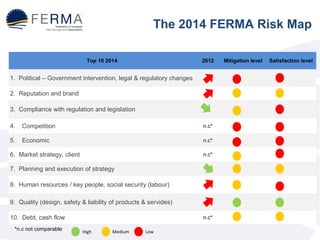

- It focuses on helping members address global risks like economic crises, climate change, and political instability, as well as developing risk management best practices.

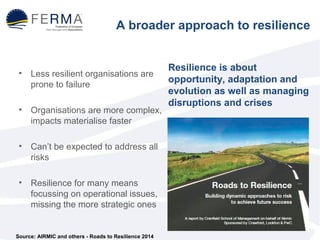

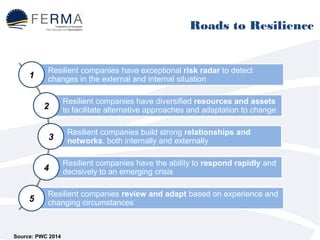

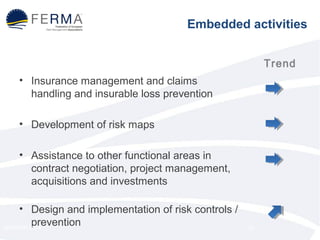

- The presentation calls for organizations to take a broader, more strategic approach to resilience by improving risk monitoring, contingency planning, and responsiveness to crises.